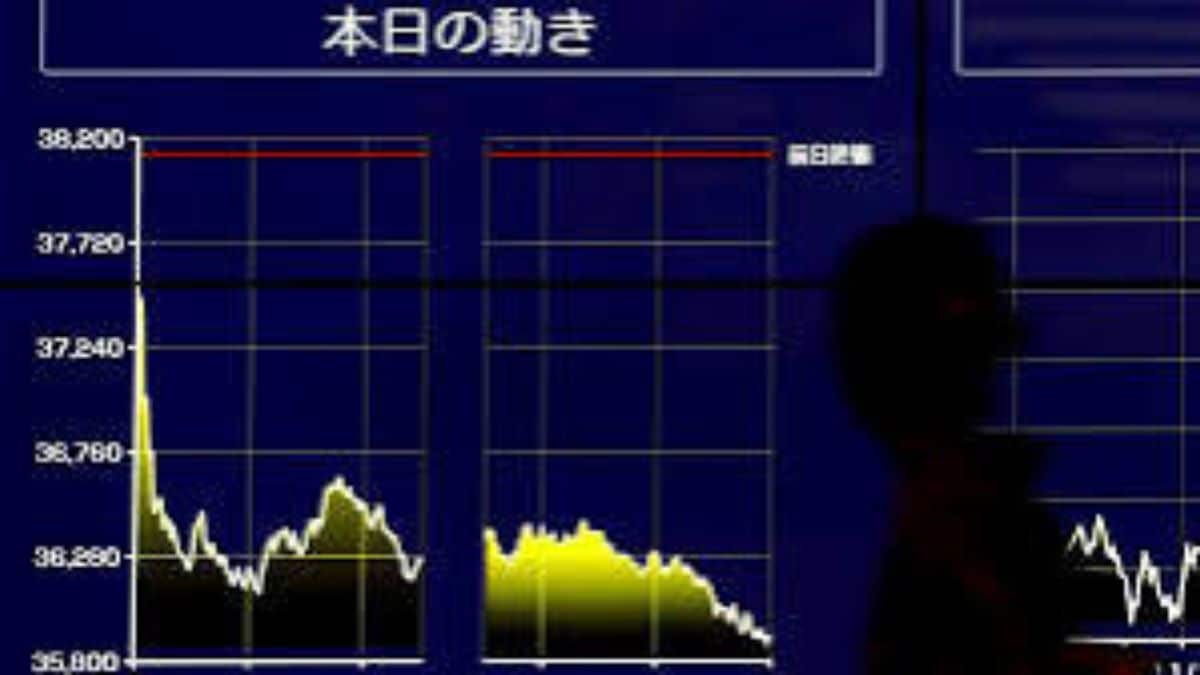

The Tokyo stock market was rocked on Monday by an unprecedented wave of selling, driven by a confluence of fears about a U.S. economic slowdown, plummeting U.S. stock prices, and a sharply appreciating yen. The benchmark Nikkei 225 index plummeted a staggering 4,451 points, marking the largest single-day point loss in its history and surpassing the infamous “Black Monday” decline of 1987. Over the past three trading days, the Nikkei has shed more than 7,600 points, erasing gains accumulated earlier in the year.

The dramatic downturn followed the release of disappointing U.S. jobs data for July, which revealed nonfarm payrolls significantly below market expectations and an increase in the unemployment rate. The weak data triggered concerns about a potential hard landing for the U.S. economy, spurring a global sell-off in equities. On Friday, the Dow Jones Industrial Average had already experienced its largest decline of the year, closing down 610 points.

The negative sentiment quickly spread across global markets, with major Asian indices, including those in South Korea and Taiwan, dropping over 8%. European markets also felt the impact, with a leading index briefly falling more than 3% on Monday. In response to the turmoil, investors shifted their focus to government bonds, leading to a rise in bond prices and a corresponding drop in long-term interest rates.

The Nikkei’s decline starkly contrasts its earlier performance, having reached a record high of 42,224 on July 11, buoyed by several favorable factors: a strong U.S. stock market, the semiconductor boom driven by companies like Nvidia, and a weak yen. The latter had attracted foreign investment by making Japanese stocks appear undervalued. However, the yen’s unexpected appreciation—nearly ¥8 stronger against the dollar since Friday—has undermined this advantage, erasing perceived value in Japanese equities.

Adding to the complexity, the recent Bank of Japan decision to raise its short-term interest rate target, coupled with expectations of a U.S. Federal Reserve rate cut in September, further pressured the yen and exacerbated market instability. This sudden shift in currency dynamics has led to a reevaluation of Japanese stock valuations.

The repercussions of this volatile period extend beyond the stock market. A stronger yen could negatively impact exporting companies, reducing their operating income as highlighted by SMBC Nikko Securities. Conversely, the appreciation of the yen may help reduce import costs and ease inflationary pressures, potentially benefiting consumers.

The downturn also poses risks to domestic consumption. The recent introduction of the Nippon Individual Savings Account (NISA) program had encouraged many individual investors to enter the stock market. Prolonged low stock prices could erode their investments and dampen consumption.

Despite the immediate panic, some analysts view the situation as a potential buying opportunity. Yusuke Shimoda of the Japan Research Institute Ltd. suggests that while the market turmoil may induce short-term anxiety, long-term investors should consider the current dip as an opportunity to acquire stocks at reduced prices.