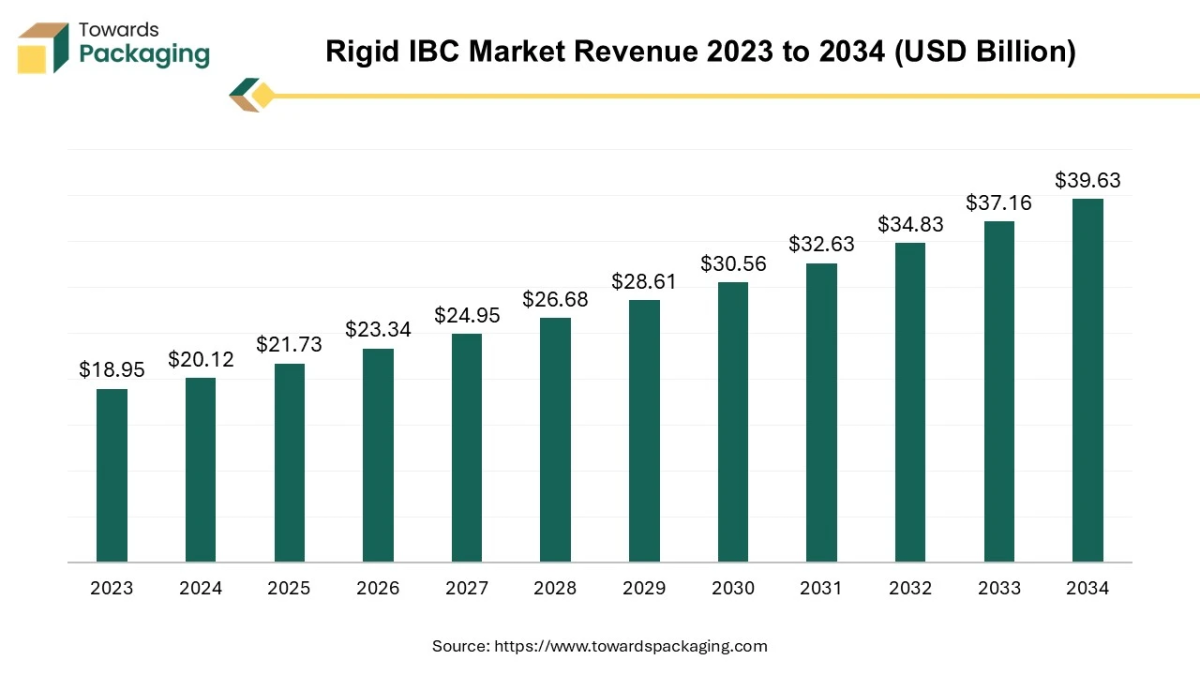

According to a recent analysis by Towards Packaging, the global rigid IBC market is projected to expand from USD 23.34 billion in 2026 to USD 39.63 billion by 2034, recording a CAGR of 6.94% between 2025 and 2034.

Ottawa, Nov. 20, 2025 (GLOBE NEWSWIRE) — The global rigid IBC market was valued at USD 21.73 billion in 2025 and is expected to grow to USD 39.63 billion in 2034, as noted in a study published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

It offers cost-effective, efficient, and even sustainable solutions for storing along transporting bulk liquids and solids. Key drivers of its expansion include the increasing need from the chemical, food and beverage, and a few industrial sectors, also a push towards more sustainable and even recyclable packaging.

What is Meant by Rigid IBC?

A rigid intermediate bulk container (IBC) is generally an industrial-grade, portable, and primarily reusable container engineered for the transport, mass handling, and storage of liquids, pastes, or granular solids. The key feature of a rigid IBC is that it manages its fixed shape whether empty or full, offering robust structural integrity and even protection for its contents. The main drivers for the rigid IBC market are the expansion in e-commerce, increased need from the agrochemical and pharmaceutical industries, and the requirement for sustainable and safe packaging solutions. Other factors involve the growth of the food and beverage sector, industrial expansion, and advancements in IBC technology, such as improved chemical resistance and smart features.

What are the Latest Trends in the Rigid IBC Market?

Increased Demand for E-Commerce and Global Trade

It is propelled by cross-border e-commerce and even global trade, which need standardized, durable containers for bulk liquids and solids. The expansion of e-commerce, especially business-to-business sales, intensifies the demand for economical and robust packaging solutions for shipping individual items along with bulk consumer goods. Global trade demands containers that meet stringent international safety standards. Moreover, rigid IBCs are usually certified for transporting dangerous goods, thus, making them important for international logistics.

Growing Needs of Various End-User Industries

This is due to the need for efficient, cost-effective, and even sustainable bulk packaging. Industries such as food and beverages, pharmaceuticals are increasing their usage of IBCs for transporting and storing large quantities, worldwide global trade expansion, stricter regulations, and a target on environmental sustainability, thus accelerate market growth. IBCs provide lower shipping expenses compared to smaller containers and enhance storage efficiency, making them an attractive alternative for businesses looking to decrease overhead. Their stackable and fork-lift accessible design also improves handling and inventory management.

What Potentiates the Growth of the Rigid IBC Market?

Increasing Adoption of Sustainable and Cost-Effective Packaging Solutions

Rigid IBCs are programmed for multiple uses, which significantly decreases the need for single-use packaging and even the consumption of raw materials, funding a circular economy. This cubic or rectangular shape of rigid IBCs improves space utilization in warehouses and during transportation, which can contribute to up to 20% savings in shipping expenses compared to cylindrical containers. Using certified IBCs assists companies in meeting stringent safety and even environmental regulations, avoiding potential fines along legal issues, which also translates into long-term expense avoidance.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5286

Regional Analysis

Who is the Leader in the Rigid IBC Market?

Asia Pacific leads the rigid IBC market because of its massive and even rapidly expanding industrial sectors, mainly chemicals and manufacturing. This expansion is fueled by remarkable industrial investment, a large population with rising consumption, and the need for efficient and safe packaging for pharmaceuticals, chemicals, and food and beverages. The region has the world’s largest chemical market, and significant investments are also being made across numerous industrial sectors, directly boosting the need for bulk containers such as IBCs.

China Market Trends

Key trends include rising need from the food and beverage, chemical, along pharmaceutical sectors, an increasing focus on sustainable and eco-friendly packaging, and technological advancements in smart together with advanced IBC solutions. The growth of e-commerce, along with the online food delivery sectors, also led to this growth.

Japan Market Trends

Key trends involve the integration of AI and IoT for smart containers, the acceptance of advanced materials for better performance and even durability, and a rise in the need for customized solutions. Moreover, the chemicals and pharmaceuticals sectors are considered as major drivers due to the requirement for safe and reliable bulk transport solutions. The pharmaceuticals sector is anticipated to show mainly strong growth.

How is the Opportunistic Rise of Europe in the Rigid IBC Market?

Europe is rising because of stringent sustainability regulations, a strong target on the circular economy, and a robust need from key end-user industries such as chemicals and food & beverage. Europe possesses large, well-established chemical and even food & beverage industries that need safe, efficient, and even compliant bulk packaging solutions. The demand for secure transport and even storage of both hazardous along with non-hazardous chemicals, in compliance with safety standards set by bodies such as the European Chemicals Agency (ECHA), boosts the adoption of rigid IBCs.

U.K. Market Trends

Key trends include rising need from the production and food/beverage sectors, a strong choice for the strength and efficiency of rigid, high-density polyethylene (HDPE) containers, and also increasing interest in smart, IoT-integrated designs as well as sustainable solutions.

Germany Market Trends

Germany’s rigid IBC market is boosted by its strong chemical and even food/beverage industries and a target on sustainability, contributing to a high market share in Europe. Key trends involve the adoption of smart solutions as well as industry-specific innovations, driven by advanced logistics, strict environmental regulations, and a focus on circular economy principles such as reusability and waste reduction.

More Insights of Towards Packaging:

- South Korea Cosmetic Packaging Market Size, Share, Trends, Segments

- U.S. Pharmaceutical Packaging Market Size, Trends, Segmentation, Competitive Landscape, Value Chain and Trade Analysis

- Flexible Packaging Adhesive Market Size, Trends, Segments, Regional Outlook (NA, Europe, Asia Pacific, Latin America, MEA), Companies

- France Pharmaceutical Packaging Market – Size, Trends, Segmentation, Competitive Landscape, Value Chain, Trade Analysis

- Europe Consumer Packaged Goods Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Trade Analysis

- Eco-Friendly Flexible Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Manufacturers and Suppliers Insights

- Chemical Repackaging Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Manufacturers & Trade Analysis

- Japan Packaging Machinery Market Size, Share, Trends, Segments Competitive Landscape, Value Chain & Trade Analysis

- Repackaging Service Market Size, Share, Trends, Segmentation, Regional Outlook (NA, Europe, APAC, Latin America, MEA)

- Commercial Packaging Market Size, Share, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape

- Consumer Packaged Goods (CPG) Market Segmentation, Regional Growth, and Competitive Analysis (2023-2034)

- Refillable Packaging Market Key Players, Market Segments, and Future Growth (2025-2034)

- Jewellery Box Packaging Market Size, Trends, Regional Growth, and Innovation Strategies (2024-2034)

- On-the-Go Packaging Market Growth, Sustainability Trends, and Competitive Dynamics (2025-2034)

- Coffee Bags Market Regional Growth, Consumer Trends, and Packaging Innovations (2025-2034)

- Pharmaceutical Glass Packaging Market Size, Segments, and Regional Outlook (2025-2034)

Segment Outlook

Material Insights

Why did the Metal IBC Segment dominate the Rigid IBC Market in 2024?

Metal IBCs are chosen for certain food products because of their resistance to flavor migration, and also with high-temperature wash stations, compatibility with automated systems, which is vital for meeting strict food-safety rules. Metal IBCs are crucial for managing the integrity of sensitive materials in industries such as pharmaceuticals and chemicals, including vaccines as well as injectable drugs. Stringent regulations, like those in the EU and US for food-safety rules, boost the demand for stainless steel IBCs, which are easy to clean and also preserve product integrity.

Capacities Insights

Why did the Standard 1250 Liters Segment dominate the Rigid IBC Market in 2024?

It states an ideal balance of efficient logistics, large capacity, and versatility for many industries, mainly petrochemicals and lubricants. This size permits for larger volume transport compared to smaller 500-1000 liter units, which in turn decreases the number of containers required and lowers shipping expenses, while its rectangular shape is considered much more space-efficient on a pallet and in trucks than cylindrical tanks. Meanwhile, the standard cubic or rectangular shape offers greater packing efficiency on pallets and in trucks, contributing to up to 20% lower transportation expenses compared to cylindrical containers.

End-use Insights

Why did the Chemicals Segment Dominates the Rigid IBC Market in 2024?

This is due to the industry’s demand for safe and efficient bulk transport of many hazardous materials, which rigid IBCs offer through their robust, durable, and leak-proof design. Rigid IBCs are important for containing and transporting bulk gases, liquids, and powders, including volatile chemicals that need high safety standards to prevent leakage and contamination. The chemical sector depends on IBCs for the storage as well as movement of core materials such as oils, solvents, and petrochemicals.

Why did the Food & Beverages Segment grow rapidly in the Rigid IBC Market during the Forecast Period?

This is due to the industry’s demand for hygienic, efficient, and even cost-effective bulk packaging solutions for transporting liquids along with granular products. The usage of food-grade materials and also designs makes rigid IBCs a preferred option for food and beverage applications, while their durability as well as chemical resistance are also critical factors. The industry’s rising focus on sustainability is also driving the market, as IBCs are usually made from recyclable materials such as polyethylene (PE), which is easier to recycle, and even their reusability is a sustainable advantage.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Global Rigid IBC Industry

- In May 2025, Mauser Packaging Solution, a Georgia-based packaging firm, announced its expansion with the start of a new product, UN-rated IBC. The new stainless steel intermediate bulk containers (IBCs) are corrosion-resistant and designed for delivering unmatched durability.

- In April 2024, Grief Inc., a producer of industrial packaging products, declared its newly started product, rigid IBC, to extend its business portfolio. The company has announced the installation of a novel Intermediate Bulk Container (IBC) manufacturing facility in Malaysia.

Top Companies in the Rigid IBC Market & Their Offerings

- Greif Inc.: Offers a comprehensive portfolio of new and reconditioned composite and plastic rigid IBCs, known as the GCUBE IBC tote, for various industries.

- Mauser Packaging Solutions: Provides a wide range of metal, plastic, fiber, and hybrid rigid IBCs, alongside global packaging and reconditioning services.

- Time Technoplast Ltd.: A major manufacturer of polymer-based molded industrial packaging, including large plastic drums and rigid IBC containers.

- Brambles Group: Specializes in pooling (share and reuse model) of reusable containers, including rigid IBCs, through its CHEP brand.

- Pyramid Technoplast Ltd.: Manufactures UN-certified rigid IBCs for the safe transport of hazardous materials in chemical, agrochemical, and pharmaceutical industries.

- Snyder Industries LLC: Manufactures high-density linear polyethylene rigid IBCs, ranging from 120 to 550 gallons, for diverse industrial applications.

- Theilmann: Specializes in manufacturing high-quality, durable stainless steel rigid IBCs for hygiene-sensitive industries like food and pharmaceuticals.

- Syspal Ltd: Designs and manufactures stainless steel equipment and handling solutions, including industrial tote bins and intermediate bulk containers, for processing environments.

- Schoeller Allibert Group BV: Provides reusable plastic packaging solutions, including the “Maximus” range of foldable and rigid plastic IBCs for logistics and material handling.

- Cabka Group: Produces innovative reusable plastic transport packaging, including rigid plastic IBCs and pallet boxes, focusing on sustainability and logistics efficiency.

- Schutz GmbH: A leading global producer of composite rigid IBCs, notably the well-known Schutz Ecobulk container, featuring an HDPE bottle within a steel cage.

- Schafer Werke GmbH: Produces high-quality stainless-steel IBCs, drums, and other container systems primarily for the beverage, chemical, and pharmaceutical industries through its Container Systems division.

- Auer Packaging: Offers a wide selection of rigid plastic containers, including large volume, stackable IBCs and pallet boxes designed for durable industrial storage and transport applications.

Segments Covered in the Report

By Material

- Metal IBC

- Composite IBC

- Paperboard IBC

- Plastic IBC

By Capacities

- Other Customized Capacities

- Standard 1250 Liters

- Standard 1040 Liters

By End-use

- Chemicals

- Oil & Lubricants

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Other Industrial (Sealants & Adhesives, Solvents)

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5286

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight – Check It Out:

- Confectionery Packaging Market Size, Trends, Segmentation, and Regional Insights (2024-2034)

- Nutraceutical Packaging Market Size, Segments, and Regional Insights (2024-2034)

- Anti-Counterfeit Packaging Technologies Market Insights, Key Segments, and Competitive Landscape (2024-2034)

- Home Care Packaging Market Size, Segmentation, Trends, and Competitive Landscape (2025-2034)

- Packaging for Aseptic Manufacturing Market Size, Segments Data, Regional Analysis (NA, EU, APAC, LA, MEA)

- Packaging Adhesive Market Size, Share, Segments, and Competitive Analysis

- Retail Ready Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Europe Food Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Sterile Medical Packaging Market Size Driven by 11.05% CAGR

- Paint Packaging Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Packaging Coatings Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Cross-linked Polyethylene Market Size, Segments, Share and Companies

- Packaging Materials Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Medical Packaging Market Size, Regional Share (NA/EU/APAC/LA/MEA) and Competitive Analysis

- Expanded Polystyrene for Packaging Market Drives at 9.53% CAGR (2025-34)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.