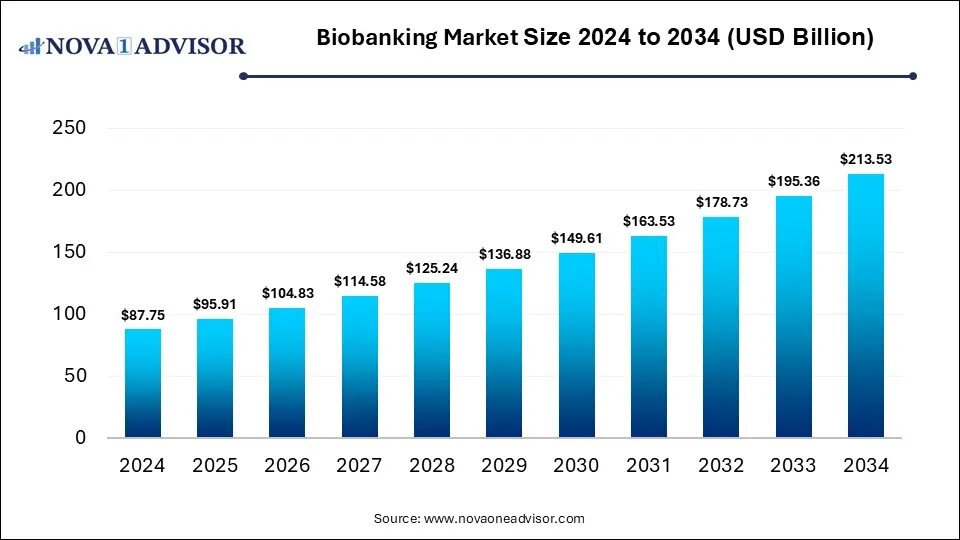

According to Nova One Advisor, the global biobanking market was valued at USD 95.91 billion in 2025 and is projected to hit around USD 213.53 billion by 2034, growing at a CAGR of 9.3% during the forecast period 2025 to 2034. A study published by Nova One Advisor a sister firm of Precedence Research.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The global biobanking market size is calculated at USD 87.75 billion in 2024, grows to USD 95.91 billion in 2025, and is projected to reach around USD 213.53 billion by 2034, growing at a CAGR of 9.3% during the forecast period 2025 to 2034. The market is growing due to increasing demand for personalized medicine and rising research in genomics and regenerative medicine. Additionally, the growing need for high-quality biospecimens to support drug discovery and clinical trials is fueling market expansion.

Key Takeaways

- Europe dominated the biobanking market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the biobanking equipment segment led the market with the largest revenue share in 2024.

- By product, the laboratory information management systems (LIMS) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By services, the biobanking & respiratory segment held the largest market share in 2024.

- By services, the lab processing segment is expected to grow at a significant rate in the market during the forecast period.

- By biospecimen type, the human tissues segment held the highest market share in 2024.

- By biospecimen type, the stem cells segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By biobank type, the physical/real biobanks segment dominated the market in 2024.

- By biobank type, the virtual biobanks segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the therapeutics segment led the market with the revenue shares in 2024.

- By application, the clinical diagnostics segment is expected to grow at a significant rate in the market during the forecast period.

- By end use, the pharmaceutical & biotechnology companies segment held the highest market share in 2024.

- By end use, the CROs & CMOs segment is expected to grow at a significant rate in the market during the forecast period.

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/9207

What is Biobanking?

Biobanking is the process of collecting, storing, and managing biological samples, such as blood, tissues, and DNA, for research and clinical use. The biobanking market is growing due to the rising demand for personalized medicine, increased genomic and clinical research, and advancements in biotechnology. The growing need for high-quality biological samples to support drug discovery disease diagnosis and therapeutic development is further driving market diagnosis, and therapeutic development is further driving market expansion. Additionally, government and private investments in diseases contribute to the market’s steady growth.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9207

Biobanking Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 95.91 billion |

| Revenue forecast in 2034 | USD 213.53 billion |

| Growth rate | CAGR of 9.3% from 2025 to 2034 |

| Historical data | 2018 – 2024 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product, By Service, By Biospecimen Type, By Biobanks Type, By Application, By End-use, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

Biobank samples are essential in scientific and medical research, providing a large and diverse resource of biological materials for various studies. These samples, which can include blood, tissue, DNA, plasma, and urine, are collected and stored for future use in research projects. Here’s how they are typically used:

- Genetic Research: Biobank samples are frequently used in genetic studies to identify genes associated with diseases or to explore the genetic basis of various health conditions. For example, researchers might use DNA samples from a biobank to study genetic variants linked to cancer, heart disease, or neurological disorders.

- Disease Understanding and Biomarker Discovery: Biobanks provide biological materials from individuals with specific diseases, as well as from healthy individuals. This helps researchers to compare and contrast the biological markers (biomarkers) between groups, leading to a better understanding of disease processes and the identification of potential diagnostic markers.

- Drug Development and Testing: Pharmaceutical companies use biobank samples to test how different drugs might interact with human biology. These samples help in screening for effective compounds, understanding drug resistance, and developing personalized medicine strategies that are more targeted to genetic or molecular profiles.

- Epidemiological Studies: Biobank samples are used in large-scale epidemiological research to study how environmental factors, lifestyle choices, or genetics influence the risk of diseases. These studies often track individuals over time to observe health outcomes in relation to biological samples.

- Public Health Research: Biobanks play a key role in public health studies by providing data and samples that help assess the prevalence and impact of diseases in different populations. Researchers can use these samples to monitor trends and evaluate the effectiveness of interventions or public health policies.

- Personalized Medicine: As personalized medicine becomes more widespread, biobank samples are crucial for developing treatments tailored to individuals based on their genetic makeup. Researchers use samples to identify which treatments are most likely to be effective for patients with certain genetic profiles.

- Longitudinal Studies: Biobanks can store samples over long periods, allowing researchers to study changes in biomarkers over time. These studies can reveal how diseases develop and progress and help identify early indicators of diseases such as Alzheimer’s or diabetes.

Biobanking offers several significant benefits to scientific research, healthcare, and public health. Here are some key advantages:

- Advancement in Medical Research: Biobanks provide researchers with a rich repository of biological samples, enabling the study of diseases, genetics, and the biological mechanisms underlying health conditions. This accelerates medical discoveries and helps identify potential treatment targets.

- Improved Disease Diagnosis and Treatment: By analyzing samples from diverse populations, researchers can identify biomarkers that help in diagnosing diseases earlier and more accurately. This also contributes to the development of personalized treatments, tailoring therapies to individual genetic profiles.

- Facilitating Drug Development: Biobanks play a crucial role in drug discovery and testing. Pharmaceutical companies use samples to screen for potential drugs, test drug efficacy, and study the effects of medications on various genetic and molecular backgrounds.

- Better Understanding of Genetics: Biobanks store genetic data that can help researchers understand how genetic variations contribute to different diseases. This knowledge aids in the identification of genetic risk factors and the development of preventative measures for genetic disorders.

- Long-Term Health Data: Biobanks often collect samples and data over long periods, allowing for longitudinal studies. These studies provide insights into how diseases develop over time and how lifestyle, environment, and genetics influence health outcomes.

- Enhancing Public Health: Biobanks support epidemiological studies, allowing researchers to track disease trends and investigate environmental, social, and lifestyle factors that contribute to health issues. This information can guide public health policies and interventions.

- Promoting Collaboration: Biobanks create opportunities for global collaboration between researchers, institutions, and companies. By providing access to large and diverse datasets, they foster cross-disciplinary research and facilitate sharing of resources for common health challenges.

- Enabling Precision Medicine: Biobanks are essential for the growing field of precision medicine, where treatments are tailored to individuals based on their genetic, environmental, and lifestyle factors. By studying samples from specific populations, researchers can create more targeted and effective therapies.

- Supporting Rare Disease Research: Biobanks often contain samples from individuals with rare diseases, which may otherwise be difficult to study due to the limited number of patients. This enables research that can lead to better understanding and treatment options for rare conditions.

- Enhancing Population Health: By storing and analyzing samples from diverse populations, biobanks help ensure that medical research reflects the needs of different groups, leading to more inclusive and effective healthcare solutions for a wider range of individuals.

What are the Key Growth Drivers of the Biobanking Market?

The biobanking market includes the increasing focus on personalized medicine, advancements in genomic research, and the growing demand for high-quality biospecimens for drug discovery and clinical trials. Rising prevalence of chronic diseases, government and private funding for biobanking infrastructure, and technological innovations in sample storage and data management also play a major role in propelling market growth.

- For Instance, In June 2025, the University of Limerick and University Hospital Limerick jointly launched the region’s first cancer biobank. This initiative allows patients to donate tissue samples, supporting faster progress in cancer research and clinical trials while strengthening collaboration between healthcare and academic research to enhance diagnostics and treatment development.

What are the Major trends in the Biobanking Market in 2024?

- In July 2025, the German Biobank Node (GBN) is set to join the Network of University Medicine (NUM) following the Federal Ministry of Education and Research’s approval of NUM’s new funding phase (NUM 3.0). This integration aims to strengthen collaboration and research within Germany’s medical network.

- In May 2024, EIT Health launched the Biobanks and Health Data Portal to improve collaboration and expand the effective use of biobank resources in research and healthcare.

What is the Emerging Challenge in the Biobanking Market?

The biobanking market is ensuring ethical data management and donor privacy amid increasing data sharing and digitalization. Maintaining high-quality and standardized samples across global biobanks, along with managing long-term storage costs, also poses difficulties. Additionally, regulatory variations between regions and limited public awareness about biobanking practices further hinder its widespread adoption and operational efficiency.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9207

Segmental Insights

By Product Insights

What made the Biobanking Equipment Segment Dominant in the Biobanking Market in 2024?

In 2024, the biobanking equipment segment held the largest revenue share due to the growing demand for advanced storage systems, such as automated freezers and temperature-controlled units, to preserve biological samples effectively. Technological advancements improving sample quality, reliability, and traceability, along with increased investments in modern biobank infrastructure, further boosted the adoption of high-performance equipment across research and clinical applications.

- For Instance, In February 2024, Azenta, Inc. launched BioArc™ Ultra, an advanced and eco-friendly automated ultracold storage system designed for large-scale sample management. This innovative technology aims to enhance efficiency and set a new benchmark in the biorepository industry.

The laboratory information management systems (LIMS) segment is expected to grow at the fastest CAGR during the forecast period due to the increasing need for efficient data handling, sample tracking, and automation in biobanks. LIMS enhances data accuracy, streamlines workflows, and ensures regulatory compliance, making it essential for managing large volumes of biospecimen data. Moreover, the growing adoption of digital platforms and integration of AI-driven analytics further support the segment’s rapid expansion.

- For Instance, In April 2024, USAID, UNDP, the Ministry of Home Affairs, and New Growth Industries launched a fully operational LIMS for the NFSS Forensic Laboratory in Belize. Implemented under the InfoSegura project, the system aims to strengthen evidence-based policies and improve citizen security.

By Services Insights

How did Biobanking & Respiratory Segment Dominate the Biobanking Market in 2024?

In 2024, the biobanking & repository services segment held the largest market share due to the rising demand for high-quality storage and preservation of biological samples for research and clinical use. These services provide secure, long-term storage solutions ensuring sample integrity and accessibility for future studies. Additionally, growing investments in biomedical research and the expansion of large-scale biobanks globally further boosted the demand for reliable repository services.

The lab processing segment is projected to grow a lucrative rate during the forecast period due to the increasing need for efficient sample preparation, analysis, and quality control in research and clinical studies. Advancements in automation and high-throughput technologies are enhancing accuracy and reducing processing time. Moreover, the growing number of biobanks and demand for standardized sample handling protocols are driving the adoption of advanced lab processing services worldwide.

By Biospecimen Type Insights

Why the Human Tissues Segment Dominated the Biobanking Market in 2024?

In 2024, the human tissue segment accounted for the highest market share due to its critical role in biomedical research, disease modeling, and drug discovery. Human tissue samples provide valuable insights into disease mechanisms and treatment responses, making them essential for personalized medicine and translational research. Additionally, increasing demand for high-quality tissue samples in cancer and genetic studies further supported the dominance of this segment in the biobanking market.

The stem cells segment is anticipated to grow at the fastest CAGR during the forecast period due to the rising use of stem cells in regenerative medicine, cell therapy, and advanced research applications. Increasing clinical trials focused on stem cell-based treatments for chronic and genetic disorders are further driving demand. Moreover, growing investments in stem cell preservation and technological advancements in cryopreservation techniques are boosting the segment’s rapid expansion in the biobanking market.

By Biobank Type Insights

What Made the Physical/Real biobanks Segment Dominant in the Biobanking Market in 2024?

In 2024, the physical/real biobank segment dominated the market due to the increasing establishment of large-scale facilities for storing biological samples such as tissues, blood, and cells. These biobanks provide secure, long-term storage and are essential for clinical and translational research. Additionally, growing government and private investments in infrastructure development and expanding research collaborations further strengthened the segment’s market dominance.

The virtual biobank segment is expected to grow at a faster CAGR during the forecast period due to the rising adoption of digital platforms for data sharing, sample tracking, and remote access to biological information. Virtual biobanks enable efficient collaboration among researchers globally, reducing the need for physical storage. Additionally, advancements in data management technologies and the integration of artificial intelligence for analyzing large datasets are further driving the growth of this segment.

- For Instance, In June 2024, the University of Tartu’s Estonian Biobank launched a new online portal, allowing participants who submitted DNA samples to access detailed information about their genetic data.

By Application Insights

How did Therapeutics Segment Dominate the Biobanking Market in 2024?

In 2024, the therapeutics segment held the largest revenue share due to the growing use of biobanked samples in drug discovery, personalized medicine, and the development of targeted therapies. Biobanking supports the identification of disease biomarkers and accelerates clinical research, leading to more effective treatment solutions. Additionally, increasing investment in pharmaceutical R&D and the rising demand for precision-based therapies further strengthened the dominance of the therapeutics segment in the biobanking market.

The clinical diagnostics segment is expected to grow at the fastest CAGR in the biobanking market due to the increasing use of stored biological samples for early disease detection and personalized diagnostics. Advances in molecular testing, genomics, and biomarker research are driving demand for high-quality biobanked specimens. Additionally, the growing focus on precision medicine and the integration of biobanking with diagnostic research are further propelling this segment’s rapid growth.

By End Use Insights

Why the Pharmaceutical & Biotechnology Companies Segment Dominated the Biobanking Market in 2024?

In 2024, the pharmaceutical and biotechnology companies segment dominated the market as these organizations increasingly utilized biobanked specimens to validate drug efficacy and safety. The growing focus on developing innovative biologics and cell-based therapies fueled the need for well-preserved biological samples. Moreover, expanding partnerships between biobanks and pharma firms for translational research and the surge in precision medicine initiatives significantly boosted this segment’s market share.

The CRO & CMO segment is expected to grow at a significant rate during the forecast period due to the increasing outsourcing of research, clinical trials, and manufacturing activities by pharmaceutical and biotech companies. Biobanking supports these organizations in managing large-scale sample collections and data efficiently. Additionally, rising demand for cost-effective research solutions, expansion of personalized medicine studies, and growing collaborations between biobanks and contract service providers are driving this segment’s strong growth.

By Regional Analysis

How is Europe Contributing to the Expansion of the Biobanking Market?

Europe dominated the market due to the presence of well-established biobank networks, advanced healthcare infrastructure, and strong government support for biomedical research. Countries such as the U.K., Germany, and Sweden have extensive biobanking programs integrated with clinical and genomic studies. Additionally, growing investments in personalized medicine, favorable regulatory frameworks, and active collaborations between academic institutions and research organizations further strengthened Europe’s leading position in the global market.

How is Asia-Pacific Accelerating the Biobanking Market?

Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period due to rising investments in healthcare infrastructure, expanding genomic and clinical research, and increasing government support for biobanking initiatives. The growing prevalence of chronic diseases and the region’s focus on personalized medicine are also fueling demand for high-quality biological sample storage. Additionally, the emergence of advanced biobanking facilities in countries like China, Japan, and India is driving rapid market growth across the region.

Biobanking Market Value Chain Analysis

1. Sample Acquisition & Collection

This stage involves sourcing and obtaining biospecimens (e.g., tissues, blood, stem cells) from donors and research subjects, along with collecting associated metadata. Institutions like the Coriell Institute for Medical Research and large national repositories such as the UK Biobank lead in cultivating well-characterized specimen collections.

2. Preservation & Storage

Specimens must be preserved under optimal conditions, cryogenic, ambient, or otherwise, to ensure long-term viability. Thermo Fisher Scientific (via Fisher BioServices), BD (Becton, Dickinson & Co.), Merck KGaA, and Biomatrica stand out with advanced storage solutions, cold chain technologies, and ambient preservation innovations.

3. Lab Processing & Sample Management

At this stage, samples undergo processing steps such as aliquoting, extraction, purification, and quality control. Providers like Hamilton Company, Tecan, and Cryoport supply automation, liquid handling systems, and logistics services that ensure high-throughput, accurate, and consistent specimen handling.

4. Data Management & Informatics

Management of sample metadata, tracking, and analytics is critical. Solutions from Thermo Fisher (LIMS), Tecan, AstridBio, and digital platforms from Qiagen power efficient sample inventory, integration with research informatics, and quality assurance workflows.

5. Distribution & Access

This stage encompasses facilitating access to biobank specimens and ensuring secure, compliant transfer to researchers or industry partners. Organizations such as BioIVT, Novogene, and the Coriell Institute provide curated, high-quality sample collections, enabling diverse applications from rare disease studies to translational research.

6. Analytics & Value-Added Services

Beyond storage, many biobanks now offer analytical services including assay development, biomarker discovery, and genomic profiling. Companies like Novogene and Qiagen enhance research value by coupling specimen management with sequencing and molecular analysis capabilities.

Key Companies Operating in the Biobanking Market

- Thermo Fisher Scientific

The company offers comprehensive biobanking solutions, including cryogenic storage systems, automated sample handling platforms, and LIMS. Its broad portfolio and global presence make it a one-stop provider for preservation, management, and analytics.

- Merck KGaA

It provides essential consumables such as cryopreservation reagents, cell culture media, and sample-safe consumables. With a strong European footprint, it supports biobanks’ foundational needs for quality and compliance.

- Qiagen

Qiagen supplies advanced sample preparation and automation systems, like QIAsymphony and QIAcube, tailored for genomic and molecular biobanking workflows. These solutions streamline sample processing and integrate well with research needs.

- Becton, Dickinson and Company (BD)

BD focuses on sample collection and preservation with products like blood collection tubes, cryovials, and integrated diagnostic tools. Their automation and digital tracking help enhance sample integrity and laboratory efficiency.

- PHC Holdings (PHCbi)

The company specializes in energy-efficient, ultra-low-temperature freezers and cold storage systems. Its sustainable biobanking solutions are especially valued in regions emphasizing green technology and cost-effective long-term storage.

- Hamilton Company

Hamilton provides automated liquid handling systems (e.g., Microlab STAR, easyBlood) and high-throughput storage solutions like BiOS, crucial for large-scale biobanks. For instance, their automation is powering the All of Us Research Program Biobank, designed to manage over 35 million biospecimens for precision medicine research.

- BioLife Solutions

BioLife Solutions strengthens the biobanking ecosystem by delivering high-performance preservation media, secure storage infrastructure, and smart logistics, all essential for ensuring the integrity, accessibility, and reliability of valuable biospecimens in research and therapy development.

- Novogene

Novogene empowers the biobanking ecosystem by enhancing sample value with rich genomic data, delivering robust automation and quality, and providing global, scalable sequencing infrastructure, thereby advancing research outcomes and enabling precision medicine efforts.

- Coriell Institute

It provides comprehensive biobanking services, including standardized sample collection and advanced management systems, which support high-quality, accessible biospecimens for research. Additionally, through collaborations with major research institutions and specialized biobanks, Coriell enhances scientific discovery and drives innovation across various fields such as genetics, cancer, and stem cell research.

Recent Developments in the Biobanking Market

- In May 2024, Abu Dhabi Biobank, launched in collaboration with M42 and the Department of Health Abu Dhabi (DoH), introduced the region’s largest hybrid cord blood bank as its first major initiative.

- In April 2024, UK Biobank launched the Global Researcher Access Fund to expand worldwide access to its biomedical database. The fund covers application fees for approved researchers from institutions in developing countries, promoting inclusive scientific collaboration.

More Insights in Nova One Advisor:

- Biopharmaceuticals Contract Manufacturing Market – The global biopharmaceuticals contract manufacturing market size was estimated at USD 45.15 billion in 2024 and is projected to hit around USD 131.71 billion by 2034, growing at a CAGR of 11.3% during the forecast period from 2025 to 2034.

- U.S. Single-use Bioprocessing Market – The U.S. single-use bioprocessing market size is calculated at USD 9.65 billion in 2024, grows to USD 11.10 billion in 2025, and is projected to reach around USD 39.24 billion by 2034, grow at a CAGR of 15.06% from 2025 to 2034.

- Single-use Bioprocessing Market – The global single-use bioprocessing market size is calculated at USD 33.55 billion in 2024, grows to USD 39.01 billion in 2025, and is projected to reach around USD 151.48 billion by 2034. grow at a CAGR of 16.27% from 2025 to 2034.

- Biopharmaceutical CDMO Market – The global biopharmaceutical CDMO market was valued at USD 21.15 billion in 2024 and is projected to hit around USD 49.61 billion by 2034, expanding at a CAGR of 8.9% during the forecast period of 2025 to 2034.

- Biologics CDMO Market – The global biologics CDMO market size is calculated at USD 22.45 billion in 2024, grows to USD 25.92 billion in 2025, and is projected to reach around USD 94.60 billion by 2034, growing at a solid CAGR of 15.47% from 2025 to 2034.

- Synthetic Biology Market – The synthetic biology market size was exhibited at USD 16.35 billion in 2024 and is projected to hit around USD 80.70 billion by 2034, growing at a CAGR of 17.31% during the forecast period 2025 to 2034.

- Biologic Drugs Market – The global biologic drugs market size is calculated at USD 453.25 billion in 2024, grows to USD 496.04 billion in 2025, and is projected to reach around USD 1,117.12 billion by 2034, growing at a CAGR of 9.44% during the forecast period from 2025 to 2034.

- Biological Safety Testing Market – The global biologics safety testing market size is calculated at USD 5.35 billion in 2024, grows to USD 6.07 billion in 2025, and is projected to reach around USD 18.78 billion by 2034, expanding at a CAGR of 13.38% from 2025 to 2034.

- Veterinary Medicine Market – The global Veterinary Medicine market gathered revenue around USD 50.45 billion in 2024 and market is set to grow USD 116.19 billion by the end of 2034 and is estimated to expand at a modest CAGR of 8.7% during the prediction period 2025 to 2034.

- U.S. Biosimulation Market – The U.S. biosimulation market size was estimated at USD 2.15 billion in 2024 and is expected to reach USD 9.82 billion by 2034, expanding at a CAGR of 16.4% during the forecast period of 2025 to 2034.

- 3D Bioprinting Market – The global 3D bioprinting market size is calculated at USD 2.59 billion in 2024, grows to USD 2.92 billion in 2025, and is projected to reach around USD 8.57 billion by 2034, growing at a CAGR of 12.7% from 2025 to 2034.

- Biopharmaceutical Third-party Logistics Market – The global biopharmaceutical third-party logistics size was exhibited at USD 143.65 billion in 2024 and is projected to hit around USD 271.94 billion by 2034, growing at a CAGR of 6.59% during the forecast period of 2025 to 2034.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the biobanking market.

By Product

- Biobanking Equipment

- Temperature Control Systems

- Freezers & Refrigerators

- Cryogenic Storage Systems

- Thawing Equipment

- Incubators & Centrifuges

- Alarms & Monitoring Systems

- Accessories & Other Equipment

- Temperature Control Systems

- Biobanking Consumables

- Laboratory Information Management Systems

By Service

- Biobanking & Repository

- Lab Processing

- Qualification/ Validation

- Cold Chain Logistics

- Other Services

By Biospecimen Type

- Human Tissues

- Human Organs

- Stem Cells

- Adult Stem Cells

- Embryonic Stem Cells

- IPS Cells

- Other Stem Cells

- Other Biospecimens

By Biobanks Type

- Physical/Real Biobanks

- Tissue Biobanks

- Population Based Biobanks

- Genetic (DNA/RNA)

- Disease Based Biobanks

- Virtual Biobanks

By Application

- Therapeutics

- Drug Discovery & Clinical Research

- Clinical Diagnostics

- Other Applications

By End-use

- Pharmaceutical & Biotechnology Companies

- CROs & CMOs

- Academic & Research Institutes

- Hospitals

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9207

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.