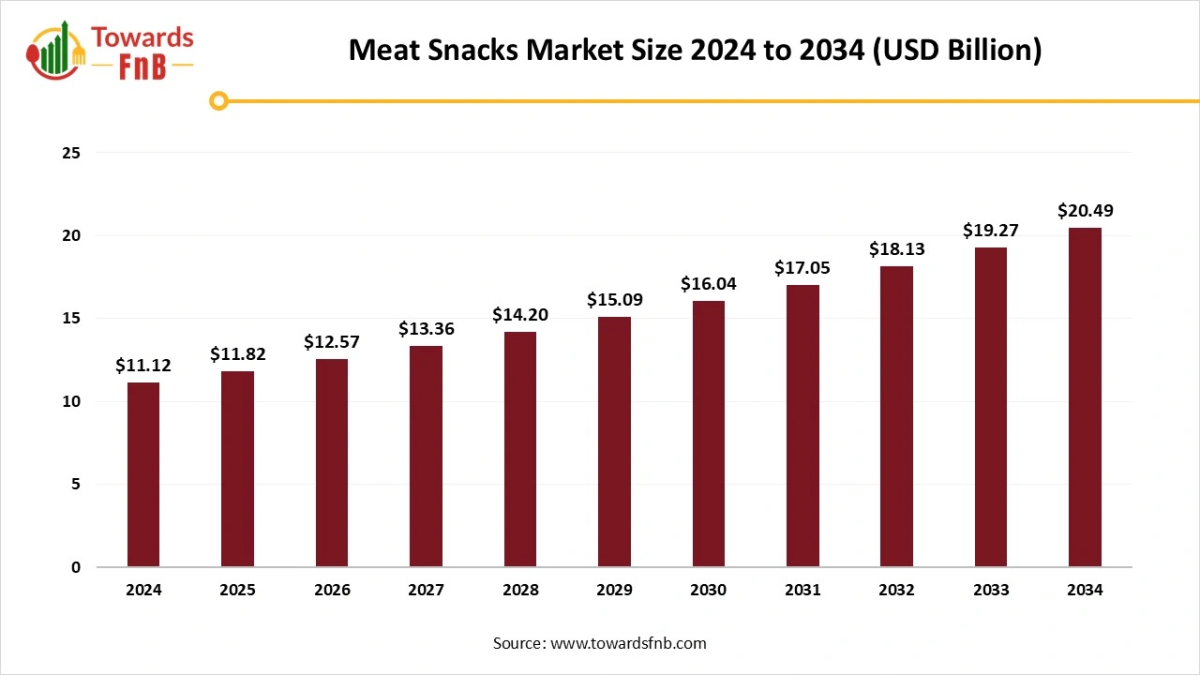

According to Towards FnB, the global meat snacks market size is evaluated at USD 11.82 billion in 2025 and is anticipated to surge USD 20.49 billion by 2034, reflecting at a CAGR of 6.3% from 2025 to 2034.

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) — The global meat snacks market size stood at USD 11.12 billion in 2024 and is predicted to increase from USD 11.82 billion in 2025 to reach around USD 20.49 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market has been growing lately due to high demand for convenient, protein-rich, and fulfilling snacks to avoid unhealthy snacking. The easy availability of protein-rich snacks to maintain the nutritional profile is one of the major factors driving market growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5925

Key Highlights of the Meat Snacks Market

- By region, North America led the meat snacks market in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By product type, the jerky segment led the meat snacks market in 2024, whereas the sticks segment is expected to grow in the foreseeable period.

- By source, the beef segment led the meat snacks market in 2024, whereas the pork segment is expected to grow in the forecast period.

- By flavor, the peppered segment led the meat snacks market in 2024, whereas the original segment is expected to grow in the foreseeable period.

- By distribution channel, the supermarkets and hypermarkets segment dominated the meat snacks market in 2024, whereas the online retail segment is expected to grow in the foreseeable period.

Higher demand for Convenient Options is helpful for the Growth of the Meat Snacks Market

The meat snacks market is expected to grow due to high demand for convenient, healthy, and flavorful options. Such snacks are in high demand among health-conscious consumers and those who prefer healthy munching over deep-fried snacks. They have a longer shelf life and are flavorful, making them easy to store and carry outdoors to maintain their nutritional profile. Meat-based snacks, available at affordable prices, appeal to different types of consumers because they are high in protein and other nutrients.

Impact of AI in the meat snacks market

Artificial intelligence is transforming the meat snacks market by improving processing efficiency, product quality, and responsiveness to consumer trends. In manufacturing, AI-powered computer vision systems inspect meat cuts for texture, color, fat distribution, and defects with greater accuracy than manual checks. These systems detect contamination risks early and ensure consistent slicing, seasoning, and drying, which is essential for jerky, meat sticks, and other ready-to-eat formats. Machine learning models also optimize marination times, drying temperatures, and smoking cycles to achieve uniform flavor and texture while reducing energy use and production waste.

AI strengthens supply chain operations by forecasting demand, optimizing inventory planning, and improving logistics for perishable raw materials. This reduces the risk of shortages and overproduction, especially in markets where protein-rich snacks experience seasonal or lifestyle-driven demand spikes. In product development, AI analyzes consumer preferences, nutritional data, and flavor trends to help manufacturers create new variants such as low-sugar jerky, high-protein sticks, plant-infused meat snacks, and globally inspired flavors.

Recent Developments in Meat Snacks Market

- In November 2025, Maple Leaf Foods announced the launch of ‘Maple Leaf Mighty Protein,’ an innovative line of chicken protein sticks. The new launch is highly beneficial for consumers searching for a protein-rich snack.

- In September 2025, The Mad Butcher launched its range of meat snack bites. The range involves Salami Bites and Chorizo Bites. They are high in protein, flavorful, and high-quality.

New Trends of Meat Snacks Market

- Consumers in search of high-protein and low-carb snacking options help to fuel the growth of the market.

- Higher demand for healthier options with low sodium and low saturated fats by consumers is another major factor fueling the growth of the market.

- Availability of bold and international flavors due to globalization is another helpful factor for the growth of the meat snacks market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/meat-snacks-market

Product Survey of the Meat Snacks Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or End Use Segments | Representative Producers or Brands |

| Jerky Products | Lean meat strips dried and seasoned for high-protein snacking. | Beef jerky, turkey jerky, chicken jerky, pork jerky | Convenience snacking, sports nutrition | Jack Link’s, Old Trapper, Country Archer |

| Meat Sticks and Sausages | Portable snack-sized meat products are made through curing, smoking, or fermentation. | Beef sticks, pepperoni sticks, turkey sticks | On-the-go snacks, lunch boxes | Slim Jim, Duke’s, Jack Link’s |

| Biltong and Droewors | Air-dried South African-style meat snacks with natural spices. | Beef biltong, droewors sausage sticks | Premium meat snacks, high protein diets | Stryve Foods, Brooklyn Biltong |

| Meat Bars and Protein Bars | Shelf-stable meat-based bars offering a clean label, paleo-friendly protein option. | Beef bars, chicken bars, turkey bars | Fitness, hiking, paleo diets | Epic Provisions, Wilde Protein Bars |

| Flavored and Gourmet Meat Snacks | Specialty seasoned meat snacks targeting gourmet and premium consumers. | Korean BBQ, teriyaki, chili lime, pepper crusted | Premium retail, flavor-driven markets | Krave Jerky, People’s Choice Jerky |

| Exotic Meat Snacks | Novel meat products made from specialty or game meats. | Venison, elk, bison, wild boar | Niche retail, specialty stores | Buffalo Bob’s, Pearson Ranch |

| Low Sodium and Healthy Positioning Meat Snacks | Products with reduced sodium, natural curing agents, and clean label ingredients. | Low-sodium jerky, no nitrite meat sticks | Health and wellness markets | Chomps, Field Trip, Nick’s Sticks |

| Organic and Grass Fed Meat Snacks | Meat snacks made from organic or grass-fed livestock for premium positioning. | Organic beef jerky, grass-fed bar snacks | Natural food stores, premium retail | Tanka, New Primal, Lorissa’s Kitchen |

| High Moisture Meat Snacks | Soft and tender meat snacks with higher moisture and fresh-like texture. | Tender jerky, meat bites | Mainstream retail, new consumers | Jack Link’s Tender Bites, Think Jerky |

| Hybrid Meat and Plant-Based Snacks | Products combining meat with plant proteins for cleaner labels or reduced fat. | Meat plant blended sticks, mixed protein bars | Flexitarian consumers, wellness categories | Perdue Chicken Plus, private labels |

| Seafood-Based Meat Snacks | Protein snacks derived from fish and seafood. | Salmon jerky, tuna sticks | Functional snacking, omega-3-rich products | Epic Salmon, Alaska Smokehouse |

| Ready to Eat Snack Packs | Meat portions combined with nuts, cheese, or crackers. | Meat and cheese packs, protein snack kits | Convenience retail, meal replacements | Hillshire Snacking, Hormel Natural Choice |

| Spicy and Specialty Regional Meat Snacks | Ethnic flavor-inspired products targeting adventurous consumers. | Sriracha jerky, Mexican adobo, Indian spice blends | Ethnic retail, global flavors | Krave, regional craft brands |

| Gluten Free and Allergen Free Meat Snacks | Snacks formulated without allergens and gluten. | Gluten-free jerky, gluten-free sticks | Allergen-conscious consumers | Chomps, Nick’s Sticks |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5925

Meat Snacks Market Dynamics

What are the Growth Drivers of Meat Snacks Market?

Higher demand for convenient, flavorful protein snack options is one of the major factors driving the market’s growth. Such snacks are high in protein and other nutrients, compared to unhealthy, deep-fried snacks, further fueling market growth. These are also affordable and are therefore highly sought after by different types of consumers. High demand for flavorful, simple meat snacks is helping drive market growth.

Challenge

Dietary Trends May Hamper the Market’s Growth

The growing number of plant-based diet, vegan diet, and vegetarian followers can be a restraint on the market’s growth. The growing population of health-conscious consumers who prefer a vegetarian diet is another major constraint on the growth of the meat snacks market. The high sodium and saturated fat content in processed meat and similar snacks may also obstruct the market’s growth by fostering consumer skepticism.

Opportunity

Product Innovation is helpful for the Market’s Growth

Food manufacturers dedicated to producing healthier meat-snack options with lower sodium and saturated fat are a major growth opportunity for the market. Such options help replace healthier alternatives, which is helpful for market growth. The availability of meat-based snacks in different flavor profiles is another major factor driving the market’s growth.

Meat Snacks Market Regional Analysis

North America Dominated the Meat Snacks Market in 2024

North America led the meat snacks market in 2024 due to high demand for meat-based snacks across different age groups. They are high in protein, convenient to carry and consume anytime, further fueling the market’s growth. Flavor innovations, easy availability across different platforms, convenience, and the higher demand for healthy snack options are also major factors driving market growth.

The availability of high-quality meat snacks, rich in nutrients and preferred by health-conscious consumers, also helps enhance market growth. The U.S. has a major contribution to the regional market’s growth due to the high following of high-protein and keto diets.

How big is the U.S. Meat Snacks Market?

The U.S. meat snacks market size was valued at USD 4.28 billion in 2024 and is expected to grow from USD 4.55 billion in 2025 to USD 7.96 billion by 2034, reflecting a CAGR of 6.4% from 2025 to 2034. Market growth is driven by rising consumer demand for portable, high-nutritional snacks that fit busy lifestyles, ongoing flavor and product innovations, the country’s strong agricultural foundation that supports raw material supply, and strategic partnerships among major industry players.

Asia Pacific is Expected to Grow in the Foreseeable Period

Asia Pacific is expected to grow over the forecast period due to high demand for protein-rich, convenient, and unique-flavored meat-based snacks. Such snacks are affordable and highly sought by young consumers, which is helpful for the market’s growth in the foreseeable future. Such snacks are highly demanded by health-conscious consumers over unhealthy snacks, further fueling the industry’s growth. Countries such as India, China, Japan, and South Korea have made major contributions to the market’s growth, driven by high demand for meat-based snacks in the region. They offer affordable, flavorful options, fueling the market’s growth in the expected timeframe.

Europe is Observed with a Notable Growth in the Foreseeable Period

Europe is expected to see notable growth over the forecast period due to high demand for meat-based snacks among consumers across different age groups. They are available in various flavors, further fueling the market’s growth in the foreseeable period. Major government certifications in the region, which claim such snacks are healthy and safe, also help fuel the market’s growth. Consumer awareness of nutritional snacking and of avoiding unhealthy options also helps elevate the market’s growth.

Trade Analysis of the Meat Snacks Market

Import & Export Statistics

What is Actually Traded

- Finished retail SKUs: sealed jerky bags, meat-stick multipacks, snack sticks, pork-crackling packets. These typically clear customs as prepared or preserved meat products under HS chapter 16 or country-specific prepared-food codes.

- Ingredient and semi-finished inputs: frozen or chilled trimmed meat for snack manufacture, seasoned meat batters, cured sausages for finishing, and spice/seasoning premixes. These often appear under meat, prepared meat, and spice HS headings.

- Private-label volumes and co-pack shipments: contract-packed finished goods shipped in pallets or smaller retail-ready shipments to importers and distributors.

Top Exporters — Who Supplies the World

- United States: a major global exporter of jerky, meat sticks and branded snack meat SKUs, driven by large domestic production capacity and strong brands that export to North America, Europe, Asia and the Middle East.

- Brazil & Argentina: large exporters of processed pork and beef snack inputs and some finished snack SKUs, leveraging competitive raw-material cost and large-scale processing.

- European Union (Spain, Germany, Netherlands): exporters of cured snack products, sausage snacks and private-label finished goods to neighbouring markets and to export hubs.

- Thailand & Vietnam: growing exporters of pork-rind snacks and low-cost private-label meat snacks to Asia and Africa.

- South Africa & Australia: regional exporters of biltong and dried-meat specialties to diaspora markets and premium importers.

Top Importers / Demand Centres

- United States: large importer markets for specialty regional snacks and ingredients, but also a major domestic consumption market that imports some premium and ethnic snack lines.

- European Union: imports premium jerky and cured-meat snacks, and also imports private-label volumes for retail chains.

- China & Southeast Asia: growing importers of Western-style meat snacks as urban retail expands and western snack formats gain popularity.

- Middle East & North Africa: import significant volumes of packaged meat snacks for retail and duty-free channels, often preferring halal-certified lines.

- Africa & Latin America: importers of cost-competitive private-label snacks and snack inputs when local processing capacity is limited.

Key Trade Flows and Logistics Patterns

- Finished SKUs via retail channels: finished branded jerky and meat-stick shipments typically move in palletized cartons by ocean freight for cost efficiency, with airfreight used for urgent retail fills or premium chilled items.

- Ingredient flows to contract manufacturers: frozen trim and seasoned batters move from primary meat exporters to contract-packers in importing regions where finishing and packaging are done locally to meet labeling and shelf-life rules.

- Private-label sourcing model: retailers in many markets source private-label meat snacks from low-cost contract manufacturers in Asia or Latin America and rebrand for local distribution.

- Diaspora and specialty lanes: ethnic or specialty products (biltong, Latin-style chicharrón) flow along diaspora trade lanes and via specialty distributors to premium retail.

Trade Drivers and Market Forces

- Protein and convenience trends: sustained consumer appetite for high-protein, low-carbohydrate snacks is a core demand driver in developed markets.

- Private-label and retail consolidation: large retailers seeking margin control source private-label snacks internationally, increasing cross-border contract manufacturing.

- Cost of raw meat and feedstock dynamics: meat prices influence export competitiveness and where processors locate value-add operations.

- Regulatory and sanitary access: importer sanitary approvals, halal/halal-equivalent certification and labelling rules determine which exporters can compete in specific markets.

- Shelf-life and packaging technology: improvements in MAP, vacuum and barrier packaging increase feasible export distances for finished meat snacks.

Regulatory, Quality and Market-Access Considerations

- Sanitary and phytosanitary approvals: export-ready processors must be listed by importer veterinary authorities for meat shipments. This is a gating item for many markets.

- Labeling and nutrition claims: importers enforce local labeling law compliance, ingredient declarations, allergen statements and nutrition claims which affect how products are branded for export.

- Halal / Kosher certification: access to Middle East and some African markets depends on recognized halal or kosher certification and audited supply chains.

- Residue & contaminant testing: heavy-metal, antibiotic-residue and microbiological testing are standard for many import consignments, especially where finished snacks are derived from cured or fermented meat.

Meat Snacks Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6.3% |

| Market Size in 2025 | USD 11.82 Billion |

| Market Size in 2026 | USD 12.57 Billion |

| Market Size by 2034 | USD 20.49 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Meat Snacks Market Segmental Analysis

Product Type Analysis

The jerky segment dominated the meat snacks market in 2024 due to high consumer demand across different age groups. It is an easy meat-based snack option that can be stored, carried, and consumed anytime to avoid unnecessary and unhealthy munching. It is a budget-friendly meat snack, further fueling the market’s growth. Flavor innovation, competitive pricing, and longer shelf life are other major factors that support the market’s growth. They are widely available on both offline and online platforms at significant discounts, making it easier for different types of consumers to buy a protein-rich meat-based snack.

The sticks segment is expected to grow the fastest over the forecast period due to their convenience, portability, taste, and texture, which are expected to drive market growth. They are highly sought after by consumers across age groups, especially by fitness enthusiasts who prefer high-protein munchies over fried, unhealthy, and spicy snack options. These are also available in different flavor profiles on various offline and online platforms, further fueling the growth of the meat snacks market.

Source Analysis

The beef segment led the meat snacks market in 2024 due to its high protein content, which is highly preferable by health-conscious consumers. Such snacks can be easily carried and help consumers avoid unhealthy snacking, further fueling market growth. Flavor innovations, cost-effectiveness, and portability, allowing consumers to carry them and stay consistent with their health goals, also help to fuel the market. Higher demand for organic and grass-fed choices is another major factor for the meat snacks industry.

The pork segment is expected to grow in the foreseeable period due to its affordability, high-protein content, and easy availability on different platforms. Pork-based snacks are highly sought after by consumers across age groups due to flavor innovations and their local flavors. Hence, the segment makes a major contribution to the market’s growth. The savory flavor, keen texture, and protein content are among the major growth drivers of the market in the foreseeable future.

Flavor Analysis

The peppered segment dominated the meat snacks market in 2024 due to high consumer demand across different age groups. Such snacks have a unique flavor profile along with high protein and rich nutritional values. Hence, the segment makes a major contribution to the market’s growth. Peppered meat-based snacks do not have a greasy aftertaste, further attracting consumers and driving market growth. Hence, such snacks are highly preferred by consumers over oily and deep-fried snacks, which is beneficial for market growth.

The original segment is expected to grow over the forecast period, as it has a large consumer base of people who prefer simple, uncomplicated tastes. The segment also shows growth among consumers who prefer simple meat snacks rather than experimental flavor profiles or overly complex tastes. They are also high in nutrition and can be used as a side dish or a main ingredient in various preparations, further fueling the market’s growth in the foreseeable period.

Distribution Channel Analysis

The supermarkets and hypermarkets segment dominated the meat snacks market in 2024 due to the high availability of these outlets near residential areas, making it easy for consumers to shop. Such markets have dedicated sections for different types of products, making it easier for consumers to shop for them. Availability of attractive schemes and discounts, attractive displays, product information, and other helpful factors aid the market’s growth. Hence, the segment makes a major contribution to the market’s growth.

The online segment is expected to grow over the forecast period due to its convenience, variety of products and flavor options, and easy availability of different product types, which are helpful for market growth. The online platform allows consumers to order a variety of products from the comfort of their homes and have them delivered within minutes. Such services are helpful for consumers with hectic lifestyles, further fueling the growth of the meat snacks market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Meat Snacks Market

- Bridgford Foods Corporation – Produces a wide range of meat snacks including beef jerky, sausage sticks, and shelf-stable protein items. The company emphasizes long-lasting, ready-to-eat formats for retail and convenience channels.

- Conagra Brands – Offers meat snacks under multiple popular brands, focusing on packaged, shelf-stable protein snacks. Conagra continues to expand its presence in premium and flavored jerky categories.

- General Mills Inc. – Participates in the market through strategic snack portfolios and category extensions aimed at protein-rich snacking. The company leverages large-scale distribution to grow its meat snack presence.

- Hormel Foods Corporation – Manufacturer of established meat snack brands such as Slim Jim and other protein snacks. Hormel focuses on flavor innovation, category leadership, and wide retail penetration.

- Jack Link’s LLC – One of the largest global producers of jerky and meat sticks, offering a broad range of flavors and formats. The company continues to expand internationally and leads in brand-driven marketing.

- Monogram Food Solutions LLC – A major co-manufacturer and brand owner specializing in value-added meat snacks like jerky, bacon snacks, and meat sticks. Monogram emphasizes private-label production and contract manufacturing.

- Nestlé S.A. – Participates in the meat snacks segment through selective brand investments and high-protein snacking initiatives. The company targets premium and health-forward snack formats within its broader global portfolio.

- Meatsnacks Group Ltd. (New World Foods Europe Limited) – A UK-based specialist in jerky and biltong products, supplying both branded and private-label offerings. The company focuses on high-protein, gourmet-style meat snacks.

- Tyson Foods Inc. – Offers meat snacks through its Hillshire Farm and other protein brands, providing beef jerky, sausage sticks, and premium crafted snacks. Tyson leverages large-scale processing and distribution to support category growth.

- Werner Gourmet Meat Snacks Inc. – Produces hand-crafted jerky, meat sticks, and trail snacks with a focus on small-batch quality. The company is known for regional distribution strength and artisanal-style formulations.

Segments Covered in the Report

By Product Type

- Jerky

- Sticks

- Sausages

- Others

By Source

- Pork

- Beef

- Poultry

- Others

By Flavor

- Original

- Peppered

- Teriyaki

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5925

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

LinkedIn | Medium| Twitter

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.