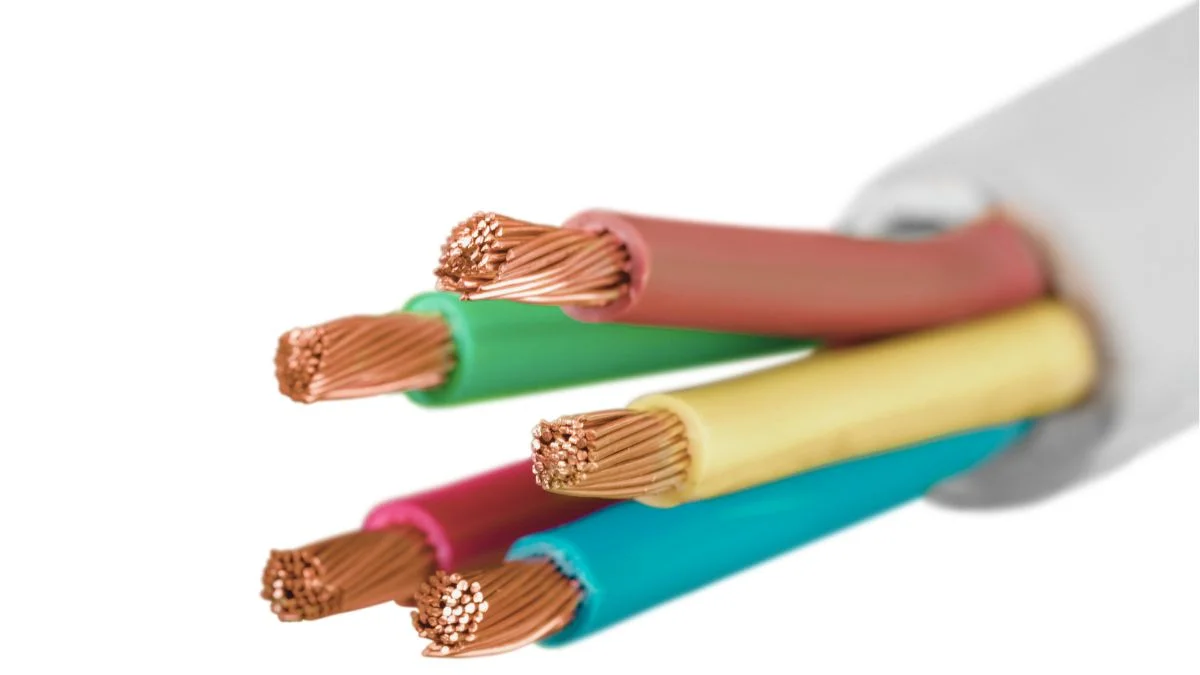

Jefferies said channel checks indicate 6–8% price hikes across the cables and wires (C&W) industry so far in Q3FY26, driven by a sharp surge in copper prices, which have risen around 18% during October–December 2025 to nearly US$12,000 per tonne. The brokerage said the increase in raw material costs has already begun to flow through industry pricing, with near-term implications for margins, volumes and inventory dynamics.

According to Jefferies, the price hikes could result in short-term inventory gains, supporting margins in the immediate quarter, while also prompting channel stocking, which may temporarily lift volumes for leading players in the C&W space. The brokerage highlighted that this dynamic is particularly relevant for large organised players such as Polycab, Finolex Cables and Havells, which have greater pricing power and faster pass-through capabilities.

In contrast, Jefferies noted that in the electronics manufacturing services (EMS) segment, including companies such as Amber Enterprises, raw material volatility is typically passed on to customers with a lag of one to two quarters, limiting immediate margin benefits from price movements.

The brokerage also pointed to divergent trends in other key raw materials. Softening VAM prices are expected to help Pidilite Industries sustain operating profit margins in the 23–24% range, offering stability despite broader commodity volatility. However, a 6% quarter-on-quarter decline in PVC prices to around US$620 per tonne could weigh on near-term margins for pipe manufacturers such as Finolex Industries, Supreme Industries and Astral, particularly in Q3FY26.

Overall, Jefferies said raw material trends are creating winners and losers across sectors, with cables and wires players positioned to benefit in the near term, while pipes companies may face margin pressure before benefits of lower PVC costs flow through with a lag.

Disclaimer: The views and recommendations above are those of Jefferies. Business Upturn does not endorse them. Please consult a financial advisor before making investment decisions.