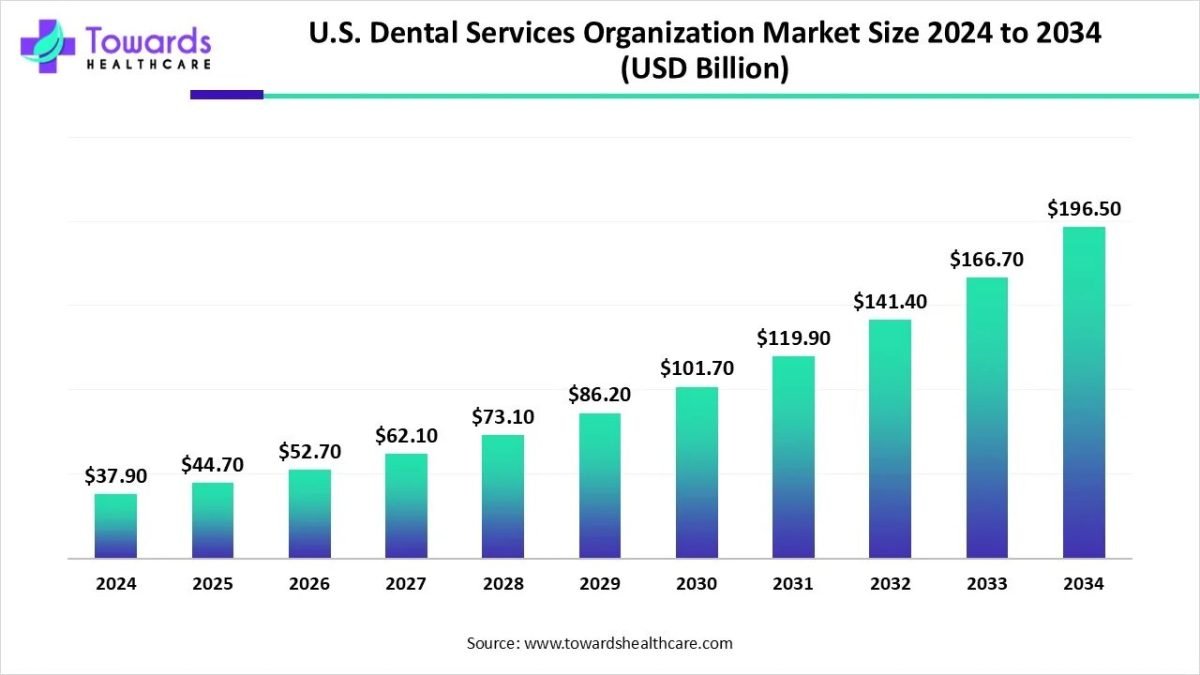

The U.S. Dental Services Organization market size is calculated at USD 44.7 billion in 2025 and is expected to reach around USD 196.5 billion by 2034, growing at a CAGR of 17.9% for the forecasted period.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The U.S. Dental Services Organization market size was valued at USD 37.9 billion in 2024 and is predicted to hit around USD 196.5 billion by 2034, rising at a 17.9% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research. The U.S. market is driven by the growing awareness, geriatric population, and industry consolidation.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5541

Key Takeaways

- By service, the medical supplies procurement segment held a major revenue share of the market in 2024.

- By service, the human resources segment is expected to witness the fastest growth in the U.S. dental services organization market during the forecast period.

- By end-use, the general dentists segment held a major revenue share of the market in 2024.

- By end-use, the dental surgeons segment is expected to witness the fastest growth in the market during the forecast period.

What is the U.S. Dental Services Organization?

The U.S. dental services organization market is driven by growing demand for efficient, accessible dental care investments, and technological advancements. The dental services organization refers to the companies providing administrative and business support to the dental practices where they handle non-clinical operations and allow dentists to focus on the clinical care, across the U.S. Moreover, they help in handling processes such as accounting, scheduling, billing, dental insurance claims, recruitment, purchasing of dental supplies, conducting campaigns, ensuring regulatory compliance, etc.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2024 | USD 37.9 Billion | |

| Projected Market Size in 2034 | USD 196.5 Billion | |

| CAGR (2025 – 2034) | 17.9 | % |

| Market Segmentation | By Service and By End-Use | |

| Top Key Players | Aspen Dental, Colosseum Dental Group, Dental Care Alliance, GSD Dental Clinics, Heartland Dental, LLC | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Major Growth Drivers in the Market?

The increasing oral health awareness is the major growth driver in the U.S. dental services organization market. This, in turn, is increasing the demand for preventive care and cosmetic surgeries, where the DSOs are expanding the patient experience by enhancing access to the services and extending the working hours with transparent financing. Additionally, industry consolidation, growing demand for affordable services, dentists’ preferences, and an aging population are other market drivers.

What are the Key Drifts in the Market?

The U.S. dental services organization market has been expanding due to the growing investments, collaborations, and funding to launch and expand the use of various dental services.

- In June 2025, for the expansion of the service offering, scale operations, and to complete acquisitions, a minority investment was secured by Southlake, Texas-based Allied OMS. Moreover, the transaction was led by 65 Equity Partners, where Everberg Capital provided the co-investment.

- In June 2025, to offer free dental care to ectodermal dysplasia patients, a collaboration between Chicago-based The Aspen Group and the National Foundation for Ectodermal Dysplasias was formed. Additionally, to connect the patient with a clinician at an Aspen Dental or Clear Choice Dental Implant Centers location, the collaboration will launch the Smile Bridge program.

- In April 2025, a total of $77 million in funding was secured by Hackensack, N.J.-based Max Surgical Specialty Management, where this capital will be used to establish new collaborations across the Northeast through the oral and maxillofacial platform.

- In March 2025, a debt financing agreement was announced between Dana Point, Calif.-based Silver Creek Dental Partners and Ivy Asset Group. The investments in the practices and expansion across California of DSO will be supported by this financing.

- In March 2025, to expand access to dental assisting programs, a collaboration between Denver-based Espire Dental and Zollege was announced. The 12-week dental assisting programs will be conducted at Espire Dental’s dental practices located in Lakewood, through this collaboration.

What is the Significant Challenge in the Market?

High integration cost is the major challenge in the U.S. dental services organization market. The acquisition of new practices under DSO requires high investments for staff training, technology adoptions, and advancements in infrastructure. Moreover, workforce shortage, data privacy concerns, clinical autonomy concerns, and regulatory restrictions are other market limitations.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

What Factor Enhanced the U.S. Dental Services Organization Market in 2024?

The U.S. is expected to experience significant growth in the market during the forecast period, due to growing collaborations between DSOs and independent dental practices, to deal with the growing workforce shortage. At the same time, the increasing oral health awareness, the demand for preventive care, and surgical procedures are also increasing, where the adoption of advanced technologies such as tele dentistry, is enhancing the patient outcomes, experience, and satisfaction, driving the U.S. dental services organization market growth. Additionally, the growing demand for affordable and more accessible services is also increasing the use of digital platforms, where new investments are supporting the clinics to expand their services.

For instance,

- As per the American Dental Association, an economic growth in the dental sector of the U.S was observed, which offered 147,000 job opportunities.

Global Dental Services Organization Market

The global dental services organization market is valued at USD 163.93 billion in 2024 and is expected to grow to USD 192.83 billion by 2025. Looking ahead, the market is projected to reach approximately USD 835.87 billion by 2034, expanding at a robust CAGR of 17.65% from 2025 to 2034.

Access the in-depth report of Dental Services Organization size, trends, shares and competitive scope @ https://www.towardshealthcare.com/checkout/5529

Segmental Insights

By service analysis

Which Service Type Segment Held the Dominating Share of the Market in 2024?

By service, the medical supplies procurement segment held the dominating share of the U.S. dental services organization market in 2024, due to a growth in the dental practices, which enhanced the repeated demand for consumables. At the same time, the cost associated with bulk orders is low, which enhances their bulk procurement. Moreover, growth in the collaborations also increased their use through online platforms.

By service, the human resources segment is expected to show the highest growth in the market during the predicted time, driven by frequent employee recruitments. This, in turn, increases the demand for these services, where the expansion of the dental practices is also contributing to the same. Additionally, to deal with the growing labor management complexities, their demand is increasing to streamline the various dental services.

By end-use analysis

What Made General Dentists the Dominant Segment in the Market in 2024?

By end-use, the general dentists segment held the largest share of the U.S. dental services organization market in 2024, as they are considered the primary dental practice providers. Moreover, the growth in patient volumes also enhanced the routine dental care services provided by them. Additionally, their widespread availability and cost-effective services enhanced their use.

By end-use, the dental surgeons segment is expected to show the fastest growth rate in the market during the upcoming years, due to the growing geriatric population, which is increasing the demand for implants. Additionally, growing cosmetics and other oral surgeries are also increasing the shift towards them. Furthermore, the presence of skilled personnel, advanced technologies, and growing oral health awareness are also increasing patient dependence on them.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments in the Market

- In June 2025, to provide support for the expansion of the business, cost savings, and streamline operations for private practice dentists, the Carabelli Club, which is an affiliate program, was launched by Dallas-based MB2 Dental.

- In June 2025, the Endura Elite full-arch restoration, the dental arches, which can be individually customized, was launched by ClearChoice Dental Implant Centers.

- In June 2025, the AI-powered platform of VideaHealth was merged into the network of more than 100 dental practices of Jonesboro, Ark.-based GPS Dental. Therefore, the operational efficiency, clinical outcomes, and quality of care will be enhanced by DSOs and dental practices with the use of this platform.

- In April 2025, to develop new approaches for clinical excellence, a new program providing daily lectures was launched by New Hyde Park, N.Y.-based Dental365.

- In March 2025, the practice management of Denticon and Apteryx, imaging software of Planet DDS, and the Second Opinion AI-powered program of Pearl will be merged to provide a single platform for all practices to streamline workflows, unify operations, and enhance patient experience.

Also Read from Towards Dental:

The global dental syringes market was valued at USD 7,031 million in 2024 and is projected to reach about USD 10,408 million by 2034, expanding at a CAGR of 4%.

The global dental flap surgery market was valued at USD 6.01 billion in 2024 and is expected to reach approximately USD 12.1 billion by 2034, growing at a CAGR of 7.25%.

The global dental device market was valued at USD 11.82 billion in 2024 and is expected to reach around USD 22.82 billion by 2034, growing at a steady CAGR of 6.8%.

The global dental simulator market was valued at USD 402.82 million in 2024 and is projected to reach approximately USD 1,040.07 million by 2034, expanding at a CAGR of 9.95%.

The global dental diagnostic and surgical equipment market was valued at USD 12.26 billion in 2024 and is projected to reach around USD 22.8 billion by 2034, growing at a steady CAGR of 6.4%.

U.S. Dental Services Organization Market Key Players List

- Dental Care Alliance

- Aspen Dental

- GSD Dental Clinics

- MB2 Dental

- Colosseum Dental Group

- Mosaic Dental Collective LLC

- Smile Brands Group, Inc.

- Heartland Dental, LLC

- Sage Dental

Segments Covered in The Report

By Service

- Medical Supplies Procurement

- Human Resources

- Marketing & Branding

- Accounting

- Others

By End-Use

- General Dentists

- Dental Surgeons

- Endodontists

- Others

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5541

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.