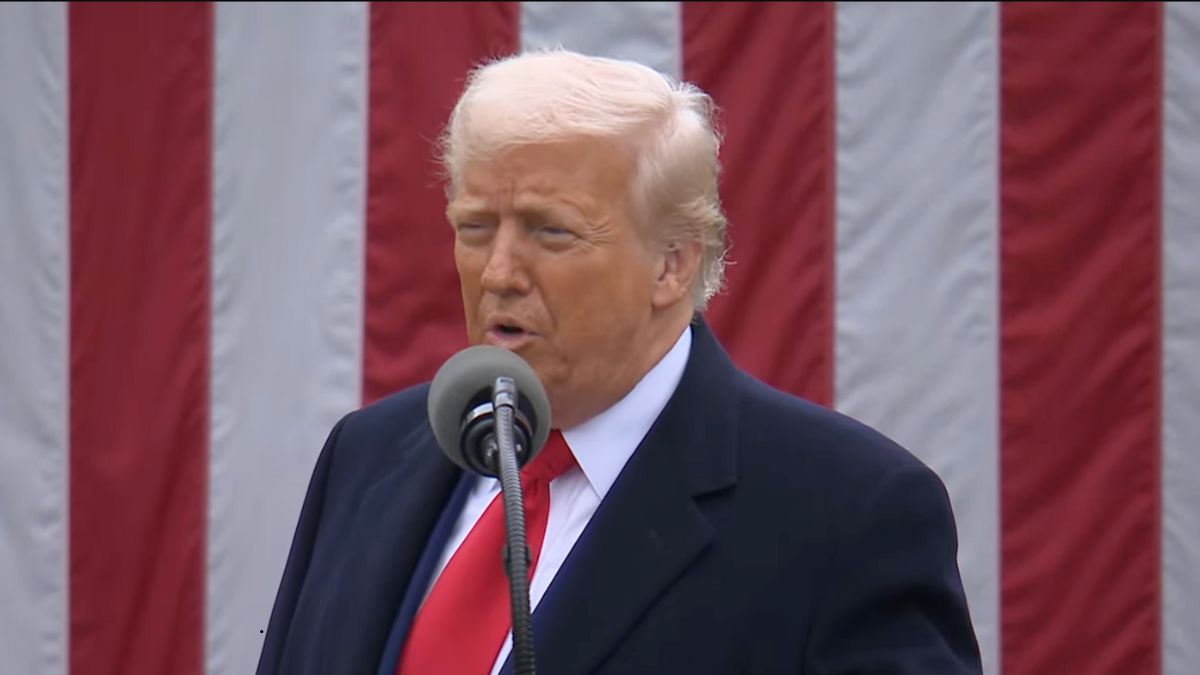

The newly announced Trump tariffs have jolted global markets, signaling a renewed era of protectionism under former U.S. President Donald Trump’s proposed economic strategy. The policy—outlined via a sweeping executive order—brings back trade war memories and introduces steep new levies under the banner of “reciprocal tariffs.” Here’s everything you need to know in 10 crucial points:

1. Trump tariffs shock the global economy and markets

The Trump tariffs mark a significant hawkish shift that surprised investors and global policymakers. This unexpected move revives concerns of a fractured global trade order and sets the stage for potential inflationary pressures and retaliatory actions.

2. Sharp hikes for China, EU, and India

Under the new Trump tariffs, China will now face a total tariff of 54%, with a 34% increase on top of the existing 20%. The European Union has been assigned a 20% rate, and Indian goods will be subjected to a 26% tariff.

3. Implementation begins April 5, sharper hikes from April 9

Starting April 5, the U.S. will impose a minimum 10% tariff on all goods imports. However, more aggressive tariff rates—especially those affecting China, India, and the EU—will be enforced from April 9.

4. Trump tariffs based on broader trade barriers

These reciprocal tariffs are not just a response to headline tariffs imposed on U.S. goods. The Trump administration has factored in non-tariff barriers, including VATs, regulatory roadblocks, and licensing restrictions, in determining the effective tariff rate.

5. Canada and Mexico remain exempt

The Trump tariffs will not apply to Canada and Mexico, two of the U.S.’s largest trading partners. This exemption reflects the special trade terms under the USMCA agreement and the strategic importance of North American trade.

6. Sectoral exclusions under Section 232

The executive order excludes goods already covered under Section 232 tariffs, which are justified on national security grounds. These include key sectors such as autos, steel, aluminum, copper, pharma, semiconductors, and lumber.

7. Effective tariff rate to soar to 25%

If fully implemented, the Trump tariffs would raise the U.S.’s average effective tariff rate to 25%, a dramatic escalation from 2.3% when Trump first assumed office. This would mark one of the steepest protectionist shifts in recent history.

8. JPMorgan: A $660 billion tax hike

According to JPMorgan, applying the Trump tariffs across the full $3.3 trillion base of U.S. goods imports translates to a $660 billion tax increase—or approximately 2.2% of U.S. GDP—effectively functioning as a massive fiscal shock.

9. Global retaliation on the horizon

The Trump tariffs could prompt immediate retaliation from China and the European Union, with other nations potentially joining. However, Trump has left the door open for country-specific negotiations, suggesting flexibility based on bilateral talks.

10. Non-tariff barriers complicate reversal

One key challenge: many of the Trump tariffs are based on non-tariff barriers—such as VAT and regulatory practices—which foreign governments may not be able to reverse easily. This limits the potential for quick resolutions via headline tariff cuts alone.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Stock market investments are subject to market risks. Please consult a qualified financial advisor before making any investment decisions.