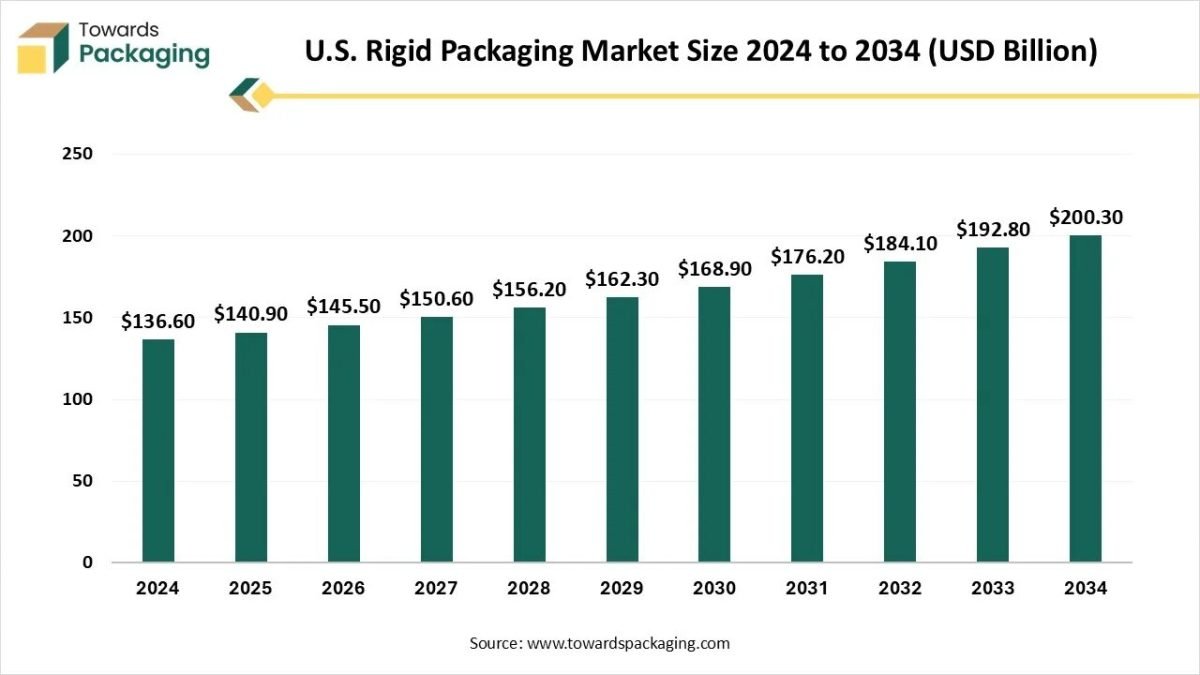

According to projections from Towards Packaging, the global U.S. rigid packaging market is set to increase from USD 145.50 billion in 2026 to nearly USD 200.30 billion by 2034, reflecting a CAGR of 3.9% during 2025 to 2034.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The global U.S. rigid packaging market reported a value of USD 140.90 billion in 2025, and according to estimates, it will reach USD 200.30 billion by 2034, as outlined in a study from Towards Packaging, a sister firm of Precedence Research. The U.S. rigid packaging market is witnessing steady growth driven by increasing demand from the food and beverage, pharmaceuticals, and consumer goods sectors. Rising consumer preference for convenient, durable, and sustainable packaging solutions is boosting the adoption of materials such as glass, metal, and high-performance plastics.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Rigid Packaging?

The rigid packaging market is driven by growing demand for durable, protective, and convenient packaging solutions across the food, beverage, pharmaceutical, and personal care industries. Rising consumer focus on product safety, sustainability, and premium presentation further fuels adoption. Rigid packaging refers to packaging materials that retain their shape and provide structural support to protect products during storage, transportation, and display. Common types include glass bottles, metal cans, and rigid plastics, offering durability, barrier protection, and aesthetic appeal.

This packaging ensures product integrity, extends shelf life, and enhances consumer experience across various sectors. Technological innovations, including lightweighting, improved barrier properties, and eco-friendly materials, are enhancing functionality while reducing environmental impact. Additionally, manufacturers are investing in automation and advanced production processes to meet evolving regulatory standards and consumer expectations.

Major U.S. Government Initiatives in the Rigid Packaging Industry:

- State-Level Extended Producer Responsibility (EPR) Laws: These state-based initiatives shift the financial burden of managing packaging waste from municipalities to the producers of the packaging.

- Post-Consumer Recycled (PCR) Content Mandates: Several states require that rigid plastic packaging contain specific minimum percentages of recycled material.

- EPA’s National Recycling Strategy and Grants: The EPA is funding grants and promoting a national strategy to build a stronger and more resilient domestic recycling system.

- Federal Trade Commission (FTC) Green Guides: The FTC provides guidelines to prevent misleading environmental claims on packaging labels and in advertising.

- Federal Agency Single-Use Plastic Reduction: The U.S. federal government is actively working to reduce and phase out the use of single-use plastic products and packaging within its own operations.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5809

What are the Latest Key Trends in the U.S. Rigid Packaging Market?

Sustainable and eco-friendly materials

Brands are increasingly adopting recyclable, bio-based plastics, lightweight glass, and mono-material formats to reduce environmental impact and meet consumer demand for greener packaging.

Smart and functional packaging

Packaging is embedding technologies like QR codes, sensors, and RFID tags to track product condition, enhance traceability, and provide interactive consumer experiences.

Lightweighting and material efficiency

Manufacturers are designing containers with thinner walls, optimized geometries, and reduced material usage without compromising durability, driven by cost and sustainability goals.

Customization and premiumization

The rise of personalization and premium branding is pushing custom-shaped, digitally printed, and high-quality rigid packaging formats that enhance shelf appeal and consumer engagement.

Regulatory compliance and circular economy focus

Stricter regulations around recyclability, waste reduction and material reuse are compelling packaging makers to adopt circular designs, closed-loop systems, and mono-material formats.

What is the Potential Growth Rate of the U.S. Rigid Packaging Industry?

Expansion of Food & Beverage Industry & Advancements in Materials

The expansion of the food and beverage market in the U.S. drives demand for rigid packaging by requiring durable, safe, and convenient containers for products such as ready-to-eat meals, beverages, and packaged foods. Simultaneously, advancements in materials and lightweighting technologies enable manufacturers to produce thinner, stronger, and more sustainable containers, reducing costs and environmental impact.

Together, these trends enhance product protection, shelf appeal, and operational efficiency, supporting broader adoption of rigid packaging solutions across retail, e-commerce, and foodservice channels.

Limitations & Challenges

Environmental Concerns & Stringent Regulatory Compliance

The U.S. rigid packaging market faces challenges, including high production costs, limited recyclability of certain materials, stringent regulatory compliance, and environmental concerns. Additionally, fluctuating raw material prices and increasing competition hinder innovation and large-scale adoption of sustainable solutions.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Regional Analysis:

U.S. Rigid Packaging Market Analysis

The U.S. rigid packaging market is characterized by strong demand from the food and beverage, pharmaceutical, and consumer goods sectors. Growth is driven by increasing e-commerce, the need for durable and protective packaging, and consumer preference for sustainable, eco-friendly solutions. Innovations in lightweighting, advanced plastics, glass, and metal materials enhance functionality, reduce costs, and improve environmental performance.

Additionally, manufacturers are investing in automation, smart packaging technologies, and premium designs, enabling better product protection, brand differentiation, and compliance with evolving regulatory standards.

Segment Outlook

Material Type Insights

What made the Plastic Segment Dominant in the U.S. Rigid Packaging Market in 2024?

Plastic dominates the market due to its versatility, lightweight nature, durability, and cost-effectiveness. Its ability to be molded into diverse shapes, provide barrier protection, and support eco-friendly innovations like recyclable and bio-based plastics makes it the preferred choice across food, beverage, pharmaceutical, and consumer goods sectors.

The biodegradable packaging segment is growing rapidly in the U.S. due to increasing environmental awareness, stringent regulations on plastic waste, and rising consumer demand for sustainable alternatives. Manufacturers are adopting compostable materials and bio-based plastics, enabling eco-friendly packaging solutions without compromising durability or product protection.

Product Type Insights

How the Bottles and Jars Dominated the U.S. Rigid Packaging Market in 2024?

The bottles and jars segment dominates the market due to their versatility, durability, and suitability for liquids, beverages, food, and personal care products. Their ability to provide secure sealing, preserve product quality, and support customization enhances brand appeal, driving widespread adoption across multiple industries.

The tubes and buckets segment is the fastest-growing in the market due to rising demand for convenient, bulk, and easy-to-dispense packaging in food, personal care, and industrial products. Their reusability, portability, and compatibility with innovative closures enhance functionality and consumer convenience, driving rapid adoption.

End-Use Industry Insights

How did the Food & Beverages dominate the U.S. Rigid Packaging Market in 2024?

The food and beverages segment dominates the market due to high demand for safe, durable, and convenient containers that preserve freshness and extend shelf life. Rising consumption of packaged foods, ready-to-eat meals, and beverages drives widespread adoption of glass, plastic, and metal rigid packaging solutions.

The pharmaceutical segment is the fastest-growing in the market due to increasing demand for safe, tamper-evident, and sterile packaging solutions. Rising production of medicines, biologics, and vaccines, along with strict regulatory requirements, drives the adoption of advanced rigid containers that ensure product integrity and patient safety.

Production Process Insights

How the Blow Molding Dominated the U.S. Rigid Packaging Market?

The blow molding segment dominates the market due to its efficiency in producing lightweight, durable, and uniform containers like bottles and jars. Its versatility, cost-effectiveness, and ability to accommodate large-scale production for food, beverage, and personal care products drive widespread industry adoption.

The thermoforming segment is the fastest-growing in the market due to its ability to create lightweight, custom-shaped, and visually appealing trays, clamshells, and containers. Its efficiency, material versatility, and suitability for food, medical, and consumer goods packaging drive rapid adoption and innovation.

Sustainability Initiatives Insights

What made the Recyclable Materials Segment Dominant in the U.S. Rigid Packaging Market in 2024?

The recyclable materials segment dominates the market due to increasing environmental awareness, regulatory pressure, and consumer demand for sustainable packaging. Materials like PET, HDPE, and aluminum enable reuse and recycling, reducing environmental impact while maintaining durability, product protection, and cost-efficiency across food, beverage, and consumer goods sectors.

The biodegradable packaging segment is the fastest-growing in the market due to heightened consumer preference for eco-friendly solutions and stricter regulations on plastic waste. Innovations in compostable plastics and bio-based materials allow sustainable, durable, and safe packaging, meeting both environmental goals and industry performance requirements.

More Insights of Towards Packaging:

- Rigid Polyolefin Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- PET Rigid Plastic Packaging Market Dynamics, Competitive Forces and Strategic Pathways

- PP Rigid Plastic Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Rigid Paper Packaging Market Demand Soars in 2025, Fueled by Food, E-Commerce, and Recyclability

- Premium Packaging Material Market Demand Surges in 2025 with Paperboard & Rigid Boxes Dominating

- Rigid Substrate Market: Smart Packaging, Sustainability, and AI Integration

- Rigid Chilled Food Packaging Market Research, Consumer Behavior, Demand and Forecast

- Rigid IBC Market Research Insight: Industry Insights, Trends and Forecast

- Luxury Rigid Box Market Outlook Scenario Planning & Strategic Insights for 2034

- Rigid Food Packaging Market Trends, Share, and Growth Analysis 2034

- Collapsible Rigid Containers Market Research Insight: Industry Insights, Trends and Forecast

- Rigid Box Market Size, Segments, and Regional Data with Competitive Analysis

- Rigid Tray Market Size, Segments, and Regional Outlook (2025-2035), Competitive Landscape

- Rigid Sleeve Boxes Market Size, Segments, Regions, Competition & Value Chain 2025-2035

- Rigid Bulk Packaging Market Size, Segments Data, Regional Trends, Competitive Landscape

Recent Breakthroughs in the U.S. Rigid Packaging Industry

- In February 2025, Amcor plc, a packaging company, partnered with Avantium to explore the use of Releaf plant-based polyethylene furanoate for rigid packaging applications. This development focuses on creating sustainable, renewable-material containers that reduce reliance on fossil-fuel plastics while maintaining durability and product protection across food and beverage applications.

- In August 2025, Amcor announced a US$10 million investment in a new recycling facility in Ohio to expand production of food-grade mechanically recycled polypropylene (rPP). The facility supports the company’s mission to deliver eco-friendly rigid packaging solutions while promoting a circular economy for plastics.

- In August 2025, Custom Packaging Pro expanded its rigid packaging product portfolio with biodegradable laminates, enhanced barrier films, and customizable designs. This launch targets luxury, electronics, and food sectors, combining sustainability with aesthetic appeal and functional performance for U.S. manufacturers and retailers.

Top Companies in the U.S. Rigid Packaging Market & Their offering:

- Amcor plc develops and produces a wide range of rigid plastic containers, preforms, and closures for the food, beverage, pharmaceutical, medical, home, and personal care industries.

- Berry Global Inc. provides innovative, sustainable rigid plastic packaging solutions, including bottles, jars, containers, and closures for consumer and healthcare products.

- Crown Holdings Inc. is a leading global supplier of rigid packaging products, primarily focusing on metal beverage and food cans, aerosol containers, and metal closures.

- Ball Corporation is a global leader in providing sustainable, infinitely recyclable aluminum packaging solutions for the beverage, personal care, and household product sectors.

- Sealed Air Corporation specializes primarily in protective and flexible packaging, and their rigid packaging offerings are not a core segment of their well-known product lines in the US market.

- Silgan Holdings Inc. manufactures and sells rigid packaging for a variety of consumer goods products, including metal containers for food and general line products, and plastic containers for personal care and healthcare.

- Sonoco Products Company offers a variety of rigid packaging solutions, including fiber-based cans, paperboard containers, and rigid plastic packaging for consumer and industrial markets.

- Alpla Werke Alwin Lehner GmbH & Co KG is a specialist in manufacturing rigid plastic packaging, such as bottles, preforms, and caps, for global markets including North America.

- Mondi plc is a global packaging and paper company that, while offering a range of packaging, focuses heavily on paper and flexible plastic solutions, with rigid offerings being a smaller part of their overall portfolio.

- Huhtamaki Inc. provides a variety of rigid food packaging solutions, including paper and plastic cups, containers, and other disposable tableware products.

Segment Covered in the Report

By Material Type

- Plastic

- Metal

- Glass

- Paperboard

By Product Type

- Bottles and Jars

- Cans

- Containers and Trays

- Tubs and Buckets

- Boxes and Cartons

By End-Use Industry

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Household and Industrial Products

- Healthcare and Medical Devices

By Production Process

- Injection Molding

- Blow Molding

- Thermoforming

- Extrusion

- Compression Molding

By Sustainability Initiatives

- Recyclable Materials

- Biodegradable Packaging

- Reusable Containers

- Lightweight Packaging

- Minimalistic Packaging Designs

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5809

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight – Check It Out:

- U.S. Beverage Packaging Market Size, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- U.S. Glass Packaging Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- U.S. Pharmaceutical Packaging Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- U.S. Cosmetic Packaging Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- U.S. Sustainable MAP Trays Market Surges Amid Eco-Packaging and Regulatory Push

- U.S. Sustainable Packaging Market Size, Segments, Companies and Competitive Analysis 2025-2034

- U.S. 503B Compounding Pharmacy Packaging Market Size and Insights

- U.S. 503A Compounding Pharmacy Packaging Market Size and Insights

- Single Serve Packaging Market Outlook 2025-2034: U.S. and Germany at the Forefront of Sustainable Innovation

- U.S. Vacuum Sealer Bags Market Research, Trends and Forecast

- U.S. Food Storage Containers Market Dynamics, Competitive Forces & Strategic Pathways

- U.S. Custom Cardboard Boxes Market Research Insight: Industry Insights, Trends and Forecast

- U.S. Personalised Packaging Market Performance, Trends and Strategic Recommendations

- U.S. Cardboard Storage Boxes Market Strategic Analysis & Growth Opportunities

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.