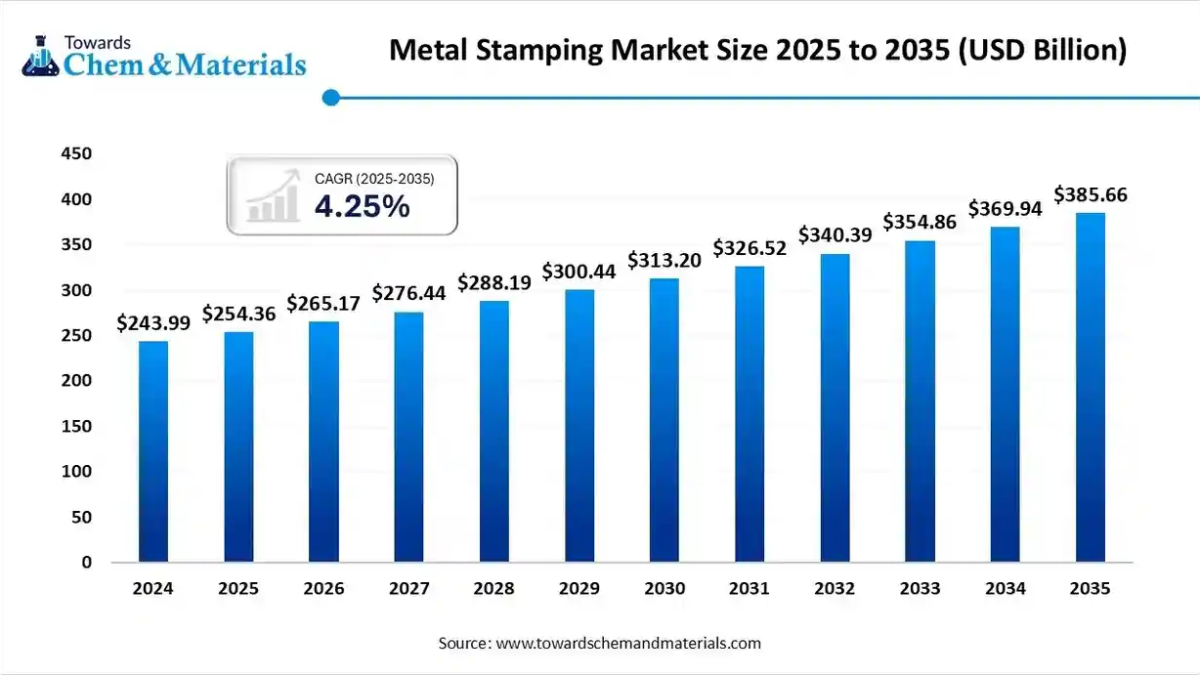

According to Towards Chemical and Materials Consulting, the global metal stamping market size is calculated at USD 254.36 billion in 2025 and is expected to be worth around USD 385.66 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.25% over the forecast period 2025 to 2035.

Ottawa, Nov. 19, 2025 (GLOBE NEWSWIRE) — The global metal stamping market size was valued at USD 254.36 billion in 2025 and predicted to increase from USD 265.17 billion in 2026 is anticipated to reach around USD 385.66 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.25% over the forecast period from 2025 to 2035. Asia Pacific dominated the Metal Stamping market with a market share of 42.2% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The metal stamping market is primarily driven by rising demand from the automotive, aerospace, electronics, and industrial machinery sectors, all of which require high-precision, lightweight, and cost-effective metal components.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6015

What is Meant by Metal Stamping?

The metal stamping market is a critical part of global manufacturing, providing high-volume, high-precision metal components used across automotive, electronics, aerospace, and industrial sectors. Growth is supported by increasing demand for lightweight and durable parts, especially as industries shift toward advanced materials and more complex component designs. Automation, CNC systems, and progressive die stamping are enhancing production efficiency, accuracy, and scalability.

The market is also benefiting from the rapid expansion of electric vehicles and consumer electronics, both of which require sophisticated stamped metal parts. Overall, metal stamping remains essential due to its cost-effectiveness, versatility, and ability to support mass production across diverse applications.

Metal Stamping Market Report Highlights

- By region, Asia Pacific dominated the market, accounting for 42.2% in 2024.

- By region, North America is expected to grow at a CAGR of 5.2% during the forecast period.

- By process, the banking segment dominated the market, accounting for 35.8% in 2024.

- By process, the bending segment is expected to grow significantly at a 4.6% during the forecast period.

- By material, the steel segment accounted for 50.6% of the metal stamping market in 2024.

- By material, the aluminum segment is expected to grow at a CAGR of 4.8% in the forecast period.

- By application, the automotive segment dominated the market, accounting for 34.5% in 2024.

- By application, the electrical and electronics segment is expected to grow at a 4.6% CAGR in the forecast period.

- By press type, the mechanical press segment accounted for 58.5% of the market in 2024.

- By press type, the servo press segment is expected to grow at a 4.5% CAGR in the forecast period.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

What are the leading metal stamping machinery options?

In the United States and Canada, a wide variety of metal stamping machines are available, playing a crucial role in modern manufacturing. These machines facilitate the efficient and cost-effective mass production of metal components across diverse industries, including automotive, aerospace, electronics, and appliances. By supporting technological advancements and contributing to economic growth, these machines are integral to many sectors. Below, we explore some of these machines and the features that have made them popular.

Komatsu E2W Series Presses

Manufacturer: Komatsu

The E2W series presses from Komatsu are renowned for their precision, reliability, and energy efficiency. Featuring advanced servo-driven technology, these presses offer precise control over the ram’s motion, ensuring consistent and accurate stamping results. Designed to minimize energy consumption and reduce operating costs, the E2W series is a popular choice for a wide range of metal stamping applications.

AIDA NC1 Series Presses

Manufacturer: AIDA Engineering

AIDA’s NC1 series presses are celebrated for their robust construction, high-speed performance, and versatility. Equipped with advanced controls and automation features, these presses enable fast and efficient production. Known for their precision and capability to handle a wide range of stamping applications, the NC1 series is a popular choice among metal stamping companies.

Bliss C1 Straight Side Press

Manufacturer: Bliss Press

The Bliss C1 Straight Side Press is renowned for its durability and rigidity, ensuring stable and accurate stamping operations. Its straight side design offers easy access to the working area, facilitating straightforward die changes and maintenance. This press is well-suited for handling heavy-duty stamping applications with efficiency and reliability.

SEYI DSF Series Servo Presses

Manufacturer: SEYI America, Inc.

The DSF Series Servo Presses from SEYI are known for their precision and high-speed performance. Utilizing servo motor technology, these presses accurately control the ram’s movement, leading to reduced energy consumption and increased productivity. They are particularly well-suited for applications involving complex forming and intricate shapes.

Heim Maxi Stamper Press

Manufacturer: Heim Group

The Heim Maxi Stamper Press is recognized for its heavy-duty construction and dependable performance. Designed to handle large and demanding stamping jobs with consistent accuracy, these presses feature advanced safety mechanisms and user-friendly controls, making them a preferred choice for various metal stamping operations.

Since specific models and their features may evolve, it is advisable to consult manufacturers or industry experts for the most up-to-date and comprehensive information on metal stamping machines available in the United States and Canada.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6015

Private Industry Investments in the Metal Stamping Industry:

- General Motors invested $491 million to upgrade its Marion, Indiana, metal stamping facility to produce parts for future electric vehicles.

- Gestamp launched a new hot stamping plant in Pune, India, with an investment of €36 million to supply automotive components to major manufacturers like Ford and Tata.

- Melling Engine Parts acquired Casalandra Metal Stamping to expand its product lines and manufacturing capabilities within the United States.

- GSC Steel Stamping, LLC acquired the assets of Dixien, LLC, allowing the company to continue its 43-year tradition of manufacturing automotive parts.

- Interplex acquired OCP Group, Inc., a custom connector and cable assembly design and manufacturer, to enhance its precision engineering services portfolio.

Read more news Carbon Steel Market Size to Worth USD 1.80 Trillion by 2035

Read more news Stainless Steel Market Size to Worth USD 357.28 Billion by 2034

Metal Stamping Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 265.17 Billion |

| Revenue forecast in 2035 | USD 385.66 Billion |

| Growth Rate | CAGR of 4.25% from 2025 to 2035 |

| Base year for estimation | 2023 |

| Historical data | 2018 – 2025 |

| Forecast period | 2025 – 2035 |

| Segments covered | By Process, By Material, By Application, By Press Type, By Region |

| Regional scope | North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa |

| Country scope | U.S., Germany, UK, Italy, China, India, Japan |

| Key companies profiled | Acro Metal Stamping; Manor Tool & Manufacturing Company; D&H Industries, Inc.; Kenmode, Inc.; Klesk Metal Stamping Co; Clow Stamping Company; Goshen Stamping Company; Tempco Manufacturing Company, Inc.; Interplex Holdings Pte. Ltd.; CAPARO; Nissan Motor Co., Ltd; AAPICO Hitech Public Company Limited; Gestamp; Ford Motor Company |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What types of metals are commonly used in the metal stamping process?

The metals commonly used in stamping processes include:

Copper Alloys

Copper alloys are frequently used in stamping processes due to their outstanding electrical conductivity, corrosion resistance, and malleability. Common copper alloys employed in stamping include:

Brass

Brass, an alloy of copper and zinc, is renowned for its attractive gold-like appearance. It is commonly used in decorative and architectural applications, as well as in electronics, plumbing fittings, and musical instruments.

Bronze

Bronze, an alloy of copper with elements such as tin, aluminum, or silicon, is valued for its durability. This makes it ideal for applications like bearings, bushings, and sculptures.

Steel Alloys

Steel is a broad category of alloys primarily composed of iron and carbon. The mechanical properties of steel depend largely on the concentration of alloying elements. Higher carbon content increases hardness but also makes the steel more brittle and less ductile, while higher levels of nickel and chromium enhance corrosion resistance. Steel alloys are generally known for their high strength and toughness, as well as their ability to withstand extreme temperatures, although they can be challenging to stamp.

The most common steel alloys used in metal stamping are stainless steel and carbon steel.

Common steel alloys used in stamping processes are:

Carbon Steel

This basic alloy of iron and carbon is widely used in automotive parts, machinery, and construction materials due to its strength and cost-effectiveness.

Stainless Steel

Stainless steel, which contains chromium, offers excellent corrosion resistance. It is ideal for applications that require both strength and resistance to rust and staining, including kitchen appliances, medical equipment, and outdoor architectural elements.

Aluminum

Aluminum is an affordable, lightweight, non-ferrous metal with excellent corrosion resistance and the ability to withstand extreme temperatures. It also offers good thermal and electrical conductivity and is highly valued for its decorative qualities. Due to its ductility, flexibility, malleability, and high strength-to-weight ratio, aluminum can be stamped easily and effectively.

Commonly used aluminum alloys are below:

Aluminum 1100

This commercially pure aluminum alloy is known for its excellent formability. It is commonly used in applications such as food packaging, chemical equipment, and heat exchangers.

Aluminum 3003

This alloy combines good strength with exceptional workability, making it suitable for use in cooking utensils, heat exchangers, and automotive components.

Aluminum 6061

Renowned for its high strength and heat-treatable properties, this alloy is commonly employed in aerospace, automotive, and structural components.

Aluminum 5052

Offering excellent corrosion resistance, this alloy is frequently used in marine applications, signage, and fuel tanks.

Major Trends of the Metal Stamping Market:

- Integration of automation and Industry 4.0 technologies: Manufacturers are increasingly adopting robotics, AI, and IoT (Internet of Things) sensors to enhance precision, increase production speed, and enable predictive maintenance in stamping operations. These connected systems and data analytics help optimize material flow, reduce human error, minimize downtime, and make data-driven decisions.

- Shift toward lightweight and advanced materials: Driven by the automotive and aerospace industries’ need for improved fuel efficiency and performance (especially for electric vehicles), there is a growing demand for stamping advanced high-strength steels and aluminum alloys. These materials require new techniques like hot stamping to form complex, durable, and lighter components without sacrificing safety or strength.

- Sustainability and circular economy practices: Companies are adopting greener manufacturing practices, such as optimizing energy consumption with servo presses and implementing extensive scrap metal recycling programs. This emphasis on eco-friendly processes and the use of recyclable materials helps meet environmental regulations and appeals to environmentally conscious customers.

AI Revolutionizing the Future of Metal Stamping

AI is transforming the metal stamping industry by enabling predictive maintenance that reduces equipment downtime and extends machine life. It enhances quality control through real-time defect detection, ensuring higher precision and minimizing scrap rates. AI-driven process optimization also improves stamping speed, tool selection, and material usage for greater operational efficiency. Additionally, intelligent automation supports smarter production planning, helping manufacturers meet increasing demand with improved consistency and lower costs.

Market Opportunity

Lightweight Materials: The Next Big Opportunity in Metal Stamping

A major opportunity in the metal stamping market lies in the growing demand for lightweight materials across the automotive, aerospace, and electronics industries. As companies push for fuel efficiency, improved performance, and sustainability, the need for advanced stamping of aluminum, high-strength steel, and composite-compatible components is rising rapidly. This shift opens doors for manufacturers to adopt new forming technologies and upgrade tooling capabilities. Firms that invest early in precision stamping for lightweight materials are positioned to capture significant market share in the coming years.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6015

Metal Stamping Market Segmentation Insights

Market Segmentation

Process Insights

The blanking segment led the market in 2024, due to it provides a fast, cost-efficient method for producing high-volume, uniform metal parts across automotive, electronics, and industrial applications. Its ability to deliver precise shapes with minimal material waste made it highly preferred for mass-production workflows. Manufacturers also favored blanking due to its compatibility with automated systems, which enhances productivity and reduces labor dependency.

The bending segment is growing fastest over the forecast period, driven by it is essential for producing complex, structurally strong components used widely in automotive frames, machinery parts, and construction hardware. Its ability to form precise angles and shapes without compromising material integrity made it ideal for applications requiring durability and tight tolerances. The growth of EV manufacturing and lightweight metal fabrication further increased reliance on bending processes for chassis, brackets, and enclosure components.

Material Insights

The steel segment led the market in 2024, due to steel’s offers high strength, durability, and cost-effectiveness, making it the preferred material for automotive, industrial machinery, and construction applications. Its wide availability and compatibility with various stamping processes allowed manufacturers to produce complex parts on a large scale without compromising structural performance. The increasing use of advanced high-strength steel in vehicles also boosted demand, particularly for safety-critical and lightweight components.

The aluminum segment is the second-largest segment, leading the market, due to its lightweight nature, made it highly attractive for automotive, aerospace, and electronics applications focused on improving fuel efficiency and reducing overall weight. Its excellent corrosion resistance and high formability enabled manufacturers to produce precise, durable components with minimal processing challenges. The rapid expansion of electric vehicles further increased the need for aluminum-stamped battery enclosures, heat shields, and structural parts.

Application Insights

In 2024, the automotive segment led the market, due to vehicle manufacturing requiring a large volume of stamped components such as body panels, chassis parts, brackets, and structural reinforcements. Automakers increasingly relied on stamping to achieve high precision, strength, and consistency while keeping production costs competitive. The rapid expansion of electric vehicles further boosted demand for lightweight stamped components, including battery housings and thermal management parts.

The electrical and electronics segment is growing fastest over the forecast period, due to the industry requiring a high volume of precise, miniaturized metal components for connectors, terminals, shielding parts, and device housings. Stamping offered the accuracy and repeatability needed to support the rapid production cycles of consumer electronics and semiconductor devices. The rise of smartphones, wearables, smart appliances, and EV electronics further accelerated demand for intricate stamped parts.

Press Type Insights

In 2024, the mechanical press segment dominated the market, due to it offers high-speed operation, making it ideal for mass production of stamped parts across automotive, electronics, and industrial applications. Its lower operational costs and simpler maintenance compared to hydraulic and servo presses made it a preferred choice for manufacturers seeking efficiency. Mechanical presses also provided consistent force and reliable performance, enabling precise stamping for both simple and moderately complex components.

The servo press segment is projected to grow fastest over the forecast period, driven by it offered superior precision and flexibility, allowing manufacturers to fine-tune speed, stroke, and motion for complex forming tasks. Its ability to handle advanced materials like high-strength steel and aluminum made it highly valuable for automotive and electronics applications that demand tighter tolerances. Servo presses also improved production efficiency by reducing setup time, lowering defect rates, and enhancing repeatability.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

Asia Pacific: The Manufacturing Powerhouse Driving Metal Stamping Dominance

The Asia Pacific metal stamping market size was valued at USD 107.34 billion in 2025 and is expected to reach USD 162.94 billion by 2035, growing at a CAGR of 4.26% from 2025 to 2035. Asia Pacific dominated the metal stamping market in 2024, accounting for 42.2% of global revenue.

Asia Pacific dominated the global market in 2024 due to its expansive automotive, electronics, and industrial manufacturing base. The region benefits from cost-efficient production capabilities, abundant raw materials, and strong government support for industrial growth. Rapid urbanization and rising consumer demand for vehicles and electronic devices continue to fuel large-scale stamping requirements. Additionally, countries like China, Japan, and South Korea lead in precision engineering and advanced stamping technologies, strengthening the region’s competitive edge.

India Metal Stamping Trends

India’s market is experiencing strong growth driven by expanding automotive manufacturing, especially the rising production of passenger and electric vehicles. The country’s increasing investments in industrial machinery, appliances, and electrical components are also boosting demand for precision-stamped metal parts. Manufacturers are adopting automation, high-speed presses, and digital quality inspection to enhance productivity and meet global quality standards.

North America Accelerates as the Fastest-Growing Force in Metal Stamping

North America emerged as the fastest-growing region in the market in 2024, driven by a strong rebound in automotive production and increasing adoption of electric vehicles that require high-precision stamped components. The region’s focus on reshoring manufacturing and strengthening domestic supply chains has boosted demand for advanced stamping solutions. Additionally, technological modernization, such as automated presses, robotics, and digital quality control, has made U.S. and Canadian manufacturers more competitive. Growth in aerospace, defense, and medical device manufacturing is further expanding the need for complex, high-performance stamped parts.

United States (U.S.): The Metal Stamping Market Growth Trends

The United States dominates the North American metal stamping industry because of its strong industrial base and highly developed automotive supply chain. The country remains one of the largest producers of vehicles and industrial machinery, and data from the U.S. Bureau of Economic Analysis shows continued growth in motor vehicle output and parts manufacturing in 2023. This steady production activity increases demand for stamped components used in structural, electrical, and drivetrain applications.

The rapid expansion of electric vehicles, aerospace components, and consumer electronics is also boosting the need for high-precision stamping. The United States is home to major EV manufacturers and leading aerospace companies, which rely on stamped aluminum, high-strength steel, and lightweight alloys to meet performance and safety requirements. These sectors require consistent quality and tight tolerances, which strengthens the demand for advanced stamping solutions.

Canada Metal Stamping Trends

Canada’s market is growing steadily, supported by a strong automotive supply chain and increasing demand for lightweight, high-precision components. The country is also seeing rising adoption of advanced stamping technologies, including servo presses and automated inspection, to improve efficiency and reduce production costs. Growth in the aerospace, construction, and electronics industries further boosts the need for customized stamped metal parts.

Europe: The Metal Stamping Sector Growth Is Driven By Government Support

Europe’s metal stamping sector continues to grow because of strict quality standards and the region’s strong base of high-value manufacturing in automotive, aerospace, and industrial machinery. Data from the European Automobile Manufacturers Association shows that Europe produced more than 12 million vehicles in 2023, which drives steady demand for stamped body panels, drivetrain components, and lightweight structural parts. These industries depend on precise and reliable stamping processes to meet safety and performance requirements.

Government support for green mobility and circular manufacturing is also shaping the market. The European Commission’s climate and industrial policies encourage the adoption of energy-efficient production systems, recycling of metals, and reduced material waste. This has led to greater use of advanced forming technologies, such as servo presses, high-strength steel stamping, and precision aluminum forming, helping manufacturers achieve sustainability goals.

Germany: The Metal Stamping Market Growth Trends

Germany serves as the centre of Europe’s metal stamping industry because of its strong automotive, machinery, and engineering capabilities. The country is home to some of the largest vehicle manufacturers and industrial equipment producers in the region, which creates consistent demand for high-precision stamped components. Data from the Federal Statistical Office shows that Germany remains one of Europe’s top producers of passenger cars and industrial machinery, underscoring the need for advanced metal-forming technologies.

The integration of Industry 4.0 practices has further strengthened the sector. German stamping facilities increasingly use robotic automation, digital monitoring systems, and optimised die design software to improve accuracy, reduce downtime, and support high production volumes. These technologies also help maintain the strict quality standards required by the automotive and aerospace industries.

South America Has Seen Growth Driven by the Growing Investments in Production

The South American metal stamping sector is growing steadily as the automotive and construction industries continue to recover and expand. According to data from the Economic Commission for Latin America and the Caribbean, industrial activity in major economies such as Brazil and Argentina showed gradual improvement in 2023, which increased demand for stamped components used in vehicles, building materials, and machinery. These sectors rely on stamping for structural parts, brackets, and precision fittings.

Countries like Brazil are experiencing increased investment in localised component production, especially for automotive systems, appliances, and industrial machinery. Government initiatives that support renewable energy infrastructure, including wind and solar projects, are also boosting demand for stamped metal parts used in turbines, mounting systems, and electrical assemblies. This trend aligns with the region’s broader push toward more resilient and diversified manufacturing capabilities.

Brazil: The Metal Stamping Market Growth Trends

Brazil is the key contributor to South America’s metal stamping sector because of its strong automotive assembly plants and heavy equipment industries. The country is one of the largest vehicle producers in the region, and data from the National Association of Motor Vehicle Manufacturers shows that Brazil produced more than 2.3 million vehicles in 2023. This scale of production creates consistent demand for stamped metal components used in body structures, powertrain systems, and chassis assemblies. Heavy machinery and agricultural equipment manufacturers also depend on precision stamping for essential structural and functional parts.

The growing focus on domestic sourcing and the modernisation of production facilities is further improving Brazil’s competitiveness. Many manufacturers are upgrading to advanced forming technologies, including servo presses and automated material handling systems, to improve efficiency and reduce operational costs. These improvements align with Brazil’s broader industrial modernisation goals and support higher-quality production across automotive and machinery supply chains.

Middle East & Africa (MEA): Key Players Play a Major Role in the Growth

The Middle East and Africa metal stamping market is emerging as a growing industry, supported by ongoing investments in infrastructure, oil and gas equipment, and renewable energy projects. Data from the African

Development Bank and the Gulf Cooperation Council indicate steady expansion in construction, pipeline systems, and power generation facilities across the region, all of which depend on stamped metal parts for structural supports, brackets, enclosures, and mechanical assemblies. These large-scale projects are creating new opportunities for local manufacturers that supply components to engineering and industrial contractors.

The transition toward industrial diversification in GCC countries is also fostering demand for fabricated metal components and precision tooling. National programs in Saudi Arabia and the United Arab Emirates that focus on manufacturing expansion, such as Vision 2030 and Operation 300bn, encourage companies to develop stronger domestic supply chains. This shift is increasing the need for advanced stamping techniques that can support automotive parts, electrical systems, and industrial machinery.

GCC Countries: The Metal Stamping Market Growth Trends

GCC nations are investing heavily in manufacturing diversification through national programs such as Saudi Vision 2030 and the United Arab Emirates’ industrial expansion strategies. These initiatives aim to reduce dependence on oil revenues and strengthen domestic production capacities across key sectors. Government reports from Saudi Arabia and the UAE show rising capital expenditure in engineered products, machinery, and industrial components, which is creating a favorable environment for metal stamping activities.

The metal stamping industry is gaining traction in energy, defence, and the automotive aftermarket, where demand for precision components is increasing. The GCC has been expanding its renewable energy pipelines and defence manufacturing bases, both of which require stamped metal parts for housings, brackets, connectors, and structural assemblies. As local procurement policies strengthen, more regional firms are entering these value chains and upgrading their production capabilities.

Top Companies in the Metal Stamping Market & Their Offerings:

- Gestamp Automoción S.A. (Spain) – A global leader specializing in automotive structural and body components.

- Arconic Corporation (US) – A major manufacturer of aluminum sheets and plates for various industries, including automotive and aerospace.

- Magna International Inc. (Canada) – A leading global automotive supplier offering a wide range of parts and systems, including stamped metal systems.

- CIE Automotive S.A. (Spain) – Designs and manufactures automotive components, with a dedicated metal stamping and tube forming segment.

- American Axle & Manufacturing Holdings, Inc. (AAM) (US) – Focuses on driveline systems and related components, including stamped and formed metal parts.

- Interplex Holdings Pte. Ltd. (Singapore) – Specializes in precision engineering services and metal stamping for electronics, medical, and industrial sectors.

- Martinrea International Inc. (Canada) – A prominent player in the development and production of lightweight steel and aluminum components, primarily for the automotive industry.

More Insights in Towards Chemical and Materials:

- Steel Rebar Market ; The global steel rebar market stands at 368.91 million tons in 2025 and is forecast to reach 530.10 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period from 2025 to 2034.

- Steel Rebar Market : The global steel rebar market size was estimated at USD 257.87 billion in 2025 and is predicted to increase from USD 272.70 billion in 2026 to approximately USD 426.51 billion by 2034, expanding at a CAGR of 5.75% from 2025 to 2034.

- Green Steel Market ; The global green steel-market size was valued at USD 718.55 billion in 2024, grew to USD 763.10 billion in 2025, and is expected to hit around USD 1,311.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.20% over the forecast period from 2025 to 2034.

- Carbon Steel Market : The global carbon steel market size is calculated at USD 1,072.38 billion in 2025 and is predicted to increase from USD 1,129.53 billion in 2026 and is projected to reach around USD 1,802.47 billion by 2035, The market is expanding at a CAGR of 5.33% between 2026 and 2035.

- Hot Rolled Coil (HRC) Steel Market ; The global hot rolled coil (HRC) steel market size accounted for USD 355.42 billion in 2024, grew to USD 375.86 billion in 2025, and is expected to be worth around USD 621.65 billion by 2034, poised to grow at a CAGR of 5.75% between 2025 and 2034.

- Flat Steel Market : The flat steel market size accounted for USD 687.55 billion in 2024 and is predicted to increase from USD 724.33 billion in 2025 to approximately USD 1,157.84 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034.

- Structural Steel Market : The global structural steel market size was approximately USD 119.12 billion in 2025 and is projected to reach around USD 188.63 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.24% between 2025 and 2034.

Metal Stamping Market Top Key Companies:

- Acro Metal Stamping

- Manor Tool & Manufacturing Company

- D&H Industries, Inc.

- Kenmode, Inc.

- Klesk Metal Stamping Co

- Clow Stamping Company

- Goshen Stamping Company

- Tempco Manufacturing Company, Inc

- Interplex Holdings Pte. Ltd.

- CAPARO

- Nissan Motor Co., Ltd

- AAPICO Hitech Public Company Limited

- Gestamp

- Ford Motor Company

Recent Developments

- In February 2025, the BM-Stamp, a breakthrough stamping simulation tool, was launched by ESI Group. This tool is designed to enhance engineers at every expertise level for running processes, including from initial feasibility checks to precise and predictive simulation on both standard and critical materials, including aluminum and high-strength steel.

Metal Stamping Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Metal Stamping Market

By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

By Material

- Steel

- Aluminum

- Copper

- Others (Brass, Titanium, Nickel Alloys)

By Application

- Automotive

- Electrical & Electronics

- Industrial Machinery

- Aerospace & Defense

- Consumer Appliances

- Construction

By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6015

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.