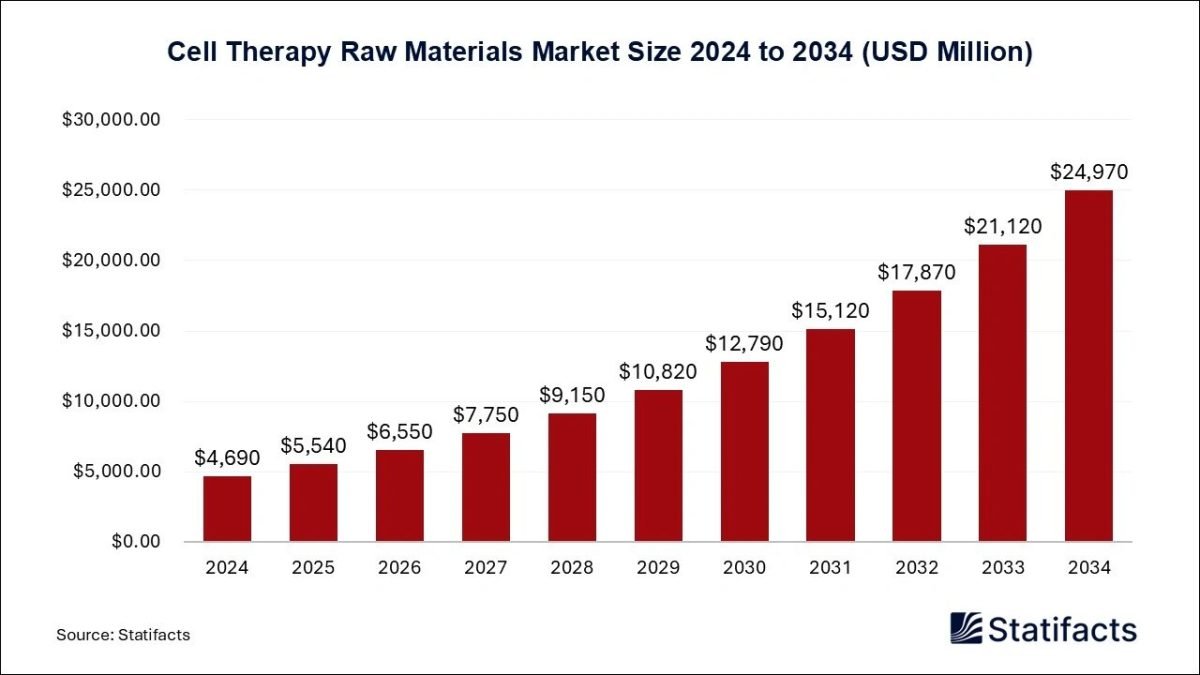

The global cell therapy raw materials market size will soar from USD 5,540 million in 2025 and is anticipated to reach around USD 24,970 million by 2034, expanding a CAGR of 18.2% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Nov. 03, 2025 (GLOBE NEWSWIRE) — According to Statifacts, the global cell therapy raw materials market size was valued at USD 4,690 million in 2024 and is predicted to be worth around USD 24,970 million by 2034, growing at a CAGR of 18.2% between 2024 and 2034. Significant investment in research and development, rising demand for personalized medicine, an increasing number of clinical trials, and the approval of cell therapies are driving the market’s growth.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8170

- North America led the cell therapy raw materials market in 2024, capturing the largest market share, and is expected to maintain its dominant position throughout the forecast period, driven by strong investments in biotechnology and a robust healthcare infrastructure.

- Asia-Pacific is anticipated to experience the fastest growth in the market, with a notable CAGR from 2025 to 2034, fueled by increasing demand for advanced cell therapy treatments and a growing number of biotech innovations in the region.

- The cell culture supplements segment dominated the market in 2024, holding the largest share, and is projected to continue its leadership due to its crucial role in supporting the growth and viability of cells in therapeutic applications.

- The media segment is expected to witness the fastest growth during the forecast period, with an accelerating CAGR from 2025 to 2034, driven by rising demand for high-quality media formulations to optimize cell expansion and production efficiency.

- The biopharmaceutical & pharmaceutical companies segment led the market in 2024, holding a dominant share, and is expected to retain its position as the key end-user due to the increasing number of cell-based therapies entering clinical and commercial stages.

- The CMOs & CROs segment is projected to experience the fastest growth in the market, driven by the expanding role of contract organizations in supporting cell therapy development and manufacturing, as well as increasing outsourcing by biopharma companies.

Kindly use the Following Link to Access Our Scheduled Meeting@ https://www.statifacts.com/schedule-meeting

What are Cell Therapy Raw Materials?

The cell therapy raw materials market encompasses the production, distribution, and utilization of cell therapy raw materials, which are components, reagents, and materials used in the manufacture of cell therapy products but are not intended to be part of the final product. Cell therapy raw materials encompass cryopreservation media, culture and isolation reagents, as well as disposables such as plasticware and bioprocessing bags. The selection of raw materials for cell therapy manufacturing can have a significant impact on the safety and efficacy of the final product.

The unmodified cells, the viral or non-viral vectors, and any other nucleic acid or protein used in the genetic modification of the cells are considered raw material. Raw materials play an important role in the successful commercialization of cell and gene therapies, as they directly impact quality, safety, and efficacy.

Major Government Initiatives for Cell Therapy Ra Materials:

- European Pharmacopoeia General Chapter 5.2.12 – The EDQM adopted a general chapter that lays out quality requirements and risk-based guidelines for raw materials of biological origin used in cell- and gene-therapy medicinal products. This helps harmonize standards, improve supplier qualification, and ensure consistent traceability and safety across EU member states.

- South Korea’s Act on the Safety and Support for Advanced Regenerative Medicine and Advanced Biological Products (2020) – This law defines and regulates advanced biological products, including cell therapies, and supports R&D, translational development, and manufacturing of raw materials (e.g., cell culture media, equipment) by designating them as “essential strategy technologies.” It provides funding, regulatory incentives, and tax credits to build the ecosystem.

- Regulation / legislation in Singapore to introduce a regulatory framework for Cell, Tissue & Gene Therapy Products (CTGTP) – The Health Sciences Authority (HSA) of Singapore has proposed amendments to its Health Products Act and new regulations specifically for CTGTP. These include definitions, licensing requirements, and safety / quality standards for raw materials used in manufacture.

- UK Government / Innovate UK Funding for Cell and Gene Therapies Industrial Manufacturing – The UK has run funding competitions (e.g., through Innovate UK) to stimulate large-scale manufacturing of cell and gene therapies. These programs help build capacity (facilities, raw materials supply, contract manufacturing) so that candidate therapies can move from lab scale into clinical trials and early market supply.

- Designation of strategic technologies and public funding in regulatory / industrial policy (e.g., South Korea, EU regions) for raw material supply chains – Governments are recognizing cell / gene therapy raw materials (growth factors, cytokines, media, vector manufacturing, culture equipment) as critical parts of the biotech value chain. For example, in South Korea, many such technologies have been declared “essential strategy technologies,” allowing preferential treatment in governmental funding, easier regulations, and tax incentives. In the EU, regulatory law (e.g., via the EMA / EDQM / EU-ATMP regulation) is increasingly codifying requirements for raw materials (origin, quality, traceability).

Key Trends of the Cell Therapy Raw Materials Market

- Shift toward chemically defined, xeno-/animal-origin-free media and reagents: To reduce batch-to-batch variability, risk of contamination, and simplify regulatory compliance, companies are shifting toward chemically defined, xeno or animal-origin-free media and reagents.

- Stronger demand for GMP-grade, traceable, and standardized raw materials: As more therapies move into late-stage clinical trials and toward commercialization, there is a rising requirement for raw materials that meet Good Manufacturing Practices (GMP), have full traceability, documented viral clearance, and consistent lot quality.

- Growth in manufacturing scale and adoption of allogeneic (off-the-shelf) therapies: Allogeneic therapies are preferred for scalability and cost-effectiveness versus autologous ones. This drives demand for higher volumes of raw materials and pushes suppliers to ensure sufficient capacity, consistency, and cost control.

- Integration of automation, closed systems, and digital tools: Automation and robotics, closed-system bioreactors, and monitoring tools like AI/ML for process optimization and supply chain traceability are increasingly used to improve consistency, reduce contamination risk, and drive down cost.

- Regulatory evolution and heightened quality/safety requirements: Regulators are putting in place clearer guidelines and standards for raw materials in cell/gene/tissue therapies. This includes requirements around donor sourcing, material origin, risk of adventitious agents, validation, documentation, etc. Suppliers must adapt to stricter oversight and better documentation.

Case Study: Thermo Fisher Scientific’s Hopewell Facility – Redefining GMP-Grade Cell Therapy Raw Material Manufacturing

Background:

As the cell therapy industry matures, the demand for GMP-grade, traceable, and standardized raw materials has surged. Companies now seek reliable partners capable of providing high-quality viral vectors, culture media, and reagents critical for scalable and compliant manufacturing.

In 2025, Thermo Fisher Scientific, a global leader in life sciences, made a landmark investment in this direction launching its 128,000 sq. ft. state-of-the-art cGMP facility in Hopewell, New Jersey. This move signaled a strategic effort to strengthen the global supply chain for cell and gene therapy raw materials, supporting both commercial-scale production and clinical-grade development.

The initiative aligns directly with Statifacts’ projection that the cell therapy raw materials market will reach USD 24.97 billion by 2034, growing at a CAGR of 18.2%, driven by technological innovation and rising demand for personalized medicine.

Challenge:

Before this expansion, the cell therapy industry faced critical challenges in its supply chain:

- Inconsistent material quality — Variability between raw material lots could impact therapy efficacy and regulatory compliance.

- Limited cGMP-compliant manufacturing capacity — Most suppliers lacked the infrastructure to produce GMP-grade materials at scale.

- Global supply chain disruptions — The pandemic and geopolitical tensions exposed weaknesses in material traceability and inventory management.

- High costs of validation and logistics — Importing high-purity materials from overseas suppliers created long lead times and increased costs for U.S.-based biopharma firms.

These challenges created bottlenecks for biopharmaceutical companies, CMOs, and CROs, slowing clinical trials and delaying product commercialization.

Solution:

Thermo Fisher’s Hopewell facility was developed to provide a holistic solution to these industry-wide issues through advanced design, automation, and sustainability.

Key features include:

- Fully cGMP-Compliant Production: Ensures consistency, traceability, and compliance with U.S. FDA and EMA regulations.

- Integrated Viral Vector Manufacturing: Supports both Adeno-Associated Virus (AAV) and Lentiviral vector production at clinical and commercial scales.

- Closed-System Processing & Automation: Reduces contamination risk and enhances reproducibility through automated bioreactor systems and AI-powered process monitoring.

- Sustainable Operations: Incorporates eco-friendly waste management and water-efficient bioprocessing, aligning with Thermo Fisher’s carbon reduction targets.

- Rapid Scale-Up Capability: Designed for flexible batch production enabling faster turnaround for clients developing new cell therapies.

This facility forms a critical node in Thermo Fisher’s global network, ensuring supply chain resilience and localized manufacturing capacity.

Implementation:

Upon its inauguration in August 2025, Thermo Fisher partnered with multiple U.S.-based and European biopharma clients to co-develop and scale their gene and cell therapy programs.

Implementation steps included:

- Establishing joint quality agreements to meet GMP specifications and regulatory expectations.

- Deploying digital twin models to simulate bioprocess parameters before live production.

- Collaborating with academic institutions for training programs in advanced biomanufacturing techniques.

Through these initiatives, Thermo Fisher successfully reduced raw material lead times by nearly 40% for key partners, while achieving 99.8% batch consistency in GMP-grade materials.

Results:

| Key Metric | Before Expansion | After Hopewell Launch |

| GMP Raw Material Availability | Limited | Expanded 3× Capacity |

| Lead Time for Viral Vector Materials | 10–12 weeks | 6–7 weeks |

| Lot-to-Lot Consistency | 85–88% | 99.8% Achieved |

| Contamination Risk | Moderate (open systems) | Minimal (closed systems) |

| Regional Client Supply Coverage | U.S. Northeast | North America + EU |

Outcome:

This expansion positioned Thermo Fisher as a top-tier CMO/CDMO partner for cell and gene therapy developers, directly supporting the rising demand from biopharma and CROs, which your press release highlights as the fastest-growing market segment.

Impact:

Industry Impact

- Reinforced the trend toward localized GMP manufacturing, reducing dependence on global imports.

- Supported the rapid scale-up of early-stage therapies into late-phase clinical trials.

- Set a new benchmark for raw material standardization and traceability in compliance with evolving U.S. and EU regulations.

Market Impact:

- Strengthened Thermo Fisher’s market share among the top suppliers of cell therapy raw materials, alongside Merck KGaA, Sartorius, and Danaher.

- Created ripple effects across CMOs/CROs, enabling smaller biotech startups to access consistent, high-quality materials without heavy infrastructure costs.

- Validated the Statifacts trend of growing GMP-grade and automation-integrated biomanufacturing.

Economic & Regional Impact:

- Added over 300 specialized jobs in New Jersey’s biomanufacturing sector.

- Contributed to the U.S. government’s push for domestic biopharmaceutical resilience.

- Attracted collaborations with academic hubs like Princeton and Rutgers for R&D acceleration.

Key Takeaways:

- Localization + Automation = Resilient Supply Chains: The Hopewell case shows how regional GMP facilities can mitigate global raw material shortages.

- GMP as a Competitive Edge: High-quality, validated materials are now essential differentiators in cell therapy manufacturing.

- Strategic Partnerships with CMOs/CROs: Collaborative manufacturing ecosystems are driving faster therapy commercialization.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8170

Cell Therapy Raw Materials Market Dynamics

Market Driver

- Rising Demand for Personalized Medicine:

Personalized medicine has the potential to fulfill the requirement to enhance health outcomes by reducing healthcare costs, drug development costs, and time. The greatest impact can be for the treatment of chronic diseases, like diabetes and asthma, in which non-compliance generally exacerbates the condition. The ability for healthcare providers to use genetic information as part of routine medical care. It helps to improve diagnostic accuracy to identify the best treatment option for a patient based on their characteristics.

Market Restraint

- Supply Chain Disruptions:

The main causes of supply chain disruption in cell therapy raw materials include transportation & logistic failures, supplier disruptions, technological vulnerabilities, pandemics, global health crises, trade disputes, geopolitical conflicts, natural disasters, and climate change. Supply chain disruptions can result in hampered productivity, production disruptions, and major negative consequences for business operations. Supply chain disruptions may cause a company to be unable to fulfill customers’ demands.

Market Opportunity

- Technological Innovation in Biopharmaceuticals:

The production of biopharmaceuticals, including monoclonal antibodies, vaccines, and therapeutic proteins, plays an important role in healthcare. Advanced technology innovation is driving lower R&D costs and progress of targeted treatments like CGTs. Biopharmaceutical technology is the study of how the pharmaceutical expression of specific drugs can impact their pharmacokinetic and pharmacodynamic behavior. AI in biopharmaceuticals includes accelerating drug development, improving operations, and ultimately improving patient outcomes.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8170

Medical Robot Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 4,690 Million | |

| Market Size in 2025 | USD 5,540 Million | |

| Market Size in 2031 | USD 15.120 Million | |

| Market Size by 2034 | USD 24,970 Million | |

| CAGR 2025-2034 | 18.2% | |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia Pacific | |

| Base Year | 2024 | |

| Historical Year | 2018 – 2024 | |

| Forecast Period | 2025 to 2034 | |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2034 | |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends | |

| Segments Covered | By Product Scope, By End Use Scope, and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | Thermo Fisher Scientific Inc., Merck KGaA, Danaher, Sartorius Stedim Biotech, Actylis., ACROBiosystems, STEMCELL Technologies., Grifols, S.A., Charles River Laboratories, RoosterBio, Inc., PromoCell GmbH, and Others. | |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Cell Therapy Raw Materials Market Segmentation

Product Scope Insights

Why does the Cell Culture Supplements Segment Dominate the Cell Therapy Raw Materials Market?

The cell culture supplements segment dominated the market in 2024. There are many benefits of using cell culture supplements, including customizing the growth conditions of your cells, improving cell viability and growth, and keeping cells healthier longer. Cell culture media supplements help ensure the reliability and consistency of cell culture and research results. Cell cultures have a highly controlled physicochemical environment that can be controlled very accurately, and the control of physiological conditions can be constantly examined.

- In July 2025, the launch of the latest advancement, GRO+ Advanced Hair Growth & Density Supplements, was announced by Vegamour, a hair longevity company leading in plant-powered biotech. The new dual-pill system formulated by MDs and backed by rigorous clinical trials marks a new internal way to address hair thinning. Source: PR Newswire

The media segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Media is important in cell culture because it provides energy for cell growth and other compounds that are essential to regulate cellular processes. Culture media are of fundamental importance for most microbiological tests to obtain pure cultures, to grow and count microbial cells, and to cultivate and select microorganisms. Without high-quality media, the possibility of achieving reproducible, accurate, and repeatable microbiological test results is reduced.

End Use Scope Insights

How Biopharmaceutical & Pharmaceutical Companies Segment Dominated the Cell Therapy Raw Materials Market?

The biopharmaceutical & pharmaceutical companies segment accounted for a considerable share of the market in 2024. Biopharmaceutical & pharmaceutical companies refer to the segment of business devoted to the design, development, and manufacture of chemical products for use in the diagnosis and treatment of chemical products for use in the diagnosis and treatment of disease, disability, or other dysfunction, or to improve function. These companies require high volumes of standardized, traceable, and regulatory-approved raw materials for both clinical development and commercialization. Their industrial-scale operations, strategic partnerships with raw material suppliers, and expertise in navigating complex regulatory pathways further position them as the primary drivers of demand.

The CMOs & CROs segment is projected to experience the highest growth rate in the market between 2025 and 2034. CMOs & CROs are capable of saving substantial time for the development of the drug and manufacturing. CROs offer services like clinical trial management, regulatory submissions, data analysis, and compliance consulting. CMOs focus on manufacturing services, including production, quality control, and scaling up processes for drug substances and finished products.

Regional Insights

Why is North America leading the Global Cell Therapy Raw Materials Market?

North America dominated the global market in 2024 due to the focus on quality & biosafety, a supportive regulatory environment, outsourcing to CMOs and CROs, personalized medicine trends, research & development investment, innovation in biotechnology, and a growing clinical pipeline in the region. Stem cells are used in the US for medical purposes, like as the treatment of cancer, blood disorders, and specific diseases affecting the bone, skin, and cartilage. Stem cells can differentiate into many types of cells in the body and regenerate diseased or damaged tissue. Source: ROSM

Advanced Pharmaceutical Industry: To Boost the U.S. Market

The U.S. dominated the regional market due to its well-established biotechnology and pharmaceutical industry, extensive investment in cell therapy research and clinical trials, and strong regulatory framework led by the FDA. The country hosts many leading raw material suppliers and manufacturers, supported by significant government funding and initiatives that promote innovation and fast-track approvals. Additionally, the U.S. benefits from advanced manufacturing capabilities and a robust supply chain, enabling large-scale production and consistent quality of GMP-compliant raw materials essential for cell therapy development and commercialization.

Asia Pacific Cell Therapy Raw Materials Market

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period because of the increasing clinical trials & approvals, expanding biomanufacturing, demand for high-quality inputs, supportive regulatory environment, increased investment & funding, innovation in biotechnology & cell biology, innovation in personalized & regenerative medicine, and increasing chronic diseases in the region. In India, raw materials used in manufacturing cell therapy products are not regulated.

- According to a report published in January 2025, India explored advances in cell and gene therapy at the PM-STIAC meeting. This session was focused on the development of Cell and Gene Therapy (CGT) in India, bringing together key stakeholders, including healthcare professionals, researchers, industry representatives, and government officials. Source: PIB GOV.

Chinese Government Investments Leveraging Innovations in Cell Therapies

China dominates the Asia Pacific Cell Therapy Raw Materials Market due to its rapidly growing biotechnology sector, substantial government investment in regenerative medicine, and increasing number of clinical trials and manufacturing facilities focused on cell therapies. The Chinese government’s supportive policies, including funding programs and streamlined regulatory pathways, have accelerated innovation and commercialization in the region. Additionally, China’s large patient population and expanding healthcare infrastructure drive strong demand for raw materials like GMP-grade media and reagents, while local suppliers are increasingly improving quality and scalability to meet both domestic and international standards.

Browse More Research Reports:

- The US cell therapy market size was calculated at USD 4.24 billion in 2024 and is predicted to attain around USD 21.41 billion by 2034, expanding at a CAGR of 17.57% from 2025 to 2034.

- The global CAR T-cell therapy market size was estimated at USD 5.51 billion in 2024 and is projected to be worth around USD 146.55 billion by 2034, growing at a CAGR of 38.83% from 2025 to 2034.

- The global automated and closed cell therapy processing system market size surpassed USD 1,530 million in 2024 and is predicted to reach around USD 12,630 million by 2034, registering a CAGR of 23.5% from 2025 to 2034.

- The global autologous cell therapy market size was evaluated at USD 5,430 million in 2024 and is expected to grow around USD 40,020 million by 2034, registering a CAGR of 22.11% from 2025 to 2034.

- The global stem cell therapy market size was evaluated at USD 16.04 billion in 2024 and is expected to grow around USD 54.45 billion by 2034, registering a CAGR of 13% from 2025 to 2034.

- The global cell therapy technologies market size was estimated at USD 6,560 million in 2024 and is projected to be worth around USD 34,040 million by 2034, growing at a CAGR of 17.9% from 2025 to 2034.

- The global cell therapy growth factor market size accounted for USD 668 million in 2024 and is expected to exceed around USD 1,389.63 million by 2034, growing at a CAGR of 7.6% from 2024 to 2034.

- The global cell therapy manufacturing market size is predicted to gain around USD 15,753 million by 2034 from USD 4,139 million in 2024 with a CAGR of 14.3%.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8170

Top Companies in Cell Therapy Raw Materials Market

- PromoCell GmbH – Provides high-quality primary human cells, specialized cell culture media, and reagents tailored for cell therapy research and development.

- RoosterBio, Inc. – Supplies ready-to-use human mesenchymal stem cells and optimized media systems designed to accelerate regenerative medicine manufacturing.

- Charles River Laboratories – Offers GMP-compliant raw materials, cell banking, and safety testing services essential for cell therapy development.

- Grifols, S.A. – Produces high-purity plasma-derived proteins and reagents used as critical raw materials in cell and gene therapy applications.

- STEMCELL Technologies – Delivers specialized cell culture media, reagents, and tools for the isolation, expansion, and differentiation of therapeutic cells.

- ACROBiosystems – Provides high-quality recombinant proteins, assay kits, and GMP-grade raw materials for cell therapy product development.

- Actylis – Offers customized, GMP-compliant raw materials and excipients for cell therapy formulation and production.

- Sartorius Stedim Biotech – Supplies advanced bioprocessing solutions, including single-use systems and critical raw materials for scalable cell therapy manufacturing.

- Danaher – Through subsidiaries like Cytiva and Pall, provides integrated technologies and GMP raw materials enabling large-scale cell therapy production.

- Merck KGaA – Supplies high-quality raw materials, media, and excipients optimized for cell therapy research and commercial manufacturing workflows.

- Thermo Fisher Scientific Inc. – Offers a comprehensive range of GMP-grade raw materials, reagents, and custom services supporting cell therapy development from research to commercialization.

Recent Developments

- In August 2025, the launch of cGMP Adeno-Associated Virus (AAV) manufacturing services at its 128,000 sq. ft. state-of-the-art facility in Hopewell, New Jersey, was announced by ProBio, a leading contract development and manufacturing organization (CDMO) specializing in gene and cell therapy. This strategic expansion is designed to meet rising industry demand for production of high-quality viral vector products and reflects ProBio’s ongoing commitment to support the innovation of life-changing gene therapies. Source: PR Newswire

- In November 2024, a new Cell Therapy business unit was launched by QPS Holdings, was announced that their Springfield campus, QPS Missouri. This facility is meeting with the exponentially rising demand for blood products to support cell and gene therapy work. Source: BusinessWire

- In March 2024, a new corporate initiative to support ex vivo cell manufacturing and manufacturers of innovative cell and gene therapies was announced by ACROBiosystems. This helps to empower engineers and scientists engaged in cell therapy manufacturing. Source: Bio Spectrum Asia

- In April 2024, the launch of HematoPAC-HSC-CB-GMP, on-demand current good manufacturing practice (cGMP)-compliant CD34+ hematopoietic stem cells (HSCs) ethically derived from fresh human cord blood was announced by OrganoBio. The new product depends on OrganaBio’s experience in the isolation of cells and the manufacturing of GMP to produce rapidly exceptional yields of highly viable CD34+ HSC cells for use in the development of next-generation cell therapies. Source: Technology Networks Biopharma

Segment Covered in the Report

By Product Scope

- Media

- Sera

- Cell Culture Supplements

- Antibodies

- Reagents & Buffers

- Others

By End Use Scope

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here – https://www.statifacts.com/get-a-subscription

Contact US:

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

- Europe: +44 7383 092 044

About US:

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Explore More Reports:

- Vitamin D Market – https://www.statifacts.com/outlook/vitamin-d-market

- Bamboo Flooring Market – https://www.statifacts.com/outlook/bamboo-flooring-market

- Spine Biologics Market – https://www.statifacts.com/outlook/spine-biologics-market

- Membrane Oxygenator Market – https://www.statifacts.com/outlook/membrane-oxygenator-market

- Hydrazine Hydrate Market – https://www.statifacts.com/outlook/hydrazine-hydrate-market

- Chelants Market – https://www.statifacts.com/outlook/chelants-market

- Cricket Equipment Market – https://www.statifacts.com/outlook/cricket-equipment-market

- Wafer-Level Vacuum Laminator Market – https://www.statifacts.com/outlook/wafer-level-vacuum-laminator-market

- Quantum Encryption Communication Modules Market – https://www.statifacts.com/outlook/quantum-encryption-communication-modules-market

- Automotive Copper Core Cable Market – https://www.statifacts.com/outlook/automotive-copper-core-cable-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.