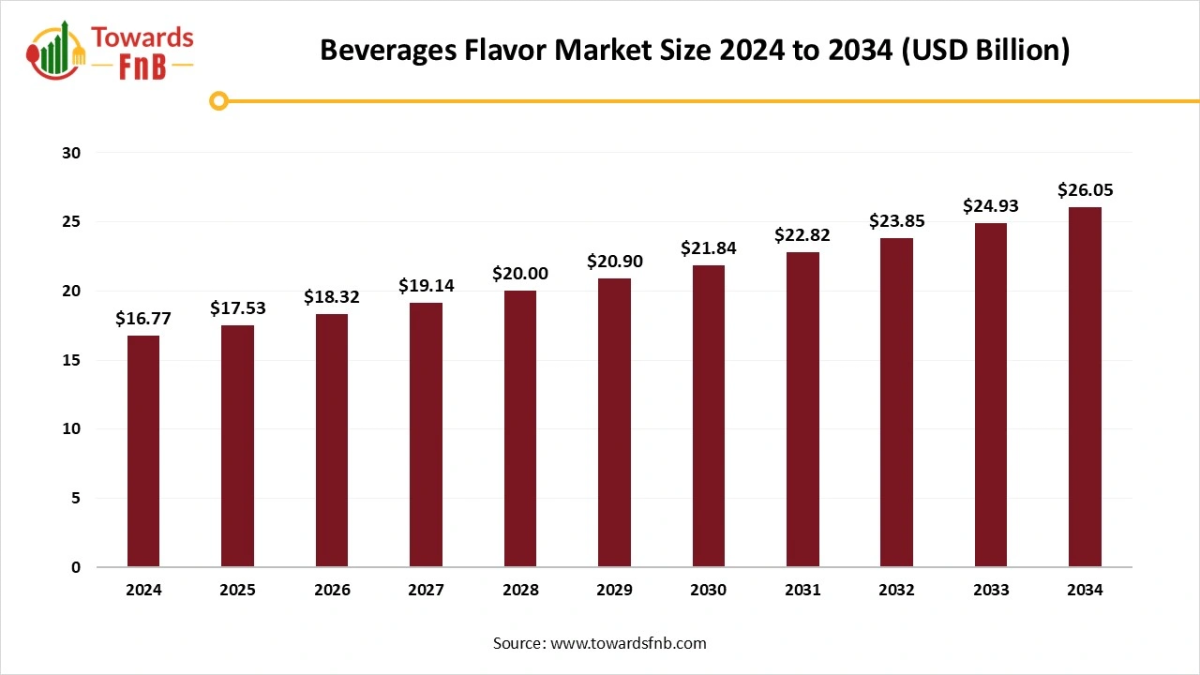

According to Towards FnB, the global beverage flavors market size is evaluated at USD 17.53 billion in 2025 and is anticipated to surge USD 26.05 billion by 2034, reflecting at a CAGR of 4.5% from 2025 to 2034. This growth is largely driven by the rising consumer preference for functional beverages that incorporate wellness-focused ingredients, such as spices and citrus flavors like ginger, which are known for their immune-boosting properties.

Ottawa, Nov. 19, 2025 (GLOBE NEWSWIRE) — The global beverage flavors market size stood at USD 16.77 billion in 2024 and is predicted to increase from USD 17.53 billion in 2025 to reach around USD 26.05 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The growth is because users are more interested in spices and citrus flavors like ginger in the beverages, which support wellness and immunity. At the current time, developing raw material costs and the supply shortages -specifically in cocoa and particular spices are prompting producers to update their products.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5520

Key Highlights of the Beverage Flavors Market:

- By region, North America dominated the beverage flavors market in 2024, driven by shifting demographics and evolving consumer preferences.

- By region, Asia Pacific is expected to witness significant growth during the forecast period, supported by an expanding number of market participants and enhanced service offerings.

- By form, the liquid segment held the largest market share in 2024, as liquid flavors provide multiple advantages that boost their adoption in the beverage flavor industry.

- By form, the crystal segment is projected to grow at a notable rate during the forecast period, fueled by rising demand for flavors with greater stability, longer shelf life, and easier transportation.

- By origin, the synthetic beverage flavors accounted for the largest share in 2024, as the demand for premium beverages and edible products continues to drive growth in the synthetic flavors market.

- By origin, the natural flavors are expected to grow at the fastest pace during the forecast period, supported by consumers’ increasing preference for healthier and more transparent food and beverage options.

- By product type, the fruit essence segment dominated the beverage flavors market in 2024, reflecting consumers’ growing inclination toward natural ingredients in beverages.

- By product type, the vegetable essence segment is anticipated to experience significant growth during the forecast period, driven by rising health awareness, increasing veganism, and growing demand for plant-based beverage products.

Understanding Beverage Flavorings: Types, Benefits, and Impact on Health

Flavourings are items added to drinks or food to change the taste and odour. These can be either a chemical compound or an edible extract. The chemical compounds are “evergreen aroma compounds,” which means that they release particles of an aroma to create a flavour recognisable. The extraction that comes from botanical contents like flowers or the fruit peels and has factors or molecules, such as through distilling, to serve a particular flavour.

Drink flavourings are usually utilised for their taste advantages that serve drinkers the quick recognisable flavour they crave. There can also be huge user and business advantages for using the flavourings, too. For users, flavourings can make a healthier product, which lowers the sugar in a drink without affecting the taste.

Government Regulations on the Beverage Flavours Market

- In August 2025, the food colours and the flavoring agents are hugely utilised in order to attract customers. The effects of the application in terms of food colour on food are huge, as they play an important role in the online display of the food. In India, the FSSAI (Food Safety and Standards Authority of India) has checked particular food colours and the flavors that are safe to use for consumption.

Major Importers of the Beverage Flavors Market:

- As per the global data, the world has officially imported 16,528 shipments of Beverage Flavor from June 2024 to May 2025. These imports were being supplied by the 1,639 exporters to 1,86 worldwide buyers, which has marked a development rate of -30% as compared to the leading twelve months. During this period, in May 2025 alone, the globe imported 536 Beverage Flavor shipments.

- Worldwide, the leading three importers of the Beverage Flavors are Ukraine, Vietnam, and Kazakhstan. Vietnam has topped the globe in terms of Beverage Flavor that has been imported, with 13,389 shipments, followed by Ukraine with 9,756 shipments, and Kazakhstan, which takes the third position with 4,341 shipments.

- Asia Pacific: The dominating sector for food and beverage flavors is being driven by the urge in India, China, and Southeast Asia. The region’s different culinary styles complete the demand for a variety of flavors.

- Europe: A main industry that is developing due to the surging demand for organic and natural ingredients, with European organizations concentrating on sustainable sourcing.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/beverage-flavors-market

AI’s Impact on the Beverage Flavors Market

Artificial Intelligence (AI) is transforming the beverage flavors market by enabling brands to analyze consumer data and predict emerging trends, leading to more personalized and innovative flavor offerings. This data-driven approach allows companies to quickly adapt to consumer preferences and stay competitive in a fast-evolving market.

AI is also revolutionizing the R&D process by simulating ingredient interactions, speeding up flavor development, and reducing costs. Additionally, AI optimizes supply chains, enhancing ingredient sourcing and minimizing waste. As technology advances, AI is becoming essential in driving sustainability, improving production efficiency, and accelerating flavor innovation in the beverage industry.

New Trends in the Beverage Flavors Market:

- Developing flavors such as Yuzu Kosho, sour cherry, and juniper displays the Thai desire for a deep and unique taste experience. Several trends concentrate on the integration of familiar factors with the latest nuances. Miso caramel, for instance, serves an agreeable balance between the umami and sweetness, while the pandan serves an exotic, lemonade-like or vanilla-like note to teas.

- The craving for the botanical flavors and a link to nature is also showcased in the developing popularity of lavender, lemon verbena, and rosemary. These contents not only serve taste complexity but also serve with taste complexities but also develop links with mindfulness and wellness. At the current time. Imaginative flavor ideas inspired by tropical and galactic aims are quickly gaining attention -particularly among the younger focus groups.

- Seasonal Limited Time Offers: Craveable lowers down with nostalgia: Limited-time offers are more than just a uniqueness as they enter into seasonality, cultural rituals, and emotions too. The beverage brands are highlighting spring blooms, fall coziness, summer fairs, and winter indulgence, too.

Coffee and tea have predicted flavors like the strawberry rhubarb, frosted sugar cookie, and the spice apple to dominate.

- Youth Appeal & Newstalgia: Where fun aligns with Familiar: With approximately 30% of the households that say kids encourage the flavour choices, which has a huge possibility in terms of bold, whimsical flavor profiles, particularly in the snackable and hydration beverage area.

- Function-First Flavor: Calm, Energy, and Clarity: Users are heavily predicting beverages to perform something for them in terms of relaxing, energizing, focusing, or assisting immunity too. The regular advantages that are driving the formulation, especially in tea, coffee, and hydration, too.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5520

Beverage Flavors Market Dynamics

Opportunity

Varieties in Beverage Flavors Industry

Current consumers expect more from their beverages. Drinks that are incorporated with probiotics, vitamins, collagen, and adaptogens like turmeric and ashwagandha are gaining popularity. Classifications like protein water, electrolyte energy Drinks, and the herbal wellness shots are developing too. Users are heavily checking contents like lists that point to an urge for cleanable drinks with fewer artificial additives.

There are also natural sweeteners, such as monk-fruit, stevia, and agave nectar, that are substituting refined sugars. At the current time, the low-sugar and the zero-calorie selections continue to stretch across spaces. Consumers are heavily represented to drinks filled with natural botanical extracts like chamomile, ginger, hibiscus, and turmeric. These ingredients not only develop the flavor but also serve health advantages such as relaxation, digestion, and immunity assistance.

Challenges

Several Issues Linked with Beverage Flavors

The natural extracts, botanical flavourings, and the essential oils change in composition, strength, and the trace volatiles. This changeability results in lower downstream performance. For instance, one feedback has marked a flavor house that should track different sourcing changes, ingredient traceability risks, and the processing losses. A flavour machine can perform differently in terms of liquid or powder that has low sugar vs low-sugar, shelf-stable, and chilled too.

Beverage Flavors Market Regional Analysis

The North America dominated the beverage flavors market in 2024 as the developing choice for the nutrition liquid beverages features a user move towards proactive health management and ease too. In order to perfectly mix nutrition beverages into daily life and develop the market, brands can highlight their evergreen nature through regular add-ons and trends like proffee, which encourages users with cutting-edge ideas and recipes. Brands can keep these drinks as essential, reliable solutions that align with current choices for dairy and tailored functionality.

Trends of Beverage Flavors in Canada

Online platforms broke the regional barricades that frequently restrict the user’s choice. Canadians can now delight in the tailored beverages from across the region or even worldwide with the selection to order at their ease. The wild tonics, for example, align with the developing urge for luxury jun beverages by making them available with the assistance of Canada, regardless of where users are located. Also, the health-conscious usage is a rigid trend currently that has Canadians finding low-sugar, organic, and probiotic options.

The jun beverages that have Wild Tonic are special in that they are naturally fermented and serve a different alternative to the kombucha that delivers both capable health benefits and a refreshing taste.

Asia Pacific is predicted to be a notable region in the foreseeable period. In this region, the growth is driven not only by the aging populations and developing incomes, but also by a development in user predictions. Users currently need a personalised solution for vitality and wellbeing, so flavor is inconsequential and the main element in their supplement selection. Adding more to this, flavor is not only updating what the supplements taste like, but also how they are drunk too. Capsules and tablets are giving the path to more pleasant chews, gummies, ready-to-mix beverages, and powders, too.

Trends of Beverage Flavors in China

As per the China Chain Store and Franchise Association (CCFA, the “latest-style tea” has pointed to freshly made beverages created with raw tea leaves or tea infusions, mixed with fresh fruit, dairy products, and vegetable juices or other ingredients too, which include instant powdered drinks. The tea drinks currently serve more than as a refreshment, but as a means of communication and participation too.

To align with the rising urge and healthier options, the Tea Barbados has classified its ingredient selection. Celery, curly kale, beetroot, bell peppers have been linked with blueberries, mulberries, seabuckthorn, and regular herbs like goji berries and dried tangerine. These additions align with health-conscious users while experiencing the flavour variety.

Beverage Flavors Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 4.5% |

| Market Size in 2025 | USD 17.53 Billion |

| Market Size in 2026 | USD 18.32 Billion |

| Market Size by 2034 | USD 26.05 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Beverage Flavors Market Segmental Analysis

By Form Analysis

The liquid segment dominated the market in 2024 as these flavors in beverages have a huge range from the cola flavors and classic fruit to the developing spiced, botanical, and exotic fruit integration. These flavors are usually available in focused liquid form for home and industrial applications. The fruit flavors have a huge range, which includes the classic options like lime, lemon, mango, strawberry, and peach, as well as the exotic and tropical selections like passion fruit, guava, pineapple, and dragon fruit.

The crystal segment is expected to rise fastest during the forecast period. The creators are moving beyond the function and fizz and shifting to the crystal segment to incorporate cocktail flavors and make a mocktail drinking experience. The manufacturers are giving feedback to a movement in the drinking culture, as folk want to consume less alcohol without adjusting the taste experience and flavor linked with the cocktail flavors. As a result, the classic mocktail has been defined and now stretches beyond cocktail alterations, which has crossed into several beverage spaces like flavored waters, soft drinks, and functional beverages, too.

Origin Analysis

The synthetic beverages segment dominated the market in 2024 as synthetic flavors denoting to artificial flavouring point to any materials, the working of which is to conduct flavor, that is not derived from any spice, vegetable or vegetable juice, fruit or fruit juice, herb, yeast, bud, bark, leaf and root or like plant material, fish, meat, eggs and poultry dairy products or the fermentation items therefore.

Basically, artificial flavours are the additives crafted to copy the taste of the natural contents. It is made with synthetically originated raw materials, which are artificial flavors too, designed to reflect the natural element, which serves producers as a smooth path to receive a particular profile.

The natural flavor segment is expected to rise fastest during the forecast period. Consumers select natural flavor and take the items that are simple with discernible ingredients and the ‘clean labels “. This has developed the urge for natural flavoring agents in terms of the beverage sector. Brands feature the natural ingredients, or the food-grade flavor contents, such as plant-based, adaptogens, and functional ingredients, in the labels in order to attract the health-conscious users.

Product Type Analysis

The fruit essence segment dominated the beverage flavours market in 2024, as the global market for fruit juices has changed significantly. On the other hand, oranges, mangoes, and pomegranates have once dominated, the industry now serves a noticeable series of both exotic and domestic fruit juices. The selections like amm panna, guava, kokum, jaljeera, sugarcane, green apples, and the berries have become famous choices in terms of fruit essence. In addition to this, the juice industry is stretching to include vegetable juices like cucumber, carrot, kale, parsley, beetroot, and mixed vegetables, too. Regular spices like turmeric and ginger are also gaining attention, which displays a rising trend towards a more diverse and health-focused juice preference.

The vegetable essence segment is expected to rise fastest during the forecast period. The vegetable flavors have become famous in the beverage sector because of a huge move in the user preference towards natural, healthier, and less-sugar drinks, too. This transformation has driven the invention across the sector, which shifts beyond regular fruit-based flavor in order to count a broader and more standard and appetizing palette too. The rising alertness of the high sugar levels in terms of fruit juices has led users to find out lower-sugar and healthier selections. The vegetable-based rinks and the mixture serve a natural look to receive Thai without adjusting flavor.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Beverage Flavors Market Top Leading Companies:

- Coca-Cola: A global leader in the beverage industry, Coca-Cola continues to innovate with new flavor profiles and healthier, functional beverage options, focusing on sustainability and market diversification.

- PepsiCo: Known for its wide range of beverages, PepsiCo integrates innovative flavors and natural ingredients to cater to health-conscious consumers, while expanding its product offerings across different categories.

- AB InBev: As one of the largest brewers in the world, AB InBev leverages a broad portfolio of flavored beverages and alcoholic drinks, emphasizing craft and regionally inspired flavors to meet diverse consumer preferences.

- Givaudan: A leading flavor and fragrance company, Givaudan specializes in creating innovative and customized flavors for beverages, combining natural ingredients with cutting-edge technology to meet market demands.

- Symrise: Symrise is a global leader in flavor and fragrance creation, focusing on the development of sustainable and health-oriented flavor solutions for the beverage market.

- Firmenich: A major player in the flavor industry, Firmenich is known for creating unique, premium beverage flavors, with a strong emphasis on natural ingredients and sustainability.

- IFF (International Flavors & Fragrances): IFF is a key innovator in the beverage flavors sector, offering creative and natural flavor solutions that meet the growing demand for clean-label, functional, and plant-based beverages.

- Keurig Dr Pepper: With a diverse range of flavored beverages, Keurig Dr Pepper focuses on developing products that blend innovation and consumer demand for flavor variety, including healthy, low-sugar options.

- Nestlé: Nestlé’s beverage portfolio includes a wide array of flavored drinks, focusing on health-driven innovations like functional beverages and plant-based options that align with consumer wellness trends.

- Heineken: Known for its beer and alcoholic beverages, Heineken is exploring flavored variations and functional beverages to appeal to changing consumer preferences for novel and refreshing taste experiences.

- Diageo: As a global leader in alcoholic beverages, Diageo enhances its offerings with premium, flavored spirits, using natural ingredients to cater to evolving consumer demands for taste and wellness.

- Monster Beverage: A leader in the energy drink sector, Monster is continually expanding its product line with innovative flavor profiles designed to appeal to a broad, active consumer base.

- Red Bull GmbH: Famous for its energy drinks, Red Bull introduces new flavors to attract consumers seeking energy-boosting options, while emphasizing natural ingredients and functional benefits.

- Danone: A major player in the dairy and beverage market, Danone focuses on functional drinks and plant-based beverages, leveraging flavors that appeal to health-conscious consumers.

- Sensient Technologies Corporation: Sensient specializes in creating high-quality natural and synthetic flavors for the beverage industry, focusing on taste innovation and sustainability in ingredient sourcing.

- Kerry Group: Kerry offers a broad range of beverage flavor solutions, with a focus on functional, health-driven innovations such as sugar-reduced and plant-based beverages.

- Pernod Ricard: Known for its alcoholic beverages, Pernod Ricard is expanding into flavored spirits and non-alcoholic beverages, focusing on innovation and consumer demand for unique, high-quality flavors.

- Asahi Group Holdings: Asahi is a prominent player in the beverage industry, offering a diverse range of flavored beverages, particularly in the alcoholic drink segment, with a focus on quality and regional taste preferences.

- Constellation Brands: With a portfolio that spans alcoholic and non-alcoholic beverages, Constellation Brands continues to innovate with new flavors, catering to consumer demands for premium and functional drinks.

- Frutarom: Specializing in natural flavors, Frutarom develops innovative and health-focused beverage solutions, particularly in the functional beverage sector, supporting growing trends toward natural ingredients.

- Mane SA: Mane is a global leader in the flavor and fragrance market, creating innovative beverage flavor solutions that prioritize sustainability and natural ingredients for health-conscious consumers.

- National Beverage: Known for its wide range of flavored sodas and beverages, National Beverage focuses on producing refreshing and innovative flavor profiles, with a particular emphasis on health-conscious choices.

- Robertet Group: Specializing in natural flavors, Robertet provides unique and sustainable flavor solutions for the beverage industry, focusing on premium ingredients and clean-label options.

- Starbucks Corporation: Starbucks continues to innovate in the beverage flavors market with its broad range of coffee-based and seasonal beverages, integrating unique flavor combinations to enhance consumer experience.

- International Flavors and Fragrances (IFF): IFF is a leading flavor company that specializes in natural and synthetic flavor solutions, providing innovative products that cater to the growing demand for personalized and functional beverages.

- Tate & Lyle: Tate & Lyle focuses on creating flavors that cater to the health-conscious beverage market, with an emphasis on reducing sugar content and providing natural ingredients for cleaner labels.

- Flavorchem Corp.: Known for its custom flavor solutions, Flavorchem develops unique beverage flavors that meet specific market demands, emphasizing innovation and sustainability in the flavor creation process.

- Sensient Technologies: Sensient creates a wide range of beverage flavors, with a focus on natural and clean-label solutions that support health trends, such as sugar reduction and functional beverage development.

Segments Covered in the Report:

By Form

- Liquid

- Powder

- Crystal

- Others

By Origin

- Natural

- Synthetic

- Nature-Identical

By Product Type

- Fruits Essence

- Vegetable Essence

- Herbs Essence

- Botanical Essence

- Brown Essence

- Dairy Essence Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5520

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

LinkedIn | Medium| Twitter

Discover More Market Trends and Insights from Towards FnB:

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.