The Investment Banking Market is expanding steadily as global capital market activity and M&A demand grow. In the U.S., the market is projected to rise to USD 79.59 billion by 2033, driven by digital trading platforms, fintech adoption, and increasing corporate financing needs.

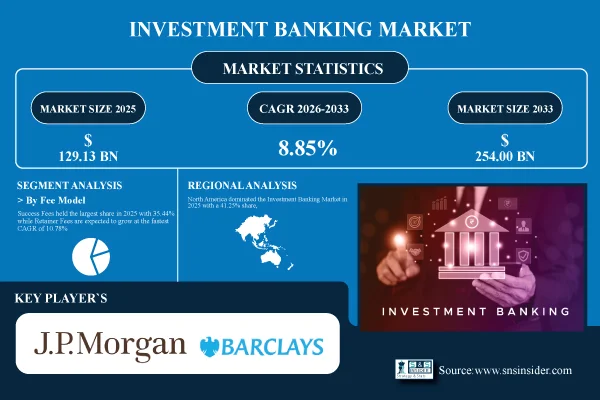

Austin, Nov. 27, 2025 (GLOBE NEWSWIRE) — The Investment Banking Market Size was valued at USD 129.13 Billion in 2025E and is projected to reach USD 254.00 Billion by 2033, growing at a CAGR of 8.85% during 2026–2033.

Market growth is being vice by increasing global capital market activity, growing corporate financing needs and demand for specialty financial advisory services across all major regions.

Download PDF Sample of Investment Banking Market @ https://www.snsinsider.com/sample-request/8646

The U.S. Investment Banking Market is projected to grow from USD 42.37 billion in 2025E to USD 79.59 billion by 2033, registering a CAGR of 8.22%.

Strong M&A trends, digital trading platforms, fintech adoption and growing corporate financing requirements across industries are driving growth.

Segmentation Analysis:

By Service Type, M&A Advisory Held the Largest Market Share of 38.25% in 2025; Trading & Brokerage is Expected to Grow at the Fastest CAGR of 10.12%

M&A Advisory services dominated the Investment Banking Market in 2025 with more than 3,800 M&A deals globally, driven by increasing corporate financing requirements, cross-border transactions, and strategic advisory demand. Trading & Brokerage services are fast-growing, with over 1,200 new technology-driven trading companies emerging, rising digital adoption, and increasing demand for data-driven trading solutions globally.

By Client Type, Corporates Dominated with a 45.67% Share in 2025; High Net Worth Individuals are Projected to Expand at the Fastest CAGR of 11.25%

Corporates dominated investment banking services in 2025, participating in over 4,500 major financing and advisory transactions globally. High-net-worth individuals are fast-growing, engaging in more than 900 personalized wealth management and investment advisory deals.

By Transaction Type, Equity Accounted for the Highest Market Share of 40.18% in 2025; Structured Finance is Projected to Record the Fastest CAGR of 10.50%

Equity transactions dominated globally in 2025, with over 2,800 IPOs and follow-on offerings completed. Structured finance is fast-growing, with more than 1,000 project financing and securitization deals executed worldwide. Corporates and governments increasingly use structured solutions for strategic funding, particularly in Asia-Pacific and Latin America.

By Fee Model, Success Fees Held the Largest Share in 2025 with 35.44%; Retainer Fees Segment is expected to Grow at the Fastest CAGR of 10.78%

Success fees dominated investment banking deals in 2025, applied in over 3,200 transactions for completed advisory milestones. Retainer fees are fast-growing, with more than 1,100 long-term advisory contracts signed globally to meet clients’ need for continuous strategic support.

If You Need Any Customization on Investment Banking Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8646

Regional Insights:

North America dominated the Investment Banking Market in 2025 with a 41.25% share, reflecting its stronghold in global financial services. Strong corporate funding requirements, technology innovation in trading platforms and cross-border advisory services have steered the region to a leading position and we expect it to not only remain as but also become the hub of global investment banking expansion.

The Asia Pacific Investment Banking Market is projected to grow at a CAGR of 9.85% during 2026–2033, driven by rising corporate financing needs and robust capital markets.

Key Players:

- J.P. Morgan

- Goldman Sachs

- Morgan Stanley

- Bank of America Securities

- Citigroup

- Barclays

- BNP Paribas

- Santander

- Societe Generale

- Nomura

- UBS

- Deutsche Bank

- HSBC

- Crédit Agricole CIB

- Macquarie

- Itaú BBA

- Lazard

- Evercore

- Moelis & Company

- PJT Partners

Investment Banking Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 129.13 Billion |

| Market Size by 2033 | USD 254.00 Billion |

| CAGR | CAGR of 8.85% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (M&A Advisory, Capital Raising, Underwriting, Trading & Brokerage) • By Client Type (Corporates, Governments, Financial Institutions, High Net Worth Individuals) • By Transaction Type (Equity, Debt, Structured Finance, Derivatives) • By Fee Model (Fixed Fees, Success Fees, Retainer Fees, Commission-Based) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

Recent News:

- In August 2025, J.P. Morgan launched the JPMorgan Equity and Options ETF (JOYT), expanding its suite for total return investors and income strategies.

- In July 2025, Goldman Sachs introduced the Private Credit Collective Investment Trust, giving defined contribution plans access to private credit investments.

- In September 2025, Morgan Stanley partnered with Zerohash to offer cryptocurrency trading on E*Trade, covering Bitcoin, Ether, and Solana.

Buy Full Research Report on Investment Banking Market 2026-2033 @ https://www.snsinsider.com/checkout/8646

Exclusive Sections of the Report (The USPs):

- HNW CLIENT & AUM GROWTH METRICS – helps you understand wealth-management performance through trends in high-net-worth client acquisition and average AUM levels, enabling assessment of premium client segment strength.

- MARKET PENETRATION & SERVICE DENSITY INDEX – helps you evaluate the competitive intensity across regions by analyzing the number of active investment banks and deals handled per bank or per corporate client.

- OPERATIONAL EFFICIENCY & DEAL PERFORMANCE SCORECARD – helps you measure average deal size and time-to-close across M&A, underwriting, advisory, and other segments, supporting benchmarking of operational productivity.

- REGULATORY IMPACT & COMPLIANCE BURDEN TRACKER – helps you assess the proportion of firms affected by new regulatory changes and quantify delays or cost increases stemming from compliance requirements.

- DEAL FLOW & CLIENT ACTIVITY BENCHMARKS – helps you map corporate deal-making frequency and identify sectors with high or low transaction momentum to support strategic targeting.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.