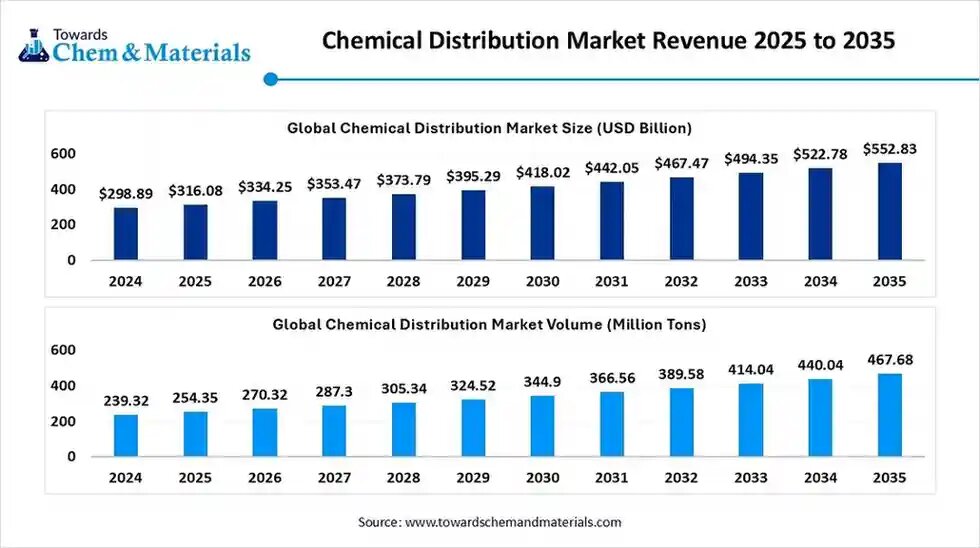

According to Towards Chemical and Materials, the global chemical distribution market size is calculated at USD 316.08 billion in 2025 and is expected to surpass around USD 552.83 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.75% over the forecast period 2025 to 2035.

Ottawa, Nov. 06, 2025 (GLOBE NEWSWIRE) — The global chemical distribution market size was valued at USD 298.89 billion in 2024 and is anticipated to reach around USD 552.83 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.75% over the forecast period from 2025 to 2035. The increased demand for specialty chemicals in industries like construction, pharmaceuticals, automotives, agriculture, and electronics is driving the global chemical distribution market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

According to Towards Chemical and Materials, the global chemical distribution market is experiencing rapid growth, with volumes expected to increase from 254.35 million tons in 2025 to 467.68 million tons by 2035, representing a robust CAGR of 6.28% over the forecast period.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5581

What is Chemical Distribution?

The global chemical distribution market is a vital link in the supply chain, facilitating the movement of a wide range of chemical products from manufacturers to diverse end-use industries. The need for chemical distribution has increased due to rapid industrialization, urbanization, and a significantly expanding manufacturing base in emerging regions. North America and Europe are playing a significant role in chemical distribution due to their robust industrial foundries and strict regulatory environment.

Multiple industries are major consumers of chemical products, with increased demand for value-added services offered by chemical distributors, the market is expected to grow in the upcoming period. Chemical manufacturing companies are focusing on Chemical manufacturing companies are focusing on adhering with local and international safety and environmental regulations like OSHA, REACH, and GHS. With spectacular innovations ongoing in Technical Support to provide expertise on chemical handling, use, and regulatory complaints, the industry is maturing rapidly.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Chemical Distribution Market Report Highlights

- The Asia pacific chemical distribution market volume is estimated at 109.91 million tons in 2025, and is expected to reach 216.81 million tons by 2035, at a CAGR of 7.03% during the forecast period 2025-2035

- The Asia Pacific chemical distribution market is was estimated at USD 186.04 billion in 2025 and is projected to reach USD 326.01 billion by 2035, growing at a CAGR of 5.77% from 2025 to 2035.

- The Asia Pacific chemical distribution market dominated with the largest Volume Share of 42.91% in 2024

- The North America chemical distribution market is expected to grow at a CAGR of over 5.62% from 2025 to 2034

- The Europe has held Volume Share of around 22.12% in 2024.

- By product, the Commodity chemicals segment led the market with the largest Volume Share of 76.43% in 2024.

- By product, the specialty chemicals segment is anticipated to register the fastest growth with a CAGR of 5.10% worldwide during the forecast period.

- By end use, the industrial manufacturing segment accounted for the largest Volume Share of 26.90% in 2024.

- By end use, the pharmaceuticals segment is likely to be the fastest-growing segment with a CAGR of 7.95% during the coming years

Chemical distributors can add value by offering the following services:

- Connecting supply and demand: Chemical distributors help chemical producers sell hard-to-reach customers, while helping their customers to find the products they need as inputs for their processes.

- Handling services: Chemical distributors offer a wide variety of handling services, from storage and transport to blending, formulating, repackaging and relabeling.

- Quality assurance: Chemical distributors pride themselves in delivering the chemicals on time and on spec, often using lab tests for quality assurance.

- Safety measures: Chemical distributors often work with dangerous chemicals. It is up to them to ensure the safe and secure storage, transport and delivery of these products.

- Regulatory compliance: Chemical distributors make sure their products comply with local laws. This includes regulations for substance registration, labelling, packaging, customs clearance and import/export.

- Financing assistance: Chemical distributors may help customers with financing, for instance by offering the possibility of payment schedules.

- Advice: Over 60,000 chemical substances are listed in the product portfolios of chemical distributors globally. Chemical distributors help their customers choose the right product based on their performance and sustainability profile.

- Sustainability: In addition to reducing the impact of their own operations, chemical distributors help customers with improving their products, optimizing production processes or substituting dangerous substances with safer ones.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5581

Chemical Distribution Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 334.25 billion |

| Revenue forecast in 2035 | USD 552.83 billion |

| Growth rate | CAGR of 5.75% from 2025 to 2035 |

| Actual data | 2021 – 2025 |

| Forecast period | 2025 – 2035 |

| Quantitative units | Revenue in USD million/billion, volume, and CAGR from 2025 to 2035 |

| Regional Scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Segments covered | By Product, By End Use, By Region |

| Key companies profiled | Univar Solutions Inc.; Helm AG; Brenntag AG; Ter Group; Barentz; Azelis; Safic Alan; ICC Industries, Inc.; Jebsen & Jessen Pte. Ltd.; Quimidroga; Solvadis Deutschland GmbH; Ashland; Caldic B.V.; Wilbur Ellis Holdings, Inc.; Omya AG; IMCD; Biesterfeld AG; Stockmeier Group; REDA Chemicals; Manuchar |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Key Supply Chain Strategies for Optimizing Chemical Distribution

1. Leveraging Technology for Human Rights in Supply Chain Operations

Technology is key in promoting ethical practices across supply chains. By implementing systems like Transportation Management Systems (TMS) and Warehouse Management Systems (WMS), companies can enhance transparency and efficiency, ensuring fair labor practices and safer working conditions. These systems help track shipments, improve order processing, and manage inventory in real time, making it easier to identify and address issues related to human rights, such as child labor, unsafe working environments, or wage discrepancies.

Predictive analytics tools can be used to forecast demand, allowing businesses to avoid overproduction that might lead to exploitative labor practices or unsafe working conditions. By gaining better visibility into the supply chain, businesses can make more informed decisions that align with human rights standards.

2. Strategic Supplier Relationships with a Focus on Ethical Practices

Building strong, ethical relationships with suppliers is fundamental for ensuring human rights standards across the supply chain. Suppliers are crucial in providing raw materials and ensuring product quality, but they also play a significant role in promoting safe, fair working conditions. By developing transparent partnerships, companies can foster trust and encourage ethical practices in all areas, from labor rights to environmental stewardship.

Collaborating on joint supply chain solutions, with an emphasis on fair wages, safe working environments, and responsible sourcing, can lead to better overall outcomes for both businesses and workers. This collaboration reduces the risk of labor violations and helps ensure that supply chain disruptions are dealt with in a socially responsible way.

3. Sustainability and Human Rights in Supply Chain Management

Sustainability goes hand in hand with human rights, especially in industries like chemicals, where production processes can have significant environmental impacts. The pressure to minimize ecological footprints must also include a focus on human rights, particularly in vulnerable communities impacted by industrial activities.

By implementing supply chain strategies that prioritize waste reduction, energy efficiency, and eco-friendly sourcing, companies can reduce harmful effects on the environment and the communities that depend on it. Ethical sourcing of raw materials, such as fair trade practices, and collaborating with suppliers who adopt responsible production methods, can protect the rights of workers and local populations.

4. Inventory Optimization with Human Rights in Mind

Efficient inventory management is not only about cost savings—it’s about ensuring that companies do not contribute to exploitative practices in their supply chains. Maintaining optimal inventory levels helps avoid situations where workers are pushed to meet unsustainable production targets, often leading to violations of labor rights, such as forced overtime or unsafe working conditions.

By using advanced tools like inventory forecasting and demand planning systems, companies can anticipate demand and maintain adequate stock levels without overburdening workers or suppliers. Ethical supply chain management also means avoiding overproduction that results in waste or unnecessary environmental degradation.

5. Adopting Just-in-Time (JIT) Delivery Systems with Fair Labor Considerations

Just-in-Time (JIT) delivery strategies help reduce waste and improve efficiency, but they must be implemented with a focus on the well-being of workers. While JIT can reduce storage costs and unnecessary stockpiling, it also requires strong, ethical coordination with suppliers to ensure that workers’ rights are respected, such as avoiding excessive work hours or unsafe transportation conditions.

For JIT to be effective in promoting human rights, companies must maintain open communication with suppliers, logistics providers, and other stakeholders to prevent disruptions that could lead to unfair labor practices or harm to workers. Additionally, having contingency plans to address unexpected delays can safeguard against exploitation during crises.

6. Implementing Human Rights-Based Risk Management Frameworks

Risk management is not just about financial or operational concerns; it must also address human rights risks in the supply chain. Companies need to have robust frameworks in place to assess, mitigate, and respond to potential human rights violations, such as unsafe working conditions, forced labor, or environmental harm.

This could include diversifying suppliers who align with ethical practices, ensuring that transportation providers adhere to fair labor standards, and ensuring compliance with local and international human rights and environmental regulations. Companies should also regularly audit their supply chains to ensure they meet these standards and prevent the exploitation of workers and communities.

What are the Key Sustainability Trends in the Chemical Distribution Industry?

- Circular Economy Integration: Distributors are moving from a linear “take-make-dispose” model to one that promotes reuse, recycling, and recovery of materials and packaging, which minimizes waste and maximizes resource utilization across the supply chain.

- Decarbonization and Net-Zero Commitments: Companies are setting ambitious targets to reduce greenhouse gas emissions across all scopes (1, 2, and 3) by improving energy efficiency, switching to renewable energy sources, and optimizing transportation logistics.

- Shift Towards Bio-based and Green Chemicals: In response to customer demand and regulation, distributors are expanding their portfolios to include more sustainable products, such as those made from renewable feedstocks or produced using green chemistry principles that reduce the use and generation of hazardous substances.

- Enhanced Supply Chain Transparency and Traceability: The use of digital tools like AI, Big Data, and blockchain is increasing to ensure full visibility of products from raw material sourcing to end-of-life, which builds stakeholder trust and aids in regulatory compliance.

- Stricter Regulatory Compliance and Reporting: New mandatory ESG reporting directives and regulations (such as the EU’s CSRD) are forcing companies to track and report their sustainability performance with greater accuracy and transparency, making sustainability a legal obligation rather than an optional initiative.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5581

Chemical Distribution Market Trends:

- Digital Transformation: Chemical distributors are increasingly adopting digital technologies, such as e-commerce platforms, AI-driven inventory management, and data analytics. This transformation enhances operational efficiency, improves supply chain visibility, and provides faster, more reliable customer service.

- Emphasis on Sustainability and Green Chemistry: Growing environmental concerns and stringent regulations are pushing the industry toward sustainable practices. Distributors are expanding their portfolios to include bio-based and eco-friendly products, while also implementing green logistics like reduced carbon footprints in transportation and waste management.

- Rising Demand for Specialty Chemicals: There is a significant shift in demand from commodity to high-value specialty chemicals used in industries like pharmaceuticals, electronics, and personal care. Distributors are focusing on offering more value-added services, such as technical support and customized solutions, to meet the specific needs of these niche markets.

- Supply Chain Resilience and Regionalization: Recent global disruptions have highlighted the need for more robust and flexible supply chains. Companies are diversifying their supplier bases, investing in local infrastructure, and leveraging advanced logistics to mitigate risks and ensure a steady supply of materials.

- Mergers and Acquisitions (M&A) and Consolidation: The market is experiencing a wave of M&A activity as larger players acquire smaller, regional distributors to expand their geographic reach, diversify product portfolios, and achieve economies of scale. This consolidation helps companies strengthen their market presence and optimize operational efficiency in a competitive landscape.

AI to Transform the Chemical Distribution Process:

There is a significant insight about the technological a reshape of supply chains with AI, IoT, blockchain, and big data. To improve supply chain resilience, chemical companies are focusing on adapting AI and digital tools for separating signals from noise in the largest amount of data to enable faster and data-driven decision making in real time.

AI is playing a crucial role in the supply chain distribution process, including risk quantification, detection of alternatives, scenario planning, and diversifying sourcing options, which helps to reduce reliance on single regions. AI further enabling advantages, such as logistics & inventory optimization, smart procurement & demand forecasting, comply with regulatory compliance & safety standards, and enhance automation & operation efficiency.

Key Market Opportunities

Rapid Industrialization and Urbanization: The chemical distribution industry is witnessing significant growth in emerging economies like China, India, and Southeast Asia due to their rapid industrialization and urbanization. The expanding industries like automotive, consumer goods, and construction are increasing demands for chemicals and expanding up operations and establishment of local partnerships and strategies.

Shift Towards Specialty Chemicals: There is a rising search for specialty chemicals driven by a shift toward application-specific and high-value chemical utilization in cutting-edge industries like personal care, cosmetics, electronics, and pharmaceuticals. These industries are emphasizing on adoption of specialty chemicals for a higher profit margin and customized solutions.

Limitations & Challenges:

- Stringent Regulatory Compliance: Adhering to the complex and evolving maze of global safety, environmental, and transport regulations is a major and costly challenge for distributors.

- Supply Chain Volatility and Disruptions: The industry is vulnerable to unpredictable raw material prices, geopolitical issues, and logistics bottlenecks, which can cause shortages and increase costs.

Chemical Distribution Market Segmentation Insights

Product Insights

Which Product Dominates the Chemical Distribution Market?

The commodity chemicals segment dominated the market in 2024, due to its large-scale production volume and increased demand in multiple industries. Commodity chemicals provide broad industrial applications. Commodity chemicals like solvents, acids, alcohols, alkaline, and polymers are produces in high volumes and help form the required raw materials for industries like agriculture, automotive, textiles, packaging, construction, and manufacturing.

The specialty chemicals segment is the fastest-growing segment in the market, driven by its continued demand for high-performance, application-specific chemical solutions and customization in various industries. Specialty chemicals offer high value with their tailored solutions to meet specific functional requirements and industries like personal care, electronics, food processing, automotive, pharmaceuticals, and construction. The growing emphasis on emphasis on innovation-driven and customized products is fueling demand for specialty chemicals and boosting the role of distributors specializing in these chemicals.

End-use Insights

Which End-use Dominates the Chemical Distribution Market?

The industrial manufacturing segment dominated the market in 2024, due to high adoption of chemicals in the industrial manufacturing process. The manufacturing industry is one of the largest and most diverse end-users of chemicals, which uses them in a wide range of production processes. The demand for commodity and specialty chemicals is high in this industry for various applications, including lubricants, coatings, metal treatment, adhesives, cleaning agents, and process chemicals improve manufacturing efficiency and product quality.

The pharmaceuticals segment is expected to grow fastest at the forecast period, due to increasing demand for medicines and specialty chemicals which utilized in drug formulation and manufacturing. The growing innovation and developments of medicines requiring active pharmaceutical ingredients (APIs) are fuelling the need for chemicals. Pharmaceutical products have a high dependency on a broad range of high-purity solvents, intermediates, expertise, and reagents, and the material with precise quality control and strict regulatory compliance.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5581

Regional Insights

Asia’s Chemical Command: Inside the Region Dominating Global Distribution

The Asia Pacific chemical distribution market is was estimated at USD 186.04 billion in 2025 and is projected to reach USD 326.01 billion by 2035, growing at a CAGR of 5.77% from 2025 to 2035. The Asia Pacific chemical distribution market stands at 109.91 million tons in 2025 and is forecast to reach 216.81 million tons by 2035, growing at a CAGR of 7.03% from 2025 to 2035.

Asia Pacific dominates the global market due to its rapid industrialization, urbanization, and expanding manufacturing base in emerging economies like China and India. The increasing adoption of cutting-edge technologies are the major player to this growth. Asia has experiences spectacular growth in demand for high-value added specialty chemicals, especially for utilization in rapidly growing electronics, like 5G technology, automotives, and pharmaceutical industries.

China Chemical Distribution Market Trends

China dominates the regional market, with its advanced port infrastructure, particularly in cities like Shanghai, Ningbo, and Tianjin, facilitates efficient import and export operations, making it a regional hub for chemical trade. The rise of e-commerce platforms and digital supply chain management systems has also enhanced transparency, safety, and traceability in chemical distribution. Major global distributors, such as Brenntag, IMCD, and Univar Solutions, have expanded their footprint in China to tap into its vast customer base and technical expertise.

North America’s Chemical Distribution Boom: Navigating the Fastest-Growing Market Trends

North America is the fastest-growing region in the global market due to its strong focus on sustainability and the development of green products. There is a rapid digitalization transformation in North America continuing in industry consolidation through mergers and acquisitions, along with a strong emphasis on supply changes resilience. Local and leading chemical companies are focusing on consideration of alignment with their strategies around five major trends, including profit prioritization, supply chain resilience, end-market demand, innovation, and AI adoption.

U.S. Chemical Distribution Market Analysis

The U.S. market is experiencing steady growth driven by rising demand for specialty chemicals, digital transformation, and sustainability initiatives across key industries such as pharmaceuticals, construction, automotive, and electronics. Distributors are shifting from traditional bulk supply models towards value-added services like blending, formulation support, and technical consulting to cater to the increasing preference for high-performance, customized chemicals. The integration of digital tools, including e-commerce platforms, ERP systems, and real-time logistics tracking, is enhancing operational efficiency and transparency in the supply chain.

- According to a report published by Deloitte, the U.S. production volumes of chemicals are projected to contract 0.2% in 2026.

Europe’s Chemical Renaissance: Navigating the Green Transition

Europe is a notable player in the global market due to its strong focus on sustainability and specialization in higher-quality chemicals. European companies are emphasizing to meet with strict regulatory standards and complaints, driven by the strong existence of stringent regulatory frameworks. Rapid digitalization is fuelling the focus on meeting these demands and solidifying operational efficiency.

Germany Chemical Distribution Market Outlook:

Germany firmly dominates the regional market owing to its strong industrial foundation, world-class infrastructure, and strategic location that makes it the central hub for chemical trade and logistics across the continent. The country is home to some of the most prominent chemical producers and distributors in the world, including BASF, Brenntag, HELM AG, Biesterfeld, and TER Chemicals, which have established extensive distribution networks serving diverse end-use industries.

More Insights in Towards Chemical and Materials:

- Specialty Chemicals Market : The global specialty chemicals market size is calculated at USD 671.19 billion in 2024, grew to USD 706.36 billion in 2025, and is projected to reach around USD 1,118.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

- GCC Specialty Chemicals Market : The global gcc specialty chemicals market size was valued at $ 36.89 billion in 2024 and is estimated to reach around USD 55.13 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.10% during the forecast period 2025 to 2034.

- Biochemical Market : The global biochemical market size was valued at USD 80.35 billion in 2024 and is predicted to increase from USD 88.89 billion in 2025 to approximately USD 220.66 billion by 2034, expanding at a CAGR of 10.63% from 2025 to 2034.

- Industrial Water Treatment Chemical Market : The global industrial water treatment chemicals market size is estimated at USD 18.84 billion in 2025, it is predicted to increase from USD 19.89 billion in 2026 to approximately USD 32.34 billion by 2035, expanding at a CAGR of 5.55% from 2025 to 2035.

- Sustainability Chemical Market : The global sustainability chemical market size was reached at USD 80.77 billion in 2024 and is expected to be worth around USD 161.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.19% over the forecast period 2025 to 2034.

- Chemical Intermediate Market : The global chemical intermediate market size is calculated at USD 118.19 billion in 2024, grew to USD 127.18 billion in 2025 and is predicted to hit around USD 246.1 billion by 2034, expanding at healthy CAGR of 7.61% between 2025 and 2034.

- Generative AI in Chemical Market : The global generative AI in chemical market size is calculated at USD 323.81 billion in 2024, grew to USD 415.12 billion in 2025 and is predicted to hit around USD 4,978.04 billion by 2034, expanding at healthy CAGR of 28.20% between 2025 and 2034.

- Biopolymers Market : The global biopolymers market size was valued at USD 19.85 billion in 2024, grew to USD 21.93 billion in 2025, and is expected to hit around USD 53.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period from 2025 to 2034.

- Petrochemical Market ; The global petrochemicals-market size was valued at USD 659.55 billion in 2024, grew to USD 700.05 billion in 2025, and is expected to hit around USD 1,196.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.14% over the forecast period from 2025 to 2034.

- Polymers Market: The global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period 2025 to 2034.

- Liquid Crystal Polymers Market : The global liquid crystal polymers market size was valued at USD 1.99 billion in 2024, grew to USD 2.25 billion in 2025, and is expected to hit around USD 6.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.95% over the forecast period from 2025 to 2034.

- Sustainable Plastics Market : The global sustainable plastics market size was valued at USD 410.73 billion in 2024, grew to USD 465.89 billion in 2025, and is expected to hit around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period from 2025 to 2034.

- Agrochemicals Market : The global agrochemicals market size accounted for USD 285.36 billion in 2024 and is predicted to increase from USD 300.91 billion in 2025 to approximately USD 485.13 billion by 2034, expanding at a CAGR of 5.45% from 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Plastics Market : The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- Epoxy Resins Market : The global epoxy resins market size was reached at USD 15.11 billion in 2024 and is expected to be worth around USD 28.66 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.61% over the forecast period 2025 to 2034.

- Plastic Compounding Market : The global plastic compounding market size was valued at USD 72.55 billion in 2024 and is forecasted to surpass around USD 148.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period from 2025 to 2034.

- Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- Plastic Waste Management Market : The global plastic waste management market size was reached at USD 38.19 Billion in 2024 and is expected to be worth around USD 54.66 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.65% over the forecast period 2025 to 2034.

- Bioresorbable Polymers Market : The global bioresorbable polymers market volume accounted for 1,121.0 kilotons in 2024 and is predicted to increase from 1,267.9 kilotons in 2025 to approximately 3,839.1 kilotons by 2034, expanding at a CAGR of 13.10% from 2025 to 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

- Phenolic Resins Market : The global phenolic resins market size is accounted for USD 16.44 billion in 2025 and is expected to be worth around USD USD 27.17 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.74% over the forecast period 2025 to 2034.

- Coating Resins Market : The global coating resins market size was valued at USD 59.71 bn in 2024 and is estimated to hit around USD 105.43 bn by 2034, growing at a compound annual growth rate (CAGR) of 5.85% during the forecast period 2025 to 2034.

- Textile Market : The global textile market size was estimated at USD 1.33 trillion in 2024 and grew to USD 1.39 trillion in 2025, and is projected to reach around USD 2.01 trillion by 2034. The market is expanding at a CAGR of 4.24% between 2025 and 2034.

- Wastewater Treatment Services Market : The global wastewater treatment services market size is estimated at USD 67.56 billion in 2025, it is predicted to increase from USD 72.22 billion in 2026 to approximately USD 131.78 billion by 2035, expanding at a CAGR of 6.91% from 2025 to 2035.

- Water Treatment Systems Market : The global water treatment systems market size is calculated at USD 46.07 billion in 2025 and is predicted to increase from USD 50.10 billion in 2026 and is projected to reach around USD 106.50 billion by 2035, The market is expanding at a CAGR of 8.74% between 2025 and 2035.

- Produced Water Treatment Market : The global produced water treatment market size is calculated at USD 11.05 billion in 2025 and is predicted to increase from USD 11.58 billion in 2026 and is projected to reach around USD 17.58 billion by 2035, The market is expanding at a CAGR of 4.75% between 2025 and 2035.

- Packaged Wastewater Treatment Market : The global packaged wastewater treatment market size accounted for USD 31.54 billion in 2025 and is predicted to increase from USD 34.34 billion in 2026 to approximately USD 73.66 billion by 2035, growing at a CAGR of 8.85% from 2025 to 2035.

- Insulation Market : The global Insulation market size is calculated at USD 74.81 billion in 2025 and is predicted to increase from USD 80.12 billion in 2026 and is projected to reach around USD 148.67 billion by 2035, The market is expanding at a CAGR of 7.11% between 2025 and 2035.

Chemical Distribution Market Top Key Companies:

- Brenntag SE

- Univar Solutions Inc.

- IMCD N.V.

- Nexeo Solutions

- Azelis Holdings S.A.

- Corteva Agriscience

- Harima Chemicals, Inc.

- Helm AG

- SABIC Innovative Plastics

- Kraton Corporation

- Groupe Charles André

- DIC Corporation

- Eastman Chemical Company

- Merck Group

- INEOS Group

Market Recent Developments

- In October 2025, a global leading partner or the distribution and formulation of specialty chemicals and ingredients, IMCD N.V., acquired 100% share capital of ingredients distributor, Dong Yang FT Corp. In South Korea. This agreement is helping IMCD to strengthen its position in South Korea and expand its offering of beauty and personal care products.

- In September 2025, an independent European private equity firm, Hivest Capital, and its partner S.A.S., acquired a stake in Novasol Chemicals. This acquisition is to accelerate Novasol’s international expansion, along with strong expertise in both organic and external growth.

Chemical Distribution Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Chemical Distribution Market

By Product

- Specialty Chemicals

- CASE

- Electronic

- Agrochemical

- Construction

- Specialty Resins & Polymers

- Commodity Chemicals

- Synthetic Rubber

- Petrochemicals

- Plastic & Polymers

- Explosives

- Others

By End Use

- Automotive & Transport

- Agriculture

- Construction

- Consumer Goods

- Industrial Manufacturing

- Textiles

- Pharmaceuticals

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5581

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.