ICIC is said to have the biggest asset in the market as of now with a total profit of 1.32 million credit cards. While HDFC has been lacking in this sector due to the fact RBI had fanned HDFC from issuing new credit cards until June 2021, which initiate a loss of 558,545 cards. ICIC took 11.03 million credits in the market in comparison to 9.71 million last year.

While SBI profited a total of 748,707 cards, which is estimated to be12.04 million and Axis bank to have 252,145 cards, which runs up to a total evaluation of 7.13 million. While the HDFC Bank is said to have a drop in the market in both outstanding cards and card spend.

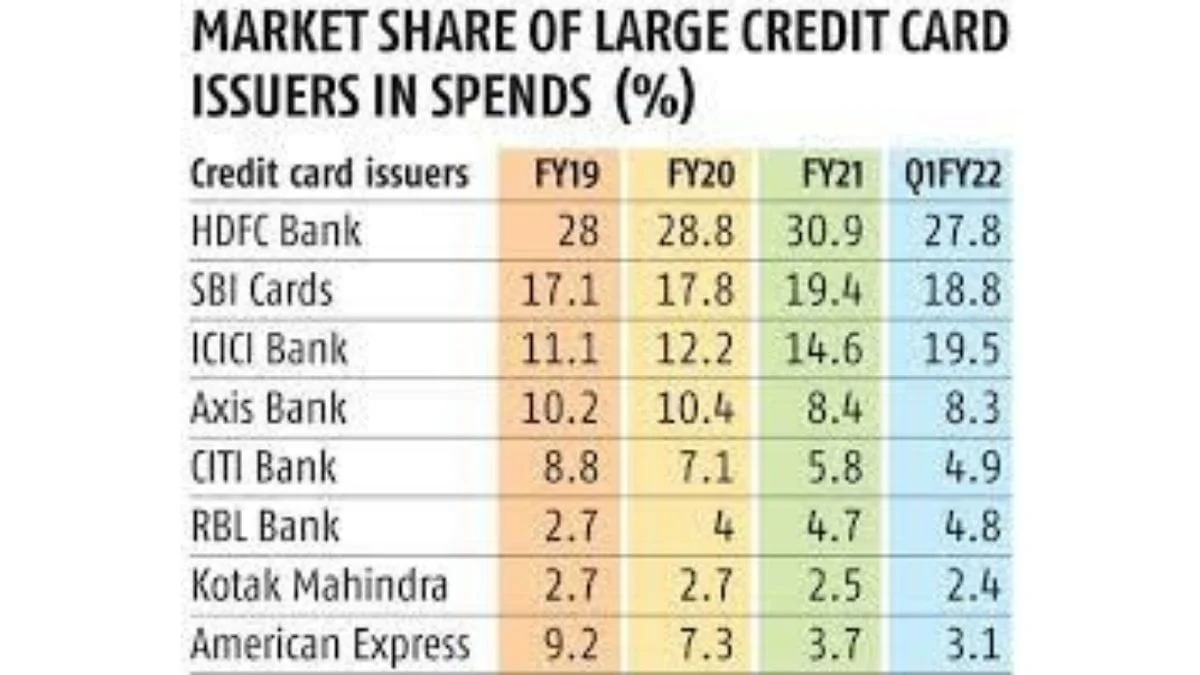

As of June 2021, HDFC Bank’s total net income of credit cards remains at 23.6 per cent, while as far as spends, it cornered a portion of the overall industry of 27.8 per cent. SBI Cards, with a 19.2 per cent credit cards, was the second-biggest part in that fragment, while ICICI Bank had the second-greatest portion of the overall industry as far as spends.