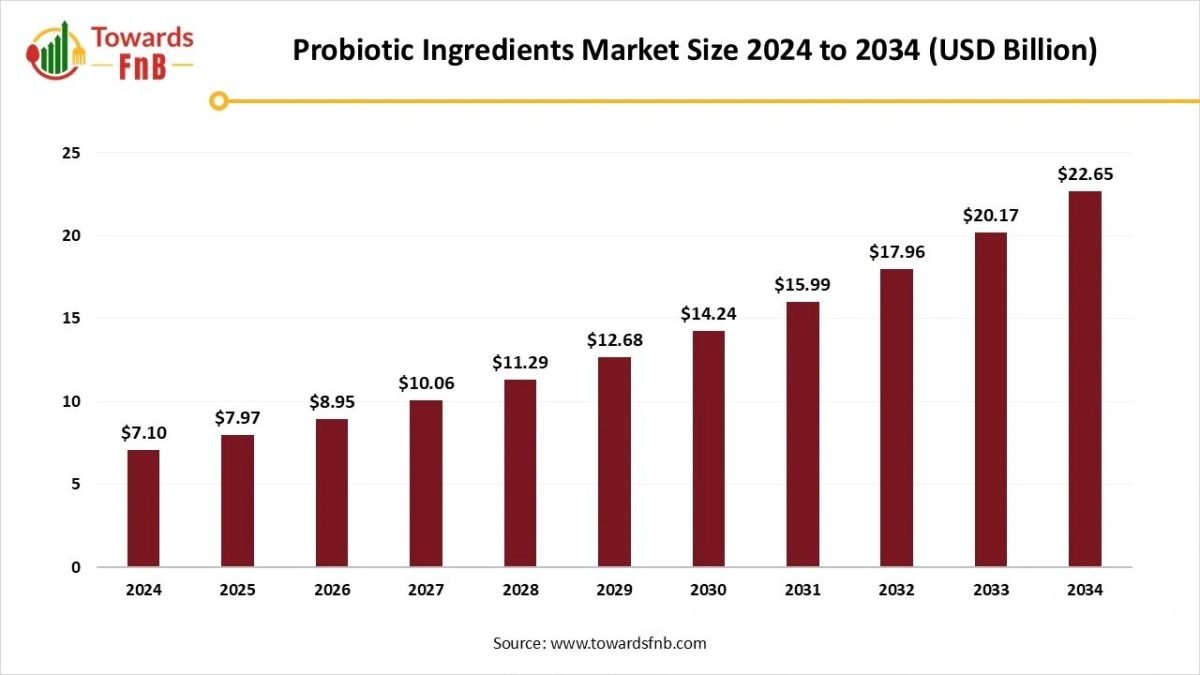

According to Towards FnB, the global probiotic ingredients market size is evaluated at USD 7.97 billion in 2025 and is anticipated to hit USD 22.65 billion by 2034, growing at an impressive CAGR of 12.3% from 2025 to 2034. This rapid expansion is fueled by rising global interest in gut health, functional nutrition, and AI-driven innovation in probiotic formulation and research.

Ottawa, Nov. 05, 2025 (GLOBE NEWSWIRE) — The global probiotic ingredients market size stood at USD 7.10 billion in 2024 and is predicted to increase from USD 7.97 billion in 2025 to reach nearly USD 22.65 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow due to rising consumer focus on gut health, the use of probiotics and functional products, and greater awareness of the importance of gut health for overall well-being.

Probiotics are no longer a niche wellness trend, they’re becoming a foundation of modern nutrition,” said Vidyesh Swar, Principal Consultant at Towards FnB. “As AI and microbiome science converge, we’re seeing a new generation of personalized, evidence-based probiotic solutions.”

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5532

Key Highlights of the Probiotic Ingredients Market

- By region, Europe led the probiotic ingredients market in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By form, the dry/powder segment captured the maximum share in 2024, whereas the liquid segment is expected to grow in the foreseen period.

- By ingredients, the bacteria segment led the probiotic ingredients market in 2024, whereas the yeast segment is expected to expand in the forecast period.

- By application, the food and beverage segment held the largest share in 2024, whereas the animal nutrition segment is expected to grow in the foreseeable period.

- By end-use, the human probiotics segment led the probiotic ingredients market in 2024, whereas the animal probiotics segment is expected to grow in the foreseen period.

These highlights underscore the accelerating adoption of probiotics across both human and animal nutrition markets, reflecting a growing convergence between food technology, wellness, and agricultural sustainability.

Prebiotics for Animal Health and Agriculture fuel the Demand for the Probiotic Ingredients Industry

Prebiotics are essential for human health to keep the gut protected and improve digestion, but they are also equally important for animal feed and agriculture for improved quality, further fueling the growth of the probiotic ingredients market. Prebiotics, when added to animal feed they help to improve the gut health of animals, further enhancing their growth. Probiotics, when added to soil they help to improve the soil quality and enhance plant growth and nutrition. Hence, such supportive factors fuel the probiotic ingredients market growth.

Impact of AI on the Probiotic Ingredients Market

Artificial intelligence is significantly transforming the probiotic ingredients market by accelerating scientific discovery, improving production efficiency, and enabling personalized health solutions. In research and development, AI-powered algorithms analyze vast datasets from microbiome research, genomic sequencing, and clinical trials to identify new probiotic strains with targeted health benefits such as gut health, immunity, and cognitive function. Machine learning models predict strain behavior, stability, and interactions with other ingredients, reducing trial-and-error experimentation and shortening product development cycles.

AI-driven predictive analytics optimize fermentation conditions, temperature control, and nutrient balance to ensure consistent probiotic viability and potency. Computer vision and sensor technologies enhance quality control by detecting contamination, verifying cell count, and maintaining product integrity throughout production and storage. These advancements help manufacturers maintain regulatory compliance while reducing energy use and production costs.

AI enables personalized nutrition by linking microbiome data and health profiles to recommend probiotic formulations tailored to individual needs. E-commerce platforms and health apps use AI recommendation engines to guide consumers toward the most suitable probiotic products, while sentiment analysis of online feedback helps brands refine offerings in line with emerging trends, such as plant-based or synbiotic formulations.

Demand for Probiotics Globally

- Asia Pacific- currently, the region has the highest demand for probiotics, fueling the probiotic ingredients market growth. Countries such as India, China, Japan, and South Korea have a major role in the market’s regional growth. Higher demand for dairy and non-dairy based probiotics, fermented products, and increased awareness of the benefits of such products help the growth of the market.

- Europe- prolonged usage of probiotics and consumer knowledge about their health benefits are major factors for the growth of the market in the region. Vegan probiotics are highly demanded by plant-based diet followers as well as vegans. Hence, the market is observed to grow in countries such as the UK, Germany, Italy, and Spain.

- North America- North America is observed to have a notable growth in the foreseen period due to higher demand for gut-friendly products, probiotics, and products helpful to keep the immunity protected. Vegans and plant-based diet followers help the growth of the market in the region.

New Trends in the Probiotic Ingredients Market

- Increased demand for personalized and effective gut-friendly products is a major factor in the growth of the probiotic ingredients market.

- Higher demand for probiotics such as yogurt, kefir, and fermented foods for improved gut health is another major factor for the growth of the market.

- Higher demand for probiotics in the dietary supplements market is another major factor fueling the probiotics industry.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/probiotic-ingredients-market

Recent Developments in the Probiotic Ingredients Market

- In October 2025, Angel Yeast, a Chinese company, announced the launch of the world’s first high-altitude probiotic production facility in Tibet- Angel Zhufeng. The newly launched company is establishing a portfolio of products with high-altitude probiotic blends, fermentation cultures for food applications, and microecological feed additives. (Source- https://www.aquafeed.com)

- In October 2025, Balchem, the specialty ingredients manufacturer for human nutrition, unveiled the StabiliPro excipient portfolio, designed to stabilize probiotic formulations and extend their shelf life. (Source- https://www.foodbev.com)

Product Survey of the Probiotic Ingredients Market

| Product Category | Description / Function | Common Strains / Forms | Key Applications / End-Use Sectors | Leading Brands / Producers |

| Lactobacillus Species | Most widely used probiotic bacteria improve gut health, immunity, and nutrient absorption. | L. acidophilus, L. rhamnosus, L. plantarum, L. casei | Dietary supplements, fermented foods, beverages, and infant formula | Chr. Hansen, DuPont Danisco, IFF Health, Yakult Honsha, Probi AB |

| Bifidobacterium Species | Support intestinal microbiota balance and digestive health; common in infant and dairy applications. | B. bifidum, B. longum, B. breve, B. lactis | Infant nutrition, dairy products, dietary supplements | Danone, DSM-Firmenich, Morinaga Milk, BioGaia |

| Bacillus Species (Spore-forming Probiotics) | Highly stable probiotic strains; heat- and pH-resistant, suitable for functional foods. | B. coagulans, B. subtilis, B. clausii | Baked goods, snacks, animal feed, supplements | Sabinsa, ADM (Deerland Probiotics), Novozymes, Kerry Group |

| Streptococcus & Enterococcus Species | Improve oral and gut health; certain strains used for fermentation and immune support. | S. thermophilus, E. faecium | Yogurts, dairy beverages, nutraceuticals | Nestlé Health Science, Biosearch Life, UAS Labs |

| Saccharomyces (Yeast Probiotics) | Yeast-based probiotics known for gut microbiota restoration and antibiotic-associated diarrhea prevention. | S. boulardii, S. cerevisiae | Nutraceuticals, pharmaceuticals, functional beverages | Lesaffre, Lallemand Health Solutions, Bio-K Plus |

| Multi-Strain Probiotic Blends | Combinations of bacterial and yeast strains for synergistic health effects. | Proprietary blends | Capsules, chewables, fermented dairy, beverages | Probi, ADM, IFF Health, Lonza, Ganeden (Kerry Group) |

| Postbiotics & Synbiotics | Emerging formulations combining probiotics with prebiotics or their metabolites for enhanced efficacy. | Probiotic + prebiotic mixes; heat-inactivated strains | Functional foods, dietary supplements | ADM, Synbiotic Health, Morinaga, Yakult |

| Customized & Targeted Probiotics | Tailored formulations designed for specific health outcomes. | Strain-specific blends for gut, immunity, skin, and mood | Personalized nutrition platforms, pharma-grade probiotics | Seed Health, Pendulum Therapeutics, DSM-Firmenich |

| Animal Feed Probiotic Ingredients | Enhance animal gut health, growth performance, and feed efficiency. | B. subtilis, L. plantarum, S. cerevisiae | Poultry, swine, and aquaculture | Novozymes, Evonik, Cargill, Adisseo |

| Functional Beverage Probiotics | Stable probiotic cultures integrated into drinks; shelf-stable and non-dairy options. | L. casei, B. lactis, S. thermophilus | Juices, kombucha, plant-based beverages | Yakult, Danone, PepsiCo (Kevita), GT’s Living Foods |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5532

Probiotic Ingredients Market Dynamics

What Are the Growth Drivers of the Probiotic Ingredients Market?

Major factors such as higher demand for gut-friendly products by consumers, improved gut health and immunity, and enhanced gut health connection, help to enhance the growth of the market. Consumer awareness regarding the importance of gut-friendly products for overall health helps boost the market growth. Higher demand for plant-based products by vegans and plant-based diet followers is another important factor influencing the growth of the probiotics industry. The importance of such products for animal feed and their improved gut health is another major factor for the growth of the market.

Challenge

Increased Infection Risk Hampers the Growth of the Market

People hospitalized for a longer period, patients who underwent surgeries, or patients using venous catheters are immediately at risk of getting an infection by use of probiotic products. Hence, such products are not safe for them, further acting as an obstruction for the growth of the market. The bacteria and yeast found in such products may enter the bloodstream of such individuals, leading to infection. Hence, such issues may turn into fatal issues if not paid attention to in time, and also cause a huge restriction in the growth of the market.

Opportunity

Usage for Agricultural Activities is helpful for the Market’s Growth

Use of probiotics for agricultural purposes is one of the major opportunities for the growth of the market. Such products help to enhance the quality of soil and also help in the growth of plants. Biofertilizers and bio stimulants help to enhance the soil quality and also improve the plant health, which is helpful for the growth of the market. Such habits also help to enhance sustainable farming practices, which is further helpful for the market’s growth.

Probiotic Ingredients Market Regional Analysis

Europe Dominated the Probiotic Ingredients Market in 2024

Europe led the probiotic ingredients market in 2024 due to increasing focus of manufacturers to enhance their product portfolio, higher demand for food and beverages options with probiotics and other functional ingredients, and demand for options friendly for the gut for improved digestion. The consumers in the region are focused on the gut and overall health connection. Hence, it further fuels the demand for a segment helpful for the growth of the market. Countries such as the UK, France, and Germany have a major role in the growth of the market due to higher demand for probiotic products, improved gut health, and balanced microbiome, which is helpful for the growth of the segment.

Asia Pacific Is Expected to Grow in the Foreseen Period

Asia Pacific is observed to be growing in the foreseen period due to consumer shifts towards gut-friendly products, including probiotics. It helps to improve their gut flora and also helps to enhance the digestive system. Improved immunity, enhanced stamina, and clean intestines are other beneficial pointers of probiotic-infused products, further fueling the growth of the probiotic ingredients market. Countries such as India, China, Japan, and South Korea have made major contributions to the growth of the market due to higher demand for gut-friendly products by consumers in these regions.

North America is expected to experience Notable Growth in the foreseeable period

North America is expected to grow in the foreseen period due to factors such as higher demand for probiotic products, increased awareness of the gut and health connection, and higher demand for gut-friendly products due to their multiple benefits for immunity. Higher demand for manufacturing of such products by the nutraceuticals and pharmaceuticals industry is another growth-influencing factor for the market.

Trade Analysis for the Probiotic Ingredients Market

United States

The U.S. is a major origin for probiotic cultures and finished probiotic ingredient shipments used in supplements, functional foods, and infant nutrition; exports combine both freeze-dried cultures and finished formulation consignments.

- Key statistics

-

- Export shipment counts (reported product-level shipments): hundreds of outbound consignments annually for core probiotic culture HS lines (documented shipment records show the U.S. as a top exporter by shipment count).

- Typical consignment types: freeze-dried culture vials and bulk probiotic powders in small to mid-sized lots (single consignments commonly under a pallet or a few pallets for high-value strains).

- Government initiatives / regulatory context

-

- Strong regulatory focus on export certification, strain documentation, and cold-chain handling; USDA/FDA processes and export-verification support are central to compliance for live-culture shipments.

China

China supplies bulk probiotic powders, capsulated finished products, and contract-manufactured probiotic formulations to regional markets; industrial-scale fermentation capacity supports outbound flows to Asia and the Middle East.

- Key statistics

-

- Recorded export shipment patterns show China among active exporters for probiotic capsules and powder formulations (documented shipment counts to regional destinations).

- Typical shipment formats: bulk drums for powders, bottling lines for capsules, and palletized finished-goods consignments for retail SKUs.

- Government initiatives / regulatory context

-

- Provincial and national incentives for biomanufacturing parks and quality-control labs; export zones often include streamlined inspection and packing-site audits to support outbound probiotic ingredient trade.

India

India is both a substantial exporter of finished probiotic capsules/products and a growing importer of specialist strains and culture inputs for supplements and food fortification; regulatory approvals for probiotic strains are an active area of public-health oversight.

- Key statistics

-

- Documented export/import trade lines show India among the top countries for probiotic capsule shipments and as a significant destination for probiotic culture imports.

- Regulatory activity: national food-safety authority records include strain-level applications and approvals, an evolving dataset affecting which strains can be used in foods and supplements.

- Government initiatives / regulatory context

-

- FSSAI strain-approval processes and Ministry/Trade outreach (export facilitation for nutraceuticals) influence which probiotic strains see export-ready documentation and market access.

Denmark & Netherlands (European hubs)

Denmark (home to large culture-house firms) and the Netherlands (a major logistics/re-export hub) are central to European probiotic ingredient flows: Denmark for R&D and seed/strain supply, and the Netherlands for EU distribution and re-export.

- Key statistics

-

- Company presence: large culture suppliers and specialty microbial houses are headquartered/operational in Denmark and nearby EU states (documented corporate footprints).

- Port/redistribution patterns: Northern EU ports handle significant inbound and onward shipments of probiotic ingredients and finished supplements destined for intra-EU markets.

- Government initiatives / regulatory context

-

- EU and national traceability, novel-food guidance, and export-certification hubs support cross-border trade in live microbial ingredients; R&D funding for strain dossiers and clinical substantiation is common.

Japan & South Korea (regional importers & innovators)

These markets import both finished probiotic ingredients and specialized strains for functional foods, infant nutrition, and pharmaceuticals; they also supply regionally focused finished probiotic products. (Trade data show active cross-border shipment patterns into and out of East Asia.)

- Key statistics

-

- Import patterns: documented flows show steady inbound shipments of finished probiotic formulations and strain imports for local formulation.

- Government initiatives / regulatory context

-

- Regulatory emphasis on strain safety dossiers, health-claim substantiation, and Good Manufacturing Practice (GMP) for microbial products.

Probiotic Ingredients Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 12.3% |

| Market Size in 2025 | USD 7.97 Billion |

| Market Size in 2026 | USD 8.95 Billion |

| Market Size by 2034 | USD 22.65 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Probiotic Ingredients Market Segmental Analysis

Form Analysis

The dry/powder segment led the probiotic ingredients market in 2024 due to its ease of handling, advanced freezing techniques, and ease of transport of the product, which is helpful for manufacturers as well as retailers. Such factors enhance the growth of the market. The convenience factors of the products lead to high demand by dietary supplement and nutraceutical manufacturers. Spray drying is an economical, easy, and effective method for making a product in its powdered form. Hence, the method also has a major role in the growth of the probiotic ingredients industry.

The liquid form segment is expected to expand in the forecast period due to its easy solubility, easy absorption by the body, and effective results, propelling the growth of the market in the forecast period. The segment also has a major contribution to the growth of the livestock segment. It can be easily mixed in the animal feed and allows their bodies to absorb nutrition easily. Hence, liquid probiotics are highly utilized for sheep, cattle, and beef livestock industries.

Ingredients Analysis

The bacteria segment led the probiotic ingredients market in 2024 due to major investments observed in bacterial research, such as Lactobacillus and Bifidobacterium. Bifidobacterium, Streptococcus, Lactococcus, and Lactobacillus are some of the major bacteria for the manufacturing of probiotic products. They help to keep the immune system safe from the attack of hostile bacteria and their damage. They also help in improving the gut flora and simultaneously maintaining overall health.

The yeast-based segment is observed to grow in the expected timeframe due to its increasing usage in different industries. It is highly utilized in the fermentation of vegetables, such as cabbage, radish, carrots, and beetroot, along with the commercial production of yoghurt as well. Hence, the segment has a major role in the growth of the probiotic ingredients market in the foreseeable period. They also have other applications, such as bioactive peptides and the production of specific enzymes.

End-Use Analysis

The human probiotics segment dominated the probiotic ingredients market in 2024 due to its multiple benefits and usage for the manufacturing of different probiotic-based products. Human probiotics are highly effective in fighting off heavy parasites, fungi, and bacteria that are commonly found in the human body. Different types of human probiotics products are formed using beneficial yeast and bacteria to recover from any kind of bacterial infection and maintain the same immunity as well. Hence, the segment has a major role in the growth of the probiotics industry.

The animal probiotics segment is expected to grow in the foreseeable period due to decreased mortality rate of animals, improved feed conversion efficiency, and increased rate of animal growth. The improved digestion process of animals, which is further helpful for their gut flora, is another market growth propelling factor in the foreseeable period.

Application Analysis

The food and beverage segment led the probiotic ingredients market in 2024 due to high demand for food and beverage options with probiotics. They help to manage gut issues and also prevent them for improved digestion. Such food products are also essential for the body due to a sedentary lifestyle, improper eating habits, and multiple digestive and serious health issues. Probiotics and prebiotics-infused food and beverages are also highly demanded by consumers of different age groups to manage their digestive disorders, and hence, the segment fuels the growth of the market.

The animal nutrition segment is expected to expand in the foreseeable period due to the rising adoption of animals, improving gut health, and better quality of livestock, which is helpful to maintain the gut flora of animals. Use of probiotics for animal feed has received positive responses from pet owners and cattle owners as well. Hence, such factors help to fuel the probiotic industry’s growth in the foreseen period. The segment also helps to manage the unorganized gut habits of animals, further fueling the market’s growth.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Probiotic Ingredients Market

- Kerry Inc. – Kerry is a global leader in taste and nutrition solutions, offering a wide range of probiotic ingredients and functional cultures under its GanedenBC30 and Sporevia™ brands. The company’s probiotic portfolio is used across functional foods, beverages, and dietary supplements, emphasizing stability, efficacy, and clinical validation to support digestive, immune, and overall wellness.

- Chr. Hansen Holding A/S – Chr. Hansen is one of the world’s foremost bioscience companies, specializing in probiotic strains, microbial cultures, and fermentation technology. Its LGG and BB-12 strains are among the most clinically studied probiotics globally, supporting gut health, immunity, and infant nutrition. The company’s science-backed approach and strain specificity make it a dominant supplier in the global probiotic ingredients market.

- DSM (now dsm-firmenich) – DSM offers a robust portfolio of probiotic cultures and nutritional ingredients, focusing on digestive and immune health. Its probiotics are used in dairy, supplements, and early-life nutrition, supported by advanced R&D and strain optimization capabilities. Following its merger with Firmenich, DSM now integrates bioscience and sensory innovation, expanding its applications in functional foods and wellness.

- DuPont de Nemours Inc. (IFF Health Division) – Formerly known for its Danisco range, DuPont’s probiotic ingredient business (now part of International Flavors & Fragrances (IFF)) provides high-quality probiotic strains such as HOWARU. These strains support gut, immune, and cognitive health. The company’s advanced microencapsulation and formulation technologies enhance probiotic stability and performance across food and nutraceutical formats.

- Associated British Foods plc (ABF) – ABF operates in the probiotic ingredients market through its AB Biotek division, which develops fermentation-based microbial and yeast solutions for human and animal nutrition. The company focuses on customized probiotics and functional fermentation solutions, aligning with the global trend toward gut health and microbiome innovation.

- Lallemand Inc. – Lallemand is a leading yeast and bacteria specialist offering probiotic and postbiotic solutions under its Lallemand Health Solutions brand. The company’s clinically validated probiotic strains target gut health, stress management, immunity, and women’s health. Its vertically integrated production and scientific rigor make it a preferred partner for the food, supplement, and pharma industries.

- Archer Daniels Midland (ADM) – ADM has emerged as a major player in probiotics through its acquisition of Deerland Probiotics & Enzymes. The company provides custom probiotic blends and spore-forming strains designed for functional foods and dietary supplements. ADM’s broad expertise in nutrition, fermentation, and formulation supports the integration of probiotics into mainstream consumer products.

- Advanced Enzyme Technologies Ltd. – Advanced Enzyme Technologies develops enzyme and probiotic ingredient blends for digestive health, nutraceuticals, and pharmaceuticals. The company’s probiotic portfolio includes lactobacillus, bifidobacterium, and spore-based strains, supported by clinical validation and sustainable fermentation practices.

- Probi AB – Based in Sweden, Probi AB specializes in clinically documented probiotic strains targeting digestive, immune, and cognitive health. Its proprietary strains, such as LP299V, are integrated into dietary supplements and functional beverages globally. Probi’s focus on clinical research, strain specificity, and delivery optimization enhances its leadership in evidence-based probiotics.

- Adisseo – Adisseo is a global feed and nutrition company providing microbial and probiotic solutions for animal nutrition and gut health. Through its Adisseo Microbial Platform and partnerships, the company develops next-generation probiotics that improve nutrient absorption, disease resistance, and feed efficiency, supporting the sustainable livestock industry.

Segments Covered in the Report

By Form

- Dry/Powder

- Liquid

By Ingredient

- Bacteria

- Lactobacilli

- Bifidobacterium

- Streptococcus

- Other Genus

- Yeast

- Spore Formers

By Application

- Functional Food and Beverages

- Dairy Products

- Yogurt

- Cheese

- Others

- Dairy Products

- Non-dairy Products

- Bakery

- Cereals

- Functional Beverages

- Others

- Dietary Supplements

- Chewables & Gummies

- Capsules

- Powders

- Tablets

- Soft Gels

- Others

- Animal Nutrition

- Others

By End-User

- Human Probiotics

- Animal Probiotics

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5532

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

LinkedIn | Medium| Twitter

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.