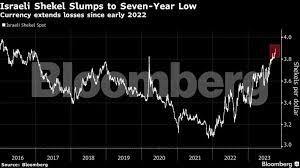

Stock markets across the Middle East faced a decline as worries grew about the potential escalation of the conflict, leading to a 2.9% drop in Dubai’s benchmark gauge. The Israeli shekel also underwent a notable decline, despite the Bank of Israel’s announcement of its preparedness to sell tens of billions of dollars in foreign exchange to steady the currency in the aftermath of a surprise attack by Hamas militants.The central bank, in an unprecedented move, announced plans to sell up to $30 billion and extend up to $15 billion through swap mechanisms to support the market, as stated in a release on Monday. The objective is to mitigate volatility in the shekel’s exchange rate and ensure necessary liquidity during this period, the bank explained.The Bank of Israel did something important and different from what it did before. They are helping the shekel, Israel’s money, by selling some foreign money. This is the first time they’ve done this since they let the money trade freely. They decided to do this because of a very bad attack on Israel by Hamas. The Prime Minister, Benjamin Netanyahu, says this fight with Hamas will last a long time and be hard.Even though the Bank of Israel is trying to help, Israel’s money went down a lot, reaching 3.9235 against the dollar. That’s 2% less, and it’s the weakest it has been since 2016. The stock market in Israel, called the TA-35, also went down by 1.3% on Monday, but then it went up by 0.2%. On Sunday, it had gone down a lot by 6.5%.This problem is not only in Israel. Other places in the Middle East, like Dubai, also had their stock markets go down by 2.9%. People are worried that this fight might become a much bigger and longer problem.

Middle East stock markets tumble as Israel’s Shekel slides amid escalating conflict

2 min read