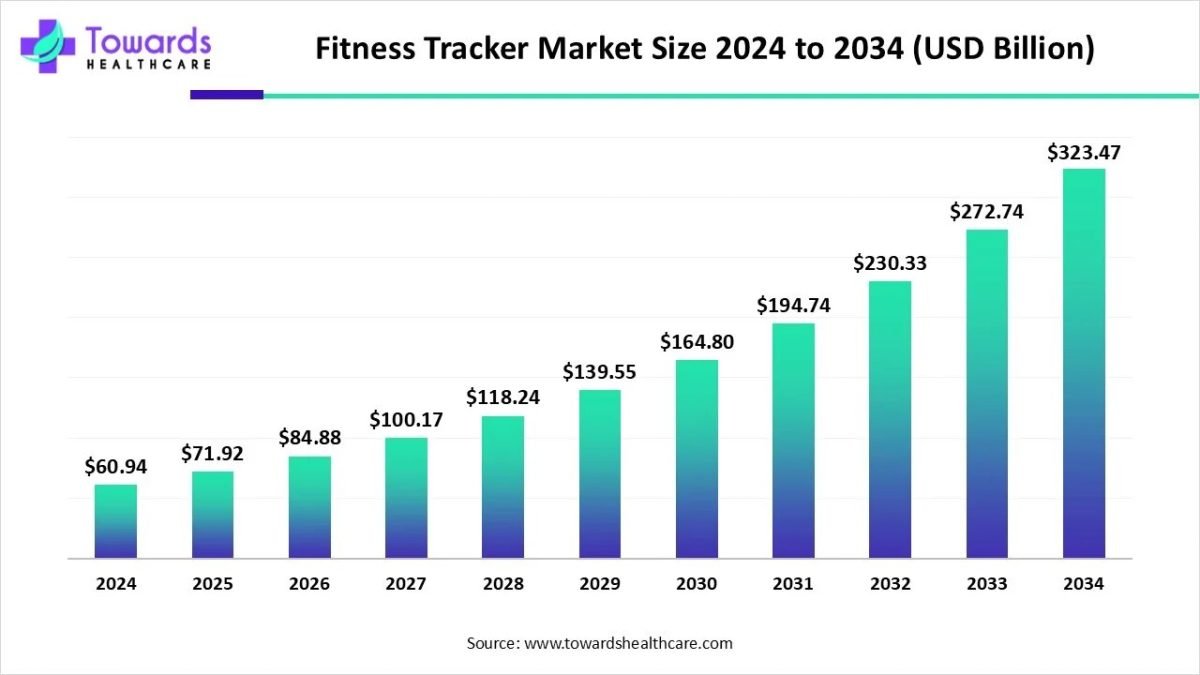

The fitness tracker market size is calculated at USD 71.92 billion in 2025 and is expected to reach around USD 323.47 billion by 2034, growing at a CAGR of 18.04% for the forecasted period.

Ottawa, Nov. 04, 2025 (GLOBE NEWSWIRE) — The global fitness tracker market size was valued at USD 60.94 billion in 2024 and is predicted to hit around USD 323.47 billion by 2034, rising at a 18.04% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is surging as more consumers embrace preventive health, digital fitness ecosystems and advanced sensor-enabled wearables to monitor daily activity, wellness and chronic conditions.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5562

Key Takeaways:

- North America dominated the global fitness tracker market in 2024.

- Asia-Pacific is projected to host the fastest-growing market in the coming years.

- By type, the smart watches segment held a dominant presence in the market in 2024.

- By type, the smart bands segment is projected to expand rapidly in the market in the coming years.

- By application, the running tracking segment led the global market in 2024.

- By application, the glucose monitoring segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By wearing type, the hand wear segment held the largest share of the market in 2024.

- By wearing type, the leg wear segment is expected to grow at the fastest rate in the market during the forecast period.

- By distribution channel, the online segment registered its dominance over the global fitness tracker market in 2024.

- By distribution channel, the offline segment is predicted to witness significant growth in the market over the forecast period.

Market Overview:

What is Stimulating the Increase of the Fitness Tracker Market?

The fitness tracker market has seen a surprising increase recently, with the total worldwide market. This is being exacerbated by the increased awareness of health and wellness, greater smartphone/client-agnostic connectivity, and quick innovation in wearable devices. As lifestyle disorders become more common and a move to remote health monitoring occurs, users are motivated to use a device that will track steps, sleep, heart rate, etc. Additionally, activity bands have moved from simple pedometer devices to more sophisticated wellness ecosystems that feature ECG monitoring, SpO₂, and AI coaching options. These newly broadened offerings have put consumers more into public view and pushed market offerings into mainstream.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

What Factors are Driving Adoption?

- Increasing health awareness and chronic disease management: With tougher sedentary lifestyles continuing to rise in prevalence globally, obesity, diabetes and cardiovascular disease-folks are turning to wearables to provide continuous monitoring and facilitate their overall wellness management.

- Integration of advanced technology (AI/IoT/sensors): Today’s fitness trackers are no longer step-counters. They come with features like ECG, SpO2, GPS capabilities, predictive analytics for user data, or simply smartphone integration for both data-collection and engagement, widely increasing the perceived value of wearables.

- Digital fitness ecosystems and corporate wellness programs: Wearables are being consolidated into different wellness programs, or become an employer incentive, or telehealth account- usage expanded from the fitness enthusiast into population health engagement across cohort eligibility.

- Emerging markets and online distribution: Regions like Asia-Pacific are also seeing increasing incomes, smartphone use, or e-commerce as factors increasing access to fitness trackers, while online channels continue in becoming a primary avenue worldwide for purchase and reducing barriers to the consumer.

Key Drifts:

What Trends Should Industry Stakeholders be Monitoring for the Present?

A move to multifunctional wearables that incorporate fitness tracking with medical-grade health monitoring (ECG, glucose sensing) and wellness information. A combination of smart bands, smartwatches and clothing/footwear wearables as companies seek new form factors and sensor placement. A greater focus on subscription, app ecosystem, and recurring revenue models tied to advanced analytics, coaching and personalization. Increased penetration of non-wrist wearables (e.g., leg-wear, smart insoles) and expansion into application for special purpose (e.g., glucose monitoring, children’s wearables, corporate wellness).

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Significant Challenge:

What is the Main Obstacle in the Fitness Tracker market?

Although fitness trackers provide rich streams of personal health data that may be used to audit personal health initiatives, changes in data privacy, security, and trust issues pose significant challenges to consumer adoption. With the advent of wearables, public awareness of sensitive personal information being transmitted via mobile applications, telehealth systems, and corporate wellness platforms has altered expectations around trust and security. Similarly, battery life represents a constraint preventing advanced sensor-laden devices from delivering all-day continuous monitoring (e.g. ECG, glucose sensing, multi-sport modes). These devices risk a slow evolution of consumer acceptance when real-life monitoring fails to meet expectations for battery life or comfort.

Regional Analysis:

In 2024, North America asserts a leading share of the fitness tracker market. The regional leadership is due to high disposable income, high health-and-fitness awareness, high smart phone penetration and established e-commerce channels. Additionally, in the U.S., the mature corporate wellness infrastructure and health insurance incentive programs increase the demand for health and fitness trackers for employees and patients. The established retail and online distribution channels also allow for quicker product to market and higher product adoption rates.

As fitness trackers become more categorized not just for consumer fitness, but for health monitoring and telemedicine use cases, North America remains the reference region for innovation, premium pricing, and ecosystem partners. Thus, fitness tracker manufacturers frequently use North America as a pilot for new devices, features and subscription services ahead of a larger global rollout.

The Asia-Pacific region is likely to see the greatest growth in the forecast period due to the rapid urbanization, income growth among the middle classes, growing smartphone penetration, and rising health awareness in several countries, such as China and India. In addition, the Asia-Pacific region’s manufacturing capability also enables lower cost production to support a competitive price point and volume growth. In several markets within the Asia-Pacific region, a younger market and the use of fitness trackers to supplement a fashion accessory also increases growth.

Emerging markets in both Southeast Asia and South Asia are seeing increased demand for affordable fitness trackers, smart bands, and health solutions developed specifically for regional and local uses. The shift in demand from premium to mass market wearables represents a significant driver of growth, and as local brands roll out value propositions developed for the region need growth opportunities continue to remain strong.

Segmental Insights:

By Type:

In 2024, the smartwatch category was estimated to have the largest share of the global fitness tracker market, largely due to the inclusion of multi-purpose advanced health metrics such as heart rate traffic, blood oxygen saturation, stress, sleep quality, and real-time GPS. Accordingly, consumers are more frequently opting for smartwatches instead of basic fitness bands, both for their multi-functionality and compatibility with smartphones as well as the high-quality design. Major manufacturers such as Apple, Samsung, Garmin, and Fitbit have continuously improved their watchOS and Wear OS platforms that include simultaneously merging fitness with lifestyle management and productivity.

The smart band category is likely expected to witness strong growth in the coming years because of these bands’ low costs, longer battery life, and lighter weight design of the wearable device that appeals to mass markets. Smart bands serve those who are fitness enthusiasts, students and/or consumers seeking basic fitness metrics but who are unable or unwilling to pay a premium for the higher-end more advanced devices that have numerous health metrics and features. In particular, this segment appeals to consumers seeking access to affordable, basic wearable fitness devices in emerging economies in the Asia Pacific and Latin American regions where health awareness for improvements is likely expanding.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

By Application:

The running tracking segment accounted for the largest share of the global fitness tracker market in 2024, owing to the growing adoption of outdoor fitness activities and the presence of marathon culture. Many fitness trackers are designed to track running-based metrics, such as distance, cadence, stride length, elevation, and pace, allowing consumers to gain more accurate information about their running and providing insights into improvements that may help develop endurance and performance. Trackers have become an essential fitness accessory for athletes and amateur runners due to ongoing developments in running technology that integrate GPS, artificial intelligence-based coaching, and performance mapping tools similar to what traditional sports scientists use to assist runners.

While running and activity track technologies will continue to expand, the glucose monitoring segment will experience the greatest CAGR during the forecast period due to the global epidemic of diabetes and prediabetes. Companies can develop innovative non-invasive tracking technologies for glucose monitoring in wearables that allow consumers to monitor blood glucose levels continuously and consistently without the inconvenience of traditional pricking. Major firms actively working to make glucose active monitoring fitness trackers essentially medical staff-grade preventive health care devices include Fitbit, Apple, and Dexcom.

By Wearing Type:

In 2024, within the fitness tracker market, the hand-wear segment accounted for the largest share because it was convenient, comfortable, and familiar. Users are accustomed to wearing devices on their wrist, which allows them easy access to live data while exercising, receiving notifications, and health metrics provided. These devices have fully transformed from a “fitness” tracker, with users now placing their wearables into distinct lifestyle habits. The majority of wrist devices even allow users to make mobile payments, filter calls, and operate smart home devices. The rapid change of materials, from lightweight titanium to eco-friendly band options have increased the durability and aesthetic of wrist devices, even further increasing their demand.

The leg-wear segment is anticipated to grow at the fastest rate for the forecast period, as wearable and mobile technology has become increasingly sport-specific. Smart leg bands and apparel with sensor technology are now being studied in both professional sport and clinical settings. Specifically, capabilities within sports are allowing better movement analysis for enhanced return to sport and rehabilitation injury analysis, all of which was not possible just a few short years ago (e.g., step accuracy and quantifying muscle performance under high intensity).

By distribution channel:

In 2024, the online distribution channel represented the biggest share of the global fitness tracker market, attributed to the rapidly-expanding e-commerce ecosystem and the increasing appeal of convenience, product comparisons and digital deals. Major online platforms including Amazon, Flipkart, Alibaba, and official brand stores have meaningfully improved accessibility and awareness of wearable technologies, with a pronounced increase in developing countries. Frequent launches exclusive to online platforms, discounts, and subscription-based offerings have added greater strength to the online sales channel.

However, the offline channel segment is also poised for growth in the coming years, based on reopening of retail chains, increased brand-exclusive experience retail stores, and the growing preference for touching and trying product experiences. If nothing else, physical stores remain one of the main outlets for after-sales support and warranty service options, especially consideration in developing and semi-urban areas across the globe.

Browse More Insights of Towards Healthcare:

The safety lancets market was valued at USD 2.1 billion in 2023 and is projected to reach USD 6.32 billion by 2034, growing at a CAGR of 10.54% from 2024 to 2034.

The nebulizer devices market was valued at USD 1.17 billion in 2023 and is anticipated to grow to USD 2.2 billion by 2034, expanding at a CAGR of 5.94% during the forecast period.

The global bionic eye market is estimated at USD 109.06 million in 2024 and is expected to reach USD 255.59 million by 2034, registering a CAGR of 8.89% between 2024 and 2034, driven by the rising blind population and rapid technological advancements.

The coronary stent market is projected to increase from USD 9.65 billion in 2025 to USD 13.27 billion by 2034, witnessing a steady CAGR of 3.6% over the forecast period.

The ventricular assist device (VAD) market is anticipated to grow from USD 1.82 billion in 2025 to USD 3.38 billion by 2034, at a CAGR of 7.1%.

The global medical supplies and labware market is expected to rise from USD 157.6 billion in 2025 to USD 234.21 billion by 2034, expanding at a CAGR of 4.50% throughout the forecast period.

The artificial intelligence in magnetic resonance imaging (MRI) market is projected to grow from USD 6.13 billion in 2024 to USD 11.22 billion by 2034, advancing at a CAGR of 6.23% from 2025 to 2034.

The insulin pump market is forecasted to expand from USD 6.87 billion in 2024 to USD 17.25 billion by 2034, growing at a CAGR of 9.65% between 2025 and 2034.

The global non-invasive blood glucose monitoring system market is estimated at USD 34 million in 2024 and is projected to reach USD 316.65 million by 2034, showcasing a remarkable CAGR of 25% over the forecast period.

The global smart bandages market is expected to grow from USD 880.42 million in 2025 to USD 2,518.71 million by 2034, progressing at a CAGR of 11.5% from 2025 to 2034.

Recent Developments:

In June 24, 2025, Amazfit (under Zepp Health Corporation) introduced its “Balance 2” smartwatch and “Helio Strap” screen-free tracking band, both requiring no subscription and aimed at performance training and recovery.

Fitness Tracker Market Key Players List:

- Amazfit Global

- Apple

- Asus

- Fitbit

- Garmin

- Huawei Technologies Co. Ltd.

- Oura Health Ltd.

- Samsung Electronics

- Whoop

- Xiaomi Technology Co. Ltd.

- YOORX

Segments Covered in the Report

By Type

- Smart Watches

- Smart Bands

- Smart Clothing

- Others

By Application

- Heart Rate Tracking

- Sleep Monitoring

- Glucose Monitoring

- Sports

- Running Tracking

- Cycling Tracking

- Others

By Wearing Type

- Hand Wear

- Leg Wear

- Head Wear

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5562

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.