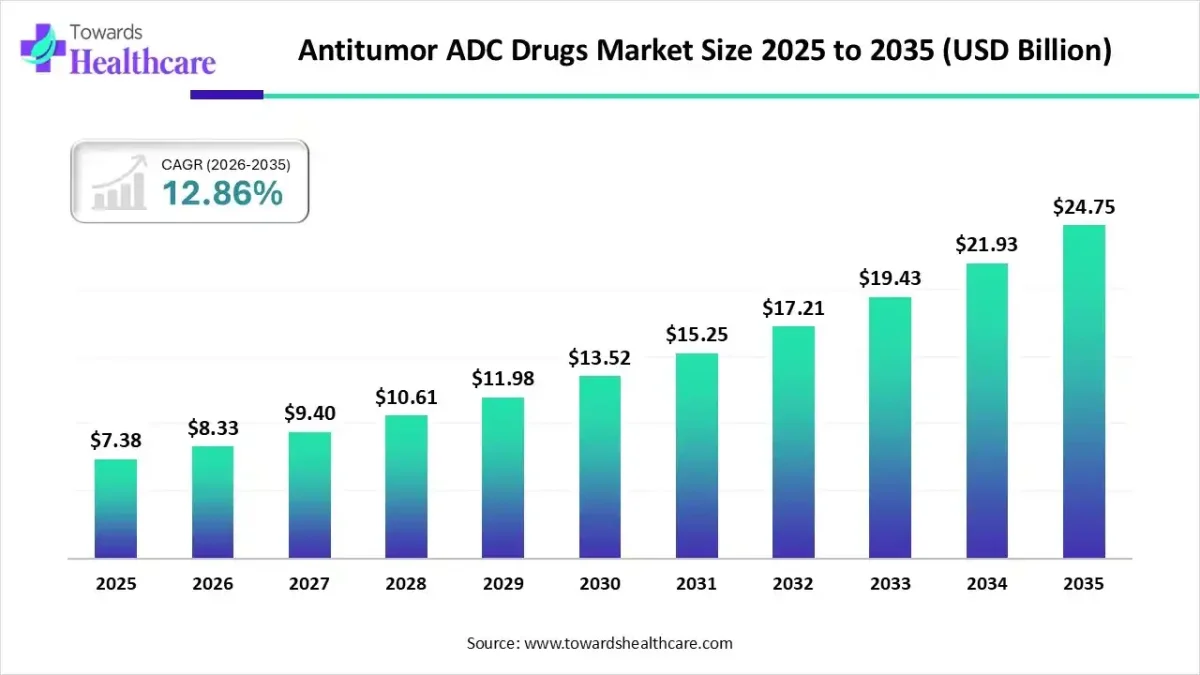

The global antitumor ADC drugs market size is valued at USD 7.38 billion in 2025 and is predicted to hit around USD 24.75 billion by 2035, rising at a 12.86% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) — The global antitumor ADC drugs market size is calculated at USD 8.33 billion in 2026 and is expected to reach around USD 24.75 billion by 2035, growing at a CAGR of 12.86% for the forecasted period, rising due to the accelerating global demand for targeted, high-precision cancer therapies that offer superior efficacy with reduced systemic toxicity.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6367

Key Takeaways:

- North America held a major revenue share of 55% in the antitumor ADC drugs market in 2024.

- Asia-Pacific is expected to witness the fastest growth during the predicted timeframe.

- By drug type, the branded ADC drugs segment registered its dominance over the global market with a share of 75% in 2024.

- By drug type, the generic/biosimilar ADC drugs segment is expected to grow with the highest CAGR in the market during the studied years.

- By payload type, the cytotoxic payloads segment held the largest revenue share of 70% in the market in 2024.

- By payload type, the novel payloads segment is expected to show the fastest growth over the forecast period.

- By linker technology, the cleavable linkers segment held a dominant presence in the antitumor ADC drugs market with a share of 60% in 2024.

- By linker technology, the site-specific/novel linkers segment is expected to witness the fastest growth in the market over the forecast period.

- By target/therapeutic area, the hematologic cancers segment dominated the market with a revenue of 35% in 2024.

- By target/therapeutic area, the solid tumors segment is expected to be the fastest-growing during the forecast period.

- By route of administration, the intravenous (IV) segment contributed the biggest revenue share of 90% in the market in 2024.

- By route of administration, the subcutaneous/intramuscular segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution channel, the hospital pharmacies/oncology centers segment dominated the market with a revenue of 70%.

- By distribution channel, the online pharmacies/direct-to-patient segment is expected to be the fastest-growing during the forecast period.

- By type of manufacturer, the in-house/integrated biopharma segment dominated the antitumor ADC drugs market with a revenue of 65% in 2024.

- By type of manufacturer, the outsourced/CDM partners segment is expected to be the fastest-growing during the forecast period.

Market Overview

What Is Causing the Unexpected Demand Increase?

The global antitumor ADC market is robustly growing due to the solid support for oncology research toward precision therapeutics. ADC therapies combine monoclonal antibodies and a cytotoxic agent to provide precision targeting and mininmal collateral damage to healthy cells, resulting in an advancement over traditional chemotherapy.

The market is in the midst of transformational or disruptive therapies, expanding indications, and improved survival benefitted from enhanced partnerships across pharma companies and biotech companies employing the disruptive new approaches.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Key Drifts:

What Are the Most Important Factors Driving the Growth of the ADC Oncology Pipeline?

- Rapid advances in precision oncology: Clinical adoption of targeted therapies and companion diagnostics is rapidly gaining traction in the clinics, resulting in increasing utilization of ADCs by physicians who are increasingly incentivized to use therapies that exhibit better safety and efficacy. Clinical shadowing of this nature is leading both pharma and biotech companies to quicken the development of ADCs.

- Robust regulatory support and rapid approval: Fast-track and breakthrough designations from regulatory agencies are continuing to shorten the length of time for an ADC to be approved for promising programs. The regulatory consideration coupled with the funding is supporting the investment into ADCs and lending acceleration to development and commercialization of the drugs.

- Growing R&D partnerships and prioritization of licensing deals: Pharmaceutical companies are enacting multi-billion dollar partnerships with developing companies to gain access to very novel and unexpected ADC platforms.

- Rising rates of cancer around the world: The number of cancer diagnoses around the world is increasing, which leads to increasing patient demands for ADC therapies. The increased patient demand for ADC is steering health systems toward more expensive cancer treatment options.

- High strides in linker and payload design: More sophisticated payloads (i.e., linkers) to increase drug stability and potency in ADC construction for more types of cancer while targeting better.

Key Drifts:

What Are The Emerging Drifts Driving Future Antitumor ADC Drug Development?

There is a clear drift in the market toward site-specific conjugation. The ultimate goal of this drift is the intended improvement in efficacy and lower toxicity. There being attention on next-generation ADC payloads, such as immune-modulating and DNA-damaging payloads, to improve the response rates of patients with cancers that have been notoriously difficult to treat.

Site-specific conjugation provides evidence that ADCs will likely drift into solid tumors as clinical outcomes continue to update positively and biomarker strategies continue to establish themselves better in clinical practices. Additionally, any possible path in development of biosimilar ADCs will likely have problematic outcomes for initial pricing that will contribute to favorability and access over time.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

Despite the growth opportunity, the market of antitumor ADC drugs faces a significant challenge, the significant challenge of constructing an ADC drug. Adding biologics and synthetic chemo-therapy to manufacturing an ADC drug is complex, and entails multi-step workflows required to produce a finished drug product including highly specialized facilities and requirements associated with it.

The challenges faced in constructing an ADC can cause heightened production costs and can create stricter regulatory consideration that collectively hinders production timelines. Many of the new biotech companies simply do not possess this factor in their infrastructure, so the many are over-reliant on very expensive contract manufacturing organizations (CMO), which limits production capabilities.

Regional Analysis:

North America sustained its position as the leading market for antitumor ADC drugs in 2024 by 55% share owing to its strong oncology research ecosystem and its propensity for early adoption of new therapeutics. This area is home to many major pharmaceutical companies which contributes to the strong R&D productivity and frequent product launches. Supportive regulatory environments that include accelerated approvals from the U.S. FDA will continue to attract a significant amount of investment into ADC pipelines. The increasing incidence of breast cancers, lymphomas, and solid tumor cancers also widens the treatment demand.

Asia-Pacific is the fastest growing region in the antitumor ADC drugs market driven by its rising cancer burden and improving healthcare capacity. Countries such as China, Japan, South Korea, and India are seeing the proliferation of oncology drug development supported by funding from the governments and fast-paced regulations for clinical trials. Local biotech companies are also increasing entering ADC research and developing partnerships with global organizations to access platforms for ADC exploratory studies. This increasing awareness of patient populations and growing disposable income is encouraging patients to adopt oncology targeted therapies.

Segment Insights:

By Drug Type

As of 2024, the form of antibody-drug conjugates (ADCs) marketed under a brand name maintained a commanding share of 75% of the global market. Much of the drug type category’s strength can be attributed to strong clinical success rates for marketed ADCs (e.g., trastuzumab deruxtecan and brentuximab vedotin), expansion of indications likely in the near future, high price points for marketed drugs, physician confidence aligned with positive clinical outcomes, and substantial amounts of real-world evidence and information. It is worth noting that branded ADCs have received sizeable investment resources for research and development (R&D) to spur possible innovation in payload chemistry and linker technology.

The generic/biosimilar drug type category is expected to have the highest compound annual growth rate (CAGR) in the forecast period as several brand-name, priced ADCs have recently gone off patent. The substantial cost for treatment options available for cancer treatment have created a need for more manufactured biosimilars to address cost of care especially in the Asia-Pacific region. Additionally, regulatory bodies are currently working to develop a framework for ADC bio-similarity assessment. Ultimately, these regulatory changes will enhance access for manufacturers to enter the ADC market with affordable biologics.

By Payload Type

With a revenue share of 70 % in 2024, cytotoxic payloads are the largest revenue segment and are tied to the high use rate of cytotoxic payloads in ADC therapy. The types of cytotoxic payloads that meshed well with antibody-drug conjugates to achieve the least amount of resistance with treatment include microtubule inhibitors and DNA damaging agents. For solid tumors and hematologic cancers, cytotoxic payloads are showing clinical efficacy.

As the dossier of research expands beyond traditional cytotoxic payloads, the novel payloads category is likely to see the fastest growth during the forecasted period. Emerging novel payloads include immune stimulators, protein degraders, targeted enzyme inhibitors through novel mechanisms, and likely combinations in the hope to burden share potential for resistance and broaden therapeutic windows. Novel payloads have tremendous potential to treat refractory solid tumors, very challenging historically for older types of antibody-drug conjugates.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

By Linker Type

Cleavable linkers had the largest market share of 60% in 2024, as they represent a backbone train of thought with cleavable linkers across the linkers category and hold a central but maybe not universally usable way to release to the tumor as marketed and marketed clinical use. Cleavable linkers are intelligently having binding mechanisms via triggers associated with the tumor where they remain stable in the blood. Usually, and as with ADC types, they generally have long, and lasting regulatory and clinical acceptability of risk and benefit processes, and the clinical success of marketed ADCs shows substantial usage across the market with this linker class due to strong commercial use.

The site-specific, or modified linkers, are likely to realize the fastest growth since the research type is leaning towards early and mid investigations with site-specific linker or modified linker for ADC formats. The modified site-specific linker format produces a uniform drug-antibody ratio (DAR). This predictably brings a stronger promise through stabilization and less off-target toxicity. Again, like the cleavable classes of linkers, the modified classes of linkers appear to show compatibility with novel payloads. Companies across biopharma have started building out preclinical and early phase investment trials to address key limitations with naturally sharing a space in biologics like the cleavable linkers used.

By Target/Therapeutic Area:

In 2024, hematologic cancers made up 35% of overall market revenues, therefore it was the pre-eminent therapeutic area of ADC uptake. ADCs have exhibited strong capabilities with lymphomas, leukemias, and myelomas due to the precision with which they target sites on the cell-surface. Most first generation ADC approvals started in hematologic indications, which led to significant clinical confidence and extensive commercialization. With the clear benefit of survival, and quicker adoption in the relapsed/refractory indication, we expect this indication will remain a focal point for developers. There are also combination studies ongoing with immunotherapies and small molecules, highlighting durability of continued growth in this area.

We expect solid tumors to be the fastest growing indication market as evidence that demonstrates significant advancements in target identification and payload optimization with ADCs is available now. ADCs for breast, lung and gastric cancer have reported good rates of response, which will support more applications in solid tumors. The continued focus by pharmaceutical developers on solid tumors, reinforces the acute unmet need in a large patient set. Further, precision biomarker approaches and precision clinical trial design has facilitated a better rate of success.

By Route of Administration:

The intravenous (IV) route achieved 90% of the overall route utilization in the U.S. in 2024, as the intravenous route continued to be the clear dominant route for ADC administration. The IV route is universally known for its reliable systemic exposure, controlled doses, and optimal therapeutic effect, which is the hallmark for ADCs to be safe and effective. Oncology centers and pharmacy risk departments will strongly recommend IV as it is well known and have good clinical guidelines from regulation. IV ADCs will lend themselves to further multi-infusion combination regimens.

We suspect the subcutaneous/intramuscular route will have the highest CAGR as biopharmaceutical innovator companies are testing multiple new routes of administration that provide a better ‘patient experience’. These routes will likely limit total infusion time, simplicity to administer the drug, and allow treating in the outpatient setting. Clinical interest is growing as BCH approve early-stage programs are demonstrating a similar therapeutic effect (with more patient comfort).

By Distribution Channel:

The bulk of global revenues for ADC therapies came from hospital pharmacies and oncology centers, comprising 70%. The clinical expertise needed to administer and manage ADCs can be found primarily in hospitals; they can handle the complexity of infusion therapies, review and manage toxicity, and generally offer multidisciplinary cancer care. Last but not least, hospital pharmacies and oncology centers frequently are crucial to post-market assessment and the real-world evidence SDK landscape for ADCs. Not only is reimbursement for the administration of infusion-based therapies well-established, many oncologists and hematologists simply prefer it in a controlled setting, especially since it is their practice role, making ADCs the predominant channel.

Online pharmacies/direct-to-patient is expected to grow the fastest, driven by growing digitalization, secular trends towards alternate treatment models, and a move merging oral dosage forms to their treatment plans as more oral ADCs and self-administered therapies are developed in the future. More patients are seeking convenience, home delivery and price transparency, which online channels can offer with relative ease. In addition, cold-chain logistics and tele-oncology platforms will support this move to online pharmacies. Although ADCs are currently infusion-based and limited to outpatient clinical administration through either specialty or hospital pharmacies, the overall long-term growth prospects increasingly seem extremely favorable.

By Type of Manufacturer:

In-house/integrated biopharma represent 65% of global revenues in 2024, demonstrating their continued dominance in innovation and commercialization of ADCs. Such properties allow for adequate processes and systems to build in quality assurance considerations enabled by proprietary technologies, and greatly expedite overall production speed to market for ADCs. The majority of the successful blockbuster ADCs on the market today have emerged through integrated or hybrid biopharma, resulting in their dominance seen in the last few years.

Outsourced/contract development and manufacturing organizations (CDMOs) are likely to be the fastest growing manufacturing segment, driven by increasing complexity of ADC manufacture, as more companies express interest in specialty services. Biotech startups particularly are leaning heavily on the expertise and capacity of CDMOs in conjugation meshes, scale-up, and good manufacturing practices for their ADCs. The total clinical candidates for ADCs is continually increasing and driving demand for capacity in flexible manufacturing capabilities, making CDMOs particularly well-suited in the future as they become better skilled at integrating biologics and small-molecule capabilities.

Recent Developments:

In January 2025, U.S. Food and Drug Administration approved Datroway, an ADC developed by AstraZeneca in collaboration with Daiichi Sankyo, for treatment of unresectable or metastatic, hormone-receptor positive, HER2-negative breast cancer in adults who have already received endocrine-based therapy and chemotherapy.

Value Chain Analysis

R&D (Research & Development)

Research begins with identifying suitable tumor antigens, designing monoclonal antibodies, selecting cytotoxic payloads, and optimizing linker technologies. Preclinical studies test efficacy, stability, and safety before progressing to human trials. Iterative refinements ensure high specificity and minimized toxicity.

Organizations: Roche, Seagen (Pfizer), Daiichi Sankyo, AstraZeneca, Gilead Sciences, ImmunoGen, Takeda.

Clinical Trial & Approval

ADC candidates undergo Phase I, II, and III clinical trials to assess safety, dosage, efficacy, and adverse effects. Regulatory submissions are prepared for authorities like FDA, EMA, and PMDA. Successful approval allows commercial manufacturing and distribution.

Organizations: FDA (USA), EMA (Europe), PMDA (Japan), national regulatory bodies, and clinical research organizations (CROs) such as IQVIA and Parexel.

Patient Support & Services

Post-launch, programs include patient education, adherence monitoring, financial support, and infusion guidance. Specialized oncology centers, hospitals, and homecare services ensure safe administration. Patient assistance programs improve treatment continuity and accessibility, enhancing overall outcomes.

Organizations: Hospital pharmacies, oncology centers, specialty pharmacies, non-profits, and pharma patient support divisions (e.g., Roche Patient Assistance, Pfizer Oncology Services).

Top Vendors in Antitumor ADC Drugs Market & Their Offerings:

Seagen (Acquired by Pfizer)

- Key Products: Adcetris (brentuximab vedotin), Padcev (enfortumab vedotin), Tivdak® (tisotumab vedotin)

- Focus: Hematologic malignancies and solid tumors

- Recent Developments: Seagen’s acquisition by Pfizer aims to enhance access to advanced cancer treatments, combining Seagen’s ADC expertise with Pfizer’s global reach.

Roche / Genentech

- Key Products: Kadcyla (trastuzumab emtansine), Polivy® (polatuzumab vedotin), Enhertu® (trastuzumab deruxtecan)

- Focus: HER2-positive cancers, including breast, gastric, and lung cancers

- Recent Developments: Roche continues to expand its ADC portfolio with multiple ongoing clinical trials targeting various cancer types.

AstraZeneca / Daiichi Sankyo

- Key Product: Enhertu (trastuzumab deruxtecan)

- Focus: HER2-targeted therapies for breast, gastric, and lung cancers

- Recent Developments: AstraZeneca’s acquisition of EsoBiotec aims to bolster its cell therapy capabilities, complementing its ADC portfolio.

Gilead Sciences (Acquired Immunomedics)

- Key Product: Trodelvy (sacituzumab govitecan)

- Focus: Trop-2-targeted ADC for breast and other solid tumors

- Recent Developments: Gilead’s acquisition of Immunomedics has strengthened its position in the ADC market, expanding its oncology pipeline.

ADC Therapeutics

- Key Product: Zynlonta (loncastuximab tesirine)

- Focus: Hematologic malignancies, particularly relapsed or refractory diffuse large B-cell lymphoma

- Recent Developments: ADC Therapeutics continues to advance its ADC pipeline, focusing on both hematologic and solid tumors.

ImmunoGen

- Key Products: Evofosfamide (formerly known as TH-302), Mirvetuximab soravtansine

- Focus: Solid tumors, including ovarian and endometrial cancers

- Recent Developments: ImmunoGen is advancing its ADC candidates through clinical trials, targeting specific tumor antigens to improve treatment outcomes.

BioNTech

- Key Product: BNT323/DB-1303 (in collaboration with Duality Biologics)

- Focus: Metastatic breast cancer

- Recent Developments: BioNTech’s ADC candidate has shown promising results in clinical trials, demonstrating longer progression-free survival compared to existing therapies.

Byondis

- Key Product: SYD985 (trastuzumab duocarmazine)

- Focus: HER2-positive cancers

- Recent Developments: Byondis is progressing its ADC candidates through clinical trials, aiming to offer effective treatments for various cancer types.

Browse More Insights of Towards Healthcare:

The global antibody optimization service market size is calculated at US$ 2.77 billion in 2024, grew to US$ 3 billion in 2025, and is projected to reach around US$ 6.07 billion by 2034. The market is expanding at a CAGR of 8.45% between 2025 and 2034.

The global antibody discovery market size was reported at US$ 8.31 billion in 2024 and is expected to rise to US$ 9.1 billion in 2025. According to forecasts, it will grow at a CAGR of 9.54% to reach US$ 20.71 billion by 2034.

The global antibody therapy market size is calculated at US$ 278.25 in 2024, grew to US$ 314.64 billion in 2025, and is projected to reach around US$ 951.24 billion by 2034. The market is expanding at a CAGR of 13.08% between 2025 and 2034.

The modified antibody market size recorded US$ 3.10 billion in 2025, set to grow to US$ 3.38 billion in 2026 and projected to hit nearly US$ 7.36 billion by 2035, with a CAGR of 9.04% throughout the forecast timeline from 2026 to 2035.

The next-generation bispecific antibody market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034.

The global human combinatorial antibody libraries market size is calculated at US$ 116.2 in 2024, grew to US$ 122 million in 2025, and is projected to reach around US$ 189.57 million by 2034. The market is expanding at a CAGR of 5.04% between 2025 and 2034.

The monoclonal antibody for asthma and COPD market size was valued at US$ 34.02 billion in 2025 and is projected to grow to 35.94 billion in 2026. Forecasts suggest it will reach approximately US$ 58.94 billion by 2035, registering a CAGR of 5.65% during the period.

The global bispecific antibody market size is calculated at USD 11.97 in 2024, grew to USD 17.24 billion in 2025, and is projected to reach around USD 460.23 billion by 2034. The market is expanding at a CAGR of 44.04% between 2025 and 2034.

The global complement C4 antibody market was estimated at US$ 19.21 billion in 2023 and is projected to grow to US$ 68.48 billion by 2034, rising at a compound annual growth rate (CAGR) of 12.25% from 2024 to 2034.

The global epigenetic antibodies market size is calculated at US$ 2.29 in 2024, grew to US$ 2.7 billion in 2025, and is projected to reach around US$ 12.01 billion by 2034. The market is projected to expand at a CAGR of 18.04% between 2025 and 2034.

Top Companies in the Antitumor ADC Drugs Market

- Seattle Genetics, Inc. (Seagen)

- Roche Holding AG

- ImmunoGen, Inc.

- Daiichi Sankyo Company, Limited

- Pfizer Inc.

- Amgen Inc.

- AstraZeneca plc

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

- Genmab A/S

- Takeda Pharmaceutical Company Limited

- Emergent BioSolutions Inc.

- Synaffix B.V.

- Sorrento Therapeutics, Inc.

- Zymeworks Inc.

- Allogene Therapeutics, Inc.

- Astellas Pharma Inc.

- Curis, Inc.

- BioNTech SE

Segments Covered in the Report

By Drug Type

- Branded ADC Drugs

- Specialty Branded

- Oncology-Focused Branded

- Generic / Biosimilar ADC Drugs

- Biosimilar ADCs

- Non-biosimilar Generics

By Payload Type

- Cytotoxic Payloads – MMAE, DM1, Calicheamicin, etc.: 70% (Dominating)

- Microtubule Inhibitors (MMAE, DM1)

- DNA-Damaging Agents (Calicheamicin, Pyrrolobenzodiazepine)

- Protein / Enzyme-Based Payloads

- Immunotoxins

- Enzyme Conjugates

- Novel Payloads (RNA, Targeted Small Molecules)

By Linker Technology

- Cleavable Linkers

- Peptide-based

- Acid-labile

- Disulfide-based

- Non-cleavable Linkers

- Site-Specific / Novel Linkers

By Target Antigen / Therapeutic Area

- Hematologic Cancers

- Leukemia

- Lymphoma

- Solid Tumors

- Breast Cancer (HER2+)

- Lung Cancer

- Gastric & Colorectal Cancer

- Other Indications

- Rare Tumors

- Immuno-Oncology Targets

By Route of Administration

- Intravenous (IV)

- Subcutaneous / Intramuscular

By Distribution Channel

- Hospital Pharmacies / Oncology Centers

- Specialty Pharmacies

- Online Pharmacies / Direct-to-Patient

By Type of Manufacturer

- In-house / Integrated Biopharma

- Outsourced / CDMPartners

- Contract Development & Manufacturing Organizations (CDMO)

- Contract Research Organizations (CRO)

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6367

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.