In today’s fast-moving financial world, trading has evolved far beyond traditional guesswork. For day traders especially, success depends on speed, accuracy, and well-defined strategies. This is where understanding price action and candlestick analysis becomes absolutely essential.

Rather than relying on indicators that lag behind, these techniques help you study price behaviour in real-time. When used correctly, they can help spot market turning points with confidence. Whether you’re new to trading or seeking to refine your approach, these methods offer a solid foundation for identifying clear opportunities and managing risk effectively.

Understanding Price Action Trading: Simplicity That Works

Price action trading is about keeping things simple yet powerful. It involves studying raw price movements on a chart and making decisions based on what the price is doing, not what an indicator says it might do.

A good price action trading course teaches you how to identify crucial patterns like:

- Double tops and bottoms – signs of potential trend reversals

- Triple tops and bottoms – confirming stronger reversal zones

- Head and shoulders / Inverse head and shoulders – widely recognised reversal patterns

- Flags, pennants and triangles – patterns signalling a continuation of trends

By studying how prices react at certain levels, traders learn to identify support and resistance zones, determine entry and exit points, and gain a deeper understanding of market psychology.

Through practical coding sessions and backtesting exercises, traders learn not just what to trade but also why making strategies far more reliable in live markets.

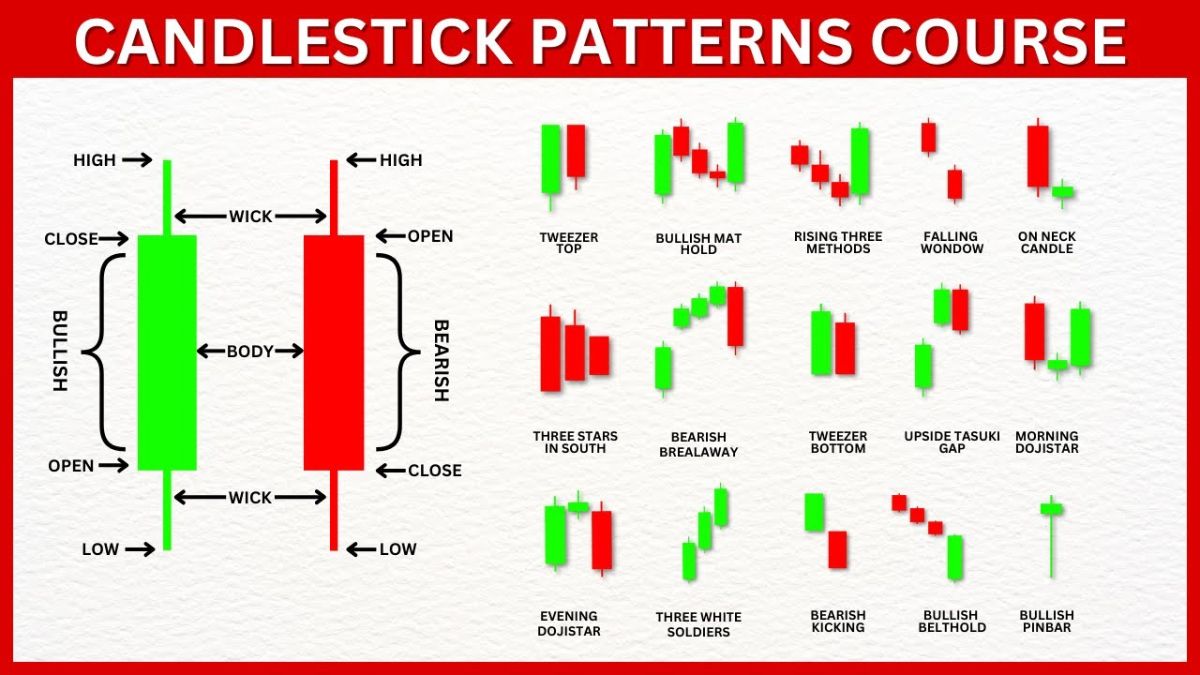

The Power of Candlestick Patterns in Market Timing

If price action provides the big picture, candlestick patterns offer the fine details. Candlesticks visually represent buying and selling pressure within a specific time frame. They reveal the ongoing battle between bulls and bears and the result of each round.

A well-structured candlestick patterns course enables traders to read these stories in real-time.

Some essential patterns include:

- Hammer and Hanging Man – often signal reversals at the bottom or top of trends

- Marubozu – showing strong conviction in either direction

- Doji – a sign of indecision, which could precede a breakout

- Engulfing, Piercing, and Dark Cloud Cover – powerful multi-candle patterns indicating trend shifts

Learning how to combine multiple candlestick patterns and overlay them with price action analysis allows traders to strengthen their trade confirmations and reduce false signals. These techniques are particularly valuable for scalping and intraday trading setups, where timing is everything.

Why Day Traders Must Blend Both Techniques

To consistently succeed as a day trader, one must be agile and well-informed. Markets can shift rapidly due to news, volume surges, or sentiment changes. That’s why combining price action and candlestick analysis is a winning approach.

Price action provides clarity about the trend, while candlesticks help confirm market turning points and entries. Together, they form a powerful toolkit for anyone involved in short-term trading.

A good day trading course teaches you how to:

- Apply momentum strategies

- Understand order flow and market depth

- Develop scalping strategies with well-defined rules

- Backtest and fine-tune your systems with real data

- Manage risk using stop-loss, position sizing, and portfolio diversification

These are not just theoretical concepts; they’re skills you can use every single trading day.

Pranav Lal: A Story of Grit, Vision, and Innovation

One of the most powerful examples of breaking barriers through knowledge is the story of Pranav Lal.

Pranav, a manager with Ernst & Young, has been visually impaired since birth. Yet, with a strong drive for learning and a deep passion for finance and technology, he set out to become a trader. Navigating charts was understandably difficult, but he didn’t let that stop him.

Instead, Pranav found ways to “see” using sound. Using a software called vOICe, developed in the Netherlands, he connected a webcam that converted visuals into sound, enabling him to interpret charts in an entirely new way.

But what truly changed the game for him was discovering QuantInsti. Their practical, step-by-step courses, especially EPAT, gave him the confidence and tools to build trading systems that weren’t dependent on visual cues alone.

With support from his family, creativity, and a hunger for independence, Pranav mastered algorithmic trading. Today, he live-trades strategies and blogs about his journey, inspiring thousands along the way.

Why Choose QuantInsti?

In a space crowded with theory-heavy platforms, QuantInsti stands out for its practical, result-oriented approach. As a global leader in algorithmic and quantitative trading education, QuantInsti has helped learners from over 190 countries.

Here’s what sets them apart:

- Real market strategies: Learn techniques that are actively used in live trading

- Interactive coding sessions: Build, test, and refine your strategies with Python

- Industry-aligned curriculum: Designed by professionals, for professionals

- Faculty support and peer learning: Engage in community discussions and live Q&A

- Capstone projects and certification: Demonstrate your trading competence with real results

Whether you take the price action trading course, day trading course, or candlestick patterns course, you’re equipped not just with knowledge but the power to execute confidently.

Begin Your Journey Today

Trading is not just about making profits, it’s about building discipline, clarity, and freedom. When you understand price movement deeply, you trade with confidence instead of fear. You stop guessing and start reading the markets.

If you’re ready to take charge of your financial future, explore QuantInsti’s wide range of trading courses. Learn from expert practitioners, backtest your ideas, and live-trade with skill.

Master the markets with purpose. The journey begins with the first strategy.

Disclaimer: The content in this article is for educational and informational purposes only. It should not be construed as investment advice or a recommendation to trade in financial markets. Trading and investing in securities involves substantial risk and may not be suitable for all investors. Past performance does not guarantee future results. Please consult a qualified financial advisor before making any trading or investment decisions.