Bharat Forge Ltd., the Pune-headquartered engineering and manufacturing giant, reported a resilient performance for the first quarter of FY26, demonstrating strong domestic momentum and continued growth in its defence segment despite ongoing global headwinds.

The company posted a consolidated revenue of ₹3,909 crore for the quarter ended June 30, 2025, supported by strong EBITDA margins of 17.5%. The company also announced securing new orders worth ₹847 crore, including ₹269 crore in the defence segment, reinforcing its strategic focus on high-value sectors.

Standalone Financial Highlights (Q1 FY26)

-

Revenue: ₹2,105 crore (down 2.7% QoQ)

-

EBITDA: ₹588 crore, with margins at 27.9%

-

Profit Before Tax (PBT): ₹465 crore

-

Profit After Tax (PAT): ₹339 crore

Consolidated Financial Performance

-

Revenue: ₹3,909 crore

-

EBITDA: ₹682 crore

-

PBT: ₹423 crore (before exceptional items)

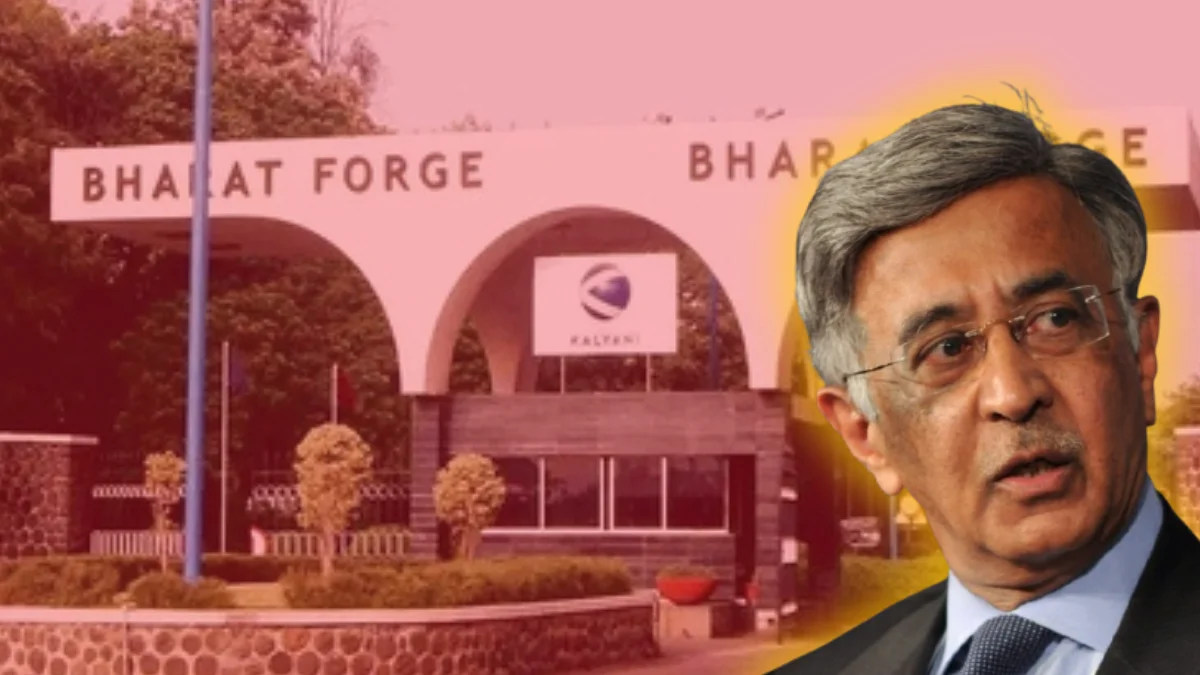

Chairman and Managing Director Baba Kalyani commented on the quarterly performance, stating:

“We secured ₹847 crore in new orders, including ₹269 crore in defence, taking our defence order book to ₹9,463 crore. With active participation in ongoing platforms, we expect more order wins this fiscal, enhancing long-term revenue visibility.”

He added that international operations in the US and Europe showed improved financial metrics, now generating cash profits, while a strategic review of European steel operations is on track and expected to yield actionable results by year-end.

However, Kalyani remained cautious about the export outlook, particularly due to tariff changes and emission regulation rollbacks in the US, noting that FY26 could be a challenging year due to global market volatility.

Segment-Wise Performance

-

Domestic Business: Passenger vehicle and industrial segments saw robust growth; defence continued strong execution.

-

Exports: Declined 12.7% QoQ; North America saw headwinds from regulatory shifts, while Europe showed early signs of recovery—especially in commercial vehicle (CV) exports.

-

International Operations: EBITDA improved across the US and Europe; aluminium business saw better execution; European steel restructuring remains a priority.

Despite export pressures, Bharat Forge remains focused on cost optimization, diversification, and targeting stable geographies to sustain growth. The defence vertical, bolstered by a strong order book, continues to be a major driver for the company’s long-term strategy.