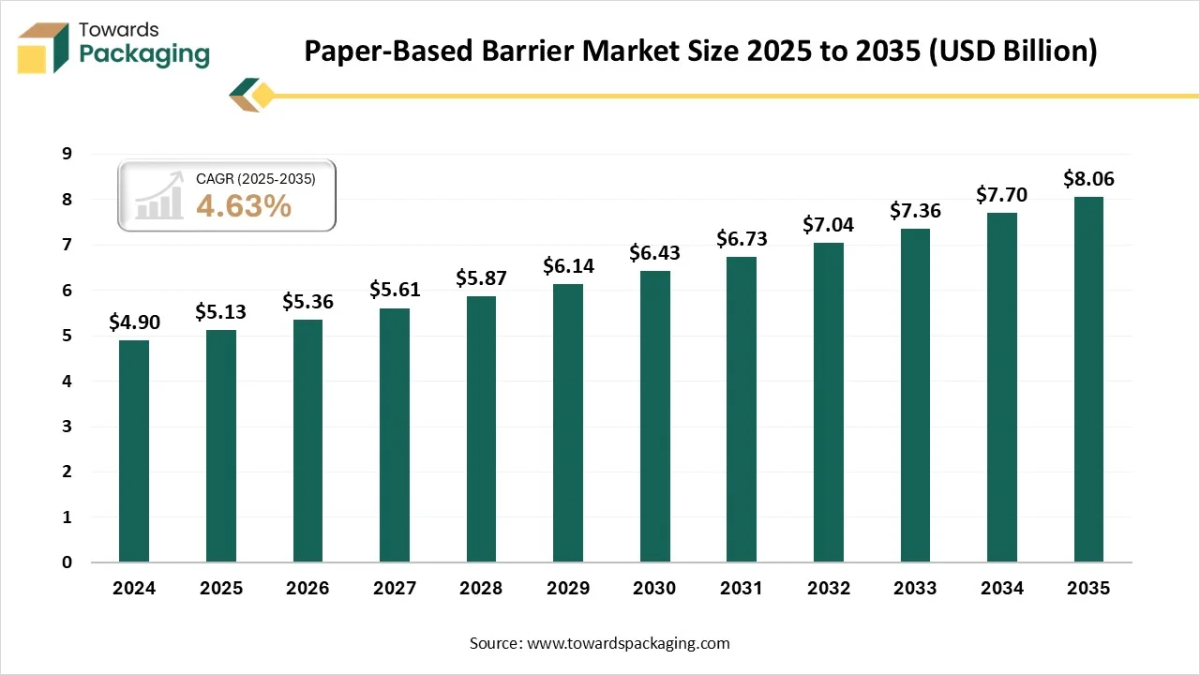

According to Towards Packaging consultants, the global paper-based barrier market is projected to reach approximately USD 8.06 billion by 2035, increasing from USD 5.36 billion in 2026, at a CAGR of 4.63% during the forecast period 2026 to 2035.

Ottawa, Feb. 02, 2026 (GLOBE NEWSWIRE) — The global paper-based barrier market was valued at USD 5.13 billion in 2025 and is expected to grow to USD 8.06 billion in 2035, as noted in a study published by Towards Packaging, a sister firm of Precedence Research. The paper-based barrier market’s growth is driven by increasing consumer demand, technological advancements, and a focus on recyclability and renewability.

Request Research Report Built Around Your Goals: [email protected]

What is Meant by Paper-Based Barrier?

A paper-based barrier is an innovative, advanced, and multi-layered packaging material that replaces traditional foils with sustainable coatings on paperboard, creating a protective shield against oxygen, moisture, light, and grease to keep food fresh. This material offers better recyclability and renewability, characteristics commonly seen in aseptic cartons. They are especially used and demanded due to the growing focus on sustainability and environmental concerns.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5933

Private Industry Investments for Paper-Based Barrier:

- Tetra Pak is investing significantly in R&D to develop a paper-based alternative to the aluminum foil barrier, to create fully renewable and recyclable packagingv.

- Mondi invested €16 million at its Solec plant to produce FunctionalBarrier Paper Ultimate, a fully recyclable, ultra-high barrier paper-based solution for food packaging.

- Stora Enso introduced a renewable barrier coating platform using bio-based polymers from wood, replacing fossil-based components.

- ACTEGA GmbH develops high-performance, water-based barrier coatings for paperboard that are food-safe and environmentally responsible, facilitating the replacement of plastic films.

- Searo Labs is developing smart, biodegradable films and coatings from seaweed to create a natural, plastic-free barrier alternative with freshness indicators.

What are the Latest Key Trends in the Paper-Based Barrier Market?

- Sustainability Focus: The growing demand for sustainable packaging and products, driven by rising environmental concerns and a strong focus on recyclable, renewable, and lower-carbon packaging, is a major trend following the circular economy.

- Plastic Reduction: The growing focus of various industries on reducing the use of plastics and plastic products to meet sustainability goals, due to strict regulations, fuels the demand.

- Technological Innovation: Development of new and advanced technologies like nanometre metalized coatings and ultrasonic sealing to replace aluminum foil in aseptic cartons is a growing trend.

What is the Potential Growth Rate of the Paper-Based Barrier Industry?

The growth of the market is driven by growing demand for sustainable packaging and reduced use of plastic due to strict regulations amid rising environmental concerns and consumer preference for eco-friendly options, which increases the demand. The growing demand from various sectors, especially food and beverages, due to the need to preserve freshness, also increases the demand. The technological advancements further help in large adoption due to improved performance, driving the expansion of the market.

Regional Analysis:

Who is the leader in the Paper-Based Barrier Market?

North America held the largest share of the market, supported by stringent sustainability mandates, corporate ESG commitments, and advanced packaging innovation. Strong demand from foodservice, pharmaceuticals, and e-commerce packaging drives adoption. Technological advancements in recyclable and compostable barrier coatings, along with high consumer awareness, are key factors shaping regional market dynamics.

U.S. Paper-Based Barrier Market Growth Trends

The United States leads the regional market owing to strong regulatory pressure on plastic reduction and high adoption of sustainable packaging by global brands. Food delivery, frozen foods, and retail packaging remain key application areas. Continuous R&D investments in PFAS-free and recyclable barrier coatings enhance the country’s technological leadership.

How is Asia Pacific Expected to Grow in the Paper-Based Barrier Market?

The Asia Pacific market is witnessing strong growth driven by the rapid expansion of sustainable packaging, rising environmental regulations, and increasing demand from the food, beverage, and personal care industries. Growing urbanization, e-commerce penetration, and the replacement of plastic packaging with fiber-based solutions are accelerating adoption. Regional manufacturing capacity expansion and cost-competitive raw material availability further support market growth.

China Paper-Based Barrier Market Trends

China dominates the Asia Pacific market due to its massive packaging industry, strong export-oriented manufacturing base, and aggressive policies to reduce single-use plastics. Demand is driven by food packaging, ready-to-eat meals, and consumer goods. Local players are investing in water-based and bio-coated barrier technologies, strengthening domestic supply and innovation capabilities.

More Insights of Towards Packaging:

- PET Bottle Blow Molding Machine Market Size and Segments Outlook (2026–2035)

- Spoon In Lid Packaging Market Size and Segments Outlook (2026–2035)

- Food Cans Market Size, Trends and Segments (2026–2035)

- Tamper Proof Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Polyolefin Shrink Sleeve Labels Market Size, Trends and Regional Analysis (2026–2035)

- Sports Cap Closures Market Size, Trends and Competitive Landscape (2026–2035)

- Premix Packaging Machine Market Size, Trends and Regional Analysis (2026–2035)

- Bag-in-box Packaging Market Analysis, Demand, and Growth Rate Forecast 2035

- Wrap-Around Cartoning Machines Market Size, Trends and Regional Analysis (2026–2035)

- Cryogenic Labels Market Size, Trends and Competitive Landscape (2026–2035)

- Medical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Automotive Plastic Compounding Market Size, Trends and Regional Analysis (2026–2035)

- Multi-med Adherence Packaging Market Size, Trends and Segments (2026–2035)

- Flexible Polyurethane Foam Market Size and Segments Outlook (2026–2035)

- Sealing and Strapping Packaging Tapes Market Size and Segments Outlook (2026–2035)

- Kraft Paper Bag Market Size, Trends and Regional Analysis (2026–2035)

- Pharma Blister Packaging Machines Market Size, Trends and Segments (2026–2035)

- Recycled Glass Market Size and Segments Outlook (2026–2035)

- Multilayer Flexible Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Testing Services Market Size and Segments Outlook (2026–2035)

Segment Outlook

Barrier Type Insight,

How did Coated Barrier Paper Segment Dominate the Paper-Based Barrier Market?

The coated barrier paper segment contributed the biggest market, due to its ability to provide effective resistance against moisture, grease, oxygen, and light while retaining recyclability. These papers are widely used in food and beverage packaging, takeaway containers, and pharmaceutical wraps. Increasing regulatory pressure to replace plastic packaging and rising demand for sustainable mono-material solutions are driving adoption across retail and institutional packaging applications.

The metallized barrier paper segment is expected to grow at the fastest rate between 2026 and 2035, as it offers enhanced barrier performance through a thin metal layer, typically aluminum, deposited onto the paper surface. It is used in premium food packaging, confectionery, and personal care products where extended shelf life and high aesthetic appeal are required. While recyclability challenges exist, ongoing innovations in lightweight metallization and improved separation technologies are supporting its growing use in high-value packaging segments.

Coating/Barrier Technology Type Insight,

Which Coating/Barrier Technology Type Segment Dominates the Paper-Based Barrier Market?

The polyethylene (PE) coating segment contributed the biggest market share, as it is widely used due to its strong moisture resistance, heat sealability, and cost-effectiveness. They are commonly applied in cups, cartons, and flexible packaging for liquid and semi-liquid food products. However, increasing environmental scrutiny around plastic-based coatings is encouraging manufacturers to develop recyclable and reduced-plastic PE coating solutions to comply with sustainability regulations.

The biopolymer coatings (PLA, PHA) segment is expected to grow fastest over the forecast period, as they are gaining traction as a sustainable alternative to conventional plastic coatings. Derived from renewable sources such as PLA, starch, or cellulose, these coatings enhance biodegradability and compostability while maintaining adequate barrier performance. Rising consumer demand for eco-friendly packaging and supportive government policies are accelerating adoption, particularly in food service, organic food packaging, and premium sustainable product lines.

Product Form Insight,

How did Rolls/Sheets Segment Dominate the Paper-Based Barrier Market?

The rolls/sheets segment dominated the biggest market share, as they offer flexibility for downstream converting processes such as printing, cutting, and forming. These formats are widely supplied to packaging converters and brand owners for customized applications. Their compatibility with high-speed production lines and diverse coating technologies makes them essential for large-scale food, beverage, and consumer goods packaging operations.

The cups & containers segment is the fastest-growing segment in the market, since they are increasingly replacing plastic disposables in foodservice, quick-service restaurants, and takeaway applications. These products require effective liquid and grease barriers while meeting recyclability and compostability standards. Growth in on-the-go consumption, food delivery services, and bans on single-use plastics are driving strong demand for barrier-coated paper cups and molded containers globally.

End-Use Industry Insight,

Which End Use Industry Segment Dominates the Paper-Based Barrier Market?

The food & beverages packaging segment contributed the biggest market share, and the growth is driven by demand for sustainable packaging that ensures food safety and shelf life. Applications include wraps, cartons, cups, and flexible packaging for dry, frozen, and liquid foods. Regulatory emphasis on plastic reduction and rising consumer preference for eco-friendly packaging continue to support market expansion in this segment.

The personal care & cosmetics segment is projected to grow fastest over the forecast period, since it is increasingly adopted in personal care and cosmetics packaging for items such as sachets, cartons, and secondary packaging. Brand owners are shifting toward sustainable packaging solutions to enhance brand image and meet ESG commitments. Improved barrier coatings that protect against moisture and contamination are enabling wider use of paper-based barriers in premium and mass-market cosmetic products.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Recent Breakthroughs in the Paper-Based Barrier Industry

- In December 2025, Tetra Pak launched the world’s first aseptic paper-based barrier for the juice category, in collaboration with Spanish beverage producer García Carrión. This innovation is being rolled out under the Don Simón brand across multiple markets.

- In September 2025, Sappi Europe introduced two recyclable, mono-material high-barrier papers, Guard Pro OHS and Guard Pro OMH, to its sustainable packaging offerings. These papers are intended to serve as alternatives to plastic and multilayer foils, assisting brand owners in meeting the requirements of evolving EU Packaging and Packaging Waste Regulations.

- In August 2025, Mondi’s FunctionalBarrier Paper Ultimate is a paper-based packaging solution providing ultra-high protection against oxygen, water vapor, and grease. It is designed as a sustainable and recyclable alternative to unrecyclable multi-material packaging.

Top Companies in the Paper-Based Barrier Market & Their Offerings:

- Toppan Printing: Offers GL-X-P, a vapor-deposition coated paper providing high oxygen and moisture resistance without aluminum.

- Stora Enso Oyj: Produces Aqua™ dispersion-barrier boards that provide liquid and grease resistance through recyclable water-based coatings.

- WestRock Company: Manufactures EnShield®, a paperboard featuring a built-in grease barrier for food service applications.

- Nordic Paper AS: Specializes in Natural Greaseproof papers that use mechanical fiber processing instead of PFAS to resist oils.

- International Paper Company: Supplies barrier-coated boards and liquid packaging solutions designed for moisture protection and shelf stability.

- Solenis LLC: Develops aqueous barrier coatings that manufacturers apply to paper to provide resistance against oil, water, and vapor.

- Mondi Plc: Features FunctionalBarrier Paper, a customizable range designed to replace plastic films in high-speed packaging lines.

- ITC Limited: Provides Filo and Indobarr boards, which offer biodegradable and heat-sealable barriers for food and pharmaceutical use.

- Delfort: Creates thin specialty papers with high-performance barriers against grease and moisture for the food industry.

- BASF SE: Supplies polymer-based coatings like Joncryl® that give paper substrates resistance to water, grease, and mineral oils.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Covered in the Report

By Barrier Type

- Coated Barrier Paper

- Laminated Barrier Paper

- Metallized Barrier Paper

- Wax-Coated Paper

- PLA / Bio-based Barrier Paper

By Coating / Barrier Technology

- Polyethylene (PE) Coating

- Polypropylene (PP) Coating

- Silicone Coating

- Biopolymer Coatings (PLA, PHA)

- Nano-coatings

By Product Form

- Rolls / Sheets

- Bags & Pouches

- Wraps & Films

- Cups & Containers

- Labels & Tags

By End-Use Industry

- Food & Beverage Packaging

- Bakery & Confectionery

- Dairy Products

- Frozen Foods

- Snacks & Ready-to-Eat

- Beverages & Hot Cups

- Medical & Healthcare Packaging

- Personal Care & Cosmetics

- E-commerce & Retail Packaging

- Industrial & Specialty Packaging

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5933

Request Research Report Built Around Your Goals: [email protected]

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight – Check It Out:

- Caps for Returnable PET Bottles Market Size, Trends and Regional Analysis (2026–2035)

- Caps for Returnable Glass Bottles Market Size and Segments Outlook (2026–2035)

- Anti-Counterfeit Cosmetic Packaging Market Size and Segments Outlook (2026–2035)

- Pharmacy Repackaging System Market Size and Segments Outlook (2026–2035)

- Decor Paper Market Size and Segments Outlook (2026–2035)

- Honeycomb Packaging Paper Market Size, Trends and Competitive Landscape (2026–2035)

- Reusable Water Bottles Market Size and Segments Outlook (2026–2035)

- Packaging Testing Market Size & Trends 2026-2035

- Carrier Bags Market Size and Segments Outlook (2026–2035)

- Punnet Packaging Market Size, Trends and Segments (2026–2035)

- Cut Flower Packaging Market Size, Trends and Segments (2026–2035)

- Spirotetramat Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Primer Market Size, Trends and Segments (2026–2035)

- Can Coatings Market Size and Segments Outlook (2026–2035)

- Wine Packaging Market Size, Share, Trends, Segments, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape to 2034

- Bioplastic Packaging Market Size and Segments Outlook (2026–2035)

- Inverted Pouches Market Size, Trends and Competitive Landscape (2026–2035)

- Eco-Friendly Food Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Smart Bottle Market Size, Trends and Regional Analysis (2026–2035)

- Starch-based Bioplastics Market Size, Trends and Competitive Landscape (2026–2035)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.