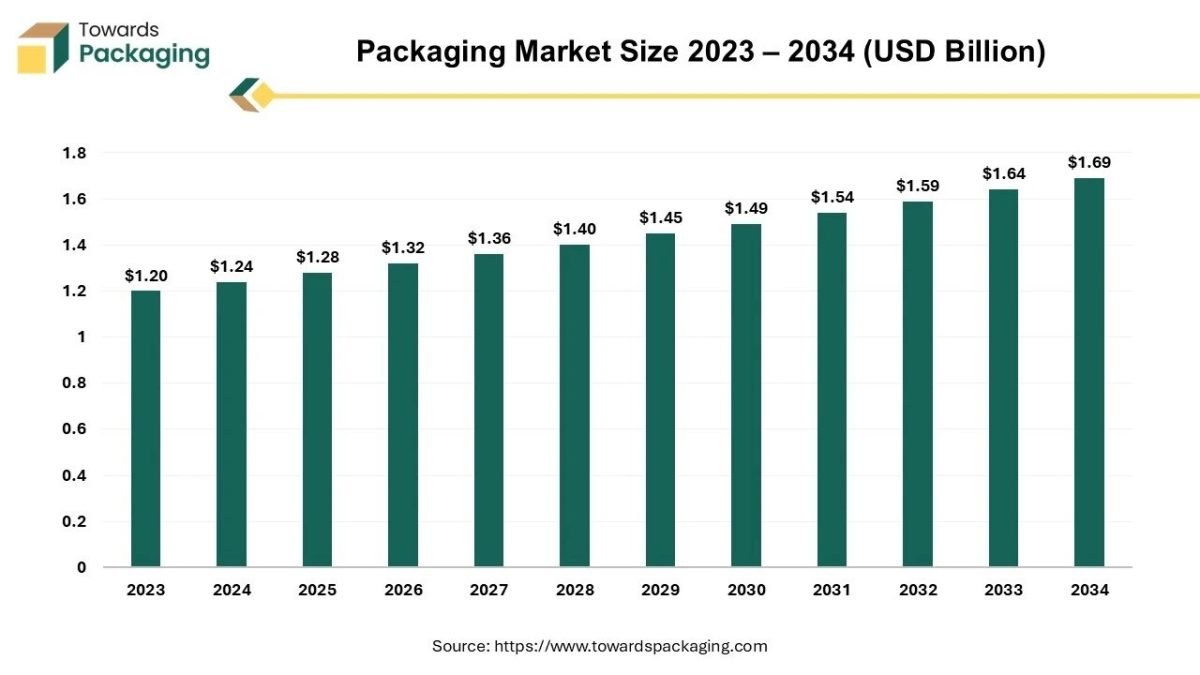

As per market analysts at Towards Packaging, the global packaging market is expected to grow from USD 1.32 billion in 2026 to nearly USD 1.69 billion by 2034, registering a CAGR of 3.16% between 2025 and 2034.

Ottawa, Nov. 05, 2025 (GLOBE NEWSWIRE) — The global packaging market was valued at USD 1.28 billion in 2025 and is expected to grow to USD 1.69 billion in 2034, as noted in a study published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Consumers, mainly younger generations, are increasingly concerned with the environmental impact. This pushes firms to use recyclable, biodegradable, and recycled materials, and to reduce waste. Brands which adopt eco-friendly practices can gain a competitive edge and also build brand loyalty.

What is the Significance of Packaging?

The significance of packaging lies in its role in protecting the product, encouraging the brand, and offering consumer convenience and even information. It safeguards items during transport along with storage, serves as a key marketing tool via branding and design, and provides practical benefits such as easy handling and storage. Effective packaging can also improve the customer experience, communicate data details, and even comply with legal requirements. Packaging is usually the first point of contact with a user and can influence purchase decisions, as it is a main tool for creating a good first impression.

What are the Major Government Initiatives for the Packaging Industry?

- Extended Producer Responsibility (EPR) Laws: These are widespread regulations (e.g., in the EU, India, and various US states) that make manufacturers, importers, and brand owners financially and/or physically responsible for the post-consumer lifecycle of their packaging.

- Bans on Single-Use Plastics (SUPs): Many governments have implemented bans on specific high-littering SUP items, such as plastic straws, cutlery, plates, and certain plastic bags, forcing the industry to adopt reusable or alternative material solutions.

- Mandates for Recycled Content: Regulations increasingly require plastic packaging to contain a minimum percentage of post-consumer recycled (PCR) content (e.g., the EU’s requirement of 30% PCR in PET beverage bottles by 2030) to stimulate the market for recycled materials.

- Plastic Packaging Taxes: Some countries, like the UK, have introduced taxes on plastic packaging that does not meet a certain threshold of recycled content (e.g., less than 30% recycled material), creating a financial incentive for sustainable material use.

- Circular Economy Action Plans: Comprehensive governmental strategies, such as the EU’s Circular Economy Action Plan, aim to transform the entire industrial system by promoting product design for durability, reuse, and high-quality recycling to minimize waste and resource leakage.

- Recycling and Recovery Targets: Governments often set specific, legally binding targets for the percentage of packaging waste that must be recycled or recovered by a certain date (e.g., the EU’s goal of recycling 70% of all packaging waste by 2030).

- Food Safety and Packaging Regulations: Regulatory bodies like the FSSAI in India and the FDA in the US implement strict rules to ensure that packaging materials (especially those using recycled content) are safe for food contact and do not pose health risks, which can drive innovation in safe recycling processes.

- National Packaging Policies and Innovation Challenges: Beyond bans and taxes, governments initiate programs and challenges to encourage domestic innovation in sustainable packaging materials and waste management infrastructure, often in collaboration with industry associations and start-ups.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5140

What are the Latest Trends in the Packaging Market?

- Increasing demand for biodegradable options: This is driven by rising user and business knowledge of environmental issues, contributing to a push for sustainable options to traditional plastics. This trend is also boosted by government regulations targeted at decreasing plastic waste, technological advancements in making more cost-effective and even versatile biodegradable materials, along with corporate commitments to sustainability goals. Biodegradable packaging is usually made from renewable resources, has a lower carbon footprint, and even assists reduce greenhouse gas emissions compared to fossil-driven plastics. Many major firms have made public commitments to achieve nearly 100% sustainable packaging targets, which pushes innovation and investment in biodegradable alternatives to meet these goals.

- E-Commerce Boom: The rapid growth of online shopping has fundamentally changed packaging demands, requiring solutions that are durable, lightweight, and cost-effective to protect products during complex shipping processes. Brands are also focusing on the “unboxing experience” with custom packaging to enhance customer satisfaction and loyalty in a competitive online market.

- Smart Packaging and Digitalization: Technology integration, such as QR codes, RFID tags, sensors, and AI, is enabling real-time product monitoring, enhanced traceability, and better consumer engagement. These innovations provide consumers with detailed product information, ensure safety, and help brands streamline supply chain management and combat counterfeiting.

- Convenience and Personalization: Modern consumers with busy lifestyles seek packaging that is easy to use, open, and transport, leading to a rise in single-serve, portion-controlled, and resealable designs. Simultaneously, brands are leveraging digital printing and design flexibility to offer personalized products and packaging, creating a unique connection with individual consumers.

What Potentiates the Growth of the Packaging Industry?

Strong consumer and regulatory shift towards sustainability

Consumers are increasingly prioritizing sustainability when making buying decisions, and even loyalty is higher for brands with huge sustainability claims. Governments globally are incorporating strict rules to decrease plastic pollution, like bans on single-use plastics and even new recycling standards. These regulations push producers to adopt sustainable packaging solutions, work with corporate sustainability targets, and decrease their carbon footprint. The shift is driving innovation in the latest materials, including plant-based plastics, mycelium, and even seaweed-based alternatives, and simpler, more recyclable packaging designs.

Limitations & Challenges

The limitations and challenges in the market include rising raw material costs and shortages, the high expense and even complexity of transitioning to sustainable packaging, and adapting to fast technological changes and evolving user demands. Companies face challenges with labor shortages, mainly in areas such as palletization, and the demand to manage complex and even sometimes inefficient supply chains. Thus, the industry must navigate a complex and even evolving landscape of regulations, which can limit packaging options, mainly for food and pharmaceuticals.

More Insights of Towards Packaging:

- Halal Packaging Market Growth, Key Segments, and Regional Dynamics

- Augmented Reality in Packaging Market Size, Share, Trends and Segments

- Rice Paper Packaging Market Growth, Key Segments, and Regional Dynamics

- Sauces, Dressings and Condiments Packaging Market Strategic Growth

- Cement Packaging Market Size, Segments, Companies, Competitive Analysis

- High-Barrier Materials for Pharmaceutical Packaging Market Size, Segments

- Sealed Wax Packaging Market Size, Segments, Regional Data

- Customized Packaging Market Growth Opportunities, Emerging Trends

- Molded Plastic Packaging Market Competitive Landscape

- Flexible Green Packaging Market Size, Segments, Regional Data

- Sustainable Flexible Packaging Market Size, Share, Trends 2025-2034

- Sustainable Food Packaging Market Competitive Analysis

- Polypropylene Corrugated Packaging Market Innovation 2025

- Single-Use Plastic Packaging Market Size, Regional Share (NA/EU/APAC/LA/MEA)

- Non-Recyclable Plastic Packaging Market Size, Segments and Regional Data

Regional Analysis

Who is the Leader in the Global Packaging Industry?

Asia Pacific leads the market because of a combination of a large and rising population, rapid urbanization, a dominant production base, and even significant technological advancements, mainly in China. A growing middle class with rising disposable income fuels consumer need across various sectors, including personal care, cosmetics, and convenience foods, which depend heavily on packaging. Government policies in countries such as China and South Korea are strategically funding the packaging and manufacturing sectors via subsidies, investment, and initiatives to enhance healthcare infrastructure and encourage self-sufficiency in areas like advanced packaging.

China Packaging Market Trends

Key trends in the Chinese market involve a rapid shift toward flexible packaging and even next-generation solutions such as smart and sustainable materials, boosted by e-commerce, convenience, and new regulations. The market is also undergoing in the processed food sector, fueled by changing user habits and need for ready-to-eat alternatives, with paper and paperboard contributing in overall market share by material.

Japan Packaging Market Trends

Key trends in Japan’s market include a strong focus on sustainability, propelled by consumer need for recyclable and eco-friendly materials, that is contributing to the adoption of biodegradable options along with glass bottles. Growth is also boosted by expanding e-commerce and even consumer convenience, and with flexible packaging gaining traction. Major fields are food and beverages, and the market is seeing raised usage of smaller package sizes for convenience.

How is the Opportunistic Rise of North America in Packaging Industry?

North American consumers’ need for on-the-go and even ready-to-eat meals is boosting the market for convenient formats like resealable pouches, single-serve packs, and also portable containers. This has accelerated expansion in the flexible packaging segment. A robust production base and high consumption levels in sectors like food and beverages, personal care, pharmaceuticals, and industrial goods offer a steady and high need for diverse packaging solutions.

U.S. Packaging Market Trends

Consumers are increasingly favoring packaging that is recyclable, compostable, and even made from sustainable materials. State together with local bans on single-use plastics and even the implementation of EPR laws is forcing firms to redesign packaging to be more environmentally friendly. Plastic continues to hold a remarkable market share, but expense pressures from regulations such as PFAS-free mandates and the requirement for higher-barrier materials are influencing its use.

Canada Packaging Market Trends

Key trends in the Canadian market include the increasing need for flexible packaging and even the growing target on sustainability and even eco-friendly options, such as paper-based and compostable packaging. Meanwhile, consumer habits are also a major driver, with a requirement for on-the-go solutions and also e-commerce-ready packaging, while e-commerce expansion and industrial growth are boosting the industrial packaging sector.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Material Insights

Why did the Paper and Paperboard Segment Dominates the Packaging Market in 2024?

This is due to its eco-friendly characteristics, like being recyclable, biodegradable, and even a sustainable option to plastic. Its versatility is also a vast factor, as it can be used for a broad range of applications from food together with cosmetics to e-commerce and construction.

Packaging Type Insights

Why did the Rigid Packaging Segment Dominates the Packaging Market in 2024?

This is due to its superior durability, protection, and even extended shelf life for products, mainly in high-demand industries such as food, beverages, and pharmaceuticals. This type of packaging, made from materials such as plastic, glass, and metal, provides essential protection against contamination, damage, and also spoilage during transport and storage. Rigid packaging can be produced via various methods such as blow molding and injection molding, creating a broad range of shapes along sizes to meet diverse product needs. Growing need is fueled by an increasing focus on hygiene, grooming, and even wellness products, especially in emerging economies.

Printing Technology Insights

Why did the Flexography Segment Dominates the Packaging Market in 2024?

This is due to its high speed, cost-effectiveness, and versatility in printing on a broad range of substrates such as films, paper, and foil. It is efficient for large-volume runs, utilizes quick-drying inks, and is well-suited for the rising demand for flexible and even paper-based packaging. Flexography also supports the demand for customization, permitting for personalized packaging and also promotional labels. Flexography is adaptable to sustainable substrates such as paper and mono-materials, working with increasing consumer and even regulatory demands for eco-friendly packaging.

End User Insights

Why did the Food & Beverages Segment Dominates the Packaging Market in 2024?

This is due to the sheer volume of products, which need packaging for safety, preservation, and even transport. This is further fueled by trends such as the surge in processed together with convenience foods, the rising global need for beverages, and the growth of e-commerce for food delivery, all of which necessitate durable, protective, and sometimes specialized packaging solutions. Food safety regulations, along with a rising emphasis on sustainability compel producers to use compliant and even innovative packaging which is safe for contact with food and helps reduce waste.

Recent Breakthroughs in the Packaging Industry

- In January 2025, Ardagh Glass Packaging-North America, a division of Ardagh Group, impoved its 12oz Heritage glass beer bottle range by introducing a new bottle color and an additional closure choice. Thus, the two new 12oz (355ml) Heritage bottles come in flint (clear) glass featuring a pry-off cap, along with amber (brown) glass with a twist-off cap.

- In September 2024, Marigold Health Foods, in collaboration with Sonoco, started its new, completely recyclable packaging for an array of natural, plant-driven food items. Marigold provides a variety of products, which include Engevita nutritional yeast, bouillon, gravy, stock cubes, sauces, and even plant-based alternatives for meat and fish.

Top Companies in the Packaging Market & Their Offerings:

- Smurfit Kappa: Smurfit Kappa (now part of Smurfit Westrock) is a global leader in providing an extensive portfolio of paper-based packaging solutions, primarily focusing on corrugated packaging, bags, and displays.

- Mondi PLC: Mondi offers a uniquely broad range of innovative and sustainable packaging and paper solutions, operating as a vertically integrated business spanning from managing forests to producing flexible and corrugated packaging.

- WestRock Company: WestRock (now merged with Smurfit Kappa to form Smurfit Westrock) specialized in sustainable paper and packaging solutions, including paperboard, corrugated containers, and consumer packaging for various industries.

- Huhtamaki Oyj: Huhtamaki is a key global player in food on-the-go and on-the-shelf packaging solutions, providing a wide range of paperboard, molded fiber, and flexible packaging products for food and beverage, personal care, and healthcare markets.

- Constantia Flexibles: Constantia Flexibles specializes in producing flexible packaging solutions, including pouches, foils, and laminates, primarily for the food, pet food, pharmaceuticals, and household goods industries.

- Polyplex Corporation: Polyplex Corporation is a global manufacturer of thin polyester (PET) films and other plastic films which are used as a base material in various packaging applications.

- Klöckner Pentaplast Group: Klöckner Pentaplast (kp) is a global leader in rigid and flexible plastic packaging, specialty film products, and services, primarily for the pharmaceutical, food, and beverage markets.

- Renolit SE: Renolit SE provides a wide array of plastic films and related products, including high-quality flexible and semi-rigid films used in various applications such as medical packaging, labels, and technical products.

- Aptar Group Inc: Aptar Group is a global provider of a broad range of innovative dispensing, sealing, and material science solutions, including consumer product dispensing systems (e.g., spray pumps and closures) for the beauty, personal care, and food and beverage markets.

Segments Covered in the Report

By Material

- Plastic

- Paper and Paperboard

- Glass

- Metal

By Packaging Type

- Flexible Packaging

- Rigid Packaging

By Printing Technology

- Offset

- Flexography

- Screen

- Gravure

- Digital

By End User

- Food & Beverages

- Pharmaceutical

- Beauty and Personal Care

- Industrial

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5140

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight – Check It Out:

- Track and Trace Packaging Market Size, Segments, Share and Companies

- Rigid Paper Packaging Market Demand Soars in 2025

- Business-to-Business (B2B) Packaging Market Size, Segments, Share and Companies

- Active and Intelligent Packaging Market Size, Regional Share

- Consumer Goods Sustainable Packaging Market Size, Segments, Companies

- Commercial Packaging Market Size, Segments, Share and Companies

- Eco-Friendly Flexible Packaging Market Size, Segments, Companies, Competitive Analysis

- Connected Food Packaging Market Size, Segments, Companies, Competitive Analysis

- Biopolymer Packaging Market Size, Regional Share (NA/EU/APAC/LA/MEA)

- Non-Recyclable Polystyrene Packaging Market Size, Segments

- 3D Printed Packaging Market Size, Segments, Companies, Competitive Analysis

- Circular Economy in Packaging Market 2025 Trends

- Blockchain-Integrated Smart Packaging Market Trends 2025–2034

- Plastic-Free Cosmetic Packaging Market Outlook 2025–2034

- Flexible Industrial Packaging Market Drives at 4.93% CAGR (2025-34)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.