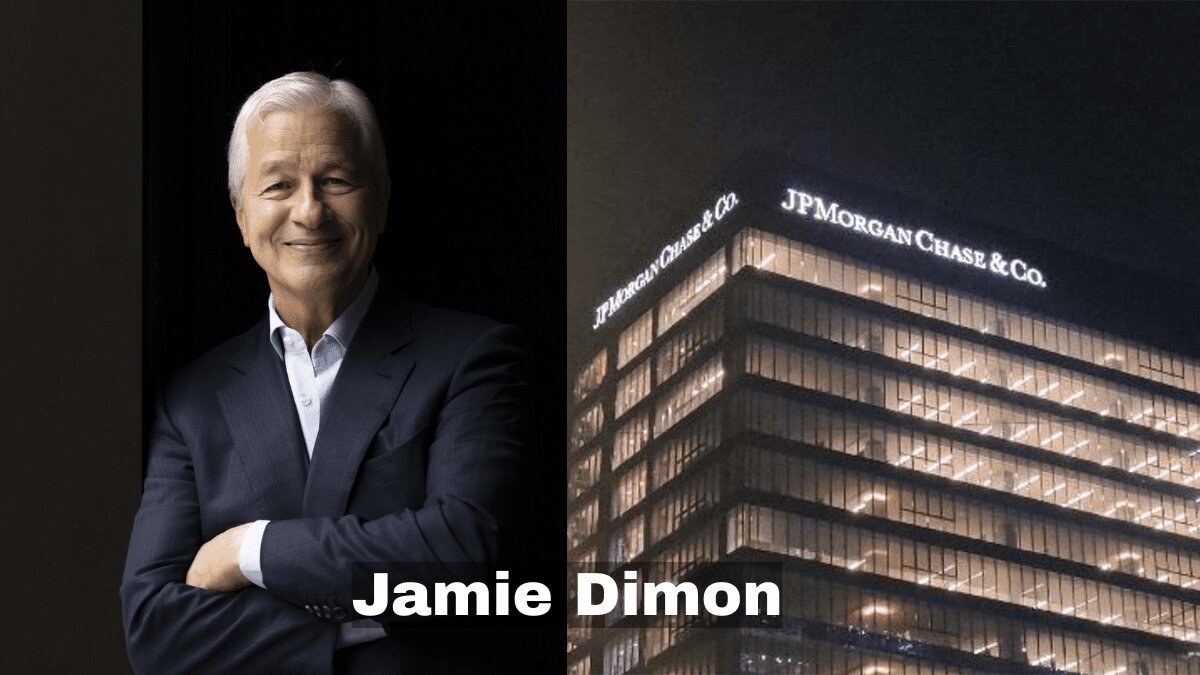

The Visionary CEO Behind JPMorgan Chase

In the world of finance, few names command as much respect and recognition as Jamie Dimon. As the long-standing CEO and Chairman of JPMorgan Chase, Dimon has become synonymous with resilience, strategy, and leadership in the banking world. From steering JPMorgan through the 2008 financial crisis to spearheading modern banking innovations, his career has become a case study in visionary leadership. But before Jamie Dimon became a titan of Wall Street, he was a young student with ambition, discipline, and a passion for numbers.

As he once said,

“You have to earn your success every day, and you can’t make excuses.”

credit- news week

Early Life and Education: From Tufts to Harvard – Building the Foundations of Leadership

Jamie Dimon’s early life laid the intellectual and emotional groundwork for a career that would one day redefine American banking. Born on March 13, 1956, in New York City, Dimon was raised in a Greek-American household where education, discipline, and financial awareness were highly valued. His grandfather, a Greek immigrant, was a banker in Athens before relocating to the U.S., and both his father and grandfather worked as stockbrokers at Shearson, giving Dimon early exposure to the world of finance.

Growing up in Queens, New York, Dimon was a curious and ambitious child. His parents instilled in him the importance of education, critical thinking, and hard work. He attended the elite Browning School in Manhattan before enrolling at Tufts University. At Tufts, Dimon majored in psychology and economics—an unusual combination that later served him well in understanding both numbers and people.

Dimon’s academic drive stood out. He was known for his analytical approach, sharp wit, and relentless curiosity. His senior thesis, focused on economic policy, impressed many of his professors and foreshadowed his future as a strategist and decision-maker. But what truly set him apart was his ability to connect economics with real-world applications.

After Tufts, Dimon was accepted into the prestigious Harvard Business School. During his time there, he earned the distinction of being a Baker Scholar, a title reserved for the top 5% of his class. At Harvard, he didn’t just learn corporate finance; he debated fiercely, built networks, and honed a leadership style that combined data-driven decision-making with human empathy.

One of his Harvard professors once remarked, “Jamie had a razor-sharp mind, but more than that, he had purpose.”

Dimon also interned at Goldman Sachs during his MBA, but he famously turned down a lucrative offer to work with Sandy Weill at American Express, a decision that would eventually shape his entire career. Reflecting on this moment, Dimon said,

“I wanted to be part of something bigger than a salary—I wanted to build something.”

His Harvard years weren’t just about academics; they were about shaping a lifelong vision of leadership, one based on merit, bold thinking, and strategic patience. As he would later put it,

“Education isn’t just about what you learn, but how you use what you learn to make an impact.”

From Tufts to Harvard, Jamie Dimon was already walking the path that would one day lead him to the summit of global finance.

Jamie Dimon with Spouse: Judith Kent- credits- coming soon. net

Career Milestones: Navigating Citigroup, Rescuing Bank One, and Reigning at JPMorgan Chase

Jamie Dimon’s career journey is a testament to strategic foresight, adaptability, and courageous leadership. After graduating from Harvard Business School, he chose to work under financial pioneer Sandy Weill at American Express, turning down more lucrative offers elsewhere. This decision laid the foundation for a lifelong mentor-protégé relationship that would shape Dimon’s early career.

Dimon and Weill later left American Express to build Commercial Credit, which they transformed into a financial powerhouse through a series of aggressive mergers. Their journey culminated in the creation of Citigroup in 1998, after merging with Travelers Group. Dimon served as President and Chief Operating Officer of Citigroup. Despite the firm’s meteoric rise, internal tensions grew. In 1998, Dimon was abruptly fired due to personal disagreements with Weill. Reflecting on this, Dimon later remarked,

“You learn more from setbacks than you do from successes. That moment made me stronger.”

In 2000, Dimon made a stunning comeback by joining Bank One—a struggling midwestern bank—as CEO. Within four years, he revitalized the organisation, cut costs, restructured operations, and restored investor confidence. His leadership style was hands-on, data-driven, and brutally honest. As one former Bank One executive put it, “Jamie wasn’t afraid to make the tough calls. He led from the front.”

Dimon’s turnaround of Bank One caught the attention of JPMorgan Chase. In 2004, JPMorgan acquired Bank One, and Dimon became President and COO of the combined entity. A year later, he was named CEO—and in 2006, Chairman of the Board.

His tenure at JPMorgan Chase has been nothing short of historic. He steered the bank through the 2008 financial crisis with a steady hand, making bold acquisitions like Bear Stearns and Washington Mutual. Unlike many rivals, JPMorgan emerged stronger, thanks in large part to Dimon’s emphasis on risk management.

As Dimon famously said during the crisis,

“You can’t run a bank by looking at a rearview mirror. You need to see what’s coming.”

Under his leadership, JPMorgan Chase became the largest bank in the United States by assets. His strategic decisions, including investing in technology and expanding internationally, ensured the bank’s resilience and relevance in a digital world.

Today, Dimon is not just a CEO—he is a symbol of leadership in high-stakes environments. As The New York Times once wrote, “In Jamie Dimon, Wall Street found its general in the fog of war.”

Legacy and Leadership Style: Jamie Dimon’s Influence on Wall Street and Global Finance

Jamie Dimon’s legacy goes beyond corporate growth and quarterly earnings. He is widely credited with reshaping modern banking and setting new benchmarks for ethical leadership and financial responsibility. His leadership style is marked by clarity, resilience, and a long-term vision, even in the face of immense pressure.

Unlike many of his peers, Dimon never hesitated to speak truth to power. Whether testifying before Congress or writing annual shareholder letters, he often voiced his unfiltered views on the U.S. economy, global markets, and regulatory reforms. “

We need a banking system that works for the people, not just for the bankers,” Dimon

wrote in a 2019 letter—an ethos that resonates throughout his leadership.

A key aspect of Dimon’s leadership is transparency. Employees, investors, and policymakers trust him not just because of his track record but because of his authenticity. He doesn’t shy away from difficult conversations, and he takes responsibility when things go wrong. After the “London Whale” trading loss in 2012, Dimon publicly admitted the bank’s failures, saying, “This should never have happened. Period.”

He’s also been a champion for digital transformation within banking. Under his leadership, JPMorgan invested billions in fintech, cybersecurity, and AI, ensuring it remained ahead of competitors. He pushed for modernisation not just as a survival tactic but as a forward-thinking strategy. As he put it,

“Banks that don’t innovate will become history.”

Dimon also prioritized corporate responsibility. From community development to diversity hiring initiatives, he believed that banks should do more than make money—they should make a difference. His leadership at JPMorgan Chase Foundation helped direct millions toward underserved communities and small businesses.

On Wall Street, Dimon is often viewed as a moral compass—a rarity in an industry known for volatility. His name is frequently floated in political circles, and some have speculated that he could run for public office. Though Dimon has dismissed such ambitions, his influence on public policy remains substantial.

“Jamie Dimon isn’t just a banker,” said a CNBC anchor, “He’s the conscience of corporate America.”

In a post-pandemic world, as industries grapple with uncertainty, Dimon’s leadership continues to inspire executives across the globe. His legacy is one of steadiness in chaos, strength in adversity, and vision in complexity.

The Enduring Legacy of Jamie Dimon

Jamie Dimon’s life and career reflect the kind of leadership the modern world desperately needs—decisive, ethical, and future-ready. From his early days studying psychology and economics to becoming the most powerful banker on Wall Street, his journey has been anything but ordinary.

He turned early lessons into lifelong principles and turned setbacks into fuel for comebacks. Whether revitalising Bank One, stabilising JPMorgan Chase during the financial crisis, or driving innovation through fintech, Dimon proved that great leaders don’t just respond to change—they anticipate it.

In a world often rocked by economic uncertainty and leadership vacuums, Jamie Dimon remains a symbol of clarity, credibility, and resilience. His biography isn’t just a story of one man—it’s a blueprint for navigating modern leadership with intellect and integrity.

As the financial world continues to evolve, one thing is certain: the legacy of Jamie Dimon will endure—etched into the fabric of global finance.