The Video Streaming market is expanding rapidly as consumers shift to on-demand OTT platforms, fueled by high-speed internet, smartphone adoption, AI-powered recommendations, and ultra-HD content delivery.

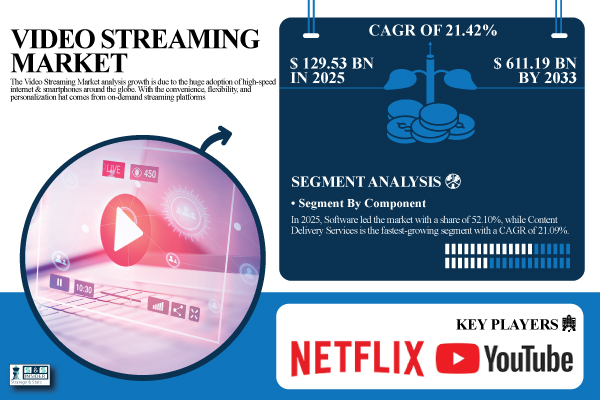

Austin, Oct. 21, 2025 (GLOBE NEWSWIRE) — The Video Streaming Market Size was valued at USD 129.53 Billion in 2025E and is expected to reach USD 611.19 Billion by 2033 and grow at a CAGR of 21.42% over 2026-2033.

The global use of smartphones and high-speed internet worldwide is driving the expansion of the video streaming market. Customers are moving away from traditional broadcast and cable television owing to the convenience, customization, and flexibility offered by on-demand streaming alternatives.

Download PDF Sample of Video Streaming Market @ https://www.snsinsider.com/sample-request/8721

The U.S. Video Streaming Market size was USD 35.74 Billion in 2025E and is expected to reach USD 165.09 Billion by 2033, growing at a CAGR of 21.10% over 2026-2033.

Strong OTT adoption, extensive smartphone use, and high broadband penetration are the main factors propelling the U.S. market’s expansion. With the help of cutting-edge technology and individualized, superior content experiences, consumers are favoring on-demand and live streaming more and more.

Key Players:

- Netflix

- Amazon Prime Video

- YouTube

- Disney+

- HBO Max

- JioHotstar

- Apple TV+

- Spotify

- NBCUniversal

- Paramount+

- Peacock

- Hulu

- Max

- Dacast

- Uscreen

- Muvi

- Panopto

- VIDIZMO

- VPlayed

- Sling TV

Video Streaming Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 129.53 Billion |

| Market Size by 2033 | USD 611.19 Billion |

| CAGR | CAGR of 21.42% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Content Delivery Services) • By Streaming Type (Live Video Streaming, Non-Linear Video Streaming) • By Platform (Gaming Consoles, Laptops & Desktops, Smartphones & Tablets, Smart TV) • By Solutions (Internet Protocol TV, Over-the-Top [OTT], Cable TV, Pay-TV) • By End User (Enterprise, Consumer) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

If You Need Any Customization on Video Streaming Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8721

Segmentation Analysis:

By Component, in 2025, Software Led the Market with a Share of 52.10%, while Content Delivery Services is the Fastest-growing Segment with a CAGR of 21.09%

In the Video Streaming Market, the Software leads in 2025, due to its essential role in enabling content management, streaming, and user interface functionality. Content Delivery Services forecast to be the fastest-growing segment as demand for high-quality, low-latency streaming across multiple devices continues to grow.

By Streaming Type, in 2025, Live Video Streaming Held the Largest Share of 55.30%, while Non-Linear Video Streaming is the Fastest-growing Segment with a CAGR of 22.10%

In the Video Streaming Market, the Live Video Streaming leads in 2025, owing to the increasing demand for real-time content, including sports, news, concerts, and interactive events. Non-Linear Video Streaming segment is the fastest-growing segment–driven primarily by the demand for on-demand content that allows users to watch shows, movies, and educational material at their own convenience.

By Platform, in 2025, Smartphones & Tablets Dominated the Market with a Share of 53.20%, while Smart TVs is the Fastest-growing Segment with a CAGR of 22.30%

In the Video Streaming Market, Smartphones & Tablets lead the market in 2025 due to their widespread adoption, portability, and convenience, enabling users to stream content anytime and anywhere. Smart TVs are the fastest-growing segment, driven by the increase is attributed to their capability to hold OTT apps and use upgrades of television and display technology.

By Solutions, in 2025, Over-the-Top (OTT) Dominated with a Share of 48.70%, while Internet Protocol TV is the Fastest-growing Segment with a CAGR of 21.80%

In the Video Streaming Market, the Over-the-Top (OTT) leads in 2025, owing to provide on-demand content through internet for streaming directly to consumer devices, such as media players, smart TVs, and gaming consoles streaming services (OTT). Internet Protocol TV is the fastest growing segment due to ever-growing broadband penetration, increasing enterprise adoption, and the need for high quality, low latency streaming.

By End-User, in 2025, Consumer Segment Accounted for the Largest Share of 62.80%, while Enterprise is the Fastest-growing Segment with a CAGR of 23.10%

Consumer leads in 2025, derived by increasing needs for entertainment, on demand content, and subscription-based services. Enterprise segment is the fastest growing segment supported by the use of video streaming for corporate communication including corporate virtual meetings, webinars and online training programs.

Regional Insights:

North America dominated the Video Streaming Market in 2025E, with over 38.30% revenue share, due high internet penetration, smartphone adoption, and broadband infrastructure.

The Asia Pacific region is expected to have the fastest-growing CAGR 22.59%, due to growing smartphone adoption, deepening internet penetration, and a vibrant and youthful population highly engaged with digital content.

Recent Developments:

- In September 2025, YouTube launched new AI tools, including Google DeepMind’s Veo 3 for YouTube Shorts, aimed at improving content creation, monetization, and viewer engagement on the platform.

- In October 2025, Apple TV+ launched the new mystery thriller series Down Cemetery Road, starring Emma Thompson and Ruth Wilson, which adds to the platform’s collection of exclusive original content.

Buy Full Research Report on Video Streaming Market 2026-2033 @ https://www.snsinsider.com/checkout/8721

Exclusive Sections of the Report (The USPs):

- Content Personalization & Behavioral Engagement Metrics – helps you understand how effectively platforms drive stickiness by tracking personalized recommendations consumed per user, engagement with AI-curated playlists, and interaction heatmaps showing where users rewind or skip most.

- Cross-Platform Viewing Continuity Index – helps you evaluate device-agnostic consumption patterns by measuring users switching devices mid-stream, multi-platform login behavior, and the adoption rate of bundled access across services or hardware ecosystems.

- Social Interaction & Community Participation Score – helps you quantify the virality and community pull of video platforms by analyzing video shares/likes, participation in live streams via comments and polls, and the impact of social media influence on subscription uptake.

- Content Lifecycle & Refresh Velocity Metrics – helps you assess retention power by examining the average lifespan of content popularity, frequency of new content drops (episodes/live events), and the rate at which titles are removed or expire.

- Competitive Landscape – helps you gauge the strategic positioning of leading streaming providers backed by an analysis of their content refresh speed, engagement depth, bundling strategies, pricing innovations, and recent catalog or technology developments.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.