Calculating Social Security benefits involves several steps, taking into account factors such as your earnings history, the age at which you choose to claim benefits, and other eligibility criteria. Here’s a step-by-step guide on how to calculate your Social Security benefits:

- Understand Your Full Retirement Age (FRA):

- Your Full Retirement Age (FRA) is the age at which you can receive your full Social Security retirement benefits. It varies depending on the year you were born. You can find your FRA on the Social Security Administration’s (SSA) website or by contacting the SSA directly.

- Review Your Earnings History:

- Social Security benefits are based on your highest-earning 35 years of work. The SSA uses an indexed formula to adjust your past earnings for inflation. You can check your earnings history on your Social Security statement, available on the SSA’s website.

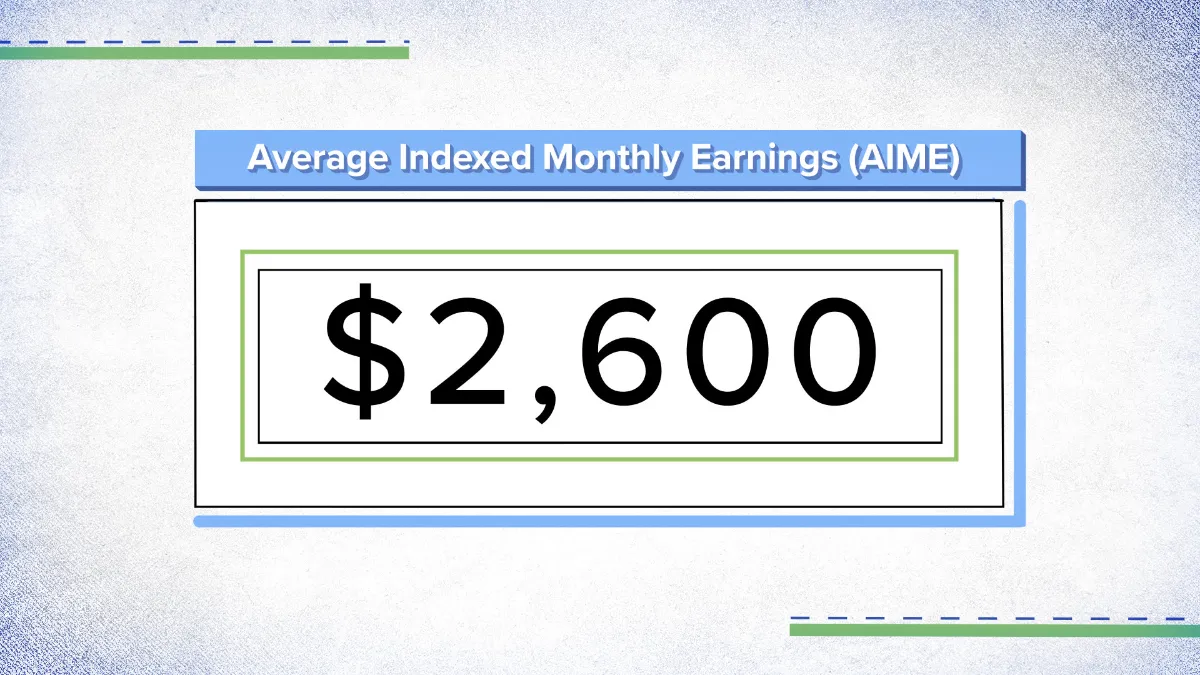

- Calculate Average Indexed Monthly Earnings (AIME):

- Sum up your highest-earning 35 years and divide the total by 420 (the number of months in 35 years). This gives you your Average Indexed Monthly Earnings (AIME).

- Determine Your Primary Insurance Amount (PIA):

- Apply a formula to your AIME to calculate your Primary Insurance Amount (PIA). The formula varies depending on the year you become eligible for benefits. The PIA represents the amount you would receive if you claim benefits at your Full Retirement Age.

- Understand Adjustments for Early or Delayed Retirement:

- If you choose to claim benefits before your Full Retirement Age, your benefits will be reduced. Conversely, if you delay claiming benefits beyond your FRA, you may be eligible for delayed retirement credits, resulting in higher monthly benefits.

- Consider Spousal Benefits:

- If you’re married, divorced, or a surviving spouse, you may be eligible for spousal benefits based on your spouse’s or ex-spouse’s earnings. Understanding the rules for spousal benefits can impact your overall Social Security strategy.

- Use the Social Security Calculator:

- The Social Security Administration provides online calculators that can help estimate your benefits based on different claiming ages. These calculators consider various scenarios, allowing you to explore the impact of early, full, or delayed retirement on your benefits.

- Consult with the Social Security Administration or a Financial Advisor:

- If you have specific questions or need personalized guidance, consider reaching out to the Social Security Administration directly. Alternatively, consulting with a financial advisor who specializes in retirement planning can provide valuable insights tailored to your unique financial situation.

Remember, Social Security calculations can be complex, and individual circumstances vary. Utilize available resources, stay informed about the rules and regulations, and consider seeking professional advice to make well-informed decisions about your Social Security benefits.

TOPICS:

Social Security Calculator