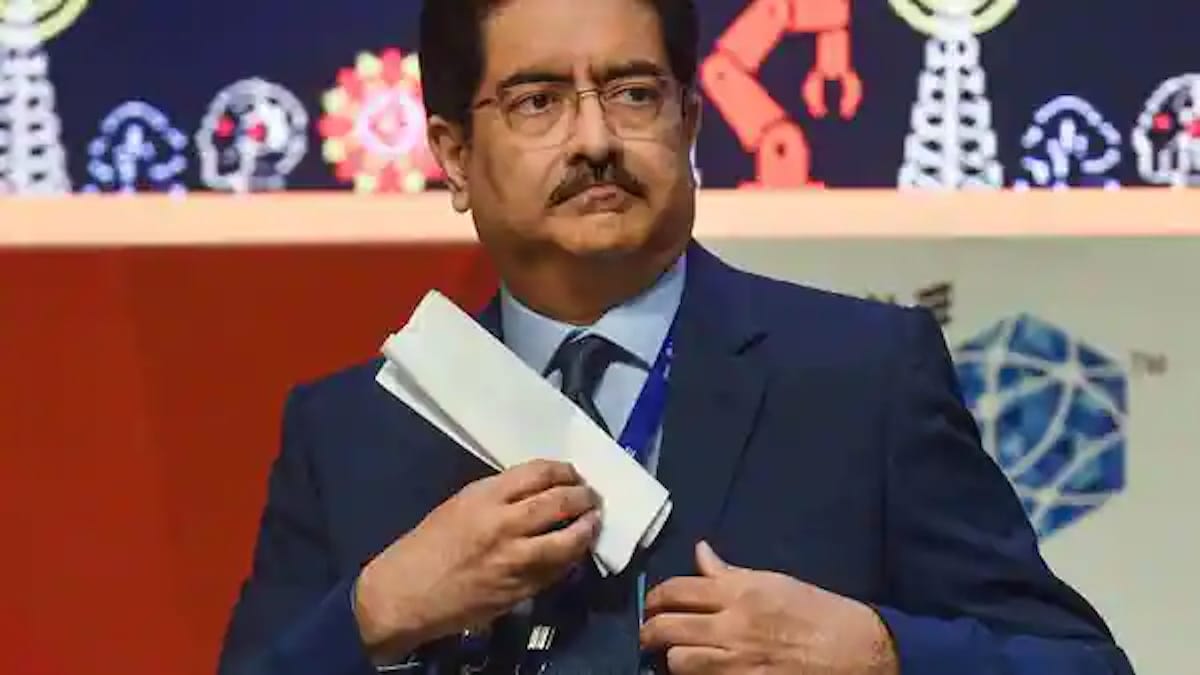

According to people familiar with the matter, Aditya Birla Capital Ltd., headed by billionaire Kumar Mangalam Birla, is considering selling its insurance brokerage subsidiary as the group attempts to restructure its financial services sector.

The publicly traded company has held discussions with potential purchasers about selling Aditya Birla Insurance Brokers Ltd. because it has been unable to build up the 19-year-old business, according to persons who asked not to be identified because the information is not public . It is one of India’s largest composite insurers, which means it provides both life and non-life policies, although the unit reported revenue of barely 6 billion rupees ($73 million) in the fiscal year ending March 31, 2021, according to its website.

According to the people, the sale is part of Aditya Birla Capital CEO Vishakha Mulye’s efforts to restructure the company’s businesses, which span from asset management to mortgage financing, in order to increase shareholder returns. Though the company’s shares have never traded above their initial public offering price in 2017, they have increased by more than 50% since Mulye took over in June.

The company intends to conclude the purchase by March 31, but no final decision on the valuation has been made, and the sale might still be shelved, according to the people. An Aditya Birla Group official declined to comment.

According to the website, the unit is under consideration for sale provides brokerage and advising services to companies and individuals, as well as reinsurance solutions to insurers. It employs around 350 individuals across 11 locations in India.