This report, published by Towards Healthcare, a sister firm of Precedence Research, provides an in-depth analysis of the global Medical Device CMO and CDMO market, covering market size, key players, emerging trends and growth dynamics shaping the industry’s future.

Ottawa, Nov. 06, 2025 (GLOBE NEWSWIRE) — The medical device CMO and CDMO market is experiencing robust growth and is projected to generate substantial revenue over the forecast period from 2025 to 2034. This upward trend is driven by shifting consumer preferences, rapid technological innovation, and the growing need for operational efficiency within the medical device industry.

As manufacturers increasingly outsource production, assembly, and development processes, contract manufacturing and development organizations (CMOs and CDMOs) are becoming vital partners in enhancing productivity, reducing costs, and accelerating time-to-market. The market’s expansion is further fueled by the rising demand for advanced medical devices, stringent regulatory standards, and continuous technological advancements.

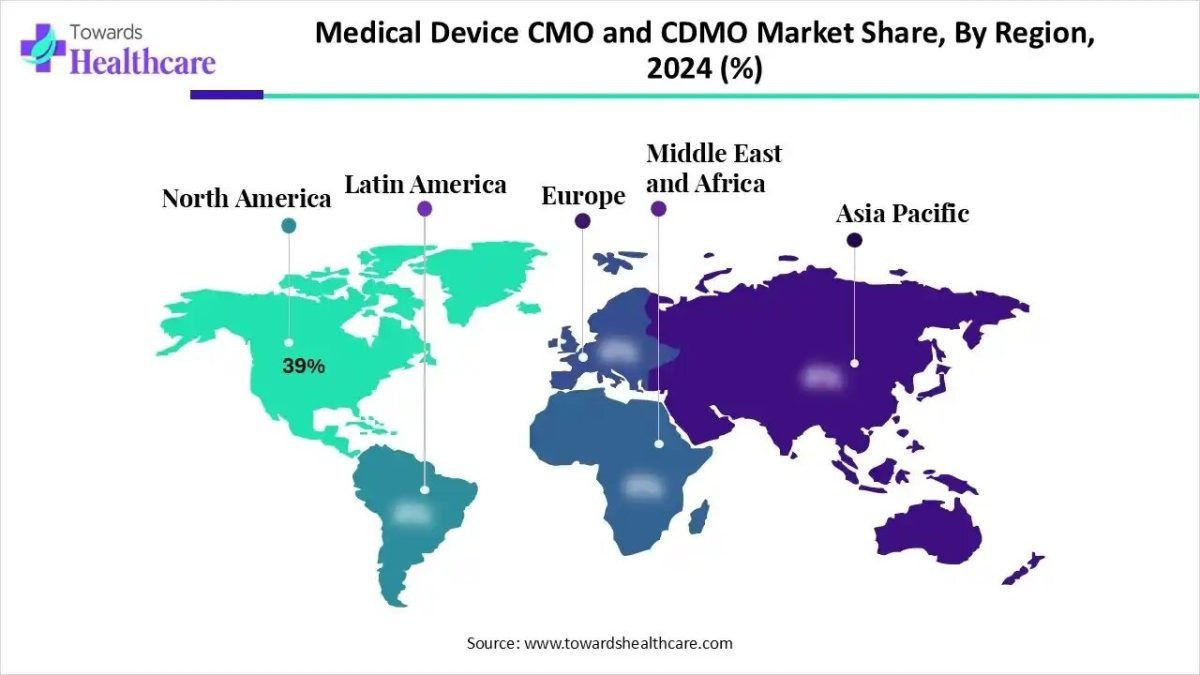

Regionally, North America currently dominates the market, supported by a well-established healthcare infrastructure and a strong presence of major medical device companies. Meanwhile, Europe and the Asia-Pacific regions are emerging as high-growth markets, driven by increasing healthcare investments and expanding adoption of outsourced manufacturing and development services.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6249

Key Takeaways

- North America held a major share of the market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the studied years.

- By service type, the component manufacturing segment held the largest market share in 2024.

- By service type, the finished device assembly segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By device class, the class II devices segment led the medical device CMO and CDMO market with the largest revenue share in 2024.

- By device class, the class III devices segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By device type, the orthopedic devices segment led the market with the largest revenue share in 2024.

- By device type, the drug-device combination products segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By material/technology platform, the ceramics segment dominated the market.

- By material/technology platform, the electronics/mechatronics segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the large medical device OEMs segment held the largest medical device CMO and CDMO market share in 2024.

- By end user, the mid-size & emerging OEMS segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is a Medical Device CMO and CDMO?

The global medical device CMO and CDMO market involves the outsourcing of development and/or manufacturing processes for medical devices to third-party specialist firms. This market provides crucial services to original equipment manufacturers (OEMs), who can then reduce capital expenditure, access specialized technologies like advanced 3D printing and automation, and accelerate time-to-market by focusing on their core competencies like research and marketing.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drivers in the Medical Device CMO and CDMO Market?

A prominent driver is the adoption of advanced manufacturing technologies, rising outsourcing of non-care functions like manufacturing and development, to focus internal resources on research & development, marketing, and sales. Stringent and complex regulatory landscape, rising complexity of devices, and expansion in emerging markets.

What are the Major Trends in the Medical Device CMO and CDMO Market?

- In June 2024, DuPont acquired Donatelle Plastics Incorporated to bring advanced capabilities in medical device injection moulding and assembly in-house.

- In February 2025, Jabil acquired Pharmaceutics International Inc. to broaden its integrated healthcare and drug-device combination product capabilities.

- In March 2024, Alcami Corporation and Tanvex CDMO (March 2024) partnered to offer a complete solution from bulk drug substance to finished drug products.

What is the Emerging Challenge in the Medical Device CMO and CDMO Market?

The market is mainly facing a hurdle in the rising connectivity of medical devices, increasing cybersecurity risk, supply chain volatility and geopolitical risk. Significant shortage in qualified professionals, particularly in specialized areas, and high cost of innovation hindered the market growth.

Regional Analysis

How did North America Dominate the Market in 2024?

In 2024, North America captured the biggest revenue share of the market. The mature healthcare infrastructure and robust ecosystem of major pharmaceutical and biotech firms. The significant R&D investment, a clear regulatory framework, and high demand for advanced and complex medical devices. This established environment and the presence of leading CDMOs and OEMs cemented the region’s market leadership.

For instance,

- In October 2024, Biomerics launched new metal injection molding (MIM) services to strengthen its focus on advanced metals manufacturing for complex, high-precision interventional devices.

Why did Asia Pacific Grow Notably in the Market in 2024?

Asia Pacific is anticipated to expand at a rapid CAGR during 2025-2034 in the medical device CMO and CDMO market. The cost-effective manufacturing and a large, skilled workforce. The region became a prime destination for global companies seeking supply chain diversification and lower costs, driven by countries like India and China offering strong capabilities and supportive government initiatives. Investments in advanced manufacturing technologies and local facility expansions.

For instance,

- In November 2024, Terumo BCT partnered with Terumo Medical Products to invest in a production facility in Hangzhou to provide locally made blood collection and apheresis devices for the Chinese market.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Major Medical Device CMOs and CDMOs with Certified Facility in 2024-2025

| Facility | |

| Lonza Group AG | Received GMP licenses from the FDA, EMA, and MHRA for various products. |

| Thermo Fisher Scientific Inc. | FDA-registered and compliant with global standards, supporting end-to-end services for small molecules, biologics, and cell/gene therapies. |

| Jabil Inc. | They operate FDA-registered facilities and have a strong North American presence. |

Segmental Insights

By Service Type Analysis

Which Service Type Led the Medical Device CMO and CDMO Market in 2024?

The component manufacturing segment accounted for a dominant share of the market in 2024. They are increasing their operational efficiency and focusing on core competencies like R&D. The rising demand for complex medical devices (especially Class II and Class III) and the need for faster time-to-market and enhanced supply chain resilience.

However, the finished device assembly segment is predicted to expand at a lucrative CAGR. The OEMs are increasingly outsourcing to manage the complexity of modern medical devices. This trend allows manufacturers to significantly accelerate time-to-market and reduce capital expenditure while leveraging CDMOs’ specialized expertise and advanced automation technologies like robotics. The ability of contract manufacturers to navigate stringent regulations and provide scalable, cost-effective assembly solutions

By Device Class Analysis

What Made the Class II Devices Segment Dominant in the Market in 2024?

The class II segment held a major revenue share of the medical device CMO and CDMO market in 2024. This is a wide product range and diverse applications. Outsourcing for these devices, which require specialized controls but less intense regulation than Class III, provided significant cost and efficiency benefits to OEMs.

However, the class III devices segment is estimated to expand rapidly in the predicted timeframe. OEMs increasingly rely on CMOs and CDMOs to manage the extreme complexity and high risk associated with life-sustaining products like pacemakers and heart valves. This outsourcing trend allows manufacturers to leverage specialized expertise and advanced manufacturing technologies while avoiding significant capital investment and navigating stringent regulatory scrutiny more effectively.

By Device Type Analysis

What Made the Orthopaedic Devices Segment Dominant in the Market in 2024?

The orthopaedic devices segment held a major revenue share of the medical device CMO and CDMO market in 2024. The sustained high demand from an ageing global population with musculoskeletal conditions. The orthopaedic OEMs are outsourcing complex, high-precision manufacturing of implants to specialized CDMOs, leveraging their advanced technologies like 3D printing for cost-efficiency, expertise, and adherence to strict regulatory standards.

On the other hand, the drug-device combination products segment is estimated to expand rapidly in the predicted timeframe. The rising prevalence of chronic diseases and demand for convenient, patient-centric solutions like insulin pumps and autoinjectors. This growth is accelerated by the complex manufacturing and regulatory needs of these advanced products, which push original equipment manufacturers (OEMs) to partner with specialized CDMOs.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Material/technology Platform Analysis

What Made the Ceramics Segment Dominant in the Market in 2024?

The ceramics segment held a major revenue share of the medical device CMO and CDMO market in 2024. The high demand in orthopaedic and dental applications is due to its superior biocompatibility, durability, and wear resistance. OEMs strategically outsourced manufacturing of these ceramic-based devices to specialized CDMOs, leveraging their expertise in advanced materials and technologies like 3D printing.

However, the electronics/mechatronics segment is estimated to expand rapidly in the predicted timeframe. Due to the surge in demand for complex, connected devices, wearable tech, and IoMT applications. This expansion necessitates specialized expertise in miniaturization, robotics, and integrated electronics, which OEMs increasingly source from CDMOs to manage complexity and reduce costs. Leveraging advanced manufacturing capabilities and strategic partnerships allows CDMOs to accelerate time-to-market for innovative digital health solutions.

By End-user Analysis

What Made the Large Medical Device OEMs Segment Dominant in the Market in 2024?

The large medical device OEMs segment held a major revenue share of the medical device CMO and CDMO market in 2024. The OEMs’ ability to reduce capital expenditures, mitigate regulatory risks, and focus internal resources on core competencies like R&D and commercialization. By outsourcing to CDMOs for specialized expertise, scalability, and enhanced cost-efficiency, large OEMs accelerated their time-to-market and maintained market leadership, while navigating a highly regulated and competitive landscape.

However, the mid-size & emerging OEMs segment is estimated to expand rapidly in the predicted timeframe. There is access to expertise and technology, cost efficiency and reduced capital investment, and regulatory support. Their emphasis on faster time-to-market, access to innovative technologies, and global distribution through contract partners drives strong adoption.

Browse More Insights of Towards Healthcare:

The global medical device CRO market was valued at USD 8.49 billion in 2024, increased to USD 9.25 billion in 2025, and is projected to reach approximately USD 19.9 billion by 2034, expanding at a CAGR of 8.98% from 2025 to 2034.

The medical device testing market was valued at USD 10.77 billion in 2025 and is expected to reach USD 24.32 billion by 2034, registering a CAGR of 9.47% during the forecast period.

The global medical device outsourcing market stood at USD 160.3 billion in 2024, rose to USD 180.59 billion in 2025, and is anticipated to reach USD 507.89 billion by 2034, witnessing robust growth at a CAGR of 12.65% between 2025 and 2034.

The medical device gaskets & seals market was estimated at USD 0.92 billion in 2023 and is projected to grow to USD 1.57 billion by 2034, expanding at a CAGR of 5% from 2024 to 2034.

The global medical device contract manufacturing market was valued at USD 78.61 billion in 2024, increased to USD 87.14 billion in 2025, and is forecasted to reach USD 220.57 billion by 2034, growing at a CAGR of 10.86% from 2025 to 2034.

The 3D printed medical devices market is expected to surge from USD 5.59 billion in 2025 to USD 24.69 billion by 2034, reflecting an impressive CAGR of 17.94% during 2025–2034.

The global Class C & Class D medical devices market was valued at USD 55.13 billion in 2024, expected to reach USD 69.52 billion in 2025, and projected to hit approximately USD 559.55 billion by 2034, expanding rapidly at a CAGR of 26.12% throughout the forecast period.

The AI in medical devices market reached USD 22.29 billion in 2024, grew to USD 32.21 billion in 2025, and is anticipated to skyrocket to USD 886.39 billion by 2034, growing at an exceptional CAGR of 44.53% between 2025 and 2034.

The global wearable medical devices market was valued at USD 42.78 billion in 2024, expanded to USD 53.68 billion in 2025, and is expected to reach USD 408.61 billion by 2034, growing rapidly at a CAGR of 25.57% from 2025 to 2034.

Lastly, the global implantable medical devices market was valued at USD 97.17 billion in 2024, rose to USD 103.14 billion in 2025, and is projected to reach USD 176.33 billion by 2034, advancing at a CAGR of 6.14% during the forecast period.

What are the Revolutionary Developments in the Medical Device CMO and CDMO Market?

- In January 2025, Arterex acquired Adroit and Phoenix to strengthen global footprints and offer end-to-end solutions, particularly in Europe.

- In January 2024, Integer Holdings acquired Pulse Technologies to enhance its micro-machining capabilities for structural heart devices.

Key Players List:

- Orchid Orthopedic Solutions

- Phillips-Medisize (a Molex company)

- SMC Ltd.

- Tecomet Inc.

- Nemera (drug delivery device CDMO)

- Celestica Inc.

- West Pharmaceutical Services (drug-device combination CDMO)

- Gerresheimer AG (medical device CDMO division)

- Viant Medical

- Creganna Medical (part of TE Connectivity)

- Tessy Plastics

- Providien (a Carlisle company)

- Nypro (Jabil subsidiary)

- Benchmark Electronics

- Nolato AB

Segments Covered in this Report

By Service Type

- Product Design & Development

- Prototyping & Rapid Manufacturing

- Process Development & Validation

- Component Manufacturing

- Finished Device Assembly

- Sterilization, Packaging, and Labeling

- Quality & Regulatory Support

By Device Class

- Class I Devices

- Class II Devices

- Class III Devices

- Others

By Device Type

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging Devices

- Minimally Invasive Surgical Devices

- Drug-Device Combination Products

- Dental Devices

- Ophthalmic Devices

- Wearables & Digital Health Devices

By Material/Technology Platform

- Metals

- Polymers

- Ceramics

- Electronics/Mechatronics

- Others

By End User

- Large Medical Device OEMs

- Mid-size & Emerging OEMs

- Startups & Innovators

- Academic/Research Institutions collaborating on new device technologies

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6249

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.