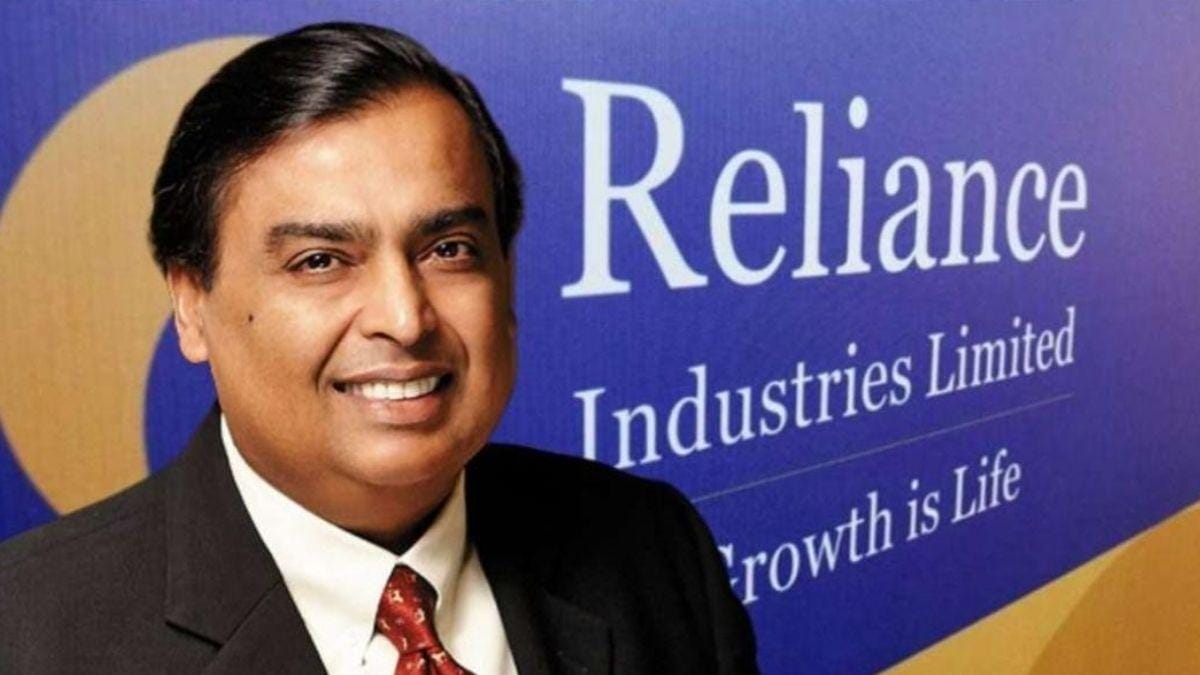

After being the fifth richest person in the world on 22 July, according to the Real-Time Billionaires List of Forbes magazine, Reliance Industries Ltd (RIL) chairman and MD Mukesh Ambani overthrew ExxonMobil Corp. to become the world’s largest energy firm after Saudi Aramco, while creditors stacked up in a corporation driven by digital firm of India and retail forays.

In Mumbai on Friday, Reliance, which operates the largest refining network, added 4.3 % by raising $8 billion to boost its market cap to $189 billion, while Exxon Mobil removed around $1 billion.

The shares of RIL have risen 43 % this year compared to a 39 % decline in Exxon ‘s shares while refiners around the world are grappling with a decrease in demand for petrol. Aramco is the world’s largest energy firm, with a market valuation of $1.76 trillion.

Although the energy sector accounted for around 80 % of Reliance ‘s sales in the year ended March 31, Chairman Mukesh Ambani ‘s strategy to grow the digital and distribution parts of the firm has seen him draw $20 billion through the venture of Jio Platforms Ltd.

Over recent months, Ambani’s salesmanship has been luring investors from Google and Facebook Inc. into the digital era. In a crucial aspect of the energy companies that he inherited from his father, he described technology and retail as potential growth zones.

In the meantime, the strong global market for oil – about 30 million barrels daily or one third routinely utilized in April – has moved oil prices to a second quarter downturn, where they have only started to recuperate from.

The decreasing refining margins and millions of barrels left unsold crude oil in tandem with OPEC supply reductions have affected major petroleum firms, such as Exxon and the Chevron Corp.