In a surprising turn of events, U.S. home prices experienced their most substantial annual gain in 2023, defying expectations and rising 4.8% nationally in October compared to the same month in 2022. According to the S&P CoreLogic Case-Shiller home price index, this marks a notable increase from the 4% annual rise reported in September, signaling resilience in the real estate market despite higher mortgage rates.

Among the top 20 cities, Detroit led the pack with an impressive year-over-year gain of 8.1% in October. San Diego closely followed with a 7.2% increase, and New York recorded a substantial 7.1% gain. Notably, the city of Portland, Oregon, was the sole outlier, experiencing a 0.6% decrease in home prices, the only decline reported in the index for October compared to the previous year.

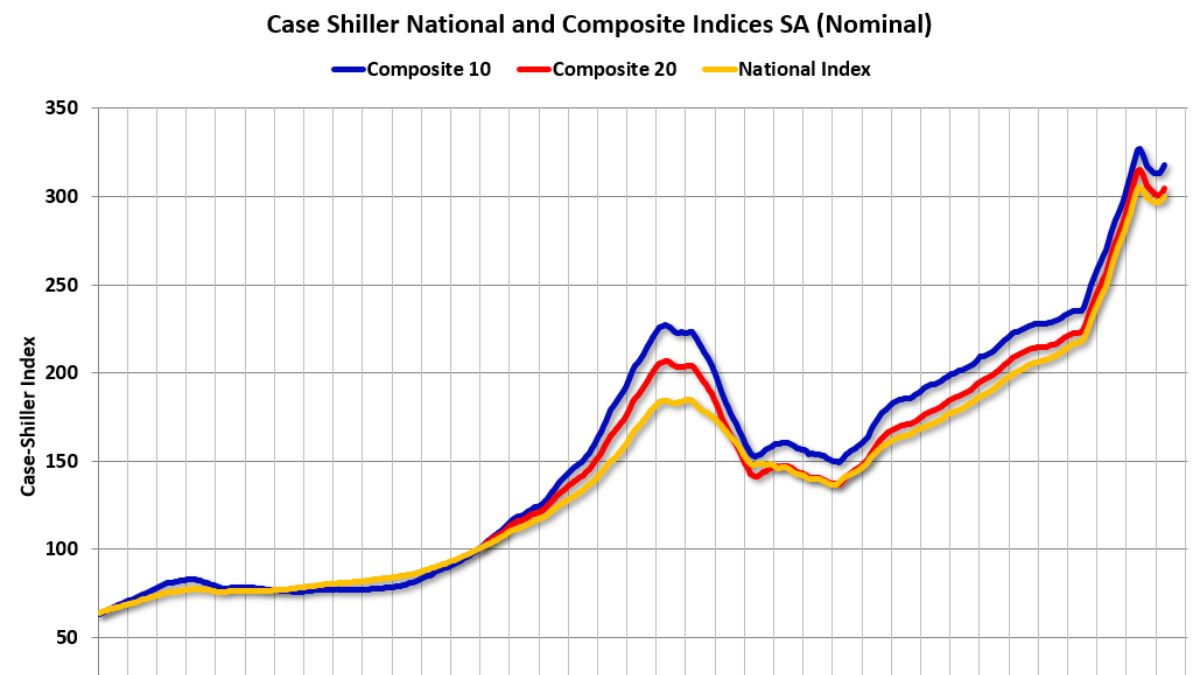

The 10-city composite posted a robust 5.7% increase, a significant uptick from the 4.8% reported in the previous month. Similarly, the 20-city composite rose by 4.9%, surpassing the 3.9% advance recorded in September.

The strength in home prices during October is particularly noteworthy given the sharp rise in mortgage interest rates. On October 19, the average rate on the 30-year fixed loan surpassed 8%, reaching the highest level in over two decades, as reported by Mortgage News Daily. However, despite these elevated rates, home prices continued to climb. Rates gradually declined throughout November and experienced a more pronounced drop in December, currently hovering around 6.7% for the 30-year fixed rate.

Brian Luke, Head of Commodities, Real & Digital Assets at S&P DJI, highlighted the resilience of the housing market, stating, “Home prices leaned into the highest mortgage rates recorded in this market cycle and continued to push higher.” Luke expressed optimism, anticipating that with the easing of mortgage rates and a more accommodative stance from the Federal Reserve, homeowners might witness further appreciation.

Selma Hepp, Chief Economist at CoreLogic, provided additional insights, stating, “Home price gains in the CoreLogic S&P Case-Shiller Index have increased by 7% since the beginning of the year and are 1% higher than at the peak in 2022, recovering all losses recorded in the second half of 2022.” Hepp projected that with stronger seasonal gains observed in early 2023, annual home price appreciation could accelerate in the winter before experiencing a slowdown in the following year. The unexpected buoyancy in home prices adds a layer of complexity to the narrative surrounding the real estate market, challenging conventional expectations amid shifting economic dynamics.