The U.S. Anti-Obesity Drugs Market is projected to grow at a CAGR of 24.07%, supported by strong patient adoption of GLP-1 based therapies, expanding digital prescription platforms, and increasing focus on metabolic disease management.

Austin, Nov. 27, 2025 (GLOBE NEWSWIRE) — Anti-Obesity Drugs Market Size & Growth Analysis:

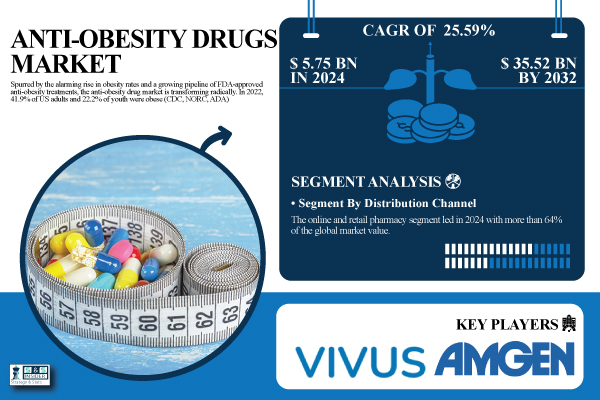

According to SNS Insider, the Anti-Obesity Drugs Market size was valued at $5.75 billion in 2024 and is expected to reach $35.52 billion by 2032. This reflects a powerful compound annual growth rate (CAGR) of 25.59% during the forecast period of 2025 to 2032. The global healthcare sector is witnessing a rapid shift toward medical weight management as obesity rates climb and new drug classes provide stronger and safer outcomes compared to traditional treatments. Anti-obesity medications are becoming central tools in long-term metabolic health management, supported by wider awareness and improving reimbursement structures.

Download PDF Brochure: https://www.snsinsider.com/sample-request/7119

The United States remains the largest and most influential regional market. The U.S. Anti-Obesity Drugs Market size was valued at $1.83 billion in 2024 and is expected to reach $10.28 billion by 2032 at a CAGR of 24.07%. Growth is powered by rising obesity rates, strong clinical acceptance of GLP-1 agonists, expanding telehealth-driven prescribing, and ongoing innovation from leading pharmaceutical companies.

Major Companies in the Anti-Obesity Drugs Market Include:

- Novo Nordisk A/S

- Eli Lilly and Company

- GlaxoSmithKline plc

- Pfizer Inc.

- Boehringer Ingelheim International GmbH

- Amgen Inc.

- F. Hoffmann-La Roche Ltd

- VIVUS LLC

- Currax Pharmaceuticals LLC

- Rhythm Pharmaceuticals

- Other Participants

Get Free Sample Report of the Anti-Obesity Drugs Market: https://www.snsinsider.com/sample-request/7119

Segmentation Analysis:

By Type

The prescription drugs segment was the largest in the global anti-obesity drugs market in 2024 and held 86% of the market. The high frequency of use of FDA-approved anti-obesity medications, such as semaglutide (Wegovy) and tirzepatide (Zepbound), which work significantly better than old therapies, is the cause of their popularity. The OTC drugs segment will grow at the highest rate due to the growing health consciousness, better access through online channels, and the demand for self-help weight loss products, especially in areas of poor healthcare infrastructure or inadequate insurance coverage.

By Distribution Channel

The online and retail pharmacy segment led in 2024 with more than 64% of the global market value as both OTC medication and prescription weight loss medication are easier for patients to access currently, due to greater utilization of online pharmacies. Hospital pharmacies are likely to be the most rapidly growing distribution channel owing to the growing bariatric care programs, hospital obesity management strategies, and integrated treatment regimens for chronic diseases such as diabetes and heart disease, which need professional management and start treatment in hospitals.

Regional Insights:

North America dominated the anti-obesity drugs market in 2024 due to a high prevalence of obesity, rapid uptake of FDA-approved anti-obesity drugs, and well-developed healthcare systems, with revenue enhanced by satisfactory insurance coverage for long-term weight control and growing doctor expertise.

The market for anti-obesity medications is growing at the fastest rate globally in Asia Pacific, driven by factors, such as rising middle-class healthcare spending, dietary changes, and urbanization. Japan holds a dominant market position due to its advanced pharmaceutical industry, early regulatory acknowledgment of weight-loss pharmacotherapy, and rising prevalence of metabolic syndrome, which affect over 40% of patients between the ages of 40 and 74.

Need Any Customization Research on Anti-Obesity Drugs Market, Enquire Now: https://www.snsinsider.com/enquiry/7119

Recent Developments:

- In January 2025, the Biden administration introduced a new federal rule aimed at tackling obesity by promoting broader access to treatment options, including prescription weight-loss drugs, as part of a national public health strategy.

- In April 2024, according to IQVIA, U.S. pharmaceutical spending surged by 11.4%, marking historic growth largely fueled by heightened demand for obesity and oncology medications, with anti-obesity drugs playing a key role in this spike.

Exclusive Sections of the Report (The USPs):

- OBESITY INCIDENCE & PREVALENCE (2024), BY REGION: Helps you understand the underlying disease burden driving demand for anti-obesity drugs, including adult and childhood obesity rates, BMI distribution patterns, and high-risk population clusters across major global regions.

- ANTI-OBESITY DRUG PRESCRIPTION TRENDS (2024), BY REGION: Helps you identify which regions show faster uptake of prescription-based weight-loss therapies due to stronger clinical guidelines, physician adoption, digital prescribing platforms, and expanding patient awareness.

- OBESITY-RELATED HEALTHCARE SPENDING (2024): Helps you understand expenditure trends across government programs, commercial insurance, private payers, and out-of-pocket channels—highlighting regions where obesity-related medical costs (diabetes, hypertension, cardiac disease) are driving drug demand.

- REGULATORY & REIMBURSEMENT LANDSCAPE (2024): Helps you evaluate approval pathways, reimbursement coverage, and regional policy differences that shape patient access, influencing which markets have favorable or restrictive environments for anti-obesity drugs.

- DRUG DISCONTINUATION & ADVERSE EVENT RATES (2024): Helps you assess safety profiles, adherence challenges, tolerability issues, and discontinuation trends that impact long-term treatment success and commercial performance.

- PUBLIC AWARENESS & ADOPTION TRENDS (2024): Helps you analyze patient perceptions, awareness levels, lifestyle acceptance, and willingness to adopt medical therapy—critical for understanding demand potential and behavioral barriers in key markets.

Purchase Single User PDF of Anti-Obesity Drugs Market Report: https://www.snsinsider.com/checkout/7119

Anti-Obesity Drugs Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | USD 5.75 Billion |

| Market Size by 2032 | USD 35.52 Billion |

| CAGR | CAGR of 25.59% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Key Segments | • By Type (Prescription Drugs, OTC Drugs) • By Distribution Channel (Hospital Pharmacy, Retail, and Online Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Related Reports

Diabetes Devices Market

Metabolic Disorder Therapeutics Market

Weight Loss Devices Market

Weight Loss Drugs Market

Bariatric Surgery Market

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: info@snsinsider.com

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.