Morgan Stanley has maintained its ‘Overweight’ rating on ITC with a target price of Rs 554, citing the Union Budget 2025 as a catalyst for the company’s growth prospects. The brokerage notes that the absence of tobacco tax hikes in the budget alleviates one of the key concerns that have historically weighed on ITC’s stock performance. This move provides a sense of stability and is viewed as indicative of the government’s future policy stance on tobacco products.

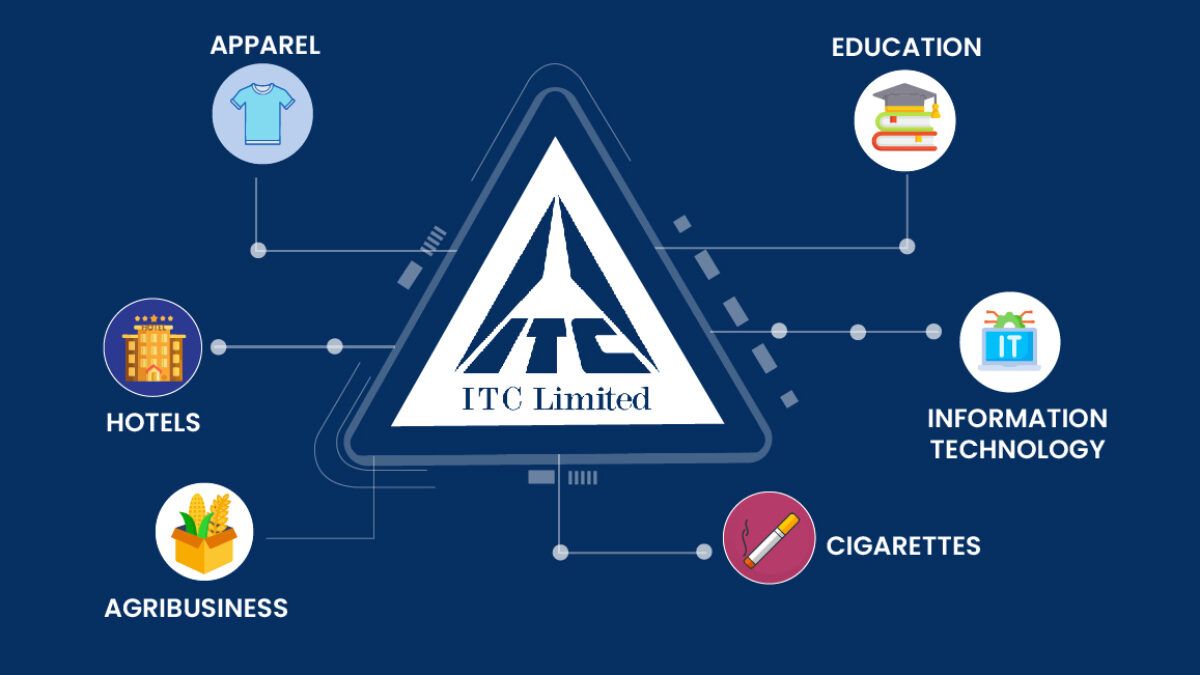

Beyond the immediate relief from potential demand disruptions, Morgan Stanley highlights that ITC is well-positioned for sustainable growth, supported by strong business fundamentals. The company’s diversified portfolio, robust distribution network, and focus on premiumization are expected to drive long-term growth. The brokerage views ITC as a re-rating candidate, given its consistent performance and favorable policy environment.

The stable tax regime, coupled with the budget’s focus on stimulating consumption through personal tax cuts, is expected to boost ITC’s earnings. Morgan Stanley believes that these factors create a favorable backdrop for ITC’s growth, making it a compelling investment opportunity in the FMCG sector.