The Insurance Analytics market is growing rapidly as insurers leverage AI, ML, and big data to enhance fraud detection, personalize offerings, and streamline underwriting and claims management for improved operational efficiency.

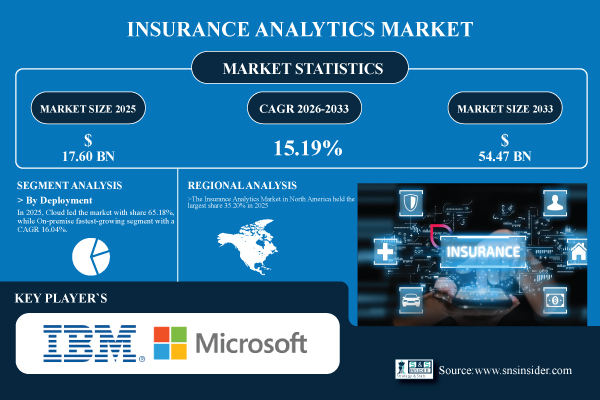

Austin, Oct. 20, 2025 (GLOBE NEWSWIRE) — The Insurance Analytics Market Size was valued at USD 17.60 Billion in 2025E and is expected to reach USD 54.47 Billion by 2033 and grow at a CAGR of 15.19% over 2026-2033.

The increasing demand for data-driven decision-making and risk management in the insurance industry is the main factor propelling the growth of the insurance analytics market. The complexity of claims processing, the rise in fraud, and the demand for personal line products compel insurers to use advanced analytics tools.

Download PDF Sample of Insurance Analytics Market @ https://www.snsinsider.com/sample-request/8765

The U.S. Insurance Analytics Market size was USD 4.34 Billion in 2025E and is expected to reach USD 13.07 Billion by 2033, growing at a CAGR of 14.81% over 2026-2033.

The U.S. market is driven by insurers’ quick adoption of cloud, big data, and artificial intelligence (AI) technologies in search of competitive advantage and operational efficiency. Regulatory compliance requirements, the need for predictive risk assessment and enhanced consumer involvement, the rise in fraudulent claims, and the desire for customized insurance products are some of the main motivators.

Key Players:

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Salesforce

- Guidewire Software Inc.

- LexisNexis Risk Solutions (RELX plc)

- Verisk Analytics, Inc.

- Accenture plc

- MicroStrategy Incorporated

- OpenText Corporation

- Sapiens International Corporation N.V.

- Hexaware Technologies Limited

- Applied Systems Inc.

- Vertafore, Inc.

- EXLService Holdings, Inc.

- Wipro Limited

- Moody’s Analytics, Inc.

- Pegasystems Inc.

Insurance Analytics Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 17.60 Billion |

| Market Size by 2033 | USD 54.47 Billion |

| CAGR | CAGR of 15.19% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Cloud, On-premise) • By Enterprise Type (Large Enterprises, Small and Medium Enterprises (SMEs)) • By Application (Claims Process Optimization, Fraud Detection & Risk Assessment, Customer Engagement & Retention, Others) • By End-user (Insurance Firms, Government Agencies, Others) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

If You Need Any Customization on Insurance Analytics Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8765

Segmentation Analysis:

By Deployment, in 2025, Cloud Segment Led the Market with a Share of 65.18%, while On-premise is the Fastest-growing Segment with a CAGR of 16.04%

The Cloud-based deployment solutions segment dominated the market due to the growing number of companies are utilizing capabilities of cloud computing that provides scalability, cost-effectiveness, and the ability to manage high incidents of structured and unstructured data. In-premise deployment segment is growing appreciably due to the high value on sensitive customer data privacy, regulatory compliance, and control over sensitive information.

By Enterprise Type, in 2025, Large Enterprises Segment Dominated the Market with a 68.40% share, while Small and Medium Enterprises (SMEs) is the Fastest-growing Segment with a CAGR of 15.80%

Large enterprises dominated the Insurance Analytics Market owing to the large customer bases, high volume of travel insurance claims, and increased expenditure on advanced analytical platforms. Small and medium enterprises (SMEs), on the other hand, are turning out to be the fastest growing segment, driven by a growing awareness of the benefits of analytics and the provision of affordable cloud-based solutions.

By Application, Claims Process Optimization Held the Largest Share of 40.24% in 2025, while Fraud Detection & Risk Assessment is the Fastest-growing Segment with a CAGR of 16.20%

Claims process optimization occupied the largest share in Insurance Analytics Market, driven by a growing focus of insurers on reducing the time taken for each processing step, eliminating errors, and enhancing customer satisfaction by providing automated, data-driven systems for the entire process. Fraud detection and risk assessment is projected to be the fastest-growing application, owing to the increasing fraudulent claims and subsequent regulatory scrutiny.

By End-user, in 2025, Insurance Firms Dominated the Market with a Share 72.34%, while Government Agencies is the Fastest-growing Segment with a CAGR of 16.04%

Insurance firms lead the end-user segment as they adopt advanced analytics to enhance claims management, improve underwriting accuracy, and deliver personalized policies that drive customer retention and profitability. Government agencies constitute the most rapidly expanding segment that is using analytics in order to enhance regulatory oversight, compliance, and fraud prevention monitoring in the insurance sector.

Regional Insights:

The Insurance Analytics Market in North America held the largest share 35.20% in 2025, supported by the strong presence of leading insurance providers, advanced technology adoption, and a mature regulatory framework that encourages transparency and risk management.

In 2025, Asia Pacific is the fastest-growing region in the Insurance Analytics Market, projected to expand at a CAGR of 16.36%, driven by rapid digital transformation, increasing insurance penetration, and growing awareness of data-driven decision-making among insurers.

Recent Developments:

- May 9, 2025, Microsoft highlighted advancements in AI for healthcare, showcasing how AI is transforming healthcare with insights from Microsoft leaders on AI advancements, success stories, and future developments.

- In May 2025, Oracle’s EPM Cloud update introduced new capabilities across Planning, Financial Close, Reporting, AI, and more, enhancing the platform’s functionalities.

Buy Full Research Report on Insurance Analytics Market 2026-2033 @ https://www.snsinsider.com/checkout/8765

Exclusive Sections of the Report (The USPs):

- PREDICTIVE ACCURACY METRICS – helps you assess how effectively analytics solutions enhance fraud detection, claim approvals, and churn prediction accuracy, improving risk assessment and underwriting precision.

- TIME-TO-INSIGHT BENCHMARKS – helps you measure the efficiency of analytics platforms by tracking how quickly actionable insights are generated and the percentage reduction in claim processing time through automation.

- DATA VOLUME & COMPLEXITY INDEX – helps you understand the data handling capacity of insurance firms by evaluating total data processed, structured-to-unstructured data ratios, and integration density across diverse sources.

- AI/ML MODEL UTILIZATION RATE – helps you gauge the maturity of AI-driven operations by examining automation levels, number of deployed machine learning models, and retraining frequency to ensure model accuracy.

- OPERATIONAL EFFICIENCY SCORECARD – helps you identify performance improvements achieved through analytics adoption, enabling comparison of cost, time, and accuracy gains across insurance segments.

- TECHNOLOGY ADOPTION OUTLOOK – helps you uncover opportunities for innovation by tracking AI, ML, and data integration trends influencing next-generation insurance analytics ecosystems.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.