Commercial Satellite Broadband Market is driven by growing demand for high-speed internet in remote areas, expansion of LEO constellations, rising connectivity needs for maritime, aviation, and enterprise applications.

Austin, Nov. 25, 2025 (GLOBE NEWSWIRE) — Commercial Satellite Broadband Market Size & Growth Insights:

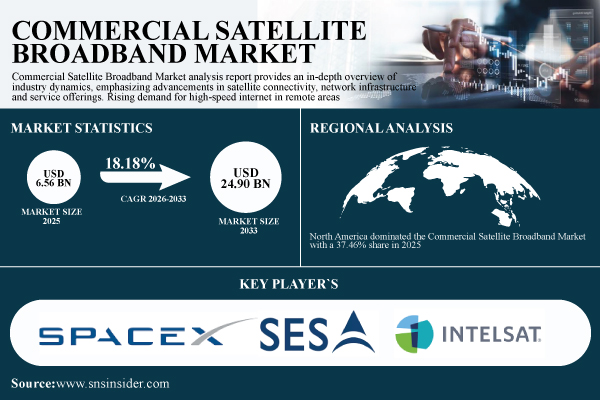

According to the SNS Insider,“The Commercial Satellite Broadband Market Size is valued at USD 6.56 Billion in 2025E and is projected to reach USD 24.90 Billion by 2033, growing at a CAGR of 18.18% during 2026–2033.”

At a CAGR of 16.85%, the U.S. commercial satellite broadband market is expected to reach USD 6.68 billion by 2033 from USD 1.92 billion in 2025E.

Rapid Expansion of Low-Earth Orbit (LEO) Constellations Boost Market Growth Globally

One of the main factors propelling the growth of the commercial satellite broadband market is the quick development of low-Earth orbit (LEO) constellations. Even in isolated areas, broadband connectivity is becoming quicker, more reliable, and more accessible as major carriers install thousands of tiny satellites. By lowering latency, increasing network capacity, and redefining performance criteria for next-generation satellite communication services, this breakthrough makes seamless connectivity possible for businesses, aviation, maritime, and defense applications.

Get a Sample Report of Commercial Satellite Broadband Market Forecast @ https://www.snsinsider.com/sample-request/8859

Leading Market Players with their Product Listed in this Report are:

- SpaceX

- Hughes Network Systems

- Viasat Inc.

- SES S.A.

- Eutelsat Communications

- Inmarsat plc

- Intelsat S.A.

- OneWeb

- Iridium Communications Inc.

- Telesat

- EchoStar Corporation

- Globalstar Inc.

- Gilat Satellite Networks Ltd.

- Avanti Communications Group plc

- Thaicom Public Company Limited

- Speedcast International Limited

- KVH Industries, Inc.

- AsiaSat

- China Satcom

- ST Engineering iDirect

Commercial Satellite Broadband Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 6.56 Billion |

| Market Size by 2033 | USD 24.90 Billion |

| CAGR | CAGR of 18.18% From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Frequency Band (C Band, Ku Band, Ka Band, Others) • By Component (Satellite Capacity, Ground Equipment, Services) • By Application (Backhaul Connectivity, Remote Communication, Emergency & Disaster Management, Media & Entertainment, Others) • By End-User (Enterprise, Government & Defense, Maritime, Aviation, Energy, Others) |

Purchase Single User PDF of Commercial Satellite Broadband Market Report (20% Discount) @ https://www.snsinsider.com/checkout/8859

Key Industry Segmentation

By Frequency

Ku Band held the largest market share of 41.27% in 2025 due to its established infrastructure, widespread adoption in maritime and enterprise connectivity, and balanced coverage-cost efficiency. Ka Band is projected to grow at the fastest CAGR of 20.63% during 2026–2033 driven by higher data throughput and integration with LEO constellations.

By Component

Services accounted for the highest market share of 48.92% in 2025, while Satellite Capacity is anticipated to expand at the fastest CAGR of 19.44% through 2026–2033. The segment’s growth is driven by the growing preference for managed connectivity, subscription models, and customer-focused broadband packages.

By Application

Remote Communication dominated with a 34.75% share in 2025 as satellite broadband provides critical connectivity for offshore operations, defense outposts, and isolated enterprises. Backhaul Connectivity is expected to grow at the fastest CAGR of 21.58% during the forecast period as telecom operators increasingly integrate satellites to extend rural 4G and 5G networks.

By End-User

Enterprise held the largest share of 39.81% in 2025 due to rising satellite broadband demand across mining, oil & gas, logistics, and remote industrial facilities. Aviation is forecasted to grow at the fastest CAGR of 22.36% during 2026–2033 propelled by surging passenger demand for in-flight Wi-Fi and digital services.

Regional Insights:

With a 37.46% market share in 2025, North America led the commercial satellite broadband market due to its vast satellite network and top suppliers, such as SpaceX, Hughes, and Viasat. Continuous investment in LEO constellations and high-throughput satellites is driven by the region’s strong need for high-speed connection across the residential, business, and defense sectors.

The Asia Pacific Commercial Satellite Broadband Market is the fastest-growing region, projected to expand at a CAGR of 20.62% during 2026–2033. Growth is driven by accelerating digital inclusion programs, expanding LEO satellite deployments, and strong government support for rural broadband.

Do you have any specific queries or need any customized research on Commercial Satellite Broadband Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/8859

Recent News:

- In October 2025, SpaceX launched its 10,000th Starlink satellite, further strengthening its dominance in satellite broadband. The milestone, achieved through its 132nd Falcon 9 mission of the year, enhances internet reach and improves service quality for underserved regions.

- In April 2025, Hughes Network Systems launched its HL1100W electronically steerable antenna (ESA), a compact, flat-panel user terminal designed for mobility and remote connectivity applications. The product marks a key expansion in Hughes’ next-generation broadband solutions portfolio.

Exclusive Sections of the Commercial Satellite Broadband Market Report (The USPs):

- TECHNOLOGICAL ADOPTION & INNOVATION INDICATORS – helps you track the penetration of HTS systems, AI-driven network optimization, satellite lifespan trends, and the shift toward reusable launch vehicles.

- REGULATORY & POLICY LANDSCAPE METRICS – helps you understand government-backed broadband inclusion programs, licensing and approval dynamics, and incentive structures shaping satellite connectivity expansion.

- GLOBAL TRADE & SUPPLY CHAIN STRUCTURE – helps you assess launch service market shares, analyze manufacturing export–import flows, and evaluate local vs. imported component dependency across major economies.

- ENVIRONMENTAL & SUSTAINABILITY COMPLIANCE INDEX – helps you monitor carbon emissions per launch, adoption of debris mitigation/deorbiting practices, and the reusability ratio of launch vehicles to measure environmental impact.

- LAUNCH SERVICE COMPETITIVE BENCHMARKING – helps you compare capabilities and market strengths of leading launch providers such as SpaceX, Arianespace, and others to support strategic procurement and partnership decisions.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.