Global Military EO/IR Systems Market to Expand at 4.52% CAGR as Armed Forces Invest in Advanced Surveillance, Targeting, and Night-Vision Capabilities

Austin, Texas, Jan. 29, 2026 (GLOBE NEWSWIRE) — Military Electro-Optical and Infrared Systems Market Size & Growth Analysis:

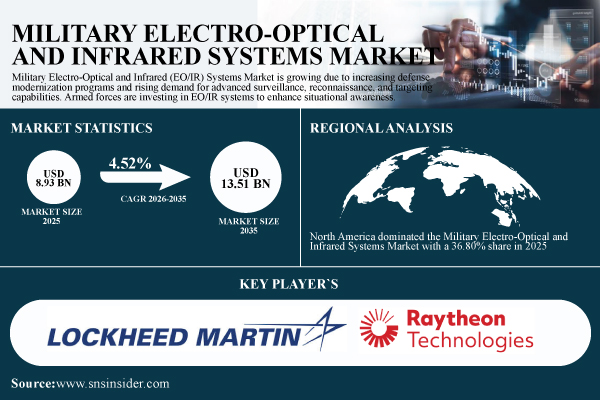

According to SNS Insider, the Military Electro-Optical and Infrared Systems Market was valued at USD 8.93 billion in 2025 and is expected to reach USD 13.51 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.52% during 2026-2035. The market is experiencing steady growth as defense forces around the world accelerate their modernization efforts and make increased investments in intelligence, surveillance, and reconnaissance (ISR) capabilities for air, land, and sea platforms. The integration of EO/IR sensors with unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and naval drones is further fueling market growth.

Market Size and Forecast

- Market Size in 2025: USD 8.93 Billion

- Market Size by 2035: USD 13.51 Billion

- CAGR: 4.52 % from 2026 to 2035

- Base Year: 2025

- Forecast Period: 2026–2035

- Historical Data: 2022–2024

Get a Sample Report of Military Electro-Optical and Infrared Systems Market: https://www.snsinsider.com/sample-request/9516

U.S. Military Electro-Optical and Infrared Systems Market Outlook

The U.S. Military EO/IR Systems Market was valued at USD 2.69 billion in 2025 and is projected to reach USD 3.98 billion by 2035, expanding at a CAGR of 4.01% over the forecast period. Market growth is fueled by ongoing defense modernization efforts, increased focus on ISR dominance, and significant investments in next-generation surveillance and targeting systems.

The U.S. Department of Defense remains committed to high-resolution sensors, advanced night vision technology, and AI-integrated EO/IR systems to improve operational capabilities. Increasing use of EO/IR systems on manned and unmanned platforms, as well as upgrades to existing systems, is driving steady demand across the Army, Navy, and Air Force.

Rising Global Defense Expenditures and ISR Focus Drive Market Growth

Increasing geopolitical tensions, border conflicts, and emerging asymmetric warfare threats are forcing governments around the world to increase their defense expenditures. A large portion of these expenditures is being allocated to ISR technology to improve battlefield situational awareness, threat detection, and rapid decision-making.

Military EO/IR technology is playing an increasingly important role in real-time surveillance, reconnaissance, and target detection in all-weather and low-light environments. As military forces around the world upgrade their equipment and improve ISR readiness, the demand for long-range, high-resolution EO/IR sensors is steadily increasing in global defense markets.

Integration with Unmanned and AI-Enabled Platforms Drives Adoption

The increasing use of unmanned platforms is one of the major trends influencing the military EO/IR systems market. The integration of EO/IR sensors with UAVs and autonomous platforms is facilitating persistent surveillance, minimizing operational risks, and optimizing mission effectiveness. In addition, the application of artificial intelligence and machine learning algorithms for image processing, automated target recognition, and data fusion is adding value to advanced EO/IR solutions.

High Costs Remain a Key Market Challenge

Despite the increasing demand, the high development, procurement, and operational costs of advanced EO/IR solutions are a major market barrier. These solutions require complex sensors, optics, cooling systems, and advanced image processing algorithms, which are expensive to develop and procure. Maintenance, recalibration, and periodic upgrades of these systems further increase their total cost of ownership.

Smaller defense forces and developing countries are often constrained by budget limitations, making it difficult to widely adopt advanced EO/IR solutions. Budget constraints may cause delays in procurement or continued dependence on legacy systems, which can slow market growth in budget-constrained regions.

Major Players Analysis Listed in the Military Electro-Optical and Infrared Systems Market Report are

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

- BAE Systems plc

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- Leonardo S.p.A.

- Teledyne FLIR LLC

- Rheinmetall AG

- Saab AB

- Safran SA

- Israel Aerospace Industries Ltd.

- Textron Inc.

- CONTROP Precision Technologies

- Hensoldt AG

- Airbus SE

- Aselsan A.Ş.

- OIP Sensor Systems

Need Any Customization Research on Military Electro-Optical and Infrared Systems Market, Enquire Now: https://www.snsinsider.com/enquiry/9516

Segmentation Analysis:

By Platform

Airborne led with 58% share due to their extensive use in fighter jets, transport aircraft, reconnaissance aircraft, and unmanned aerial vehicles (UAVs). Land platforms are the fastest-growing segment as armies increasingly equip vehicles and ground troops with advanced EO/IR systems for surveillance, targeting, and navigation.

By Component

Sensors & Detectors led with 34% share as the core component of EO/IR systems, including focal plane arrays, photodetectors, and imaging sensors. Laser Designators & Illuminators are the fastest-growing component segment, supporting precision targeting, range-finding, and guided munitions.

By Technology

Infrared Systems led with 35% share due to their essential role in night operations, low-visibility environments, and thermal detection. Hyperspectral systems are the fastest-growing technology segment, offering advanced detection, material identification, and target discrimination capabilities.

By Application

Surveillance & Reconnaissance led with 33% share as they are extensively used for monitoring enemy movements, intelligence gathering, and battlefield awareness. Navigation & Guidance is the fastest-growing application segment, as EO/IR systems are increasingly integrated with UAVs, missiles, and precision-guided munitions.

By End-User

Air Force led with 39% share due to extensive procurement for fighter aircraft, transport planes, and UAVs. The Navy is the fastest-growing end-user segment as maritime security and littoral operations drive the need for EO/IR integration on ships, patrol vessels, and unmanned systems.

Regional Insights:

North America dominated the Military Electro-Optical and Infrared Systems Market with a 36.80% share in 2025 due to the region’s advanced defense infrastructure, high defense spending, and strong presence of leading defense contractors.

Asia Pacific is expected to grow at the fastest CAGR of about 5.87% from 2026–2035, driven by increasing defense budgets, modernization of military forces, and rising demand for advanced surveillance, targeting, and reconnaissance systems.

Recent Developments:

- October 2024: Lockheed unveiled its next-generation Legion Pod IRST21 (Infrared Search and Track) enhancements at AUSA 2024, featuring improved long-range passive detection capabilities against stealth aircraft using advanced IR sensors and AI-enabled tracking algorithms. The pod is being integrated onto F-15EX and F-16 fleets.

- March 2024: Northrop Grumman received a USD215 million U.S. Air Force contract to deliver LITENING Advanced Targeting Pods, which include cutting-edge mid-wave infrared (MWIR) and short-wave infrared (SWIR) sensors. The pods support precision strike missions for F-16s and A-10s.

Purchase Single User PDF of Military Electro-Optical and Infrared Systems Market Report (20% Discount): https://www.snsinsider.com/checkout/9516

Exclusive Sections of the Report (The USPs):

- R&D & INNOVATION INVESTMENT METRICS – helps you assess R&D intensity, patent activity, AI/ML-enabled sensing adoption, time-to-fielding of next-generation EO/IR systems, and investment focus on low-SWaP technologies.

- OPERATIONAL UTILIZATION & MISSION PERFORMANCE METRICS – helps you evaluate mission success improvements, false alarm reduction, detection accuracy across ranges, operational availability, and system reliability in active deployments.

- TECHNOLOGY MODERNIZATION & AUTONOMOUS SENSING INSIGHTS – helps you identify the integration level of autonomous sensing, advanced algorithms, and next-generation sensor capabilities shaping battlefield effectiveness.

- EXPORT & DEFENSE PARTNERSHIP ANALYSIS – helps you understand export revenue share, adoption by international military partners, growth in foreign military sales, and the impact of defense cooperation agreements.

- PROGRAM READINESS & DEPLOYMENT RISK INDICATORS – helps you gauge maturity timelines, production models (licensed vs direct supply), and potential risks affecting large-scale EO/IR procurement programs.

About the Report

The Military Electro-Optical and Infrared Systems Market Report delivers comprehensive insights, including:

- Market size and forecasts (2022–2033)

- Detailed segmentation and regional analysis

- Competitive benchmarking and company profiling

- Technology trends, opportunities, and challenges

- Strategic insights for investors and industry stakeholders

Access Complete Report Details of Military Electro-Optical and Infrared Systems Market Analysis & Outlook: https://www.snsinsider.com/reports/military-electro-optical-and-infrared-systems-market-9516

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: [email protected]

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.