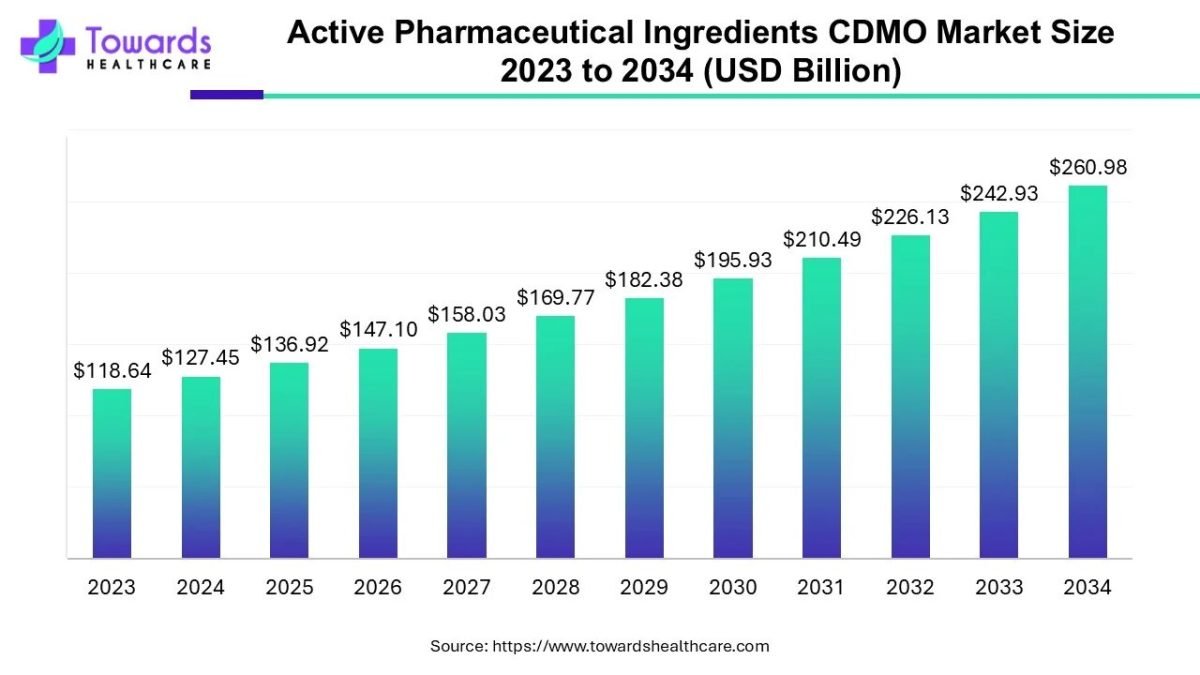

The global active pharmaceutical ingredients CDMO market size is calculated at USD 136.92 billion in 2025 and is expected to reach around USD 260.98 billion by 2034, growing at a CAGR of 7.43% for the forecasted period.

Ottawa, Nov. 05, 2025 (GLOBE NEWSWIRE) — The global active pharmaceutical ingredients CDMO market size was valued at USD 127.45 billion in 2024 and is predicted to hit around USD 260.98 billion by 2034, rising at a 7.43% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5462

Key Takeaways

- Asia-Pacific held a major revenue share of the market in 2024.

- North America is expected to grow notably in the active pharmaceutical ingredients CDMO market during 2025-2034.

- By product, the traditional active pharmaceutical ingredient segment dominated the market in 2024.

- By product, the antibody-drug conjugate segment is expected to grow at a notable CAGR in the studied years.

- By synthesis, the synthetic segment held the dominating share of the market in 2024.

- By synthesis, the biotech segment is expected to witness rapid expansion in the predicted timeframe.

- By drug, the innovative segment registered dominance in the market in 2024.

- By drug, the generic segment is expected to grow significantly in the coming years.

- By application, the oncology segment captured a dominant share of the global market in 2024.

- By application, the glaucoma segment is expected to witness notable growth during 2025-2034.

- By workflow, the commercial segment led the market in 2024.

- By workflow, the clinical segment is expected to grow at a significant CAGR in the upcoming years.

How CDMO is Revolutionising the Active Pharmaceutical Ingredients?

The active pharmaceutical ingredients CDMO market refers to the substances that give therapeutic effects after administration in different dosage forms. For this, CDMOs are acting as a prominent factor due to their affordability and scalability, ongoing advances in technology, including AI and automation, and strategic supply chain realignments. Currently, they are fostering the utilization of peptide and oligonucleotide APIs for gene therapy and the adoption of green chemistry and continuous manufacturing for more sustainable and extensive production.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drivers in the Market?

The growing outsourcing by pharma companies to lower expenditure and boost emphasis on R&D, with raised demand for complex and speciality drugs such as biologics and gene therapies, is impacting the overall expansion of the active pharmaceutical ingredients CDMO market. Moreover, the immersion of stricter quality and regulatory frameworks supports pharmaceutical companies in further collaboration with CDMOs for acquiring expertise to navigate complex compliance requirements, like those from the FDA.

What are the Major Trends in the Market?

- In October 2025, Wilmington PharmaTech, a U.S.-based speciality contract research, development, and manufacturing organization (CRDMO), received a majority investment by Curewell Capital, a Los Angeles-based private equity player, to boost WPT’s manufacturing capacity and further scale its end-to-end capabilities in developing a full range of small molecule API in the U.S.

- In October 2025, SK Pharmteco and LOTTE BIOLOGICS signed a strategic alliance to accelerate global ADC CDMO capabilities.

- In October 2025, AstraZeneca raised the scope of a new US API manufacturing facility by $500m.

What is the Emerging Limitation in the Market?

Commonly involved barriers are supply chain disruptions, changing raw material expenditures, and the requirement to adopt innovative technologies, particularly automation and AI and finally the increasing demand for specialised products, such as high-potency APIs (HPAPIs).

Regional Analysis

What Made the Asia Pacific Dominant in the Market in 2024?

By capturing the biggest share, the Asia Pacific led the active pharmaceutical ingredients CDMO market in 2024. Specifically, this region leverages inexpensiveness and a skilled workforce, which results in spending benefits and government incentives in countries like China and India. To control the growing incidences of diverse diseases among the population, they are emphasising specialised therapies, mainly antibody-drug conjugates (ADCs), biologics, and other complex modalities.

For instance,

- In July 2024, Pfizer Inc. invested SGD$1 billion to manufacture small molecule APIs for oncology, pain, and antibiotic medicines in Tuas Biomedical Park, Singapore.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

How did North America Grow Notably in the Market in 2024?

In the prospective period, North America is anticipated to expand significantly in the active pharmaceutical ingredients CDMO market. The regional leaders are fostering supply chain security through local manufacturing, robust regulatory oversight, ensuring quality, rising demand for complex biologics and tailored medicines. They are also bolstering capabilities for assisting new and advanced therapies, including RNA therapeutics and ADCs.

For instance,

- In October 2025, Cambrex, a leading global contract development and manufacturing organization (CDMO), invested $120 million to boost its U.S. operations, addressing the accelerating demand for API development and manufacturing.

Government Initiatives in the Market in 2024-2025

| Production Linked Incentive (PLI) Schemes for Bulk Drugs/APIs | Offers a financial outlay of ₹6,940 crore, provides financial incentives for the domestic manufacturing of 41 critical KSMs (Key Starting Materials), DIs (Drug Intermediates), and APIs to minimise import dependence. |

| FDA “PreCheck” Program | Introduced in August 2025, this simplifies the regulatory review process and offers active engagement with manufacturers during the planning and construction of novel domestic facilities. |

Segmental Insights

By product analysis

Why did the Traditional Active Pharmaceutical Ingredient Segment Lead the Market in 2024?

The traditional active pharmaceutical ingredient segment captured a major share of the active pharmaceutical ingredients CDMO market in 2024. Due to the greater demand for drugs treating chronic diseases, affordability and large-scale production of generic and small-molecule drugs are fueling the expansion. Nowadays, the market is stepping into innovations in high-potency APIs (HP-APIs) for oncology, biologics, peptides, nucleotides, and nucleic acid-based APIs for gene and cell therapies.

Whereas the antibody-drug conjugate segment will expand significantly in the coming era. The complicated manufacturing process includes the integration of a monoclonal antibody with a cytotoxic payload, which necessitates specialised expertise and infrastructure for high-potency handling, linking, and conjugation. Alongside, continuous innovations in antibody engineering, linker technology, and payload development are accelerating applications of ADCs.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By synthesis analysis

How did the Synthetic Segment Dominate the Market in 2024?

In 2024, the synthetic segment accounted for the largest share of the active pharmaceutical ingredients CDMO market. This approach explores the usual affordable production as compared to biological ones, which is driven by minimal raw material expenditure and more simplified production solutions. Also, they facilitate increased control over the API’s composition and purity, resulting in more consistent and predictable quality across various batches.

On the other hand, the biotech segment is estimated to expand at a rapid CAGR. Prominently, a rise in complexity of new therapies, especially biologics, gene, and cell therapies, and the expansion of precision medicine are bolstering the overall segmental growth. They are implementing continuous manufacturing, AI, and machine learning, and widely investing in seamless manufacturing, sophisticated fermentation systems, and cell culture technology.

By drug analysis

What Made the Innovative Segment Dominant in the Market in 2024?

The innovative segment held a major share of the active pharmaceutical ingredients CDMO market in 2024. The market is leveraging diverse continuous manufacturing and green chemistry, with expanded strategic partnerships for the development of new therapies. Alongside, the leading players use advanced biologics, genomic APIs, and mRNA for customised medicine, gene editing, and advanced vaccines.

Moreover, the generic segment is anticipated to witness notable expansion. This mainly comprises new strategic FDA product-specific guidances for complex generics, particularly Amikacin Sulfate and Apixaban, and the growing use of highly sophisticated manufacturing technologies (AMTs) and AI/ML to enhance effectiveness. Recently, the FDA approved complex generics, such as cyclosporine ophthalmic emulsion eye drops and budesonide and formoterol fumarate dihydrate inhalation aerosol.

By application analysis

Why did the Oncology Segment Dominate the Market in 2024?

The oncology segment led with the biggest share of active pharmaceutical ingredients CDMO market in 2024. A gradual rise in cancer cases is increasingly demanding immunotherapies and biosimilars, with the increased demand for HPAPIs, peptides, and antibody-drug conjugates, are acting as a crucial catalyst. The recent developments encompass antibody-drug conjugates (ADCs), those encapsulated HPAPIs in payloads for more accurate tumour targeting, and polymer-drug conjugates, by employing EZN-2208 and other advanced polymers, for expanding efficacy and lowering side effects.

Although the glaucoma segment is predicted to witness the fastest growth. The companies are fostering the use of prostaglandin analogues, beta blockers, and combination drugs for treating glaucoma and other chronic eye diseases. Recently, the FDA has approved iDose TR (travoprost intracameral implant, a single-administration implant that consistently releases travoprost for up to three years. Whereas, Ciliary Neurotrophic Factor (CNTF)-secreting implants possess stabilisation of visual function and accelerate retinal nerve fiber layer thickness.

By workflow analysis

How did the Commercial Segment Lead the Market in 2024?

The commercial segment captured a dominant share of the active pharmaceutical ingredients CDMO market in 2024. This mainly encourages scaling up production for approved drugs, confirming regulatory compliance, and managing global supply chains. Currently, the globe is putting efforts into the rising integration of services from drug discovery to commercialisation (CRDMOs), growth in high-growth areas like High-Potency APIs (HPAPIs) and biotech.

Eventually, the clinical segment will expand notably in the coming era. CDMOS are facilitating specialised services, specifically formulation development, analytical testing, and small-batch manufacturing for early-stage drugs. Nowadays, the market is focusing on complex therapies like those for rare diseases and advancing cell and gene therapies. CDMOs are further facilitating expertise and documentation to support clients in navigating the complex regulatory requirements for trial submissions.

Browse More Insights of Towards Healthcare:

The global multiplex PCR kit market is estimated at US$ 1.25 billion in 2024 and expected to rise to US$ 1.38 billion in 2025, reaching approximately US$ 3.43 billion by 2034. The market is forecasted to expand at a CAGR of 10.64% between 2025 and 2034.

The innovative drug CRO market is witnessing steady momentum, with projections indicating significant revenue gains that could reach hundreds of millions over the forecast period from 2025 to 2034.

The global ADC outsourcing service market is valued at US$ 2.76 billion in 2024, projected to increase to US$ 2.94 billion in 2025, and further reach US$ 5.19 billion by 2034, registering a CAGR of 6.52% during 2025–2034.

The global AAV vector CDMO services market is estimated at US$ 1.24 billion in 2024, growing to US$ 1.43 billion in 2025, and expected to attain US$ 5.14 billion by 2034, expanding at a robust CAGR of 15.24% between 2025 and 2034.

The Latin America central lab market was valued at US$ 276 million in 2024, anticipated to rise to US$ 292 million in 2025, and projected to reach around US$ 482 million by 2034, reflecting a CAGR of 5.73% throughout the forecast period.

The cryopreservation and platelet storage technologies market is poised for strong growth, with substantial revenue expansion expected to reach hundreds of millions between 2025 and 2034.

Meanwhile, the home healthcare market is forecasted to surge from US$ 226.92 billion in 2025 to an impressive US$ 476.80 billion by 2034, advancing at a steady CAGR of 8.6% over the forecast timeline.

Recent Developments in the Active Pharmaceutical Ingredients CDMO Market

- In October 2025, Hikal Ltd., a global life sciences company, opened its High Potency Active Pharmaceutical Ingredient (HPAPI) Laboratory at its Integrated Innovation Centre in Pune.

- In September 2025, Kazan Pharmaceutical Plant Sever Pharmaceuticals, part of the Izvarino Pharma Group, initiated production of active pharmaceutical ingredients (APIs) for cancer drugs.

- In February 2025, SK Pharmteco, a global contract development and manufacturing organization (CDMO), unveiled an enhanced analytical testing laboratory especially dedicated to High Potency Active Pharmaceutical Ingredients (HPAPIs).

Active Pharmaceutical Ingredients CDMO Market Key Players List

- Cambrex Corporation

- Recipharm AB

- Thermo Fisher Scientific Inc. (Pantheon)

- Corden Pharma International

- Samsung Biologics

- Lonza Group

- Catalent, Inc.

- Siegfried Holding AG

- Piramal Pharma Solutions

- Boehringer Ingelheim

Segments Covered in the Report

By Product

- Traditional Active Pharmaceutical Ingredient (Traditional API)

- Highly Potent Active Pharmaceutical Ingredient (HP-API)

- Antibody Drug Conjugate (ADC)

- Others

By Synthesis

- Synthetic

- Biotech

By Drug

- Innovative

- Generics

By Workflow

- Clinical

- Commercial

By Application

- Oncology

- Hormonal

- Glaucoma

- Cardiovascular Disease

- Diabetes

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5462

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.