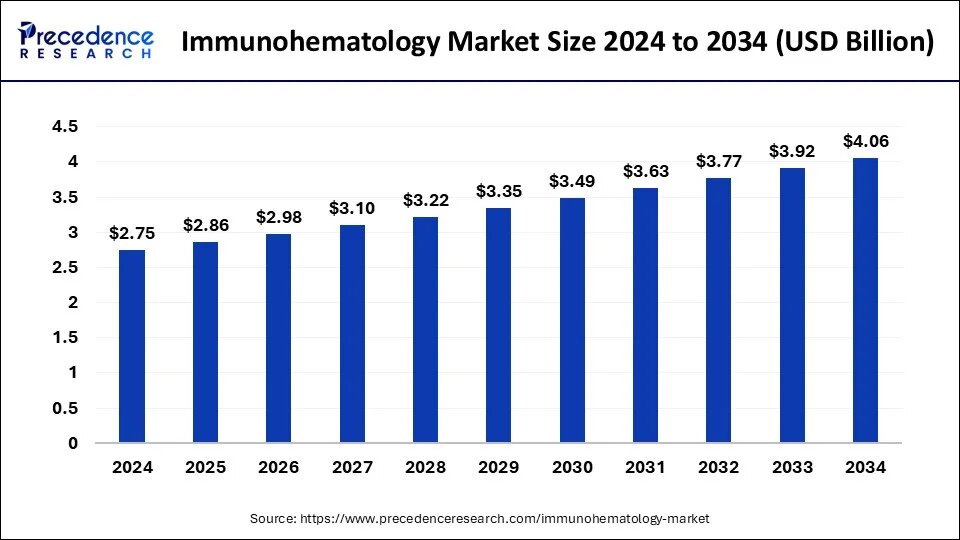

According to Precedence Research, the global immunohematology market size will grow from USD 2.86 billion in 2025 to nearly USD 4.06 billion by 2034, with a CAGR of 3.97% from 2025 to 2034. North America dominated the market, by holding more than 39% of market share in 2024.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The immunohematology market is estimated at USD 2.86 billion in 2025 and is predicted to increase from USD 2.98 billion in 2026 to USD 4.06 billion by 2034, registering a CAGR of 3.97%.

The market growth is fueled by the rising prevalence of blood disorders, increasing demand for safe blood transfusions, and technological advancements such as automation, molecular diagnostics, and AI integration in transfusion medicine. Government initiatives like India’s Haemovigilance Programme, rare donor registries, and quality assessment schemes further support blood safety and standardization. North America leads the market, while Asia Pacific is poised for the fastest growth due to expanding healthcare infrastructure and a surge in voluntary blood donations.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4342

Immunohematology Market Highlights:

- In terms of revenue, the global immunohematology market was valued at USD 2,750 million in 2024.

- It is projected to exceed USD 4,060 million by 2034.

- The market is projected to grow at a CAGR of 3.97% from 2025 to 2034.

- North America dominated the market, holding more than 39% of the market share in 2024.

- By product, the reagents segment held the major market share of 66% in 2024.

- By technology, the PCR segment accounted for the highest market share of 39% in 2024.

- By end use, the diagnostic laboratories segment captured the largest market share of 25% in 2024.

What is Immunohematology?

The immunohematology market growth is driven by the growing prevalence of blood disorders, the need for safe blood transfusions, and increasing blood donations. Immunohematology is the study of blood group antibodies and antigens related to blood transfusion. It helps to detect blood type and supports blood component preparation. Immunohematology offers benefits like the diagnosis of hemolytic disease, enhances blood transfusion safety, supports patient care, and prevents transfusion-transmitted infections.

➤ Get the Full Report @ https://www.precedenceresearch.com/immunohematology-market

Major Government Initiatives for Immunohematology

- Haemovigilance Programme of India (HvPI) – Launched in 2012, HvPI is a system for surveillance of the entire transfusion chain (from collection of blood and components to follow-up of recipients) to detect, report, assess, and prevent adverse events and reactions, thereby improving the safety of blood transfusions.

- Rare Donor Registry of India (RDRI) integrated with e-Rakt Kosh – The government is linking the RDRI—which catalogs donors with rare blood groups (e.g., Bombay, Rh-null, etc.)—with the e-Rakt Kosh digital platform to allow real-time access and coordination among blood banks, ensuring rare phenotype matching when needed.

- External Quality Assessment Schemes (EQAS) for immunohematology under Blood Transfusion Services (BTS) – India’s Blood Transfusion Services has set up EQAS for immunohematology (blood group serology, antibody screening, etc.), requiring blood centres to participate in proficiency testing and standardize quality across states.

- National Standards and Roadmap for Blood Transfusion Services – The Directorate General of Health Services (DGHS), with WHO support, has organized workshops and released national standards for blood centres to ensure uniformity, safety, and quality in blood transfusion services across India.

- Voluntary Non-Remunerated Blood Donation & Digitalization (e-RaktKosh etc.) – Government policy (through BTS) emphasizes increasing voluntary donation, non-remunerated donors, organizing blood donation camps, awareness campaigns; also use of digital systems like e-RaktKosh to register donors, track blood supply, manage inventory, and ensure traceability.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

What are the Key Trends of the Immunohematology Market?

- Automation & high-throughput systems: Laboratories and blood banks are increasingly moving from manual serologic methods to fully or semi-automated platforms for blood typing, crossmatching, and antibody screening, boosting speed, accuracy, and efficiency.

- Molecular diagnostics and genotyping: Use of molecular assays (like PCR, next-generation sequencing) for blood group genotyping, rare antigen detection, and complex sample analysis is growing rapidly, enabling more precise matching, especially for alloimmunized patients or rare phenotype donors.

- Integration of AI, data analytics, and IT systems: AI/ML, cloud-based solutions, laboratory information systems (LIS), and predictive analytics are being incorporated to improve traceability, reduce errors, optimize inventory and workflow, and enhance decision support in immunohematology workflows.

- Point-of-care testing/miniaturization: There is a trend toward smaller, portable, rapid immunohematology devices (including POC blood typing and compatibility testing) to serve remote or resource-limited settings, mobile blood collection, and urgent clinical needs.

- Emphasis on safety, rare blood groups, and personalized transfusion medicine: Growing attention to patient blood management, improving pretransfusion safety, dealing with interference (e.g., from therapeutic antibodies), identifying rare antigen profiles, and tailoring transfusion practices based on individual immunologic/genetic profiles are pushing innovation.

Immunohematology Market Opportunity

Growing Blood Disorders

The growing prevalence of blood disorders like leukemia, thalassemia, anemia, and hemophilia increases demand for immunohematology services and products. The growth in population and focus on the management of blood disorders increase the adoption of immunohematology services. The growing demand for safe blood transfusions and increasing antibody screening increases the adoption of immunohematology services.

The strong focus on preventing transfusion reactions and increasing the prevalence of chronic blood disorders increases demand for immunohematology services. The growing awareness about transfusion-related care and growth in trauma cases requires blood products like immunoglobulin, plasma, and platelets. The growing blood disorders create an opportunity for the growth of the market.

Limitations and Challenges

High Cost of Devices Limits Market Expansion

Despite several benefits of immunohematology services, the high cost of devices restricts the market growth. Factors like design complexity, high-quality materials, automated process, specialized facilities, ongoing maintenance, and reagent costs are responsible for the high cost of devices.

The need for premium material for device durability & safety, and stringent regulations on components, increases the cost. The development of automated processes and the need for sophisticated hardware increases the cost. The need for specialized infrastructure and a highly skilled workforce increases the cost. The high cost of devices hampers the growth of the market.

Immunohematology Market Report Coverage

| Report Coverage | Details |

| Market Size in 2024 | USD 2.75 Billion |

| Market Size in 2025 | USD 2.86 Billion |

| Market Size in 2026 | USD 2.98 Billion |

| Market Size by 2034 | USD 4.06 Billion |

| Growth Rate (2025–2034) | CAGR of 3.97% |

| Leading Region in 2024 | North America |

| Fastest-Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Market Drivers | Rising prevalence of blood disorders, increasing blood donations, advancements in automation and molecular diagnostics, and government-led blood safety programs. |

| Key Trends | Adoption of AI and data analytics in transfusion medicine, shift toward fully automated testing systems, and development of point-of-care immunohematology devices. |

| Challenges | High device and reagent costs, limited availability of skilled personnel, and infrastructure gaps in low-resource settings. |

| Opportunities | Growing demand for personalized transfusion medicine, expansion of blood banks and diagnostic laboratories, and rising investments in healthcare modernization. |

| Segments Covered | Product (Analyzers, Reagents), Technology (Biochips, Gel Cards, Microplates, PCR, Erythrocyte-Magnetized Technology), End-User (Hospitals, Diagnostic Laboratories, Blood Banks), and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Leading Companies | Grifols S.A., Immucor Inc., Thermo Fisher Scientific, Merck KGaA, Abbott Laboratories |

| Recent Developments | Launch of Grifols’ Erytra Eflexis automated blood-typing system in China; Kerala government’s digital blood bank tracking software; Applied Science’s HemoFlow 500 Series for automated blood collection. |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4342

Immunohematology Market Regional Insights

Why North America Dominates the Immunohematology Market?

North America dominated the market with a 39% share in 2024. The strong presence of blood banks and well-established transfusion centers increases the demand for immunohematology services. The presence of advanced healthcare infrastructure and the growing rate of blood disorders like anemia, leukemia, & lymphoma increases demand for immunohematology services. The growing development of automated immunohematology systems and strong government support for blood safety drive the overall growth of the market.

What is the U.S. Immunohematology Market Size?

According to Precedence Research, the U.S. immunohematology market size is calculated at USD 780 million in 2025 and is expected to cross USD 1,150 million by 2034, with a CAGR of 4.37% from 2025 to 2034.

The U.S. dominates the regional market due to its advanced healthcare infrastructure, high volume of blood transfusions, and strong regulatory oversight by bodies like the FDA and AABB. The widespread adoption of automated and molecular diagnostic technologies, supported by substantial investments in research and development from leading companies such as Thermo Fisher, Abbott, and Immucor, further strengthens its market position.

Additionally, favorable reimbursement policies, integration of lab systems with digital health records, and active government initiatives in transfusion safety and hemovigilance contribute to the U.S.’s leadership in driving innovation, quality, and scale in immunohematology services.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/4342

How Asia Pacific Experiences the Fastest Growth in the Immunohematology Market?

Asia Pacific experiences the fastest growth in the market during the forecast period. The growing disorders like sickle cell disease, hemophilia, thalassemia, and anemia increase demand for immunohematology services. The aging population and a strong focus on blood safety increase the adoption of immunohematology services.

The growing blood transfusion activities and increasing promotion of safe blood donation require immunohematology services. The expansion of healthcare infrastructure and favorable government policies support the overall market growth.

Country-Level Investment and Funding for the Immunohematology Market

- United States – REDS-III Program (NHLBI): Funded ≈ US$87.2 million over 7 years by the National Heart, Lung, and Blood Institute. Supports research in blood safety, donor-recipient matching, immunohematology diagnostics, and transfusion epidemiology.

- United Kingdom – NIHR & NHSBT Blood and Transplant Research Units (BTRUs): Joint investment of £19.9 million (2022–2027) across multiple research units. Focuses on transfusion medicine, donor genomics, and new immunohematology technologies.

- Australia – Blood Synergy & NHMRC/National Blood Sector R&D Programs: AUD 5 million Synergy grant + AUD 6 million in R&D funding + AUD 2.9 million MRFF for transfusion data infrastructure. Targets improvements in immunoglobulin use, donor-patient matching, and transfusion outcomes.

- Germany – Hemoforce Project (Designer Blood Cells): Over €3 million funded by the German Ministry of Defense. Aims to create universal or antigen-adapted blood cells from stem cells, reducing immunohematologic mismatch risks.

- European Union – EBA Research & Development Grant Program: Offers up to €25,000 per project for EU-wide research on blood safety, immunohematology, and component quality. Supports practical innovations in donor-recipient compatibility and blood product performance.

✚ Related Topics You May Find Useful:

➡️ Blood Transfusion Diagnostics Market: Explore how automation and molecular testing are transforming transfusion safety and compatibility screening.

➡️ Immunomodulators Market: Understand how novel biologics and immune therapies are reshaping chronic disease and cancer treatment landscapes.

➡️ Immunoassay Market: Track innovations in high-sensitivity assays driving precision diagnostics across infectious and chronic diseases.

➡️ Blood and Blood Components Market: Analyze global trends in plasma, platelets, and red cell utilization across healthcare systems.

➡️ Automated Immunoassay Analyzers Market: Discover how next-gen analyzers are enhancing throughput, accuracy, and operational efficiency in clinical labs.

➡️ In Vitro Diagnostics Market: Examine the evolution of diagnostics through digitalization, AI integration, and point-of-care innovations.

➡️ Cell Counting Market: See how automated cell counters and imaging technologies are advancing cell-based research and clinical testing.

➡️ Research Antibodies Market: Gain insight into how recombinant antibodies and custom reagents are powering life science discoveries.

➡️ Blood Plasma Derivatives Market: Explore rising demand for immunoglobulins, coagulation factors, and albumin across therapeutic applications.

➡️ Biological Sample Collection Kits Market: Learn how home-based testing and biobanking trends are driving demand for standardized collection systems.

➡️ Biosensors Market: Understand how wearable and point-of-care biosensors are revolutionizing real-time health monitoring and diagnostics.

➡️ Immunohistochemistry Market: Discover how AI-driven pathology and multiplex staining are advancing cancer and biomarker research.

Immunohematology Market Segmentation Insights:

Product Insights

Why the Reagents Segment is Dominating the Immunohematology Market?

The reagents segment dominated the market with a 66% share in 2024. The growing immunohematology procedures, like cross-matching and blood typing, increase demand for reagents. The increasing automated testing workflows and the rise in prevalence of blood cancers increase the adoption of reagents. The strong focus on accurate diagnostic results and disease management increases the adoption of reagents, driving the overall market growth.

The analyzers segment is the fastest-growing in the market during the forecast period. The growing blood disorders, like anemia and leukemia, increase demand for analyzers. The increasing surgical procedures and the need for reliable blood transfusions increase demand for analyzers. The growing modernization of blood bank facilities and the rise in adoption of personalized medicine increase demand for analyzers.

Technology Insights

How PCR Segment Held the Largest Share in the Immunohematology Market?

The PCR segment held the largest revenue share of 39% in the market in 2024. The strong focus on amplification of DNA or RNA and the increasing need for quick diagnosis increase the adoption of PCR. The growing demand for accurate detection of genetic mutations and the focus on identifying blood type increases demand for PCR. The increasing prevalence of bacterial & viral infections and the rise in adoption of personalised medicine increase demand for PCR, driving the overall market growth.

The erythrocyte-magnetized technology is experiencing the fastest growth in the market during the forecast period. The focus on the elimination of centrifugation and the development of a fully automated blood typing process increases demand for erythrocyte-magnetized technology. The increasing need for transfusion safety and focus on faster processing of blood samples increases the adoption of erythrocyte-magnetized technology, supporting the overall market growth.

End User Insights

Which End-User Segment Dominated the Immunohematology Market?

The diagnostic laboratories segment dominated the market with a 25% share in 2024. The growing routine blood testing and high volume of blood testing increase testing in diagnostic laboratories. The presence of automated analyzers and advanced systems in diagnostic laboratories helps market growth. The presence of skilled personnel and specialized equipment in laboratories drives the overall growth of the market.

The hospitals segment is growing at a notable rate in the immunohematology market. The growing prevalence of blood disorders and the presence of advanced immunohematology services increase the adoption of hospitals. The strong focus on safe blood transfusion and diagnostic tools in hospitals helps the market growth. The presence of molecular techniques, automated systems, and advanced reagents in hospitals drives the overall growth of the market.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Top Companies in the Immunohematology Market

- Grifols S.A. – provides automated analyzers and reagents for accurate blood typing and antibody screening in transfusion medicine.

- Immucor Inc. – delivers specialized instruments and reagents to support safe and efficient blood compatibility testing.

- Thermo Fisher Scientific – offers a broad range of tools for blood typing, cross-matching, and antibody identification.

- Merck KGaA – supplies high-quality reagents and research tools used in immunohematology and blood group serology.

- Abbott Laboratories – develops diagnostic platforms that enable precise and rapid blood screening for transfusion safety.

Recent Developments

|

|

|

Segments Covered in the Report

By Product

- Analyzers

- Reagents

By Technology

- Biochips

- Gel Cards

- Microplates

- PCR

- Erythrocyte-Magnetized Technology

By End User

- Hospitals

- Diagnostic Laboratories

- Blood Banks

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4342

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.