According to a report by Mint, the fast-moving consumer goods (FMCG) heavy-weight Hindustan Unilever (HUL) is in talks to buy a major stake in MDH. Its pan-India presence and penetration in major cities and growing demand made HUL look into a collaboration.

MDH as of today could be worth Rs 10,000 to 15,000 crores, an internal source mentioned this development to Mint news. Indian business ecosystem has earlier witnessed such acquisitions where spice producers have quoted valuations worth 12 times to 15 times as per the Ebitda calculations.

To cite an example when ITC acquired Kolkata’s Sunrise foods for a massive Rs 2,150 crores; Sunrise’s Financial Year Ebitda was at Rs 88 crore and its revenue was at Rs 2,150 crores shooting its valuation 25 times the 2019 financial years profit valuations. When compared to MDH, it made Rs 507 crores in the Financial year 2021 on a business of Rs 1,191 crore.

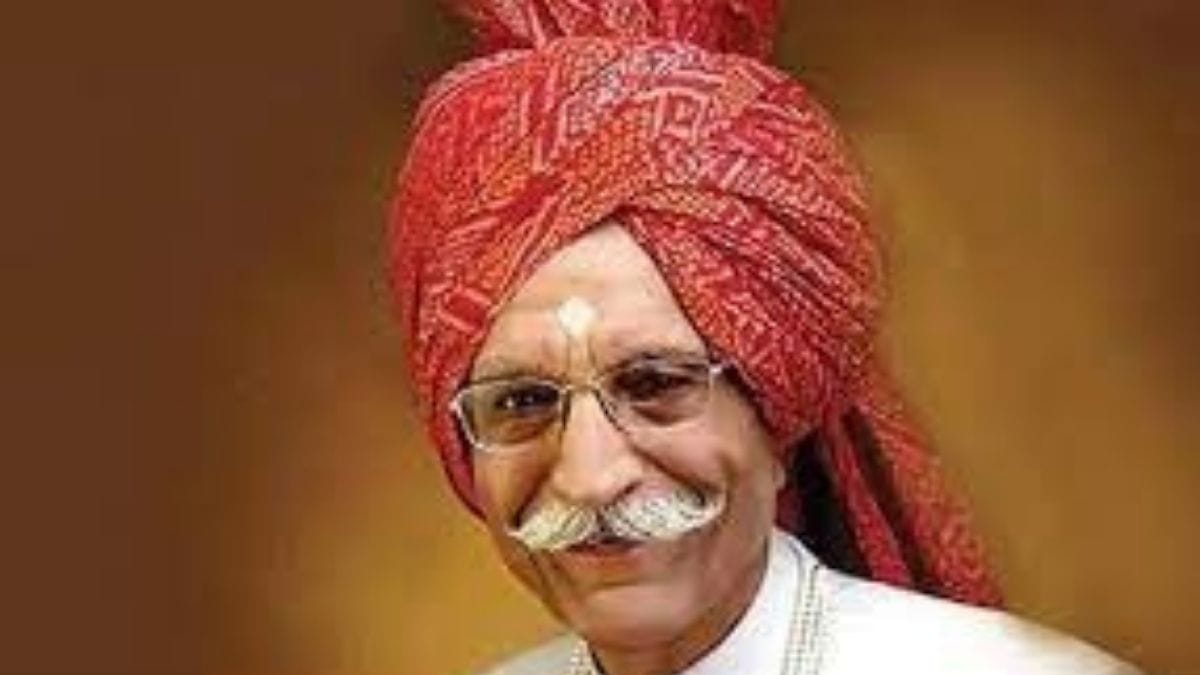

After the Founder of MDH, Dharampal Gulati’s sad demise, MDH spices have been in talks with other companies however who showed inclination is yet not clear.

Avendus Capital, an investment banking firm predicts India’s well-known spice market will increase twice in revenues to Rs 50,000 crores and in terms of penetration by 2025. However, the regional spaces are dominated by local spice players who supply and understand the cooking habits and consumerism which are absolutely different from state to state.

Economists predict that HUL’s momentum backing MDH could propel MDH to massive heights as HUL has a strong distribution network. MDH has a staggering production of 60 varieties and produces 30 tonnes of spice in a day as per its company website. Analysts feel that HUL’s entry into the space could change the dynamics, especially if it leverages its distribution muscle to promote MDH after the acquisition.