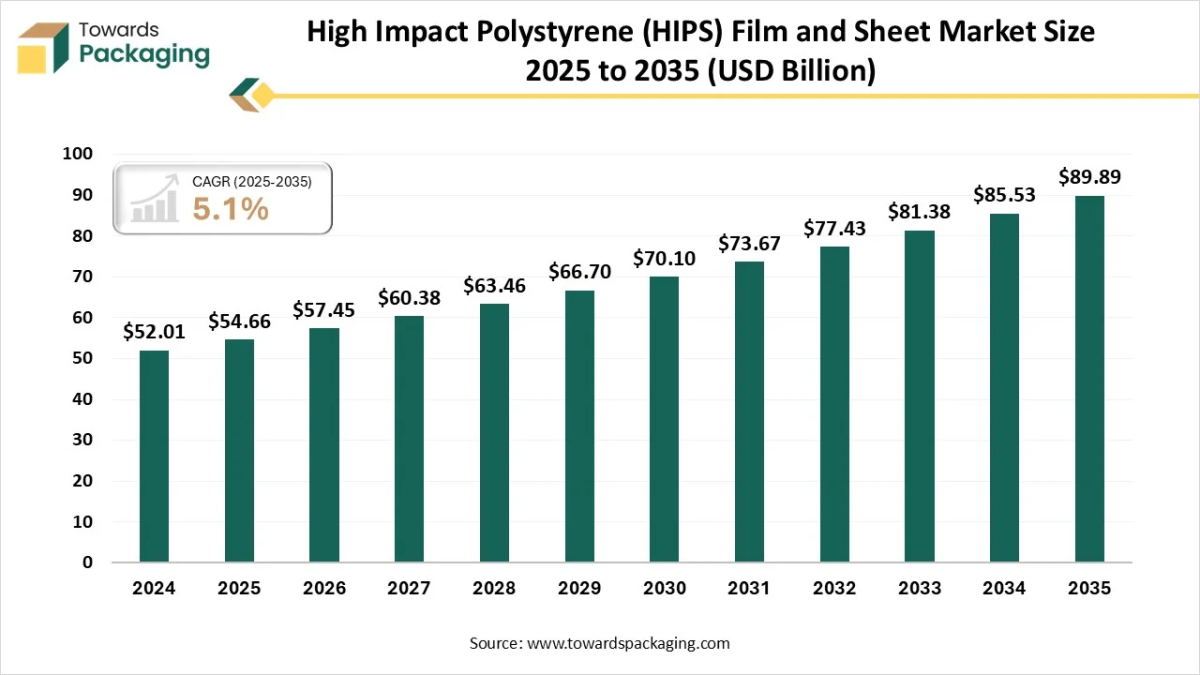

According to researchers from Towards Packaging, the global high impact polystyrene (HIPS) film and sheet market, estimated at USD 54.66 billion in 2025, is forecast to expand to USD 89.89 billion by 2035, growing at a CAGR of 5.1% over the forecast period.

Ottawa, Jan. 30, 2026 (GLOBE NEWSWIRE) — The global high impact polystyrene (HIPS) film and sheet market hit USD 54.66 billion in 2025, with current forecasts pointing to USD 89.89 billion by 2035, according to Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: [email protected]

What is Going on in the High Impact Polystyrene (HIPS) Film and Sheet Industry?

High-impact polystyrene (HIPS) film and sheet are plastic materials modified with rubber to enhance toughness, impact resistance, and processability, and are widely used in packaging, appliances, and consumer goods. The market is driven by rising demand for lightweight, cost-effective packaging, ease of thermoforming, good printability, and growing applications in food packaging and disposable products.

Private Industry Investments for High Impact Polystyrene (HIPS) Film and Sheet:

- UFlex Limited invested over Rs 700 crore (around $78.5 million) to expand its packaging film manufacturing line in Karnataka, an expansion that includes capacity that could be relevant to HIPS applications, given its general focus on packaging films.

- Versalis S.p.A. opened a new recycling plant in Porto Marghera, Italy, dedicated to producing plastics made from mechanically recycled raw materials, including crystal polystyrene and expandable polystyrene from waste, which is a major sustainability investment impacting the broader polystyrene market.

- Epsilyte launched a new expanded polystyrene product with a minimum of 50% post-consumer recycled (PCR) content for packaging applications, focusing on sustainability through extrusion technology at its Ohio facility.

- BEWI launched new expanded polystyrene raw material grades, some derived from recycled feedstock, and incorporated them into new products like fish boxes to reduce CO₂ emissions by up to 60%.

- Supreme Petrochem Ltd offers a wide range of HIPS grades with exceptional properties for demanding applications like refrigerator cabinet/door liners, which involves continuous investment in R&D and masterbatch technology for customization.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5916

What Are the Latest Key Trends in the High Impact Polystyrene (HIPS) Film and Sheet Market?

1. Rising Preference for Thermoform-Friendly Packaging Materials

High-impact polystyrene films and sheets are increasingly favored for applications requiring smooth thermoforming and dimensional stability. Their ability to maintain shape under heat, combined with good impact resistance and surface clarity, makes them suitable for trays, lids, and protective packaging. This trend is supported by rising consumption of packaged and ready-to-use products across industries.

2. Shift Toward Environment-Conscious Material Development

Manufacturers are focusing on improving the environmental profile of HIPS films and sheets by incorporating recyclable content and optimizing material efficiency. Efforts include downgauging, improved recyclability, and compatibility with existing waste-management systems. These developments help meet regulatory expectations while responding to growing demand for packaging solutions with reduced material usage and environmental impact.

3. Advancements in Film and Sheet Production Techniques

Modern extrusion and calendaring technologies are enabling tighter thickness control, enhanced surface uniformity, and better mechanical consistency in HIPS films and sheets. Automation and process optimization reduce material waste and energy consumption. These improvements allow producers to deliver reliable performance for demanding applications while maintaining cost efficiency and scalable production output.

4. Growing Use of Customized and Modified HIPS Grades

The market is seeing increased demand for tailored HIPS formulations designed to meet specific functional needs. These include enhanced toughness, improved heat resistance, and better compatibility with printing and lamination processes. Customized grades expand the usability of HIPS films and sheets in sectors that require precise performance characteristics and consistent visual quality.

5. Strengthening Demand from Emerging Manufacturing Economies

Rapid industrial growth in developing regions is driving higher consumption of HIPS films and sheets. Expanding packaging, appliance, and consumer goods manufacturing activities increase material demand. Competitive production costs and improving infrastructure support wider adoption, positioning these regions as key contributors to global volume growth and capacity expansion.

6. Broadening Application Scope Beyond Traditional Packaging

Although packaging remains a major application, HIPS films and sheets are gaining traction in non-packaging uses such as appliance housings, display components, and interior panels. Their balance of rigidity, impact resistance, and ease of fabrication supports adoption in cost-sensitive applications requiring reliable performance and clean surface appearance.

What is the Potential Growth Rate of the High Impact Polystyrene (HIPS) Film and Sheet Industry?

The growth of the high impact polystyrene (HIPS) film and sheet industry is driven by rising demand for lightweight, durable, and cost-effective packaging materials across food, consumer goods, and industrial applications. Its excellent thermoformability, impact resistance, and smooth surface finish support wide adoption. Expanding manufacturing activities, increasing use in appliance and electronics components, and growing preference for easy-to-process materials further contribute to market expansion.

More Insights of Towards Packaging:

- Translucent Cosmetic Packaging Solutions Market Size and Segments Outlook (2026–2035)

- APET-Based Thermoformed Trays Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Materials Market Size, Trends and Segments (2026–2035)

- Ceramic Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Cross-linked Polyethylene Market Size, Trends and Segments (2026–2035)

- Plantable Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Cold Form Blister Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Nordic Beverage Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Pre-press for Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Biohazard Bags Market Size, Share, Trends, and Forecast Analysis 2034

- Air Cushion Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Polycarbonate Sheet Market Trends and Global Production Volumes for 2026-2035

- Packaging Wax Market Size, Trends and Regional Analysis (2026–2035)

- Biodegradable Plastic Films Market Size, Trends and Regional Analysis (2026–2035)

- Wafer Level Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Single Dose Packaging Market Size and Segments Outlook (2026–2035)

- Molded Pulp Packaging Market Size and Segments Outlook (2026–2035)

- Consumer Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Paper Packaging Materials Market Size and Segments Outlook (2026–2035)

- Packaging Coatings Market Size, Trends and Regional Analysis (2026–2035)

Regional Analysis:

Who is the leader in High Impact Polystyrene (HIPS) Film and Sheet Market?

Asia-Pacific dominates the market due to rapid industrialization, expanding packaging and consumer goods manufacturing, and rising urban populations. The region benefits from low-cost production, abundant raw material availability, and strong demand from food packaging, appliances, and electronics. Supportive government policies and growing export activities further strengthen regional market leadership.

China High Impact Polystyrene (HIPS) Film and Sheet Market Trends

China dominates the Asia-Pacific market due to its large-scale manufacturing base, strong domestic demand for packaging and consumer products, and well-established plastics processing infrastructure. Easy access to raw materials, cost-efficient production, and extensive export capabilities further support high output and wide application across food packaging, appliances, and industrial uses.

How is the Opportunistic is the Rise of North America in the High Impact Polystyrene (HIPS) Film and Sheet Industry?

North America is the fastest-growing region in the market due to increasing demand for advanced packaging solutions, rising use in medical and consumer goods applications, and a strong focus on material innovation. Technological advancements, the adoption of recyclable materials, and the presence of established manufacturers investing in capacity upgrades further support accelerated regional growth.

U.S. High Impact Polystyrene (HIPS) Film and Sheet Market Trends

The U.S. dominates the market due to its advanced manufacturing infrastructure, strong demand from the packaging, healthcare, and consumer goods industries, and continuous material innovation. The presence of major polymer producers, well-developed distribution networks, and increasing focus on high-performance and recyclable plastic solutions further strengthen the country’s leadership within North America.

How Big is the Success of the Europe High Impact Polystyrene (HIPS) Film and Sheet Industry?

Europe is growing at a notable rate in the market due to increasing demand for sustainable and high-quality packaging materials across the food, medical, and consumer goods sectors. Strong regulatory focus on recyclability, technological advancements in material processing, and rising adoption of lightweight, durable plastics in industrial applications support steady regional market expansion.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Product Type Insights

What made the Extrusion HIPS Segment Dominant in the High Impact Polystyrene (HIPS) Film and Sheet Market in 2025?

The extrusion HIPS segment dominates the market due to its ability to deliver consistent thickness, smooth surface quality, and high production efficiency. This process supports large-scale manufacturing, reduces material waste, and enables easy thermoforming, making it widely preferred for packaging, appliance, and industrial sheet applications.

The injection molding HIPS segment is the fastest-growing segment due to rising demand for precise, complex, and high-strength plastic components. Injection molding enables superior dimensional accuracy, smooth surface finish, and efficient mass production. Expanding use in consumer electronics, medical devices, and appliance housings further accelerates the adoption of injection-molded HIPS products.

Application Insights

How did the Packaging Dominated the High Impact Polystyrene (HIPS) Film and Sheet Market in 2025?

The packaging segment dominates the market due to strong demand for lightweight, impact-resistant, and cost-effective materials. HIPS offers excellent thermoformability, stiffness, and surface finish, making it ideal for trays, containers, and protective packaging. Growth in food, consumer goods, and e-commerce packaging continues to reinforce its leading application position.

The consumer goods segment is the fastest-growing segment in the market due to increasing demand for durable, lightweight, and visually appealing products. HIPS supports design flexibility, smooth surface finish, and cost-efficient manufacturing, making it suitable for appliances, electronics housings, and household items with consistent quality requirements.

End-User Industry Type Insights

Which Factors Make the Food & Beverage Segment the Dominant Segment in the Market in 2025?

The food & beverages segment dominates the market due to high demand for hygienic, lightweight, and impact-resistant packaging solutions. HIPS offers excellent thermoformability, good barrier performance, and an attractive surface finish, making it suitable for trays, cups, lids, and containers. Growth in packaged and ready-to-eat foods continues to strengthen its dominance.

The healthcare segment is the fastest-growing segment in the market due to increasing demand for sterile, durable, and lightweight medical packaging. HIPS offers excellent clarity, impact resistance, and thermoformability, making it ideal for medical trays, equipment housings, and pharmaceutical packaging, supporting safe and efficient healthcare operations.

Recent Breakthroughs in High Impact Polystyrene (HIPS) Film and Sheet Industry

- In November 2025, the Polystyrene Recycling Alliance (PSRA) expanded polystyrene recycling capacity through collaboration with Brave Industries. The collaboration aimed to strengthen circular economy initiatives by improving the collection, recycling, and reprocessing of high-impact polystyrene materials. By increasing recycling capacity, the alliance supports sustainable production and reduces environmental impact from plastic waste.

- In February 2025, Intertape Polymer Group Inc., a packaging products and systems company, launched its American brand Plastic Sheeting in Ultra and Performance film variants. The Ultra and Performance variants of American Plastic Sheeting were designed to provide superior tear resistance, surface protection, and flexibility for various applications, including packaging, construction, and consumer goods.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Top Companies in the Global High Impact Polystyrene (HIPS) Film and Sheet Market & Their Offerings:

Tier 1:

- INEOS Styrolution: Offers Styrolution® PS HIPS resins for extrusion into refrigerator liners and food packaging.

- Trinseo S.A.: Provides the STYRON™ and STYRON A-TECH™ portfolios, with high-melt-strength resins for refrigerator inner liners and Form-Fill-Seal food packaging.

- Chi Mei Corporation: Produces POLYREX® HIPS grades like PH-88, widely used for extrusion into sheets for electronic housings due to their impact strength.

- LG Chem Ltd.: Supplies high-impact grades like HIPS 50IS, utilized for manufacturing sheets and films for yogurt containers and refrigerator parts.

- Chevron Phillips Chemical Company: Its polystyrene business transitioned to the Americas Styrenics (AmSty) joint venture, which offers HIPS for packaging and toys.

- Formosa Chemicals & Fibre Corporation: Manufacturers of TAIRIREX® PS resins, including HIPS grades used in disposable food containers and household products.

- SABIC: Offers the SABIC® PS portfolio, with high-impact resins like PS 330 designed for sheet extrusion with high heat deflection and impact resistance.

- Versalis S.p.A.: Produces the Edistir® HIPS range, featuring specialized grades for deep-draw thermoforming of food packaging and refrigerator components.

Tier 2:

- Styron LLC

- BASF SE

- Taita Chemical Co., Ltd.

- Supreme Petrochem Ltd.

- PetroChina Company Limited

- KKPC (Kumho Petrochemical)

- Eni S.p.A.

- Sinopec Group

- Samsung SDI Co., Ltd.

- Dow Chemical Company

- Asahi Kasei Corporation

- Total Petrochemicals & Refining USA, Inc.

Segment Covered in the Report

By Product Type

- Extrusion HIPS

- Injection Molding HIPS

- Others

By Application

- Packaging

- Consumer Goods

- Electronics

- Automotive

- Construction

- Others

By End-User Industry

- Food and Beverage

- Healthcare

- Electronics

- Automotive

- Construction

- Others

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5916

Request Research Report Built Around Your Goals: [email protected]

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight – Check It Out:

- Biodegradable Packaging Materials Market Size, Trends and Segments (2026–2035)

- Hazardous Label Market Size, Trends and Segments (2026–2035)

- Advanced Packaging Market Size and Segments Outlook (2026–2035)

- Paint Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Sterile Medical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Plastic Films and Sheets Market Size, Trends and Segments (2026–2035)

- Fiber-based Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Perforated Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Waterproof Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Pressure Sensitive Labels Market Size, Trends and Segments (2026–2035)

- Personal Care Stand-Up Pouches Market Size, Trends and Regional Analysis (2026–2035)

- Fresh Food Packaging Market Size and Segments Outlook (2026–2035)

- Centerfold Laminated Bag Market Size, Trends and Regional Analysis (2026–2035)

- Display Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Hazardous Waste Bag Market Size, Trends and Segments (2026–2035)

- Zero Waste Packaging Market Size, Trends and Segments (2026–2035)

- PET Containers Market Size and Segments Outlook (2026–2035)

- Chemicals Packaging Coding Equipment Market Size, Trends and Regional Analysis (2026–2035)

- Folding Cartons Market Size, Trends and Segments (2026–2035)

- Corrugated Fanfold Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.