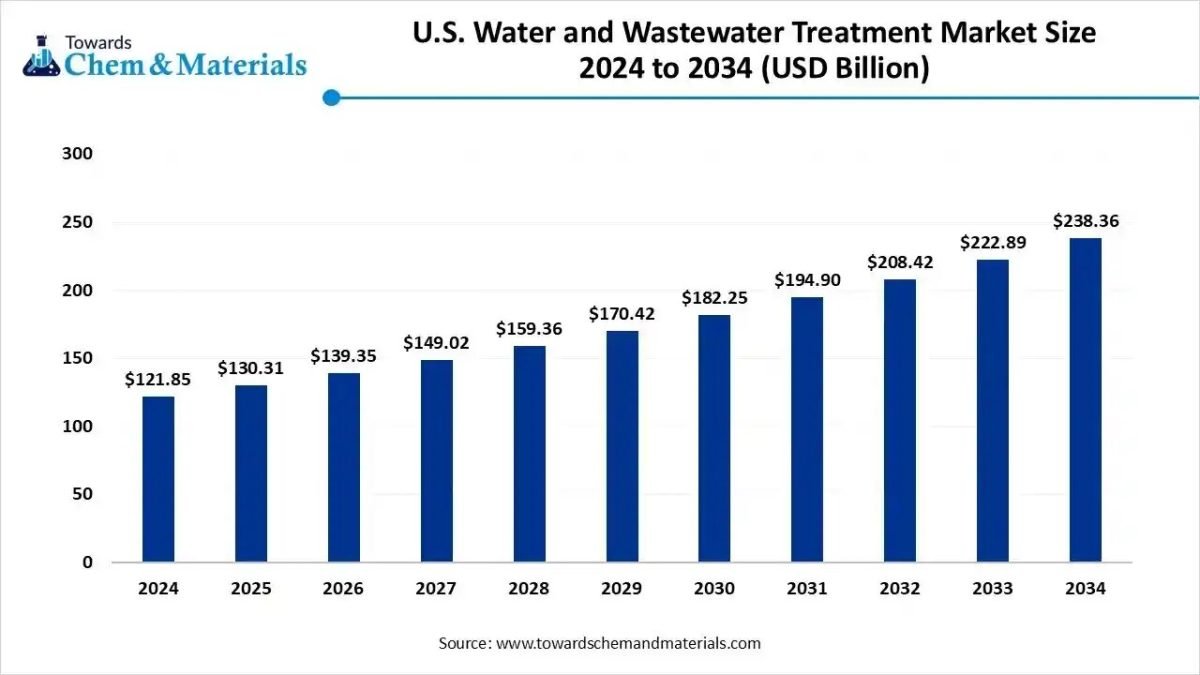

According to Towards Chemical and Materials, the U.S. water and wastewater treatment market size is valued at USD 130.31 billion in 2025 and is forecasted to reach around USD 238.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.94% over the forecast period from 2025 to 2034.

Ottawa, Nov. 05, 2025 (GLOBE NEWSWIRE) — The U.S. water and wastewater treatment market size was valued at USD 121.85 billion in 2024 and is expected to be worth around USD 238.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.94% over the forecast period from 2025 to 2034. Rising urbanization and industrialization in the U.S. are driving increased demand for advanced water and wastewater treatment solutions. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5964

What is Water and Wastewater Treatment in the U.S.?

The U.S. water and wastewater treatment market involves systems, technologies, chemicals, and services used to purify water and treat wastewater across municipal, industrial, and commercial sectors. It is driven primarily by ageing infrastructure, stricter regulatory requirements, and rising concerns over water scarcity. Looking ahead, the market is expected to expand steadily thanks to increased investment in advanced treatment technologies such as membrane filtration, UV disinfection, and smart monitoring systems, as well as growing emphasis on water reuse and recycling.

U.S. Water and Wastewater Treatment Market Report Highlights

- By type, the municipal water & wastewater treatment segment dominated the market with nearly 52% share in 2024.

- By type, the industrial water & wastewater treatment segment held approximately 38% market share and is expected to grow at the fastest CAGR over the forecast period.

- By treatment technology, the membrane filtration segment held the largest market share of nearly 27% in 2024.

- By treatment technology, the desalination & water reuse segment held approximately 8% market share and is expected to grow at the fastest CAGR over the forecast period.

- By component, the equipment segment dominated the market by holding approximately 45% share in 2024.

- By component, the software & digital solutions segment held approximately 10% market share and is expected to grow at the fastest CAGR over the forecast period.

- By application, the potable water treatment segment dominated the market with nearly 36% share in 2024.

- By application, the water reuse & recycling segment held nearly 15% market share and is expected to grow at the fastest CAGR during the projected period.

- By end user, the municipal utilities segment dominated the market by holding nearly 44% share in 2024.

- By end user, the industrial sectors segment held approximately 33% market share and is expected to grow at the fastest CAGR over the forecast period.

Key U.S. Government Initiatives for Water and Wastewater Treatments:

- Clean Water State Revolving Fund (CWSRF): Administered by the EPA, this program provides low-interest loans and other financial assistance to communities for a wide range of wastewater infrastructure projects, including building and upgrading treatment plants and managing stormwater runoff.

- Drinking Water State Revolving Fund (DWSRF): Established under the Safe Drinking Water Act, the DWSRF provides subsidized loans to public water systems to finance infrastructure improvements needed to comply with federal drinking water regulations and protect public health.

- Bipartisan Infrastructure Law (BIL) Funding: This law provides a historic, one-time investment of an additional $50 billion into the water sector, with the majority of funds channeled through the existing State Revolving Funds to address critical infrastructure needs across the nation.

- Water Infrastructure Finance and Innovation Act (WIFIA) Program: This federal credit program provides large, long-term, low-interest loans for regionally and nationally significant water and wastewater infrastructure projects that typically cost over $20 million.

- USDA Rural Water and Waste Disposal Program: The U.S. Department of Agriculture (USDA) offers grants and direct loans specifically to finance drinking water supply and wastewater facilities in rural areas and small communities with populations of not more than 10,000 people.

Immediate Delivery Available | Buy This Premium Research Report (Single Region Dive USD USD 3200) https://www.towardschemandmaterials.com/checkout/5964

U.S. Water and Wastewater Treatment Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 139.35 Billion |

| Revenue forecast in 2034 | USD 238.36 Billion |

| Growth Rate | CAGR of 6.94% from 2025 to 2034 |

| Actual data | 2020 – 2025 |

| Forecast period | 2025 – 2034 |

| Segments covered | By Type, By Treatment Technology, By Component, By Application, By End User |

| Regional scope | Florida; Georgia; South Carolina; North Carolina |

| Key companies profiled | Ecolab’s Nalco Water, Veolia North America, SUEZ North America (Veolia subsidiary) , Pentair plc , 3M Company ,Aqua-Aerobic Systems, Inc. , Evoqua Water Technologies (part of Xylem) , Danaher Corporation (Hach, Trojan Technologies) , AECOM , Jacobs Solutions Inc. , Kurita America Inc. , DuPont Water Solutions , Siemens Water Technologies , ITT Inc. , Calgon Carbon Corporation , Hydranautics (Nitto Group Company) , Ovivo Inc. , Clean Water Services , Black & Veatch |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Water & Wastewater Treatment Market Size and Growth 2025 to 2034

The global water and wastewater treatment market size is calculated at USD 348.19 billion in 2024, grew to USD 371.00 billion in 2025, and is projected to reach around USD 656.68 billion by 2034. The market is expanding at a CAGR of 6.55% between 2025 and 2034. The increasing water scarcity issues, growing manufacturing activities, and stricter regulations for water quality drive the market growth.

The rapid urbanization and growing industrial activities across various countries increase demand for water & wastewater treatment. The growing utilization of water in activities like cleaning, production, and cooling in various industrial processes increases demand for water & wastewater treatment. The growing expansion of industries like food & beverage, paper production, chemical, oil & gas, pharmaceuticals, and manufacturing increases the generation of wastewater that requires water & wastewater treatment.

The stricter government regulations for water conservation and diverse industrial applications increase demand for wastewater treatment. The growing industrialization is a key driver for the growth of the water & wastewater treatment market.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5881

How Is Wastewater Treated?

Primary Treatment: Safeguarding Public Health

The first stage of wastewater treatment focuses on removing large pollutants that threaten both human health and the environment. During this process, solids and floating materials are separated from the water through screening, grit removal, and sedimentation. By eliminating these contaminants early, the treatment process protects communities from exposure to harmful pathogens and toxic materials, reinforcing the right to safe sanitation and public health.

Secondary Treatment: Protecting Ecosystems and Human Dignity

The secondary stage uses biological processes—such as bacteria that naturally break down organic matter—to further clean the water. This step is vital in preventing waterborne diseases and in maintaining ecological balance. According to the Environmental Protection Agency, secondary treatment removes about 85% of remaining contaminants, ensuring that water returned to the environment is safe for both humans and wildlife. This upholds the human right to a clean and healthy environment.

Tertiary Treatment: Upholding Environmental Justice

In regions where ecosystems are particularly sensitive, tertiary treatment—also known as effluent polishing—is used to achieve even higher water purity. This step removes residual nutrients like phosphorus and nitrogen that can disrupt aquatic ecosystems. Through advanced methods such as sand filtration, this treatment level ensures water quality suitable for reuse and, in some cases, even for drinking. It represents a commitment to environmental justice, ensuring that vulnerable communities and ecosystems are not disproportionately affected by pollution.

Why Water and Wastewater Treatment ? – Benefits

ChatGPT said:

Water and wastewater treatment are essential for maintaining public health, protecting the environment, and ensuring sustainable water use. Here are some of the key benefits:

1. Protection of Public Health

- Prevents Waterborne Diseases: Proper treatment removes harmful pathogens, bacteria, and viruses from water, significantly reducing the risk of waterborne diseases such as cholera, dysentery, and typhoid.

- Safe Drinking Water: It ensures that potable water meets safety standards, preventing contamination that could harm consumers.

2. Environmental Protection

- Reduces Pollution: Wastewater treatment helps in removing toxic substances, chemicals, and pollutants from industrial and domestic waste before they are discharged into rivers, lakes, or oceans. This helps protect aquatic ecosystems and wildlife.

- Improves Ecosystem Health: Proper treatment of effluents ensures that water quality remains high, supporting biodiversity in water bodies.

3. Conservation of Water Resources

- Recycling and Reuse: By treating and purifying wastewater, water can be reused for non-potable purposes like irrigation, industrial cooling, or landscaping. This reduces the demand for fresh water and promotes sustainable water use.

- Saves Water for Future Generations: Treating water ensures its availability for future generations by managing and conserving water supplies responsibly.

4. Economic Benefits

- Supports Industry and Agriculture: Treated water can be reused in various industries, agriculture, and manufacturing, reducing the need for fresh water, lowering operational costs, and promoting economic sustainability.

- Job Creation: The water treatment industry itself creates jobs in engineering, operations, maintenance, and management, contributing to the local economy.

5. Compliance with Regulations

- Meets Legal Standards: Wastewater treatment ensures that industries and municipalities meet environmental protection regulations and water quality standards set by local or international authorities.

- Avoids Fines: Companies that fail to meet water treatment standards can face hefty fines or legal actions, so having an effective treatment system in place is crucial for compliance.

6. Improvement of Quality of Life

- Access to Clean Water: Proper water treatment infrastructure ensures consistent access to clean water, improving quality of life, particularly in developing regions.

- Better Living Conditions: Reducing the spread of disease through waterborne pathogens directly improves living conditions, especially in densely populated urban areas.

What Are the Major Trends in The U.S. Water and Wastewater Treatment Market?

- Growing enforcement of stricter regulatory standards is driving demand for advanced treatment technologies and resilient infrastructure.

- Increasing adoption of water reuse, recycling, and resource recovery models is reshaping how municipalities and industries approach wastewater.

- Digitalization and smart monitoring solutions are being integrated to enable real-time operations, predictive maintenance, and efficient treatment management.

- Rising demand from industrial sectors such as semiconductors, pharmaceuticals, and power generation is creating specialized treatment requirements and driving customized solutions.

- Retrofitting aging infrastructure and managing legacy assets are becoming more prominent priorities, with investment shifting toward upgrading existing plants rather than just building new ones.

How Does AI Influence the Growth of the U.S. Water and Wastewater Treatment Industry in 2025?

The integration of artificial intelligence (AI) into the U.S. water and wastewater treatment industry is enhancing operational efficiency by enabling real-time monitoring and predictive maintenance of treatment assets. This smart monitoring capability reduces downtime and chemical usage. AI is also supporting the shift towards water reuse and resource recovery by optimizing treatment processes and enabling adaptive control of complex systems. This trend accelerates the market’s transformation toward sustainable treatment models and is a key growth enabler for 2025.

Immediate Delivery Available | Buy This Premium Research Report (Single Region Dive USD USD 3200) https://www.towardschemandmaterials.com/checkout/5964

U.S. Water and Wastewater Treatment Market Dynamics

Growth Factors

Can Water Reuse Reshape Treatment Demand?

Growing acceptance of treated wastewater for industrial and municipal reuse is transforming the U.S. water sector. This shift drives investment in advanced treatment technologies that enable recycling instead of disposal. As more states adopt reuse policies, utilities expand capacity and upgrade systems, boosting market growth.

Will Infrastructure Renewal Spark Market Expansion?

Aging U.S. water systems are prompting large-scale upgrades supported by federal and state initiatives. These efforts fuel demand for modern equipment, smart monitoring, and sustainable treatment solutions. Infrastructure renewal continues to act as a key driver of long-term market growth.

Market Opportunity

Could Smart Monitoring Open New Growth Doors?

The shift towards real-time data monitoring and analytics in U.S. water utilities is creating opportunities for systems that optimize asset performance and detect leaks early, driving demand for advanced IoT platforms. This trend enables treatment providers to offer value-added services that go beyond classical purification. As utilities seek to improve reliability and reduce waste, smart monitoring becomes a competitive differentiator. Vendors and service firms that can bundle hardware, software, and analytics to benefit.

Will Decentralized Treatment Become A Strategic Pathway?

On-site and decentralized wastewater treatment systems are gaining attention as viable alternatives to traditional large-scale plants, especially in remote or energy-constrained settings. These systems reduce reliance on freshwater imports and enable reuse for irrigation or industrial processes, opening up new markets for modular treatment units. Providers offering compact, efficient modules tailored to specific sites can tap into these evolving needs. As sustainability pressures mount, flexibility in deployment and modularity become important competitive edges.

Limitations & Challenges

- The high operational cost of running modern water and wastewater treatment facilities, including energy usage, chemical consumption, and maintenance of complex equipment, acts as a key barrier to market expansion in the U.S.

- Fluctuations in raw prices and the technological complexity of integrating advanced treatment systems hinder broad adoption and slow the pace of upgrades across smaller utilities.

U.S. Water and Wastewater Treatment Market Segmentation Insights

Type Insights:

Why Is the Municipal Segment Dominating in the U.S. Water And Wastewater Treatment Market?

The municipal water and wastewater treatment segment dominated the market. The growing demand for safe and clean drinking water, coupled with stringent federal and state regulations on wastewater discharge, has pushed municipalities to invest heavily in modern treatment systems. Urban population expansion, gaining infrastructure, and environmental mandates have increased the reliance on advanced municipal treatment facilities. Additionally, government initiatives supporting infrastructure renewal have encouraged the adoption of technologies that improve purification efficiency, resource recovery, and system resilience. Municipal utilities remain at the centre of national water management, ensuring reliable supply and environmental compliance across the country.

The industrial water and wastewater treatment segment is expected to grow at the fastest rate. Rapid industrialization and stricter water quality standards are pushing manufacturers to install in-house treatment units to manage water reuse and discharge. Sectors such as pharmaceuticals, food and beverages, and energy are increasingly investing in tailored treatment systems to ensure operational sustainability and compliance. Companies demand specialized technologies. The trend toward sustainable industrial practices and cost-effective water management continues to make this segment a prime growth driver in the coming years.

Treatment Technology Insights:

Why Does Membrane Filtration Dominate the U.S. Water and Wastewater Treatment Market in 2024?

The membrane filtration segment dominated the market. Its superior performance in removing contaminants and providing high-quality water output has made it a preferred choice across municipal and industrial settings. Membrane technologies such as ultrafiltration and reverse osmosis are widely adopted due to their efficiency, compactness, and ability to handle diverse water qualities. Growing concerns over micro pollutants and emerging contaminants have further accelerated their deployment. The increasing integration of smart monitoring and automated cleaning systems has also enhanced their long-term viability and cost efficiency, strengthening their position on the market.

The desalination and water reuse segment is projected to experience the fastest growth. With rising water scarcity and climate variability, desalination and reuse are merging as vital solutions for securing sustainable water supplies. States facing water stress are investing in advanced reuse projects to reduce dependence on freshwater sources. The combination of improved membrane performance and energy-efficient systems is making these technologies more feasible. As awareness about circular water management expands, desalination and reuse are gaining strong traction as a further ready solution for both municipal and industrial users.

Component Insights:

Why Does Equipment Dominate in the U.S. Water and Wastewater Treatment Market?

The equipment segment dominated the market. The rising need for upgrading existing facilities with efficient filtration, pumping, and disinfection equipment is fuelling this segment’s prominence. Both municipal utilities and private operators are focusing on modernizing systems to enhance operational reliability and meet stricter standards. Advancements in automation, compact design, and low-maintenance machinery are making equipment solutions more attractive. Continued investment in robust, energy-saving devices ensures long-term operational stability, reinforcing the equipment segment’s essential role in the treatment process.

The software and digital solutions segment is anticipated to grow rapidly in the market. The integration of smart sensors, AI, and real-time monitoring platforms is transforming the way treatment systems operate. Digitalization enables predictive maintenance, operational optimization, and better resource allocation, reducing overall costs and inefficiencies. Utilities and industries are adopting data-driven tools to track system performance and ensure compliance with environmental standards. As infrastructure modernization continues, digital solutions are becoming central to achieving smart, sustainable water management.

Application Insights:

Why Does Potable Water Treatment Dominate in the U.S. Water And Wastewater Treatment Market?

The potable water treatment segment dominated the market. Increasing public awareness of water quality and health safety is driving the installation of advanced purification systems. Municipal bodies are prioritizing technologies that ensure the removal of pathogens, heavy metals, and emerging contaminants. The growing need for safe and sustainable drinking water infrastructure further supports the segment’s dominance. Investments in filtration, disinfection, and monitoring systems are helping maintain consistent water quality standards nationwide.

The water reuse and recycling segment is expected to expand rapidly in the market. Growing environmental consciousness and rising pressure on freshwater resources have made water reuse a vital strategy for sustainability. Both industries and municipalities are adopting closed-loop systems that allow wastewater to be treated and reused for non-potable or process applications. Advancements in treatment efficiency and regulatory support are promoting large-scale reuse initiatives. This approach not only conserves water but also supports cost reduction and long-term resource resilience.

End-User Insights:

Why Do Municipal Utilities Dominate in the U.S. Water And Wastewater Treatment Market?

The municipal utilities segment dominated the market. Municipalities handle the majority of the nation’s water and wastewater treatment operations, ensuring compliance with environmental and health standards. Continuous population growth and urban development have intensified the demand for reliable municipal systems. Government funding remains vital in maintaining public thorough safe, sustainable, and efficient water management practices.

The industrial sectors segment is projected to grow at the fastest rate. Industries are increasingly prioritizing water conservation, reuse, and treatment efficiency to align with sustainability goals. Customized treatment solutions are being deployed to address sector-specific challenges such as process water reuse and pollutant removal. Regulatory compliance and cost pressures are prompting industries to adopt innovative systems that minimize environmental impact. As manufacturing and energy production continue to expand, industrial users will remain a major growth force in the U.S. water and wastewater treatment market.

Which U.S. Region Dominated the Market in 2024?

The southern U.S. emerged as the dominant region in the market, driven by the expansion of water-dependent industries such as food processing, manufacturing, and pharmaceuticals. Growing population levels in the region have also intensified both residential and industrial water needs, encouraging large-scale adoption of efficient wastewater management systems.

The western region is projected to record the fastest growth, supported by ongoing infrastructure upgrades and increasing challenges related to water scarcity. States including California, Arizona, and Nevada are prioritizing advanced water treatment and recycling solutions to ensure a sustainable supply for their growing communities.

The Midwestern region is expecting steady expansion, backed by substantial investments in infrastructure modernization and stricter environmental regulation. The area’s strong manufacturing base, spanning chemical, automotive, and paper industries, continues to fuel the demand for reliable and efficient water treatment systems.

Top Companies in the U.S. Water and Wastewater Treatment Market & Their Offerings:

- SUEZ North America (Veolia subsidiary): SUEZ North America, now fully integrated with Veolia North America, provides comprehensive water and wastewater treatment services, including regulated utilities, operation of municipal facilities through public-private partnerships, and industrial water management solutions.

- Pentair plc: Pentair delivers a wide range of water and fluid management solutions for residential, commercial, industrial, and municipal applications, including pumps, filters, valves, and full systems for water supply, disposal, and treatment.

- 3M Company: 3M offers filtration and separation products, including cartridges, housings, and systems for residential, commercial, and industrial water applications, focused on improving water quality and meeting regulatory requirements.

- Aqua-Aerobic Systems, Inc.: This company provides adaptive water management solutions for municipal and industrial markets, specializing in aeration and mixing, biological processes (like aerobic granular sludge), cloth media filtration, and membranes to meet stringent effluent requirements.

- Evoqua Water Technologies (part of Xylem): As part of Xylem, Evoqua offers a comprehensive portfolio of water and wastewater treatment solutions, including disinfection, filtration systems, carbon and resin technologies, and advanced biological treatment for various applications.

- Danaher Corporation (Hach, Trojan Technologies): Danaher’s water brands, such as Hach and Trojan Technologies, focus on providing instruments, technologies, and services for water quality analysis, disinfection (UV-based), and overall water management across the entire water cycle.

- AECOM: AECOM provides engineering, design, and construction services for water and wastewater infrastructure projects, helping municipal and government clients to build and upgrade treatment plants and related facilities.

- Jacobs Solutions Inc. Jacobs offers professional technical services, including consulting, design, and operations and maintenance for water and wastewater systems, focusing on delivering sustainable and resilient water management solutions for a range of clients.

- Kurita America Inc.: Kurita specializes in providing advanced water treatment solutions, including chemicals, equipment, and engineering services, aimed at improving efficiency, reducing environmental impact, and ensuring regulatory compliance for industrial and institutional customers.

- DuPont Water Solutions: DuPont provides a broad range of membrane technologies, including reverse osmosis (RO), ultrafiltration (UF), and ion exchange resins, used for desalination, water reuse, and purification in industrial and municipal applications.

Immediate Delivery Available | Buy This Premium Research Report (Single Region Dive USD USD 3200) https://www.towardschemandmaterials.com/checkout/5964

More Insights in Towards Chemical and Materials:

- Water Treatment Chemicals Market : The global water treatment chemicals market size was reached at USD 38.88 billion in 2024 and is expected to be worth around USD 58.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period 2025 to 2034.

- Industrial and Institutional Cleaning Chemicals Market : The global industrial and institutional cleaning chemicals market size was reached at USD 83.97 billion in 2024 and is expected to be worth around USD 192.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.64% over the forecast period 2025 to 2034.

- Wastewater Treatment Services Market : The global wastewater treatment services market size is estimated at USD 67.56 billion in 2025, it is predicted to increase from USD 72.22 billion in 2026 to approximately USD 131.78 billion by 2035, expanding at a CAGR of 6.91% from 2025 to 2035.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

- Industrial Water Treatment Chemical Market : The global industrial water treatment chemicals market size is estimated at USD 18.84 billion in 2025, it is predicted to increase from USD 19.89 billion in 2026 to approximately USD 32.34 billion by 2035, expanding at a CAGR of 5.55% from 2025 to 2035.

- Boiler Water Treatment Chemicals Market : The global boiler water treatment chemicals market size was reached at USD 5.52 billion in 2024 and is expected to be worth around USD 15.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.85% over the forecast period 2025 to 2034.

- Aquaculture Market : The global aquaculture market size is calculated at USD 310.66 billion in 2024, grew to USD 326.66 billion in 2025, and is projected to reach around USD 513.31 billion by 2034. The market is expanding at a CAGR of 5.15% between 2025 and 2034.

- Paints and Coatings Market : The global paints and coatings market size was valued at USD 211.44 billion in 2024 and is expected to hit around USD 348.04 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period from 2025 to 2034.

- Structural Steel Market : The global structural steel market size was approximately USD 119.12 billion in 2025 and is projected to reach around USD 188.63 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.24% between 2025 and 2034.

- Carbon Black Market : The global carbon black market size is accounted for USD 29.23 billion in 2025 and is anticipated to hit around USD 44.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.85% over the forecast period from 2025 to 2034.

- Aerospace Foam Market : The global aerospace foam market size is estimated at USD 7.32 billion in 2025 and is expected to hit around USD 13.27 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.84% over the forecast period from 2025 to 2034. North America dominated the aerospace foam market with a market share of 40% in 2024.

- U.S. Aquaculture Market : The U.S. aquaculture market size is calculated at USD 80.81 billion in 2025 and is predicted to increase from USD 84.94 billion in 2026 to approximately USD 126.55 billion by 2034, expanding at a CAGR of 5.11% from 2025 to 2034.

- U.S. Steel Rebar Market : The U.S. steel rebar market size was estimated at USD 7.31 billion in 2025 and is predicted to increase from USD 7.70 billion in 2026 to approximately USD 11.59 billion by 2034, expanding at a CAGR of 5.25% from 2025 to 2034.

- U.S. Copper Market : The U.S. copper market size was approximately USD 14.55 billion in 2024 and is projected to reach around USD 26.33 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.11% between 2025 and 2034.

- North America Building Thermal Insulation Market : The North America building thermal insulation market size was valued at USD 12.88 billion in 2024 and is expected to hit around USD 20.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.85% over the forecast period from 2025 to 2034.

- U.S. Agrochemicals Market : The U.S. agrochemicals market size was valued at USD 35.19 billion in 2024 and is expected to hit around USD 42.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 1.95% over the forecast period from 2025 to 2034.

- U.S. Nickel Market : The U.S. nickel market size was valued at USD 12.19 billion in 2024 and is expected to hit around USD 17.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.65% over the forecast period from 2025 to 2034.

U.S. Water and Wastewater Treatment Market Top Key Companies:

- SUEZ North America (Veolia subsidiary)

- Pentair plc

- 3M Company

- Aqua-Aerobic Systems, Inc.

- Evoqua Water Technologies (part of Xylem)

- Danaher Corporation (Hach, Trojan Technologies)

- AECOM

- Jacobs Solutions Inc.

- Kurita America Inc.

- DuPont Water Solutions

- Siemens Water Technologies

- ITT Inc.

- Calgon Carbon Corporation

- Hydranautics (Nitto Group Company)

- Ovivo Inc.

- Clean Water Services

- Black & Veatch

Recent Developments

- In October 2025, the American Water Works Co. announced a plan to merge with Essential Utilities in an all-stock deal, creating a combined entity that would serve millions of water connections across multiple states. The move is seen as a way to scale treatment infrastructure and streamline operations in the regulated utilities space.

- In June 2025, New rules in Texas governing permitting for wastewater disposable wells have raised the costs and complexity for oil and gas producers navigating disposable wells have raised the costs and complexity for oil and gas producers of advanced treatment and reuse approaches in energy sector applications.

U.S. Water and Wastewater Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global U.S. Water and Wastewater Treatment Market

By Type

- Municipal Water & Wastewater Treatment

- Industrial Water & Wastewater Treatment

- Commercial & Institutional Treatment

By Treatment Technology

- Membrane Filtration (RO, UF, NF, MF)

- Biological Treatment (Activated Sludge, MBR, SBR)

- Disinfection (UV, Ozone, Chlorination)

- Clarification & Filtration Systems

- Desalination & Water Reuse

- Chemical Treatment (Coagulation, Flocculation)

- Others (Adsorption, Ion Exchange, Advanced Oxidation)

By Component

- Equipment (Pumps, Valves, Membranes, Aerators, etc.)

- Chemicals (Coagulants, Flocculants, Biocides, pH Adjusters)

- Services (Operation, Maintenance, Consulting)

- Software & Digital Solutions (IoT, AI, SCADA, Smart Water Management)

By Application

- Potable Water Treatment

- Wastewater Treatment

- Water Reuse & Recycling

- Desalination

- Groundwater Remediation & Industrial Process Water

By End User

- Municipal Utilities

- Industrial Sectors

- Power Generation

- Food & Beverage

- Pharmaceuticals

- Chemicals & Petrochemicals

- Electronics & Semiconductors

- Commercial & Institutional

- Agriculture & Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Single Region Dive USD USD 3200) https://www.towardschemandmaterials.com/checkout/5964

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.