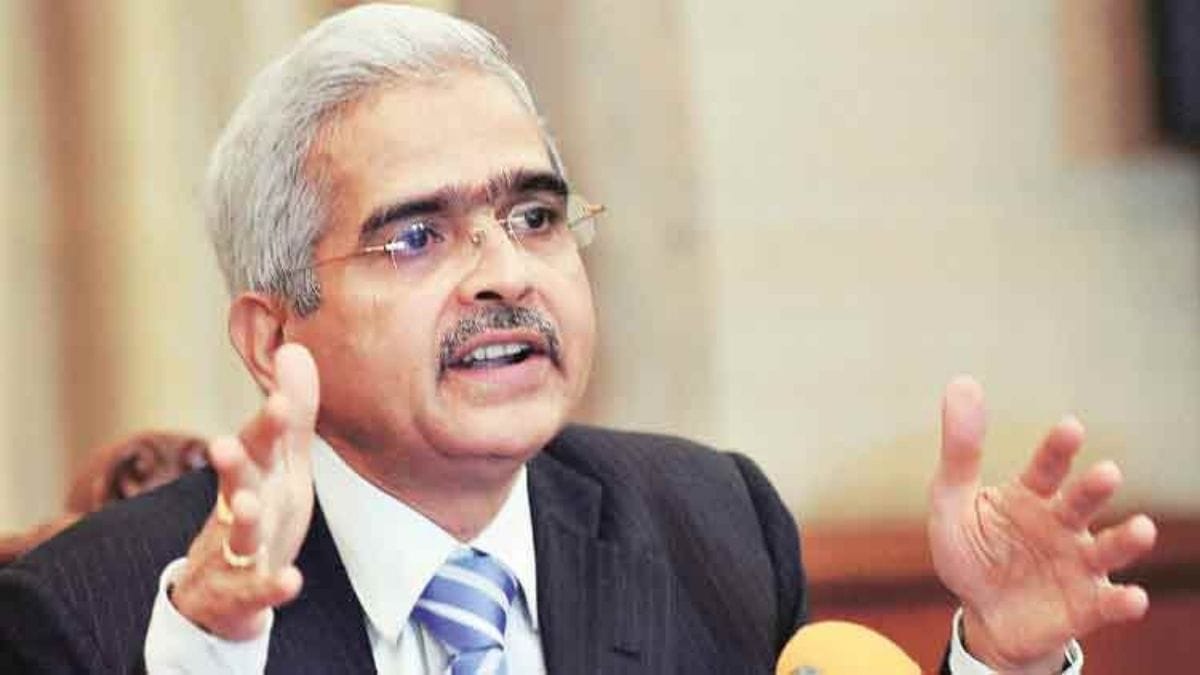

The Reserve Bank of India’s Governor Shaktikanta Das announced that in a unanimous decision, the Monetary Policy Committee (MPC) in its bi-monthly Monetary Policy Meeting maintained its stance on the repo rate, keeping it unchanged for the eighth consecutive time at 4 per cent. For the October policy, the reverse repo rate has been set at 3.35 per cent.

MPC is a six-member unit of the Reserve Bank of India and is responsible for setting the benchmark interest rates in the country. In the latest meeting held for three days starting October 6, the committee also decided 5:1 to move forward with its continued accommodative stance for the monetary policy as long as it feels essential to sustain growth on durable grounds.

Moreover, the RBI Governor stated that the Consumer Price Index (CPI) inflation for Q1 of FY 2022-23 is projected at 5.3 per cent and for Q2 it is estimated to be 5.1 per cent. It is projected to be 4.5 per cent in Q3 and 5.8 per cent in Q4 of FY 2022-23.

Disclosing the CPI inflation to be lower than expected for the July-September quarter, he affirmed that “India is in a much better place today than at the time of the last MPC meeting. Growth impulses are strengthening, inflation trajectory is more favourable than expected.”

The Monetary Policy Committee has retained its FY21 GDP growth forecast of 9.5 per cent, while the projection for Q2FY22 GDP growth has been raised to 7.9 per cent from the previous estimate of 7.3 per cent.

Meanwhile, RBI has proposed to increase the per transaction limit for IMPS to Rs. 5 lakhs from the prior authorisation of Rs. 2 lakhs, RBI Governor Shaktikanta Das stated.