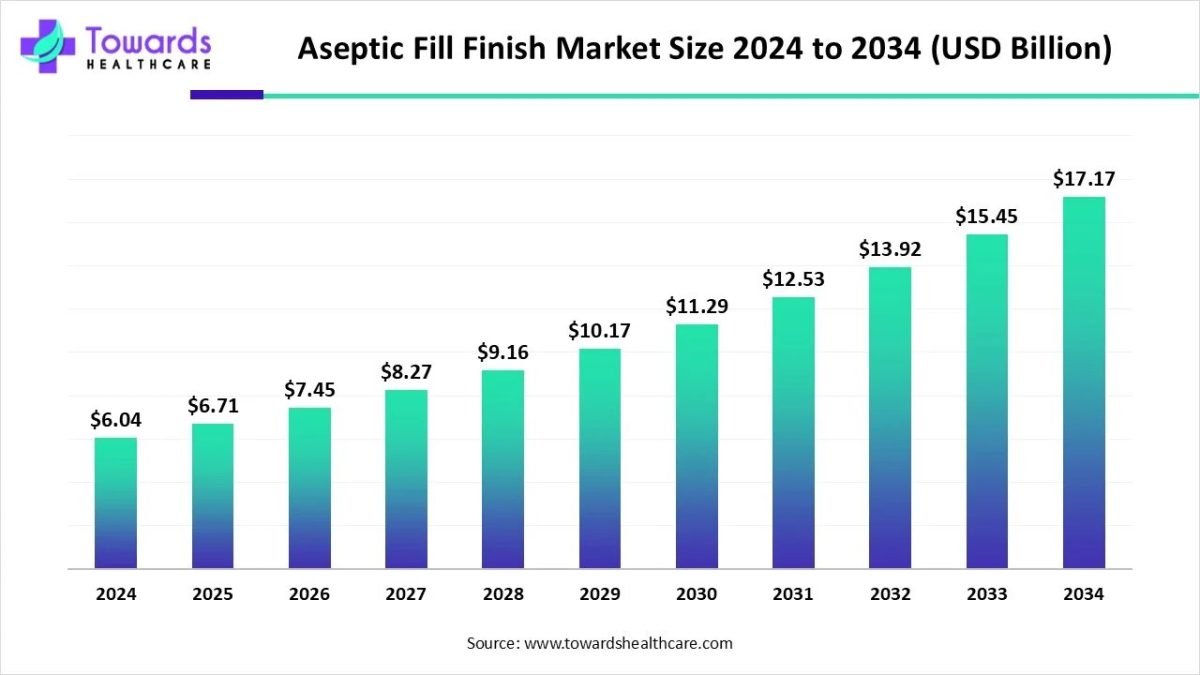

The aseptic fill finish market size is calculated at USD 6.71 billion in 2025 and is expected to reach around USD 17.17 billion by 2034, growing at a CAGR of 11.04% for the forecasted period.

Ottawa, Nov. 05, 2025 (GLOBE NEWSWIRE) — The global aseptic fill finish market size was valued at USD 6.04 billion in 2024 and is predicted to hit around USD 17.17 billion by 2034, rising at a 11.04% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The growth of the market is driven by the growing need and investment for biologics and injectables, which require advanced facilities, driving the growth of the market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5584

Key Takeaways

- North America dominated the aseptic fill-finish market in 2024.

- Asia Pacific is estimated to grow at the fastest CAGR during the forecast period.

- By molecule type, the biologics segment led the market in 2024.

- By molecule type, the small molecule segment is estimated to grow at the fastest rate during the predicted time frame.

- By container packaging type, the ampoules segment held the largest share of the market in 2024.

- By container packaging type, the vials segment is estimated to be the fastest-growing during the forecast period.

- By drug product, the vaccine segment dominated the market in 2024.

- By drug product, the gene therapies segment is estimated to be the fastest-growing during the forecast period.

- By therapeutic area, the autoimmune disorders segment led the aseptic fill finish market in 2024.

- By therapeutic area, the oncological disorders segment is estimated to be the fastest-growing during 2025-2034.

- By service type, the formulation segment led the market in 2024.

- By service type, the filling segment is expected to grow at a significant rate during the forecast period.

- By scale of operation, the preclinical/clinical segment was dominant in the market in 2024.

- By scale of operation, the commercial segment is anticipated to witness the fastest growth rate during the forecast period.

- By end-use, the pharmaceutical companies segment led the aseptic fill-finish market in 2024.

- By end-use, the biotechnology companies segment is estimated to grow at a noticeable rate during 2025-2034.

Market Overview & Potential

In the highly dynamic market of aseptic fill/finish, a critical step in producing sterile medications like vaccines and other injectables, fluctuating demand and delayed supply might suggest that capacity is limited. This fast-changing market requires precise matching between buyers and suppliers who can meet their production needs to optimise the use of available capacity. As demand continues to grow faster than capacity, the fill/finish industry remains a strong area for investment. This trend is expected to persist for the next five to ten years, despite significant investments from both in-house and outsourced suppliers.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2024 | USD 6.04 Billion | |

| Projected Market Size in 2034 | USD 17.17 Billion | |

| CAGR (2025 – 2034) | 11.04 | % |

| Leading Region | North America | |

| Market Segmentation | By Molecule Type, By Packaging Container Type, By Drug Products, By Therapeutic Area, By Service Type, By Scale of Operation, By End-Use, By Region | |

| Top Key Players | AbbVie Contract Manufacturing, Asymchem, Aenova, APL, BioPharma Solutions, BioReliance, Boehringer Ingelheim BioXcellence, Catalent Biologics, Charles River Laboratories, CordenPharma, Delpharm, Fareva, Fresenius Kabi, Glaxo SmithKline, Hetero Drugs, Intas Pharmaceuticals, Lonza, Pierre Fabre, Pfizer CentreOne, Plastikon Healthcare, Patheon, PiSA Farmaceutica Recipharm, Wacker Biotech, Syngene, Sharp Services, Siegfried, Takara Bio, WuXi Biologics, Wockhardt, Other Prominent Players | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What is the Growth Potential Responsible for the Aseptic Fill Finish Market?

The main drivers for the aseptic fill-finish market are the growing demand for biologics, vaccines, and personalised medicines, technological advancements like automation and robotics, and the increasing trend of outsourcing fill-finish operations to contract manufacturing organisations (CMOs). Additionally, stringent regulatory standards requiring high levels of sterility and quality are pushing the market towards advanced, sterile fill-finish technologies.

What Are the Growing Trends Associated with the Aseptic Fill Finish Market?

- Automation and isolators: There is a significant trend toward using high-automation and isolator technology to minimise human intervention, which enhances sterility and safety.

- Small-batch and personalised medicine: The market is adapting to cater to the manufacturing needs of personalised medicines and smaller-batch products.

- Advanced sterilisation: The use of advanced sterilisation technologies, such as vaporised hydrogen peroxide (VHP) in isolators, is becoming a standard for achieving higher levels of sterility assurance.

- Data integrity: Modern systems are incorporating enhanced data integrity and traceability systems to document and track every process step, which is crucial for regulatory compliance and audits.

What Is the Growing Challenge in the Aseptic Fill Finish Market?

The aseptic fill-finish market faces challenges, including high technology costs, complex and evolving global regulations, and the inherent difficulty of maintaining sterility throughout the process. Other challenges involve handling increasingly complex drug products like biologics, scaling up production without compromising quality, and the need for highly trained personnel. Additionally, there is growing pressure to use sustainable, PFAS-free consumables, which requires expensive material innovation and requalification.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

How Did North America Dominate the Aseptic Fill Finish Market in 2024?

The North American aseptic fill-finish market is a dominant global player in the market, with the United States being the largest contributor. Growth of the market in the region is driven by the biopharmaceutical industry presence, particularly the demand for biologics and personalised medicine, advancements in technology, and outsourcing of manufacturing operations to contract manufacturing organisations (CMOs), which contributes to the growth. Key drivers include increasing investment in new biologics, growing vaccination rates, and the rise of cell and gene therapies, which support the growth of the market in the region.

What Made the Asia Pacific Significantly Grow in The Aseptic Fill Finish Market In 2024?

Asia Pacific has seen significant growth in the market in the forecasted period. The aseptic fill-finish market in Asia-Pacific is the fastest-growing region, driven by increasing pharmaceutical manufacturing in countries like China and India, a rising demand for injectable drugs, and government support for local production further contributes to the growth of the market. The market is expected to see significant growth, as local contract manufacturing organisations (CMOs) upgrade facilities to meet international standards to attract global outsourcing and cater to the growing healthcare needs within the region, supporting the growth.

Segmental Insights

By Molecule Type,

The biologics segment led the market in 2024. The biologics segment dominates the aseptic fill-finish market due to the increasing adoption of biologics, vaccines, and biosimilars requiring sterile environments. Growing demand for monoclonal antibodies, cell-based therapies, and mRNA vaccines is driving investment in high-precision aseptic filling systems that ensure sterility, minimise contamination risk, and maintain biologic stability during large-scale manufacturing processes.

The small molecule segment is estimated to grow at the fastest rate during the predicted time frame. The small molecule segment continues to hold a substantial share, supported by the wide use of parenteral formulations. Many injectable drugs in oncology, pain management, and cardiovascular therapies rely on aseptic fill-finish processes to preserve purity and prevent degradation. Increasing outsourcing by pharmaceutical firms for sterile filling of injectables also contributes to steady growth.

By Container Packaging Type,

The ampoules segment held the largest share of the market in 2024. Ampoules are commonly used for single-dose formulations requiring high sterility and protection from external contamination. Their sealed design and compatibility with various liquid formulations make them suitable for small-scale, high-value drugs. The segment benefits from their precision, glass integrity, and ability to maintain product stability throughout the aseptic filling process.

The vials segment is estimated to be the fastest-growing during the forecast period. The vials segment dominates due to its application in multi-dose injectable drugs and vaccines. Vials offer flexibility for different fill volumes and enable integration with automated filling and capping lines. Their reuse potential in clinical and commercial settings, along with cost efficiency, supports their growing adoption across biologics and small molecule formulations.

By Drug Product,

The vaccine segment dominated the market in 2024. The vaccine segment accounts for a major market share, driven by ongoing immunisation initiatives and mRNA vaccine production. Aseptic fill-finish is essential for ensuring vaccine sterility, safety, and stability. The rise in global pandemic preparedness and continuous public health efforts is prompting manufacturers to expand sterile filling capacity for large-scale vaccine distribution.

The gene therapies segment is estimated to be the fastest-growing during the forecast period. Gene therapies represent a fast-emerging sub-segment due to advancements in precision medicine and personalised therapies. These products require highly specialised aseptic fill-finish capabilities to handle low-volume, high-value biologics. CDMOs are increasingly developing flexible systems for gene therapy filling to meet complex regulatory standards and maintain product quality during sensitive filling stages.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Therapeutic Area,

The autoimmune disorders segment led the aseptic fill-finish market in 2024. The autoimmune disorders segment is growing due to increasing demand for biologics targeting diseases such as rheumatoid arthritis and multiple sclerosis. These therapies require aseptic fill-finish operations to maintain product sterility and potency. Rising biopharma investments in chronic disease treatments continue to fuel demand for sterile filling capabilities in this segment.

The oncological disorders segment is estimated to be the fastest-growing segment during 2025-2034. Oncological disorders dominate the market, with a rising pipeline of injectable cancer therapies. The segment benefits from the surge in monoclonal antibody-based and targeted biologics requiring aseptic filling. Growing emphasis on maintaining sterility and accurate dosing in oncology injectables is driving the adoption of automated, closed-system filling technologies among major manufacturers.

By Service Type,

The formulation segment led the market in 2024. Formulation services are critical for ensuring product stability and compatibility before filling. This involves preparing biologic and small molecule formulations under controlled aseptic conditions. The segment is growing as pharmaceutical and biotech companies increasingly outsource formulation to specialised CDMOs that ensure consistency, scalability, and compliance with global regulatory standards.

The filling segment is expected to grow at a significant rate during the forecast period. The filling segment holds a dominant position as it involves the precise dosing and sealing of sterile drugs into containers. Automation and robotics have improved filling accuracy, reduced contamination risks, and increased throughput. Demand for flexible aseptic filling lines has risen with the expansion of biologics and vaccine manufacturing worldwide.

By Scale of Operation,

The preclinical/clinical segment was dominant in the market in 2024. The preclinical and clinical segments are expanding due to the increasing number of biologic and vaccine candidates under investigation. Companies prefer flexible, small-batch aseptic filling systems to support early-stage production. CDMOs offering clinical-scale filling solutions are witnessing higher demand from biotech firms seeking GMP-compliant sterile filling support for drug trials.

The commercial segment is anticipated to witness the fastest growth rate during the forecast period. The commercial segment dominates as large-scale production of approved biologics and vaccines requires robust aseptic fill-finish operations. Pharmaceutical firms are investing in advanced aseptic technologies, including isolators and robotics, to enhance throughput and quality control. Growing global vaccine and biologic distribution further supports the expansion of commercial aseptic filling capacity.

By End-Use,

The pharmaceutical companies segment led the aseptic fill-finish market in 2024. Pharmaceutical companies represent the leading end users of aseptic fill-finish systems, driven by the production of biologics, vaccines, and parenteral drugs. They invest heavily in automation, robotics, and isolator technology to ensure sterile filling. Integration of in-house aseptic filling facilities is becoming common to enhance supply chain efficiency and regulatory compliance.

The biotechnology companies segment is estimated to grow at a noticeable rate during 2025-2034. Biotechnology companies increasingly rely on contract manufacturing organisations (CMOs/CDMOs) for aseptic fill-finish services. Their focus on novel biologics and gene therapies requires customised, small-batch sterile filling. Growing partnerships with specialised service providers help biotechs manage high-value products efficiently while adhering to stringent sterility and regulatory standards.

Browse More Insights of Towards Healthcare:

The global aseptic filling machine market size is calculated at USD 1.87 in 2024, grew to USD 1.97 billion in 2025, and is projected to reach around USD 3.18 billion by 2034. The market is expanding at a CAGR of 5.45% between 2025 and 2034.

The global automatic aseptic sampling market size is calculated at USD 150 million in 2024, grew to USD 179.01 million in 2025, and is projected to reach around USD 884.54 million by 2034. The market is expanding at a CAGR of 19.34% between 2025 and 2034.

The global aseptic fill finish manufacturing market size is calculated at USD 5.94 billion in 2024, grew to USD 6.47 billion in 2025, and is projected to reach around USD 14.01 billion by 2034. The market is expanding at a CAGR of 8.94% between 2025 and 2034.

The global aseptic sampling market was estimated at US$ 0.95 billion in 2023 and is projected to grow to US$ 2.31 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.76% from 2024 to 2034.

Recent Developments

- In November 2024, the CDMO GBI Biomanufacturing (GBI) is expanding its Drug Product (DP) services by including automated sterile fill and finish capabilities. At its Plantation, Florida, location, GBI helps clients with commercial launches and Drug Substance (DS) and DP clinical research.

- In October 2024, Kindeva Drug Delivery (Kindeva), a leading global CDMO, announced two noteworthy milestones for its state-of-the-art facility in Bridgeton, Missouri. The first registration batch for the site’s Groninger high-volume vial line has been completed successfully. This achievement shows the facility’s readiness to meet the growing demand for injectable fill-finish capabilities and marks an important turning point in the company’s development.

Aseptic Fill Finish Market Key Players List

- AbbVie Contract Manufacturing

- Asymchem

- Aenova

- APL

- BioPharma Solutions

- BioReliance

- Boehringer Ingelheim BioXcellence

- Catalent Biologics

- Charles River Laboratories

- CordenPharma

- Delpharm

- Fareva

- Fresenius Kabi

- Glaxo SmithKline

- Hetero Drugs

- Intas Pharmaceuticals

- Lonza

- Pierre Fabre

- Pfizer CentreOne

- Plastikon Healthcare

- Patheon

- PiSA Farmaceutica

- Recipharm

- Wacker Biotech

- Syngene

- Sharp Services

- Siegfried

- Takara Bio

- WuXi Biologics

- Wockhardt

- Other Prominent Players

Segments Covered in The Report

By Molecule Type

- Biologics

- Small Molecules

By Packaging Container Type

- Ampoules

- Vials

- Cartridges

- Syringes

By Drug Products

- Vaccines

- Gene Therapies

- Antibodies

- Cell Therapies

- Oligonucleotides

- Recombinant Proteins

- Others

By Therapeutic Area

- Autoimmune Disorders

- Oncological Disorders

- Cardiovascular Disorders

- Infectious Disorders

By Service Type

- Formulation

- Filling

- Lyophilization

- Packaging

- Others

By Scale of Operation

- Preclinical/Clinical

- Commercial

By End-Use

- Pharmaceutical Companies

- Biotechnology Companies

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5584

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.