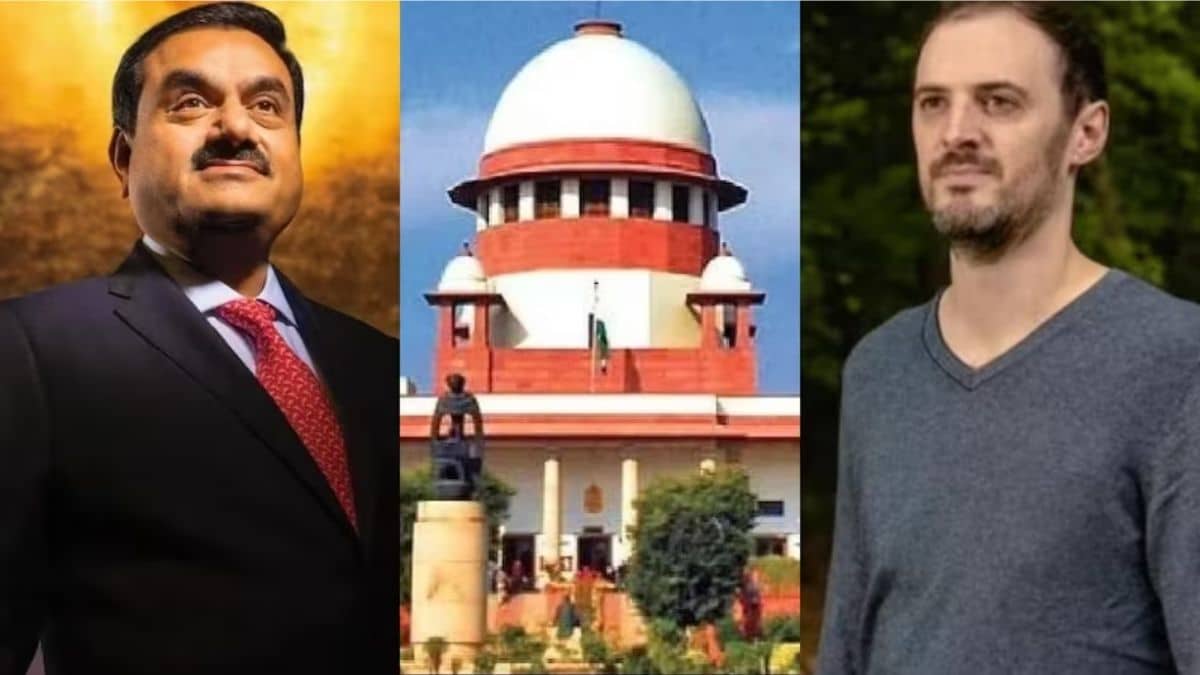

The Supreme Court on Tuesday adjourned the hearing on the Adani-Hindenburg case to August 14. This date is also the deadline by which the Securities and Exchange Board of India has to finish the probe in the case.

Solicitor General Tushar Mehta, appearing on behalf of the central government and SEBI, said that they have received the report of the expert committee. He said, “So far as a reference made to Sebi (is concerned), some guidelines are given. We have filed our response. It’s a constructive response. Since it was filed late, it’s not before your lordships.” Mehta referenced the latest response of SEBI, in which the market regulator said that it was ‘not appropriate’ and ‘not possible’ to put straightjacket timelines for its proceedings and investigations.

The report also informed the top court that its 2019 rule changes do not make it tougher to identify beneficiaries of offshore funds.

While asking about this response, Chief Justice of India DY Chandrachud asked, “What is the status of the investigation?”

SG Mehta in response said, “That is in report. Let us have that on record. For your lordship’s assistance, since the committee has given a report, we have given a response.”

The submissions were made to the Supreme Court in response to the recommendations made by an expert committee set-up to probe in the Adani-Hindenburg case. Besides overlooking the probe proceedings, one of the mandates given to the six-member panel headed by former SC judge AM Sapre was to suggest necessary structural reforms in India’s regulatory body SEBI.

In its 173 page report submitted in May, the panel suggested several recommendations that would strengthen the existing statutory and regulatory framework of SEBI.

Senior Advocate Prashant Bhushan, who is representing one of the petitioners in the case, said that the expert committee of the Supreme Court has stated that there is no chance of SEBI proceedings anywhere with the investigation given what they have done. He commented “They have done things fatal to the investigation.”

CJI told Mehta that the latest report submitted by SEBI, should be circulated with all the concerned parties involved in the case. The court also noted that Bhushan has also submitted a reply to the report by the expert committee. Bhushan told the bench that the expert committee said that the SEBI investigation cannot go anywhere because they amend the definition of opaque structure, related party transactions-in order to prevent this ‘kind of fraud being exposed’.

SEBI countered the report of the expert panel’s observations saying it had faced difficulties in identifying economic interest holders partly because of the repeal of ‘opaque structures’ provisions in foreign portfolio investment regulations. In its report, while referencing to ‘opaque structure’, SEBI said it was removed as it had an element of redundancy and ambiguity.

SEBI’s role came under radar when New York based shortseller Hindenburg Research published a report accusing Adani conglomerate of financial frauds that resulted in a subsequent Rs 12 trillion wipeout of Adani Group companies. In March, Supreme Court gave SEBI, a period of three months to complete the probe on the allegations made by Hindenburg which is set to end on August 14.