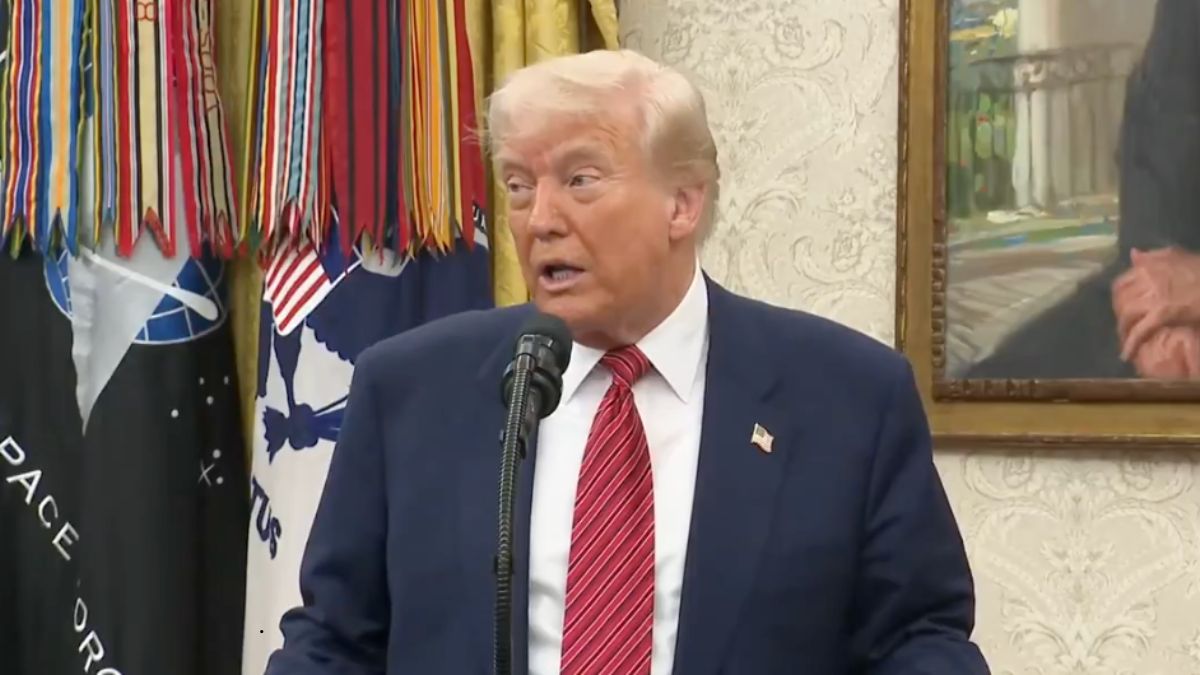

Auto stocks, particularly Tata Motors and select auto ancillary players, are in sharp focus after former U.S. President Donald Trump announced a delay in the imposition of 50% tariffs on European Union goods to July 9, providing automakers with a crucial window to strategize. The development is expected to ease near-term concerns for Indian auto companies with substantial exposure to Europe.

The move followed Trump’s phone conversation with European Commission President Ursula von der Leyen, who pledged to engage in “serious negotiations.” Trump’s decision grants businesses and regulators additional time to find common ground, easing immediate market volatility.