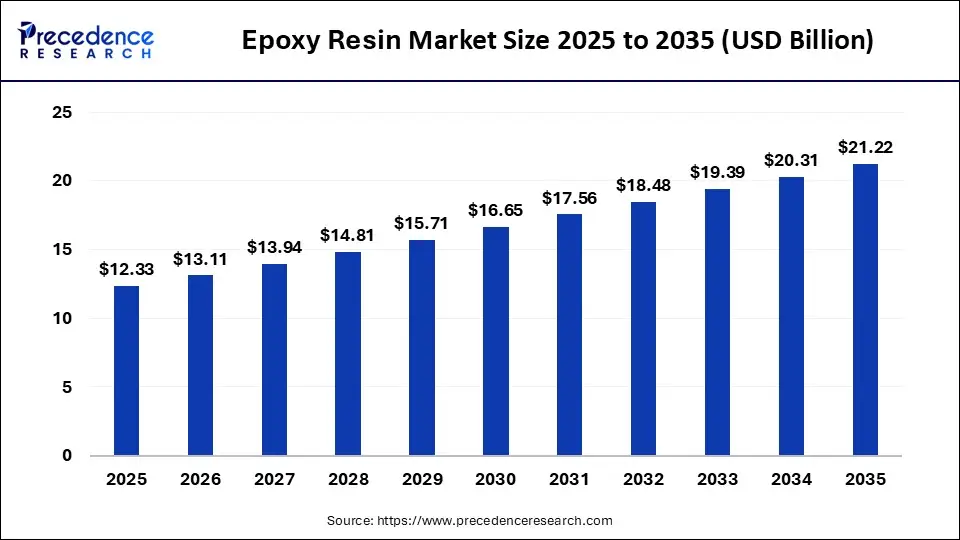

The global epoxy resin market size is expected to be worth over USD 21.22 billion by 2035, increasing from USD 13.11 billion in 2026, growing at a strong CAGR of 5.58% between 2026 and 2035. In 2025, the Asia Pacific held the largest market share at 59.81%, while North America is projected to grow at a significant CAGR.

Ottawa, Dec. 29, 2025 (GLOBE NEWSWIRE) — According to Precedence Research, the global epoxy resin market size is valued at USD 12.33 billion in 2025 and is expected to grow from USD 13.11 billion in 2026 to nearly USD 21.22 billion by 2035. The market is poised to grow at a CAGR of 5.58% from 2026 to 2035. The rapid development of EVs and the increasing use of wind energy drive the market growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/2150

What is Epoxy Resin?

The epoxy resin market growth is driven by strong spending on infrastructure projects, increasing need for industrial coatings, strong growth in electric vehicles, development of encapsulating components, and leveraging 5G infrastructure.

Epoxy resin is a two-part synthetic polymer that forms robust composite structures after reacting with curing agents or hardeners. They offer strong adhesion, excellent strength, and high durability. They are available in solid, liquid, and paste forms. Epoxy resin is widely used in applications like coatings, adhesives, composites, concrete repair, component encapsulation, and glossy finishes.

Epoxy Resin Market Key Takeaways:

- Regional Dominance: Asia Pacific led the global epoxy resin market in 2025, accounting for 59.81% of the total market share.

- Top Application: The paints and coatings segment was the largest application, contributing 41.50% of market share in 2025.

- Fastest Growing Application: The adhesives & sealants segment is expected to grow at a CAGR of 5.60% from 2026 to 2035.

- Leading Raw Material: DGBEA (Bisphenol A and ECH) dominated the raw material segment with a 36.33% share in 2025.

- Technology Preference: Solvent cut epoxy captured the largest technology segment with 29.93% market share in 2025.

- Preferred Sales Channel: Direct company sales held the biggest share at 32.18%, indicating a preference for bulk and customized purchasing.

- Top End-Use Sector: The consumer goods segment, including sporting equipment, generated the largest share at 46.93% in 2025.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

Private Industry Investment for Epoxy Resin:

- Aditya Birla Group The company has expanded its manufacturing and formulation capacity in Vilayat, Gujarat, to 246,000 tonnes annually to establish itself as a significant global player in advanced materials.

- Westlake Chemical Corporation This company acquired Hexion’s global epoxy business for approximately $1.2 billion to expand its integrated business into downstream coatings and composite products.

- DIC Corporation To meet the increasing demand from the semiconductor industry, the company announced the construction of a new epoxy resins facility at its Chiba Plant in August 2025.

- Atul Ltd. This firm has completed a liquid epoxy resin capacity expansion to 50,000 tonnes per annum with an approved investment of Rs 200 crore at its facility in India.

- Kukdo Chemical Co., Ltd. The company has strategically established a production factory in Gujarat, India, with a capacity of 40,000 tons per year to capture growing domestic demand after China.

What are the Key Trends of the Epoxy Resin Market?

- Shift Toward Sustainable and Bio-Based Formulations

The market is moving rapidly from petroleum-based feedstocks toward bio-derived resins made from renewable sources like lignin, vegetable oils, and agricultural waste. This transition is driven by stringent environmental regulations on Volatile Organic Compounds (VOCs) and Bisphenol A (BPA), as well as a corporate push for carbon-neutral materials. - Expansion in Electric Vehicles (EVs) and Lightweighting

Epoxy resins are becoming critical for the automotive sector as manufacturers prioritize lightweighting to enhance fuel efficiency and EV range. These resins are increasingly used in advanced composites for battery encapsulation, structural adhesives, and body-in-white applications that replace traditional heavy metals. - Integration with Advanced Digital Manufacturing

Innovative production techniques, particularly 3D printing and automated manufacturing, are reshaping how epoxy photopolymers are utilized for complex, high-precision components. This trend enables more efficient production cycles and the creation of specialized formulations for high-tech sectors like 5G electronics and smart infrastructure.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Epoxy Resin Market Opportunity

Expanding Construction Base Fuels Demand for Epoxy Resin

The rapid development of urban areas and the increasing number of construction projects increase demand for epoxy resin for various applications. The strong focus on creating aesthetic floors and the growing development of industrial spaces increase demand for epoxy resin. The increasing need for enhancing load-bearing capacity and focus on preventing corrosion increases demand for epoxy resin.

The rise development of infrastructure projects like bridges, airports, & others, and the growing transition towards green buildings, increases demand for epoxy resin. The focus on protecting steel from corrosion and the development of easy-to-clean floors requires epoxy resin. The increasing use of sealants, adhesives, flooring, and coatings in construction projects requires epoxy resin. The expanding construction base creates an opportunity for the growth of the market.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Epoxy Resin Market Report Coverage

| Report Coverage | Details |

| Market Size in 2025 | USD 12.33 Billion |

| Market Size in 2026 | USD 13.11 Billion |

| Market Size by 2035 | USD 21.22 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.58% |

| Largest Market | Asia Pacific (59.81% share in 2025) |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Raw Material, Application, Technology, Sales Channel, End User, Region |

| Key Raw Materials | DGBEA (Bisphenol A & ECH) major share 36.33% in 2025 |

| Key Applications | Paints & Coatings (41.50% share in 2025), Adhesives & Sealants (CAGR 5.60%) |

| Key Technologies | Solvent cut epoxy (29.93% share in 2025) |

| Key Sales Channels | Direct company sales (32.18% share in 2025) |

| Key End Users | Consumer goods including sporting equipment (46.93% share in 2025) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| AI Impact | Enhances formulation design, process efficiency, predictive maintenance, and sustainability through bio-based and waterborne epoxies |

➤ Get the Full Report @ https://www.precedenceresearch.com/epoxy-resin-market

Epoxy Resin Market Top Companies

Tier 1:

- 3M

- Aditya Birla

- Atul Ltd

- BASF SE

- Solvay

- Huntsman

- Kukdo Chemical

Tier 2:

- Nan Ya Plastics Corp.

- Jiangsu Sanmu Group Co., Ltd.

- Jubail Chemical Industries LLC

- China Petrochemical & Chemical Corp. (SINOPEC)

- Hexion

- Kolon Industries, Inc.

- Techstorm

- NAGASE & Co., Ltd.

Global Epoxy Resin Market Concentration — Key Players Overview

| Company | Market Position / Competitive Role | Insights on Concentration |

| 3M | Major diversified chemical player | Positioned as a significant global epoxy resin supplier, leveraging strong brand and broad product portfolio across automotive, electronics, adhesives, and industrial applications. Moderately high influence. |

| Aditya Birla Management Corp. Pvt. Ltd. | Emerging regional leader | Strong presence in Asian markets with expanding capacity; contributes to competitive regional share but lower global share compared to top western producers. |

| Atul Ltd | Niche & regional participant | A key regional player in India with capabilities in specialty resins; limited presence in top global share tiers. |

| BASF SE | Major global specialty resin producer | Considered a moderately consolidated market leader, with broad product research, innovations, and global footprint. |

| Solvay | Specialty chemicals contributor | Focused more on high-performance specialty resins and additives; contributes to competition but doesn’t dominate global volume share. |

| Huntsman International LLC | One of the top core players | Strong capabilities in advanced materials and composites; consistently ranked among top global suppliers, especially in performance resin segments. |

| Kukdo Chemical Co., Ltd. | Significant Asia-Pacific specialist | Known for specialty hardeners and epoxy intermediates; influential regionally with growing global presence. |

| Olin Corp. | Among the leading concentrated producers | Highly influential with strong vertical integration (chlor-alkali to resin), ranking near the top in market share. |

| Sika AG | Niche yet strategic player | Strong in adhesives & construction market; contributes to moderate share with strong regional focus, especially Europe. |

| Nan Ya Plastics Corp. | Major Asia-Pacific player | One of the largest regional producers, important especially in electronics grade epoxy; significant within Asia market share. |

| Jiangsu Sanmu Group Co., Ltd. | Large Chinese manufacturer | Among the largest global producers by capacity; often ranked with the highest individual share (~12% of global volume). |

| Jubail Chemical Industries LLC | Regional contributor | Middle East producer contributing to regional supply; smaller to medium influence globally. |

| China Petrochemical & Chemical Corp. (SINOPEC) | Large diversified state giant | Major regional producer with strong capacity; significant contributor to overall Asia-Pacific volume. |

| Hexion | Key established global producer | Historically one of the strongest Western players, often cited among top producers; important in phenolic-modified and specialty epoxies. |

| Kolon Industries, Inc. | Specialty & regional player | Focuses on high-performance specialty resins; smaller global footprint compared with largest players. |

| Techstorm | Niche / emerging supplier | Listed among global players but with smaller relative share; typically focuses on advanced or emerging market niches. |

| NAGASE & Co., Ltd. | Distribution & specialty resin contributor | Influences market primarily via distribution networks and specialty product lines, not among the top few by volume share. |

The Complete Study is Now Available for Immediate Access | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2150

- Moderate Concentration: The global epoxy resin market is moderately consolidated — a few large players (~top 5–10) hold a significant proportion of overall volume and influence pricing, technology, and distribution.

- No Single Dominant Giant: No single company overwhelmingly dominates worldwide (>30–40%). The leading group collectively controls the largest share (>50% together).

- Competitive Dynamics: The market includes a mix of global leaders and specialty/regional players — leading companies invest in capacity expansion, sustainability (bio-based resins), technology innovation, and strategic collaborations to maintain or grow share.

- Regional Strengths:

- Asia-Pacific: Strong share led by Jiangsu Sanmu, Nan Ya Plastics, Sinopec, and regional producers.

- North America & Europe: Hexion, Olin, BASF, Huntsman, and 3M are influential.

Recent Developments in the Epoxy Resin Industry

- In March 2025, Entropy Resins launched a biobased epoxy resin system, BIOfusion, for composite manufacturing. The system develops sustainable solutions and lowers the impact on the environment. The system is used across applications like wind energy, marine, automotive, consumer goods, and construction. (Source: https://marineindustrynews.co.uk)

- In July 2024, Sinochem launched a special epoxy resin 9824 A/B and 9821 A/B for hydrogen storage tanks. The resin has excellent mechanical strength, high heat resistance, and superior process formability. The resin is suitable for type IV and type III hydrogen storage bottles. (Source: https://www.jeccomposites.com)

Epoxy Resin Market Regional Analysis:

How Big is the Asia Pacific Epoxy Resin Market?

According to Precedence Research, the global Asia Pacific epoxy resin market size will grow from USD 7.37 billion in 2025 to nearly USD 13.20 billion by 2035, with an expected CAGR of 6% from 2026 to 2035.

Why Asia Pacific Dominates the Epoxy Resin Market?

Asia Pacific dominated the market in 2024. The robust expansion of infrastructure development and the dynamically growing electronic industry increases demand for epoxy resin. The increasing production of EV components and strong government backing for renewable energy increase demand for epoxy resin. The thriving aerospace sector and extensive manufacturing activities create demand for epoxy resin. The ongoing industrialization drives the overall growth of the market.

China Epoxy Resin Market Trends

China’s market is experiencing steady growth driven by strong demand from construction, electronics, and wind energy sectors. Rapid expansion of infrastructure projects and rising use of epoxy-based coatings and adhesives are supporting market expansion. In the electronics industry, increasing production of printed circuit boards and semiconductor components is boosting consumption of high-performance epoxy resins.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/2150

How North America is Experiencing the Fastest Growth in the Epoxy Resin Market?

North America is experiencing the Fastest Growth in the Market during the forecast period. The increasing investment in clean energy projects and the expansion of 5G infrastructure increase demand for epoxy resin. The rise in the development of wind turbine blades and the growing data centers increases the adoption of epoxy resin. The focus on enhancing the fuel efficiency of vehicles and increasing the adoption of solar panels requires epoxy resin, supporting the overall growth of the market.

U.S. Epoxy Resin Market Trends

The U.S. market is showing consistent growth, supported by rising demand from the construction, automotive, aerospace, and electrical & electronics industries. Increasing use of epoxy resins in high-performance coatings, adhesives, and composites is driven by the need for durability, corrosion resistance, and lightweight materials. Expanding investments in infrastructure rehabilitation and renewable energy projects, particularly wind energy, are further boosting market demand.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

✚ Related Topics You May Find Useful:

➡️ Epoxy Composites Market: Analyze lightweight material adoption across aerospace, wind energy, and transportation

➡️ Coating Resins Market: Understand performance-driven innovation in protective, decorative, and industrial coatings

➡️ Specialty Resins Market: Track high-value applications fueled by customization and advanced material requirements

➡️ C-Resin Market: Gain insights into niche resin usage across electronics and specialized industrial processes

➡️ Plastic Resins Market: Examine evolving demand patterns driven by packaging, automotive, and consumer goods

➡️ Lignin-Based Resins Market: Discover bio-based alternatives gaining momentum amid sustainability regulations

➡️ Glass Prepreg Market: Assess demand from high-strength composites in electronics and industrial manufacturing

➡️ Aerospace Adhesives and Sealants Market: Understand material performance needs driven by lightweighting and aircraft modernization

➡️ Carbon Fiber Prepreg Market: Track advanced composite adoption across aerospace, automotive, and sporting goods

➡️ Electronic Adhesives Market: Analyze miniaturization trends and thermal management needs in next-gen electronics

Epoxy Resin Market Segmentation Insights:

Raw Material Insights

Why DGBEA Segment Dominates the Epoxy Resin Market?

The DGBEA (bisphenol A and ECH) segment dominated the market in 2024. The rise in paints & coatings production and the increasing need for electronics encapsulation increase demand for DGBEA. The excellent chemical resistance, high durability, and cost-effectiveness of DGBEA help market growth. The increasing production of structural adhesives and the rise in the development of vehicle components increase demand for DGBEA. The ease of processing and versatility of DGBEA drive the overall growth of the market.

Application Insights

Which Application held the Largest Revenue Share in the Epoxy Resin Industry?

The paint & coating segment held the largest revenue share in the epoxy resin industry in 2024.

The increased renovation projects and growing use of protective building materials increase demand for paint and coating. The increasing development of factories and the increasing need for automotive refinishing fuel demand for paints & coatings. The development of sustainable construction and the transition towards waterborne formulations support the overall growth of the market.

Technology Insights

How Solvent Cut Epoxy Segment Dominated the Epoxy Resin Market?

The solvent cut epoxy segment dominated the market in 2024. The faster curing, excellent adhesion, and superior resistance of solvent cut epoxy help market expansion. The production of floor coatings and the increasing need for sealant increase demand for solvent cut epoxy. The high-quality finishes, improved workability, and better substrate penetration of solvent cut epoxy drives the overall growth of the market.

Epoxy Resin Market Size (USD Million), By Technology, 2022 to 2024

| By Technology | 2022 | 2023 | 2024 |

| Solvent Cut Epoxy | 3,028.0 | 3,237.1 | 3,457.7 |

| Liquid Epoxy | 2,469.7 | 2,637.6 | 2,814.5 |

| Waterborne Epoxy | 2,150.7 | 2,287.7 | 2,431.4 |

| Others | 2,530.6 | 2,697.7 | 2,873.4 |

Sales Channel Insights

Why did Direct Company Sale hold the Largest Share in the Epoxy Resin Industry?

The direct company sale held the largest revenue share in the industry in 2024. The increasing demand for tailored epoxy resin formulations and the bulk purchasing of epoxy resin increase the demand for direct company sales.

The availability of technical support and focus on building customer relationships increases the adoption of direct company sales. The authenticity of the product and the bulk pricing option support the overall growth of the market.

Epoxy Resin Market Size (USD Million), By Sales Channel, 2022 to 2024

| By Sales Channel | 2022 | 2023 | 2024 |

| Direct Company Sale | 3,295.4 | 3,508.9 | 3,733.1 |

| Direct Import | 1,520.2 | 1,623.5 | 1,732.5 |

| Distributors & Traders | 3,010.4 | 3,221.4 | 3,444.4 |

| Retailers | 2,353.0 | 2,506.1 | 2,667.1 |

End User Insights

Which End User Dominated the Epoxy Resin Market?

The consumer goods segment dominated the market in 2024. The growing use of tabletops and the increasing demand for various sports equipment increase the adoption of epoxy resin. The increasing use of dryers & washers and the rise in demand for decorative items create demand for epoxy resin.

The strong focus on the development of easy-to-clean surfaces and the increased production of jewellery requires epoxy resin, supporting the overall market growth.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Segments Covered in the Report

By Raw Material

- DGBEA (Bisphenol A and ECH)

- DGBEF (Bisphenol F and ECH)

- Novolac (Formaldehyde and Phenols)

- Aliphatic (Aliphatic Alcohols)

- Glycidylamine (Aromatic Amines and ECH)

- Other

By Application

- Paint & Coatings

- Construction

- Electrical & Electronics

- Wind Turbine & Composites

- Civil Engineering

- Adhesive & Sealants

- Others

By Technology

- Solvent Cut Epoxy

- Liquid Epoxy

- Waterborne Epoxy

- Others

By Sales Channel

- Direct Company Sale

- Direct Import

- Distributors & Traders

- Retailers

By End User

- Building & construction

- Automotive, large & heavy vehicles & railroads

- Aerospace

- Consumer goods (including sporting equipment)

- General industrial

- Wind power

- Marine

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2150

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

✚ Explore More Market Intelligence from Precedence Research:

➡️ Generative AI in Life Sciences: Explore how AI innovations are revolutionizing drug discovery, research efficiency, and precision medicine.

➡️ Biopharmaceuticals Growth: Understand the accelerating expansion of biologics, therapeutic proteins, and cutting-edge pharma pipelines.

➡️ Digital Therapeutics: Discover how technology-driven treatments are reshaping patient care and improving clinical outcomes.

➡️ Life Sciences Growth: Gain insights into emerging opportunities, market expansion, and innovation trends in the life sciences sector.

➡️ Viral Vector & Gene Therapy Manufacturing: Analyze the production advancements powering next-generation gene therapies and precision medicine.

➡️ Wellness Transformation: See how consumer wellness trends are shaping supplements, functional foods, and lifestyle-driven markets.

➡️ Generative AI in Healthcare: Unlocking Novel Innovations in Medical and Patient Care: Explore AI applications enhancing diagnostics, treatment personalization, and patient engagement.

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Auto | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards ICT | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.