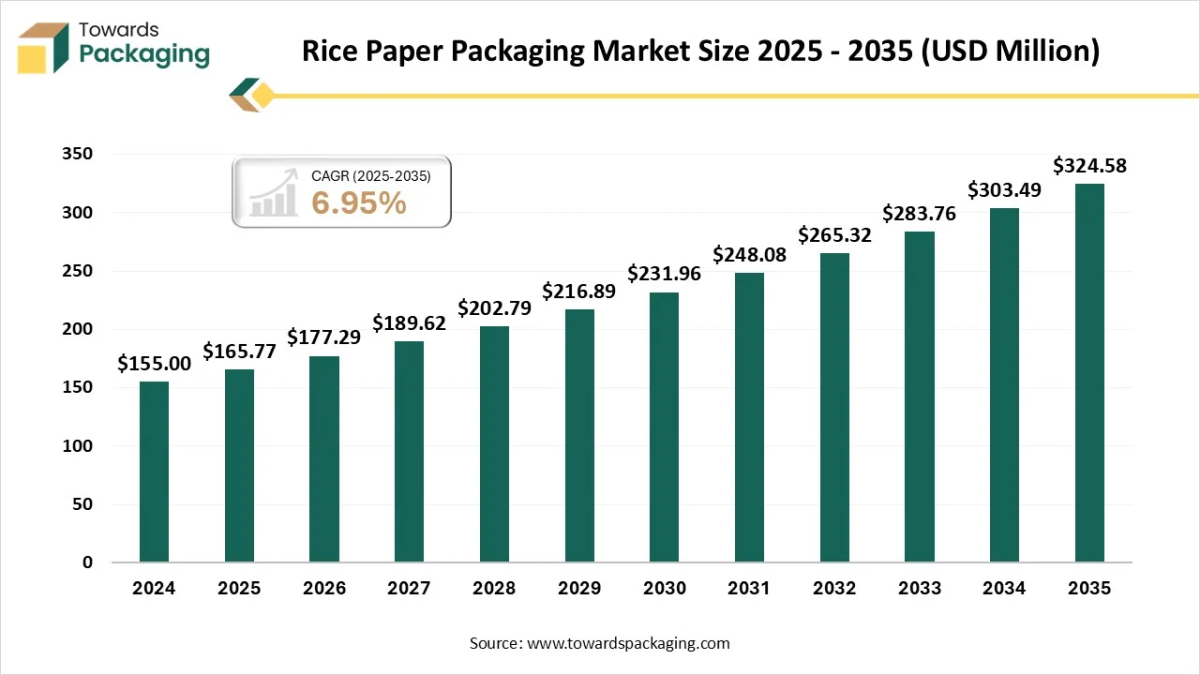

As detailed in the latest report by Towards Packaging, the global rice paper packaging market is forecast to grow from USD 177.29 billion in 2026 to about USD 324.58 billion by 2034, at a CAGR of 6.95% between 2025 and 2034.

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) — The global rice paper packaging market reported a value of USD 165,77 billion in 2025, and according to estimates, it will reach USD 324.58 billion by 2034, as outlined in a study from Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by rice paper packaging?

The rice paper packaging market is rapidly driven by increasing demand for sustainable, biodegradable, and plastic-free packaging solutions across food, cosmetics, and retail industries. Growing awareness of environmental impact, shifting consumer preference toward natural materials, and supportive government regulations are accelerating adoption globally, especially among eco-conscious brands. Rice paper packaging is made from natural plant fibers derived mainly from rice, tapioca, or mulberry, making it lightweight, compostable, and food-safe. It provides excellent transparency, moisture resistance, and adaptability for pouches, wraps, and bags.

Its clean label appeal, minimal carbon footprint, and suitability for organic and artisanal brands make it an attractive replacement for synthetic packaging. Asia Pacific dominates the market due to the region’s large rice production base, strong eco-packaging adoption, and expanding food, cosmetics, and retail sectors. Growing consumer preference for natural, toxin-free packaging and increasing support for green regulations continue to accelerate market expansion.

Government Initiatives in the Rice Paper Packaging Industry:

- Extended Producer Responsibility (EPR) Schemes: These regulations, active in various US states and across Europe, mandate that manufacturers are financially and physically responsible for the entire lifecycle of their packaging, encouraging the use of easily recyclable materials.

- Single-Use Plastic Bans: Numerous countries, including members of the EU and India, have implemented bans on various single-use plastic items, driving businesses to seek alternatives like paper and other biodegradable options.

- Tax Incentives and Subsidies for Green Initiatives: Several nations, such as the Netherlands, Ireland, Italy, and Japan, offer tax breaks, subsidies, and grants to companies that invest in and adopt sustainable and compostable packaging solutions.

- FSSAI Packaging Regulations (India): The Food Safety and Standards Authority of India has established specific regulations (2018) that permit the use of food-grade paper, glass, and metal alloys for packaging water and other items, promoting a shift away from certain plastics.

- EU Packaging and Packaging Waste Directive: This directive sets ambitious targets for 2030, requiring all packaging placed on the EU market to be recyclable or reusable, thus stimulating innovation in sustainable materials like rice paper.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5869

What Are the Latest Key Trends in the Rice Paper Packaging Market?

1. Sustainable, biodegradable materials

Companies are increasingly replacing conventional plastics with rice-paper packaging that is compostable and derived from natural sources. This shift is being driven by rising consumer awareness of plastic waste and supportive sustainability regulations.

2. Growth of non-food applications

While food & beverage packaging remains dominant, rice-paper materials are gaining traction in sectors like cosmetics, personal care, and retail gift wraps due to their premium feel, eco-friendly credentials, and visual appeal.

3. E-commerce and convenience packaging surge

The rise of online retail and food delivery has spurred demand for lightweight, protective, and sustainable packaging formats. Rice-paper wraps and pouches are increasingly used to meet this need in last-mile delivery and takeaway contexts.

4. Innovation in coatings and durability

Manufacturers are developing advanced coatings, lamination techniques, and barrier improvements on rice-paper substrates to overcome challenges like moisture sensitivity and enhance shelf life and performance in diverse environmental conditions.

5. Regional expansion in the Asia Pacific

Driven by a strong agricultural base, large rice production, and increasing sustainability adoption in countries like China and India, the Asia Pacific is a hotspot for rice-paper packaging growth both for local consumption and export.

What is the Potential Growth Rate of the Rice Paper Packaging Industry?

Rising Government Regulation & Increased Adoption in the Food Industry

Government regulation targeting plastic reduction and increased food industry adoption significantly drives the growth of the market. For instance, in 2025, the Food Safety and Standards Authority of India amended its packaging rules to enable greater use of recycled and non-plastic food contact materials. These regulatory shifts push brand owners and food manufacturers to search for alternatives like rice-paper biodegradable, plant-based substrates that meet sustainability goals and comply with stricter packaging standards.

More Insights of Towards Packaging:

- Rigid Box Market Size, Segments, and Regional Data with Competitive Analysis

- Plastic Bag Market Size, Segments, Regional Insights, and Competitive Landscape

- Peelable Lidding Films Market Size, Segmentation, and Competitive Landscape

- Biofoam Packaging Market Size, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Returnable Packaging Market Size, Share, Trends, and Global Forecast 2025-2035

- Highly Visible Packaging Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA)

- Cosmetic Packaging Machinery Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Landscape

- Wine Packaging Market Size, Share, Trends, Segments, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape to 2034

- Ethical Label Market Size, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape & Value Chain Analysis, 2025-2035

- Polystyrene Packaging Market Size, Segments, Regions, Competition & Trade (2025-2035)

- Adherence Packaging Market Size (2025-2035), Segments, Regional Data (NA, EU, APAC, LA, MEA), Companies

- Transit Packaging Market Size (2025-2035), Segments, Regional Data (NA, EU, APAC, LA, MEA), Companies, Competitive & Value Chain Analysis

- Green Packaging Film Market Size, Segments, Regional (NA, EU, APAC, LA, MEA), Companies, Competitive Landscape

- Corrugated Mailers Market Size (2025-2035), Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies

- Pre-made Pouch Packaging Market Size, Segments, Regional Insights, and Competitive Landscape 2025-2035

Regional Analysis:

Who is the leader in the Rice Paper Packaging Market?

Asia–Pacific is the dominant region in the market due to its strong cultural familiarity with rice-based materials, large agriculture-driven economies, and abundant rice production that supports low-cost raw material availability. Additionally, rapid growth in sustainable packaging adoption among food, confectionery, and takeaway brands, along with supportive government initiatives reducing plastic waste, continues to strengthen the region’s leadership in this market.

China Rice Paper Packaging Market Trends

China plays a leading role in the market due to its vast rice production base, well-established packaging manufacturing ecosystem, and cost-efficient supply chain. Strong government initiatives encouraging plastic reduction and rapid adoption of eco-friendly solutions in food service, retail, and e-commerce continue to expand China’s dominance and export capabilities in sustainable packaging.

What are the Current Trends in the India Market?

India is the fastest-growing country in the market due to its expanding food processing and e-commerce sectors, rising disposable incomes, and increasing demand for sustainable solutions. A strong paper and packaging manufacturing ecosystem, government policies against single-use plastics, and abundant agricultural by-products ready for conversion into rice-paper materials all combine to accelerate growth.

How is the Opportunistic is the Rise of Europe in the Rice Paper Packaging Industry?

The European region is the fastest-growing in the market due to strict bans on single-use plastics, aggressive sustainability goals, and strong consumer preference for biodegradable packaging. Food delivery services, supermarkets, and cosmetics brands are increasingly adopting rice-paper to meet eco-label requirements and appeal to environmentally conscious customers. Supportive government incentives and packaging innovation hubs across Germany, France, and the UK further accelerate market expansion.

The UK Rice Paper Packaging Market Trends

The UK stands out as the dominant country in Europe’s market for several key reasons. First, its robust regulatory environment, including the upcoming Extended Producer Responsibility (EPR) scheme and stringent recyclability requirements, pushes brands toward sustainable materials like rice paper. Second, consumer demand for eco-friendly packaging in food, cosmetics, and retail sectors is high, encouraging the adoption of plant-based substitutes.

Finally, the UK has a well-developed packaging manufacturing and supply-chain infrastructure, making sourcing, printing, and scaling rice-paper materials more accessible and cost-efficient than in many other European markets.

How Big is the Success of the North American rice Paper Packaging Industry?

North America is a notably growing region in the market due to increasing concern over plastic pollution, strong regulatory momentum on single-use plastics, and rising consumer preference for sustainable products. The food service, snack, and subscription-box industries are increasingly adopting rice paper packaging for its compostable nature. Innovations in barrier coatings and printability also boost manufacturer confidence in this natural substrate, supporting faster uptake across the U.S. and Canada.

What are the Ongoing Trends in the U.S. Market?

The U.S. leads North America’s market due to its large, mature food processing and e-commerce sector, strong environmental regulations, and growing consumer demand for plant-based, sustainable packaging. It benefits from advanced printing and packaging manufacturing infrastructure, enabling rapid adoption of rice-paper substrates. Strategic investments in research, development, and barriers to moisture and durability are making rice paper increasingly viable for mainstream use in the U.S.

How Crucial is the Role of Latin America in the Rice Paper Packaging Market?

Latin America plays a crucial role in the market as an emerging region with growing demand in food exports, retail packaging, and sustainability initiatives. Abundant agricultural by-products, rising consumer awareness of eco-friendly packaging, and increasing investment in regional manufacturing capacity drive market momentum. Governments’ focus on reducing plastic usage and supporting biodegradable alternatives further accelerates the region’s growth in rice-paper solutions.

How Big is the Opportunity for the Growth of the Middle East and Africa Rice Paper Packaging Industry?

The Middle East and Africa are growing notably in the market due to increasing demand from foodservice and export-oriented agribusiness, rising e-commerce and retail modernization, and stronger sustainability regulations encouraging plastic alternatives. Investments in local converting capacity, tourism-driven hospitality packaging needs, and partnerships with Asian suppliers create large substitution opportunities. Urbanization and growing consumer preference for eco-friendly products further expand market potential across the region.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Product Type Insights

What made the Edible Rice Paper Segment Dominant in the Rice Paper Packaging Market in 2024?

The edible rice paper segment dominates the market because it offers dual functionality as both packaging and consumable material, eliminating waste and supporting zero-plastic goals. Its natural, allergen-free and biodegradable composition makes it ideal for bakery, confectionery, and ready-to-eat products. Growing consumer preference for clean-label and plant-based solutions, along with regulatory support for sustainable food packaging, further strengthens its leadership in the market.

The non-edible rice paper segment is the fastest-growing due to its expanding applications across retail packaging, cosmetics, electronics, and premium goods, where lightweight, biodegradable, and visually appealing materials are preferred. Brands increasingly adopt non-edible rice paper for custom printing, tamper-resistant sealing, and luxury branding. Rising bans on single-use plastics and the demand for recyclable, compostable alternatives significantly accelerate the adoption of non-edible rice paper across global packaging industries.

Application Insights

How did the Food Packaging Dominated the Rice Paper Packaging Market in 2024?

The food packaging segment dominates the market because rice paper offers a safe, biodegradable, and chemical-free alternative ideal for direct food contact. It preserves freshness, adds moisture resistance, and suits bakery, confectionery, snacks, and ready-to-eat applications. Growing demand for sustainable packaging in restaurants, food delivery services, and export-focused food industries further reinforces its leadership. Consumer preference for eco-friendly, natural packaging strengthens widespread adoption in food applications.

The ready-to-eat meals packaging segment is the fastest-growing because rising urban lifestyles and on-the-go consumption demand sustainable packaging that is safe for direct food contact and maintains product freshness. Rice paper supports edible wrapping, portion control, and biodegradable packaging formats, appealing to health-conscious consumers. Food delivery platforms, convenience stores, and meal-kit brands increasingly adopt rice paper to meet clean-label and plastic-free packaging expectations, accelerating its rapid growth in this segment.

End-Use Industry Insights

How did the food and beverages Segment dominate the Rice Paper Packaging Market in 2024?

The food and beverages segment dominates the market because rice paper provides a safe, biodegradable, and chemical-free solution ideal for direct contact with edible products. It enhances product freshness, supports sustainable branding, and suits bakery, confectionery, snacks, beverages, and export food applications. Rising demand for eco-friendly and clean-label packaging across restaurants, supermarkets, and food delivery platforms further strengthens its leadership in this market.

The retail / e-commerce packaging segment is the fastest-growing in the market because online retailers are rapidly shifting toward sustainable and plastic-free shipping materials to meet consumer expectations and regulatory compliance. Rice paper brings lightweight strength, attractive printing capability, and compostable properties ideal for eco-friendly parcel wrapping and protective inserts. The surge in direct-to-consumer brands and premium subscription boxes further accelerates adoption due to its biodegradable appeal and branding versatility.

Form Insights

What made the Sheets and Films Segment Dominant in the Rice Paper Packaging Market in 2024?

The sheets and films segment dominates the market because it offers maximum flexibility for both edible and non-edible packaging applications, making it suitable for bakery items, confectionery, wraps, retail packs, and premium branding. Sheets and films provide superior printability, excellent shelf appeal, and lightweight strength while remaining biodegradable and plastic-free. Their compatibility with automated packing lines and ease of sealing further increase adoption among large food processors, retailers, and eco-focused brands.

The laminated / coated film segment is the fastest-growing in the market because it enhances the durability and barrier properties of rice paper, making it suitable for moisture-sensitive and heat-processed foods. Lamination improves strength, sealability, and print quality, enabling use in high-speed packaging lines. As brands demand eco-friendly films without compromising shelf life and product protection, laminated and coated rice-paper solutions are increasingly preferred across food, cosmetics, and premium retail applications.

Distribution Channel Insights

How did Direct Sales (B2B) dominate the Rice Paper Packaging Market in 2024?

The direct sales segment dominates the market because manufacturers prefer selling directly to food processors, FMCG brands, and retailers to offer customized packaging solutions, bulk pricing, and faster delivery timelines. Direct sales also enable closer collaboration for product development, such as edible wraps, laminated films, and branded sheets tailored to client needs. Strong customer relationships, reliable supply management, and reduced distributor costs further reinforce the dominance of this segment.

The e-commerce / online platform segment is the fastest-growing in the market because digital channels enable global visibility and easy access to sustainable packaging suppliers, especially for small and mid-sized businesses. Rising demand for eco-friendly alternatives in online retail, subscription boxes, and direct-to-consumer brands accelerates the adoption of rice-paper packaging. Online platforms offer customization, low minimum order quantities, and faster procurement, making them highly attractive for emerging brands and export-focused sellers.

Recent Breakthroughs in the Rice Paper Packaging Industry

- On 14 July 2025, Sappi announced that at FACHPACK 2025 (23-25 September), it would spotlight its new recycled mono-material high-barrier papers Guard Pro OHS and Guard Pro OMH. These grades provide excellent protection (against oxygen, water vapour, grease, and mineral oil hydrocarbons) while remaining recyclable.

- On 3 February 2025, Argos Packaging announced a formal partnership with Bio4Pack to bring “paddy straw” trays (made from rice-plantation by-product) to the fruit & vegetable sector in the Netherlands. These trays are made from agricultural residue (rice straw that would otherwise be burnt), reducing CO₂ emissions, improving air quality, and water resource impact.

Top Companies in the Global Rice Paper Packaging Market & Their Offerings:

- Shanghai Sun Paper Products: This company is not directly associated with rice paper packaging based on the search results, though other packaging may be available in the region.

- NatureFlex / Innovia Films: Offers NatureFlex™, a compostable film derived from wood pulp that can be laminated to paper to create sustainable, flexible packaging.

- Huhtamaki: Provides various paper-based packaging solutions, including flexible options, but the available information does not confirm a specific offering in rice paper packaging.

- Tetra Pak: Primarily focuses on sustainable aseptic cartons for food and beverage items and does not appear to offer rice paper packaging.

- Berry Global: Sells various packaging solutions, including flexible pouches made from recycled plastics, but does not offer rice paper packaging.

- Stora Enso: Offers a range of environmentally friendly and food-safe packaging papers as a plastic alternative but the search results do not explicitly mention rice paper packaging.

- Mondi Group: Collaborated with a rice supplier to develop a recyclable, paper-based functional barrier packaging for dry rice.

- Winpak Ltd.: Specializes in materials and machinery for packaging perishable foods but the provided search results do not indicate an offering in rice paper packaging.

Segment Covered in the Report

By Product Type

- Edible Rice Paper

- Non-Edible Rice Paper

By Application

- Food Packaging

- Ready-to-Eat Meals

- Bakery & Confectionery

- Frozen Foods

- Retail & Consumer Convenience

- Specialty Packaging (Gift & Decorative)

By End-Use Industry

- Food & Beverages

- Confectionery & Bakery

- Retail / E-commerce Packaging

- Hospitality / Catering

By Form

- Sheets / Films

- Rolls / Continuous Films

- Laminated / Coated Films

By Distribution Channel

- Direct Sales (B2B)

- Distributors / Wholesalers

- E-commerce / Online Platforms

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5869

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight – Check It Out:

- Heavy Duty Corrugated Packaging Market Size (2025–2034), Segments, Regional Outlook (NA/EU/APAC/LA/MEA)

- Inflatable Bags Packaging Market Size, Segments, Regional Insights (NA, EU, APAC, LA, MEA), Competitive Landscape, and Value Chain Outlook, 2025-2035

- Multi Depth Corrugated Box Market Size, Segments, Regional Data (NA, EU, APAC, LA, MEA), Companies, Competitive & Value Chain Analysis, Trade, Manufacturers & Suppliers

- Industrial Drums Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competitive & Value Chain, Trade and Supplier Analysis, 2025-2035

- Hazardous Goods Packaging Market Size, Share, Trends, and Segment Forecast (2025-2035)

- Rigid Sleeve Boxes Market Size, Segments, Regions, Competition & Value Chain 2025-2035

- Bubble Wrap Packaging Market Size, Segments, Regional Outlook, and Competitive Landscape 2024-2035

- Reclosable Zipper Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive and Trade Analysis, 2025-2035

- Cornstarch Packaging Market Size, Share, Trends, and Forecast 2025-2035

- Micro Perforated Films for Packaging Market Size, Segments, Regional Insights, and Competitive Landscape Report 2025-2035

- Industrial Electronics Packaging Market Size, Segments, and Regional Outlook Report (2025-2035)

- Tinplate Packaging Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Landscape Analysis to 2034

- Topical Drugs Packaging Market Size, Segmentation, Regional Insights, and Competitive Landscape 2025-2035

- Corrugated Plastic Tray Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Value Chain Analysis, 2025-2035

- Boxboard Packaging Market Size, Share, Segments, Regional Outlook, and Competitive Landscape, 2025-2035

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.