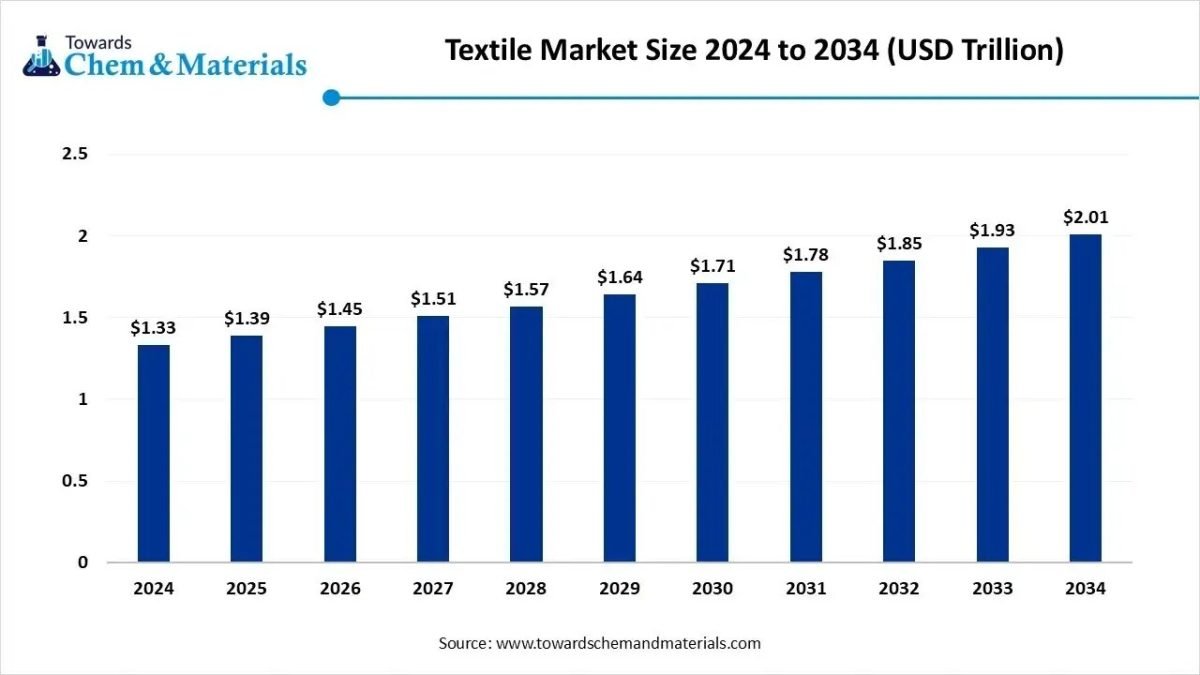

According to Towards Chemical and Materials Consulting, the global textile market size is calculated at USD 1.39 trillion in 2025 and is expected to surpass around USD 2.01 trillion by 2034, growing at a CAGR of 4.24% from 2025 to 2034.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The global textile market size was valued at USD 1.33 trillion in 2024 and is anticipated to reach around USD 2.01 trillion by 2034, growing at a compound annual growth rate (CAGR) of 4.24% over the forecast period from 2025 to 2034. Asia Pacific dominated the textile market with a market share of 50.11% in 2024. Rising consumer demand for sustainable and eco-friendly fabrics is a key growth factor driving the expansion of the textile market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5968

What is Textile?

The global textile market is undergoing a dynamic transformation driven by rising demand for apparel, home furnishings, and technical textiles, as well as growing consumer preference for sustainable and high-performance fabrics. Innovation in materials such as bio-based fibres and recycled synthetics is reshaping supply chains and production practices, reinforcing the industry’s shift toward circular economy models and technological integration.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Textile Market Report Highlights

- Asia Pacific dominated the textile market and accounted for the largest revenue share of 50.11% in 2024.

- By material/fibre type, the synthetic fibres segment accounted for the largest revenue share of 42.4% in 2024.

- By fabric/form, the woven fabrics segment held the largest revenue share of 51.4% in 2024.

- By product type, the fabric segment accounted for the largest revenue share of around 44.4% in 2024.

- By application / end-use, the apparel/fashion segment dominated the market with a share of 54.5% in 2024.

Branches Of The Textiles Industry

- Fiber Production: Textile fibers are sourced from natural or synthetic materials. The process of obtaining these fibers often involves labor that must be fair, ethical, and free from exploitation. Ensuring that workers in this sector receive fair wages, safe working conditions, and are not subjected to child labor or forced labor is essential.

- Yarn Production: Yarn is made by spinning fibers together, whether natural or synthetic. The workers involved in yarn production should have access to safe working environments, fair pay, and the right to organize. Child labor and hazardous conditions must be strictly avoided in this process.

- Fabric Production: Fabric is created by weaving or knitting yarns, typically from materials like cotton, wool, silk, or synthetics. Human rights considerations in fabric production include ensuring that workers are treated with dignity and respect, provided with safe working environments, and receive adequate wages for their labor. The use of child labor and unsafe working conditions must be eliminated.

- Accessories: Accessories, which are materials used to enhance the visual appeal of garments, also require ethical sourcing and production. Companies must ensure fair wages, respect for workers’ rights, and access to safe working conditions for those involved in the production of textile accessories.

- Dyeing, Printing, and Embroidery: These processes add aesthetic value to fabrics, but they must also be done under humane conditions. Workers involved in dyeing, printing, and embroidery should not face exposure to harmful chemicals without proper protective measures. The right to a safe workplace and fair treatment is critical in these areas.

- Pre-Treatment: Pre-treatment processes involve cleaning and preparing fabrics for dyeing or printing. Workers in pre-treatment stages must be protected from harmful chemicals and unsafe working environments. Employers should ensure that safety standards are followed and that workers are trained and equipped with the necessary protective gear.

- Garment Manufacturing: The garment production process includes various stages such as cutting, stitching, and finishing. Workers must be guaranteed fair wages, humane working hours, and a safe environment free from harassment and abuse. There should be zero tolerance for child labor, forced labor, and unsafe working conditions.

- Finishing Treatment: Finishing techniques enhance the appearance and performance of fabric or clothing. Workers involved in finishing treatments should have access to safe, fair, and healthy working conditions, free from exposure to harmful substances. Adequate compensation and respect for labor rights are essential.

- Packaging: Garment packaging must be carried out with attention to workers’ rights. Packaging workers should be treated with dignity, have access to fair wages, and work in conditions that do not jeopardize their safety. Their labor rights must be respected in every stage of the packaging process.

- Shipment: The shipping of textiles and garments involves transportation and distribution. Workers in the shipment industry must be protected from exploitation, unfair wages, and unsafe conditions. Ethical treatment during shipment includes ensuring fair pay for labor, safe working conditions, and ensuring that workers are not subjected to long working hours or hazardous tasks.

Use Of Textile

Textiles are highly significant in material culture, serving various roles as technological products, cultural symbols, artistic expressions, and trade commodities. The textile arts represent a fundamental human activity, symbolically conveying much of what holds value in any culture.

Textiles have been employed in numerous practical applications, taking advantage of their unique characteristics. Some examples of textile products include:

- Bags and items for carrying objects

- Balloons, kites, sails, and parachutes. In the early days of aviation, cloth was a crucial component in aircraft construction.

- Clothing

- Flags

- Furnishings and a variety of home accessories

- Geotextiles

- Industrial and scientific uses, such as filtration

- Nets

- Rugs and carpets Bio textile and medical science

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5968

Textile Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 1.45 Trillion |

| Revenue forecast in 2034 | USD 2.01 Trillion |

| Growth rate | CAGR of 4.24% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Actual estimates/Historical data | 2021 – 2025 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Revenue in USD million/trillion and volume in kilotons and CAGR from 2025 to 2034 |

| Segments covered | By Material / Fibre Type, By Fabric / Form, By Product Type, By Application / End-Use, and region |

| Key companies profiled | Hengli Petrochemical Co., Ltd.; Shenzhou International Group Holdings Ltd; Toray Industries, Inc.; Inditex; Chargeurs SA; Far Eastern New Century Corporation; Sasa Polyester Sanayi A.S.; Eclat Textile Co. Ltd; TJX Companies; Vardhman Textiles |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Major Sustainability Trends in the Textile Industry:

- Circular Fashion and Economy: This trend focuses on designing products for durability, reuse, and recycling, effectively creating a closed-loop system where materials never end up as waste.

- Use of Sustainable and Biodegradable Materials: The industry is increasingly adopting organic (like organic cotton and hemp) and recycled fibers (from sources like plastic bottles and old textiles) to reduce reliance on virgin resources and ensure products can decompose safely at the end of their life cycle.

- Supply Chain Transparency and Traceability: Driven by consumer demand for ethical sourcing, brands are implementing technologies like blockchain and digital product passports to provide clear data about a product’s origin, materials, and production journey.

- Eco-conscious Water Management and Dyeing Processes: New technologies and processes, such as waterless dyeing, digital printing, and advanced water recycling systems, are being adopted to significantly reduce water consumption, wastewater generation, and the use of harmful chemicals.

- Integration of Renewable Energy: Textile manufacturers are shifting towards using renewable energy sources, like solar and wind power, to reduce the industry’s significant carbon footprint and reliance on fossil fuels.

What Are the Major Trends in the Textile Market?

- Growing adoption of sustainable and eco-friendly materials, such as recycled fibres and bio-based substances, is driving industry transformation.

- Increasing demand for high-performance and functional textiles with properties like antimicrobial, UV resistance, water repellence, and durability.

- Strong shift towards advanced manufacturing technologies, including digital printing, automation, and smart finishing processes across textile production.

- Expansion of technical/industrial textile applications beyond apparel into sectors like healthcare, automotive, and infrastructure, broadening markets.

- Rising pressure from regulations and consumer awareness is pushing transparency, traceability, and lower environmental impact throughout the textile supply chain.

How Does AI Influence the Growth of the Textile Industry in 2025?

AI is reshaping the textile industry by enabling manufacturers to streamline production and enhance quality through advanced analytics and automated systems. For example, AI-powered machine vision and predictive maintenance help reduce defects and waste, boosting operational efficiency. In research and development, AI is accelerating the creation of sustainable, high-performance textiles by predicting material behaviour and optimizing processes such as dyeing and finishing. This fosters innovation and supports the transition to eco-friendlier products.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5968

Textile Market Growth Factors

Can Eco-Fridley Fibres Ignite the Textile Surge?

Brands are increasingly shifting towards recycled and bio-based fabrics, which reduce dependency on conventional resources and appeal to sustainability-minded consumers. This push is creating new supply chains around recycled yarns and innovative materials like viscose from waste. Manufacturers are embedding these materials across apparel and home textiles, transforming both raw material sourcing and end product stories. The shift supports stronger brand positioning in a market where ecological credentials are becoming a key differentiator.

Will Smart Manufacturing Transform Textile Output?

Digital technologies such as sensors, AI-driven quality checks, and connected machines are being introduced into textiles, enabling faster operations with lower waste and higher precision. These tools also allow firms to respond more quickly to consumer trends and customize production runs, unlocking new business models centred on agility and efficiency in a traditionally rigid industry.

Market Opportunity

Can Circular Fashion Create New Opportunities?

The shift toward circular economy models is opening fresh possibilities in textile reuse and recycling. Brands are exploring ways to turn waste into resources and extend product lifecycles through repair, rental, and resale. This approach reduces environmental impact while unlocking new revenue streams and consumer trust.

Will Smart Textiles Shape the Next Wave of Fashion?

Smart fabrics that integrate sensors and digital features are creating opportunities in sportswear, healthcare, and lifestyle segments. These innovations blend technology and design, offering enhanced comfort and functionality. Textile makers collaborating with tech firms can tap into a growing market for interactive and performance-driven apparel.

Limitations & Challenges

- Raw material prices are volatile, and supply chain disruption hinders stable production costs and growth in the textile chemicals market.

- Performance gaps and consumer education challenges limit the wider adoption of bio-based and sustainable textile alternatives.

Textile Market Segmentation Insights

Material / Fibre Type Insights:

Which Material/ Fibre Type Dominated the Textile Market?

The synthetic fibres segment dominated the market in 2024. The synthetic fibres category, including popular materials like polyester, nylon, and acrylic, holds a dominant position because it combines cost-effectiveness, scalability in production, and widespread applicability across apparel, home furnishing, and industrial textiles. Manufacturers favour synthetic fibres due to their durability, ease of processing, and ability to meet performance demands such as moisture management, stretch, and resilience.

With global manufacturing infrastructure deeply rooted in synthetic fibre production and well-established supply chains, this segment maintains its strong influence over the market landscape.

As sustainability becomes a stronger differentiator, and the relative growth potential of natural fibres rises, positioning them as the fastest expanding fibre type in the market.

Fabric / Form Insights:

Which Fabric/Form Dominated the Textile Market?

The woven fabrics segment dominated the market in 2024. Woven fabrics characterised by interlaced yarns and robust structure continue to be the format of choice for many apparel lines, upholstery, home décor, and industrial uses, because they provide shape stability, durability, and a broad design canvas. The existing weaving infrastructure, global distribution of woven textile mills, and high-volume manufacturing capabilities reinforce the dominance of woven fabrics in the market. Even as other fabric formats evolve, the woven segment remains a central role in meeting mainstream textile demand.

The non-woven fabrics segment is projected to expand rapidly in the market in the coming years. Non-woven materials are emerging in applications such as hygiene products, medical textiles, filtration, packaging, and other specialty areas due to their lightweight nature, disposability, and manufacturing flexibility. With rising demand for such industrial and technical textile applications, non-woven fabrics are increasingly seen as a growth frontier, offering manufacturers an opportunity to diversify beyond traditional woven or knitted fabrics.

Product Type Insights:

Which Product Type Dominated the Textile market?

The fabric segment dominated the market in 2024. The fabric product type acts as the foundational layer of the textile value chain, supplying raw and semi-finished materials that feed apparel producers, home textile manufacturers, and industrial users alike, giving it a material share of the market.

Because fabric output is both high volume and less value added than finished goods, it still retains the largest portion of market activity in terms of production and distribution. Although downstream segments are growing, the fabric product type remains the dominant one in the global market.

The finished textiles segment is predicted to witness the fastest growth over the period 2025-2034. Finished textiles, which include final garments, home furnishing, and technical textile products ready for end use, are increasingly valued for their design complexity, branding potential, and performance enhancements. As consumer tastes evolve and value-added functionality becomes more important, the finished textiles category is gaining traction and investment.

Application / End-Use Insights:

Which Application/ End Use Dominated the Textile Market?

The apparel/fashion segment dominated the market in 2024. Apparel and fashion textiles remain the largest demand driver because everyday clothing, fast-fashion cycles, global brands, and expanding retail channels create vast volumes of textile consumption. The fashion segment’s influence extends into raw material choices, production schedules, and supply chain strategies, thereby anchoring the market’s mainstream. Despite the rise of other applications, the apparel/ fashion end-use continues to hold the dominant share across textiles worldwide.

The technical/industrial textiles segment is anticipated to grow at the highest rate during the studied years. Technical and industrial textiles used in sectors such as automotive, construction, medical, protective gear, and filtration are gaining momentum as performance requirements escalate and innovative textile formats proliferate. As industries seek materials with advanced properties, this end-use category is poised to expand faster than the more traditional consumer apparel segment.

Regional Insights

What Makes the Asia Pacific Region Dominant in The Textile Market?

The Asia Pacific textile market size was estimated at USD 670 billion in 2024 and grew to USD 698.07 billion in 2025, and is projected to reach around USD 1,010.03 billion by 2034. The market is expanding at a CAGR of 4.19% between 2025 and 2034.

Asia Pacific region dominates the global market due to its strong manufacturing infrastructure, large labor force, and easy access to natural and synthetic raw materials. Countries such as China, India, Bangladesh, and Vietnam have built extensive textile value chains that support raw material production, fabric processing, and garment manufacturing.

Countries such as China, India, Bangladesh, and Vietnam have built extensive textile value chains that support raw material production, fabric processing, and garment manufacturing. The region benefits from cost-effective production capabilities, favourable government policies, and growing investments in automation and sustainable practices. Increasing export activities and rising domestic consumption, and sustainable practices.

India Textile Market Trends

India has become one of the most dynamic markets within the Asia Pacific, leveraging its long-standing textile heritage, strong raw material base, and a rapidly modernizing manufacturing sector. The country’s large cotton and man-made fibre production, combined with skilled labor and rising technological capabilities, positions it as a global textile hub. Government initiatives promoting exports, infrastructure development, and sustainability are attracting both domestic and international investors. India’s textile industry also benefits from growing demand for eco-friendly fabrics and increased collaboration between traditional producers and advanced textile companies.

Why Is the North America Region Expected to Grow Fastest in the Textile Industry?

The North America segment is projected to register the highest growth rate in the market during the forecast period. This growth is propelled by rising demand for high-performance and technical textiles, as well as a shift toward innovative, sustainable fabrics and manufacturing technologies. Investment in smart textile solutions and advanced fibre systems in this region is strengthening market momentum. As supply chains evolve and demand spreads in sectors like automotive, medical, and industrial textiles, North America’s share is set to expand more rapidly compared with more mature regions.

U.S. Textile Market Analysis

The U.S. textile market size was valued at USD 188.55 billion in 2024 and is expected to hit around USD 283.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.15% over the forecast period from 2025 to 2034.

The U.S. stands out as a dominant national market thanks to its advanced textile manufacturing infrastructure, strong industrial base, and growing focus on performance and specialty textiles, sustainable materials, and automated processes to meet evolving consumer, industrial, and regulatory demands. This positions the U.S. as a significant hub for textile growth in North America, reinforcing the region’s overall strength and future potential.

Europe Textile Market Trends

The Europe textile market size was reached at USD 260.85 Billion in 2024 and is expected to be worth around USD 410.94 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034.

Europe textile industry is emphasizing circular textiles, biodegradable materials, and eco-certifications. EU Green Deal regulations are pushing companies to adopt sustainable practices. High demand for luxury fashion and home textiles supports innovation. Countries like Italy and Germany are leaders in textile machinery and high-quality fabrics. Technical textiles are gaining traction in automotive and industrial applications. European consumers are highly aware of ethical sourcing and environmental impact. Digital transformation is driving smart textile innovations across the region.

Germany’s textile industry is known for engineering precision in textile machinery and technical fabrics. The country is a key player in industrial, medical, and automotive textiles. Focus on sustainability and digitalization is driving innovation. Companies are developing high-performance fibers for demanding applications. Public and private R&D collaboration supports cutting-edge development. Export demand from Europe and North America remains strong. Germany is also exploring bio-based and recyclable materials for future growth.

Central & South America Textile Market Trends

Central & South America’s textile industry is recovering steadily, led by Brazil and Mexico. Trade agreements with the U.S. are aiding exports. The domestic fashion industry is growing in Brazil, Colombia, and Argentina. High raw material availability supports regional manufacturing. However, production is often challenged by inconsistent policies and logistics issues. Eco-friendly and cultural designs are attracting niche international buyers. There is increasing investment in modernizing infrastructure and technology. E-commerce is becoming a strong growth channel.

Middle East & Africa Textile Market Trends

The Middle East textile industry is emerging as a textile trade hub, particularly the UAE, with strong re-export capabilities. Turkey remains a key textile producer with high export volumes to Europe. In Africa, Ethiopia and Kenya are gaining attention as textile manufacturing destinations due to low labor costs. Governments are offering tax incentives and industrial parks to attract FDI. Local markets are growing for modest fashion and traditional wear. The region is also starting to adopt sustainable practices, though at an early stage. Demand for basic apparel and textiles is growing with rising income levels.

Top Companies in the Textiles Market & Their Offerings:

- Hengli Petrochemical Co., Ltd.: The company is an integrated producer that offers a wide range of textile polyester yarns (both for clothing and industrial uses) and fabrics, stemming from its large-scale petrochemical operations.

- Shenzhou International Group Holdings Ltd: This company is a leading vertically integrated knitwear manufacturer, producing large volumes of activewear, casual wear, and intimate apparel for major global brands like Nike, Adidas, and Uniqlo.

- Toray Industries, Inc.: A diversified materials company, Toray manufactures and sells various synthetic fibers, including polyester, nylon, and acrylic, which are used in everything from apparel and sportswear to industrial materials and home furnishings.

- Inditex: As one of the world’s largest fashion retailers (owner of brands like Zara and Massimo Dutti), Inditex primarily offers a wide range of fast-fashion clothing, footwear, and accessories, supported by a highly responsive, vertically integrated supply chain.

- Far Eastern New Century Corporation: Known for its vertical integration, the company offers a range of innovative textiles, including smart textiles, green materials, and functional fibers/fabrics, with production bases across Asia.

More Insights in Towards Chemical and Materials:

- Recycled Engineering Plastics Market Size to Hit USD 7.89 Billion by 2034

- Mechanical Recycling of Plastics Market Size to Surge USD 92.86 Bn by 2034

- Commodity Plastics Market Size to Hit USD 666.76 Billion by 2034

- Plastics Market Size to Worth USD 984.11 Billion by 2034

- Recycled Plastics Market Size to Reach USD 183.80 Billion by 2034

- Sustainable Plastics Market Size, Share, Trends & Growth Report, 2034

- Circular Plastics Market Size to Hit USD 182.21 Billion by 2034

- Recycled Plastics In Green Building Materials Market Size to Reach USD 12.24 Bn By 2034

- Transparent Plastics Market Size to Hit USD 245.19 Bn by 2034

- Plastics Extruded Market Size to Surge USD 259.21 Billion by 2034

- Bioplastics Market Volume to Reach 73,21,706.6 Tons by 2034

- Recycled thermoplastics Market Size to Exceed USD 145.34 Bn by 2034

- Biopolymers Market Size to Hit USD 53.68 Billion by 2034

- Liquid Crystal Polymers Market Size to Hit USD 6.73 Billion by 2034

- Polymers Market Size to Reach USD 1,351.59 Billion by 2034

- Bio-Based Polymers Market Size to Hit USD 58.36 Billion by 2034

- Medical Fluoropolymers Market Volume to Reach 13.87 Kilo Tons by 2034

- Lignin-based Biopolymers Market Size to Hit USD 2.07 Bn by 2034

- Fluoropolymers Market Volume to Reach 1351.23 Kilo Tons 2034

- Water Treatment Polymers Market Volume to Hit 15,477.50 Kilotons by 2034

- Bioresorbable Polymers Market Volume Reach 3,839.1 kilotons by 2034

- Recycled Polyester Market Size to Hit USD 38.53 Bn by 2034

- Plastics Extruded Market Size to Surge USD 259.21 Billion by 2034

Textile Market Top Key Companies:

- Hengli Petrochemical Co., Ltd.

- Shenzhou International Group Holdings Ltd

- Toray Industries, Inc.

- Inditex

- Chargeurs SA

- Far Eastern New Century Corporation

- Sasa Polyester Sanayi A.S.

- Eclat Textile Co. Ltd

- TJX Companies

- Vardhman Textiles

Recent Developments

- In June, 2025, Hengli restarted its No. 1 polypropylene (PP) unit at Changxing Island following maintenance, with a capacity of 450,000 t/year.

- In June 2025, Chargeurs SA completed the acquisition of two business units from Cilander, strengthening its technical interlining and smart textiles portfolio.

- In February 2025, Toray announced a chemical recycling technology for nylon 66.

- In August 2025, Gokaldas Exports Ltd approved a draft merger with BRFL Textiles Pvt Ltd to create a vertically integrated apparel and textile business. The move is expected to improve supply chain efficiencies and support fabric production capabilities under one umbrella

- In July 2025, in India’s knitwear hub of Tirupur, textile units are shifting strongly toward man-made fibres (MMF) as global sourcing strategies adopt a “China-Plus-One” approach. This transition aims to deepen domestic MMF capacity and address sourcing diversification.

Textile Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Textile Market

By Material / Fibre Type

- Natural Fibres (Cotton, Wool, Silk, Linen, Jute)

- Synthetic Fibres (Polyester, Nylon, Acrylic, Polypropylene)

- Regenerated / Man-Made Cellulosic Fibres (Viscose, Rayon, Lyocell)

- Blended Fibres

By Fabric / Form

- Woven Fabrics

- Knitted Fabrics

- Non-Woven Fabrics

By Product Type

- Fibre

- Yarn

- Fabric

- Finished Textile (Garments, Home Textiles, Technical Textiles)

By Application / End-Use

- Apparel / Fashion

- Home Textiles (Bed Linen, Curtains, Upholstery, Towels)

- Technical / Industrial Textiles (Automotive, Medical, Protective, Construction)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5968

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.