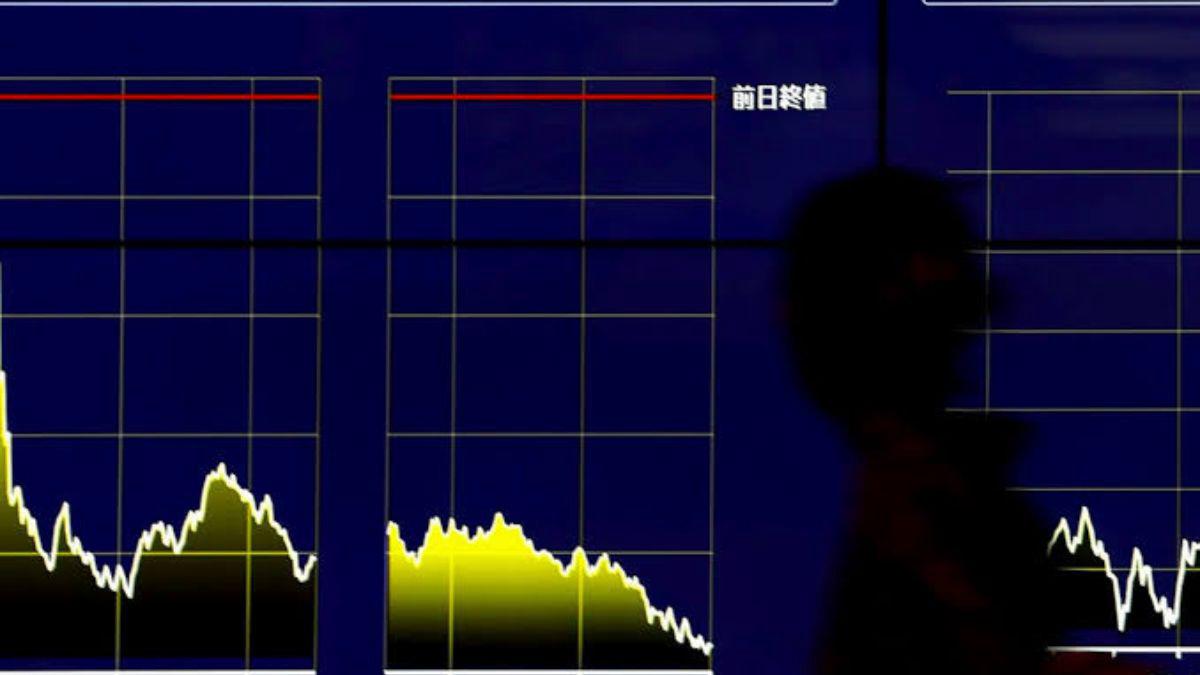

Japan’s Nikkei share average posted a solid gain on Wednesday, buoyed by news of Prime Minister Fumio Kishida’s impending resignation and cautious optimism ahead of U.S. inflation data. The Nikkei closed up 0.6% at 36,442.43, marking its third consecutive day of gains. Meanwhile, the broader Topix index rose by 1.1% to 2,581.90.

The market initially surged over 1% following reports that Kishida will step down as the leader of the ruling Liberal Democratic Party in September. Kishida confirmed these reports in a televised press conference, a move that has been widely anticipated. Despite the potential for increased political uncertainty, analysts suggest that Kishida’s low approval ratings may mitigate the negative impact on equities.

Charu Chanana, global market strategist and head of FX strategy at Saxo, commented on the situation, stating, “His low approval ratings mean a significant negative reaction from equities may be avoided.” Chanana noted that while the prime minister’s resignation could introduce some volatility, the overall effect on the market might be contained.

In addition to local political developments, the Japanese stock market also mirrored overnight gains on Wall Street, spurred by positive U.S. producer price data that reinforced speculation about a possible Federal Reserve interest rate cut in September. However, gains were moderated as investors took profits and shifted focus to the upcoming U.S. consumer price index report.

In sector performance, automakers led the day’s gains with a 2.8% rise, driven by Toyota Motor and Honda Motor, which both saw over 3% increases. Among individual stocks, SoftBank Group, a major startup investor, contributed significantly to the Nikkei’s rise with a 1.7% gain. Staffing agency Recruit Holdings also saw a 2.5% increase. Conversely, chip-testing equipment maker Advantest rose by 1%, while chip-related stock Tokyo Electron experienced a slight decline of 0.6%.

As investors await further economic data, particularly U.S. consumer prices and retail sales later in the week, market sentiment remains cautious but optimistic, with ongoing scrutiny of both domestic and international economic indicators.