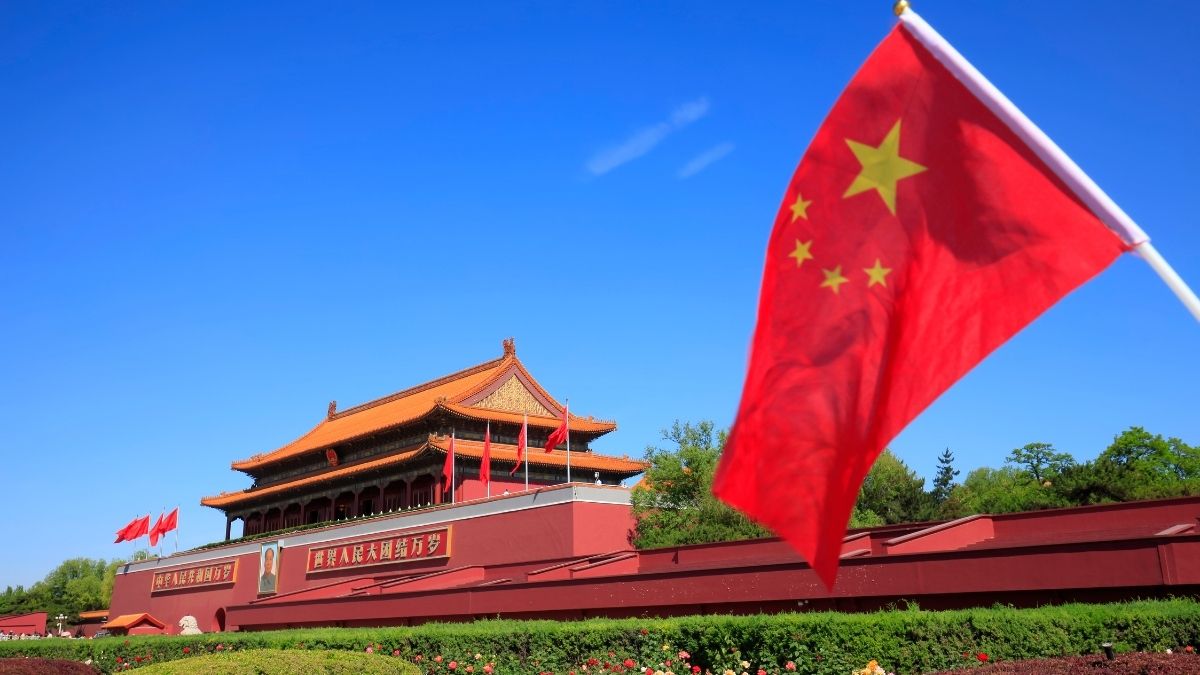

China has approved an $839 billion debt swap initiative aimed at relieving financial pressures on local governments. This move, finalized at the National People’s Congress (NPC) legislative session, is intended to provide local authorities with greater fiscal flexibility amid concerns of slowing economic growth. Additionally, China is set to increase the 2024 local government debt ceiling to 35.52 trillion yuan, expanding room for further borrowing.

The Budget Committee and the Ministry of Finance are leading this refinancing strategy to address off-balance-sheet liabilities, a growing concern for the Chinese economy. Finance Minister Lan Fo’an has hinted at this refinancing move in response to local economies showing signs of strain, with Q3 growth slowing to 4.6%.

Following the announcement of this debt refinance plan, both the CSI 300 Index and the Hang Seng Index witnessed slight declines, reflecting cautious investor sentiment. Market participants are watching closely, as the People’s Bank of China has already implemented key interest rate cuts, signaling an expansive fiscal approach.

Foreign Fund Outflows from India Following China’s Stimulus

China’s recent stimulus efforts have led to significant foreign fund outflows from India as investors reevaluate their positions in emerging markets. The impact is visible on India’s Nifty and Sensex indices, which are trending lower amid broader market weakness.

Anticipation is also high as Reuters reported that China’s National People’s Congress Standing Committee may soon approve an additional 10 trillion yuan ($1.4 trillion) fiscal package to further boost the economy. This potential issuance could provide additional support for the slowing economy, with bond traders closely monitoring the developments.

Outlook

This aggressive debt swap and the possibility of new stimulus packages underscore China’s commitment to stabilizing its economy and addressing debt burdens at the local government level. As Beijing signals its policy direction, global markets are expected to adjust in response to China’s evolving fiscal and economic strategies.