Cybersecurity firm CrowdStrike experienced a dramatic fall in its stock price on Friday, closing down approximately 11% after a major outage disrupted businesses worldwide. The significant decline followed an update-related issue that impacted its Falcon Sensor product, designed to protect against cyber breaches using cloud technology.

The day began with CrowdStrike’s shares opening with a steep drop of more than 14%, reflecting immediate investor concerns. The company, known for its endpoint protection software, saw its stock further slide as the day progressed. CEO George Kurtz addressed the situation in a social media post, clarifying that the outage was due to “a defect found in a single content update for Windows hosts,” and emphasized that it was not a result of a cyberattack.

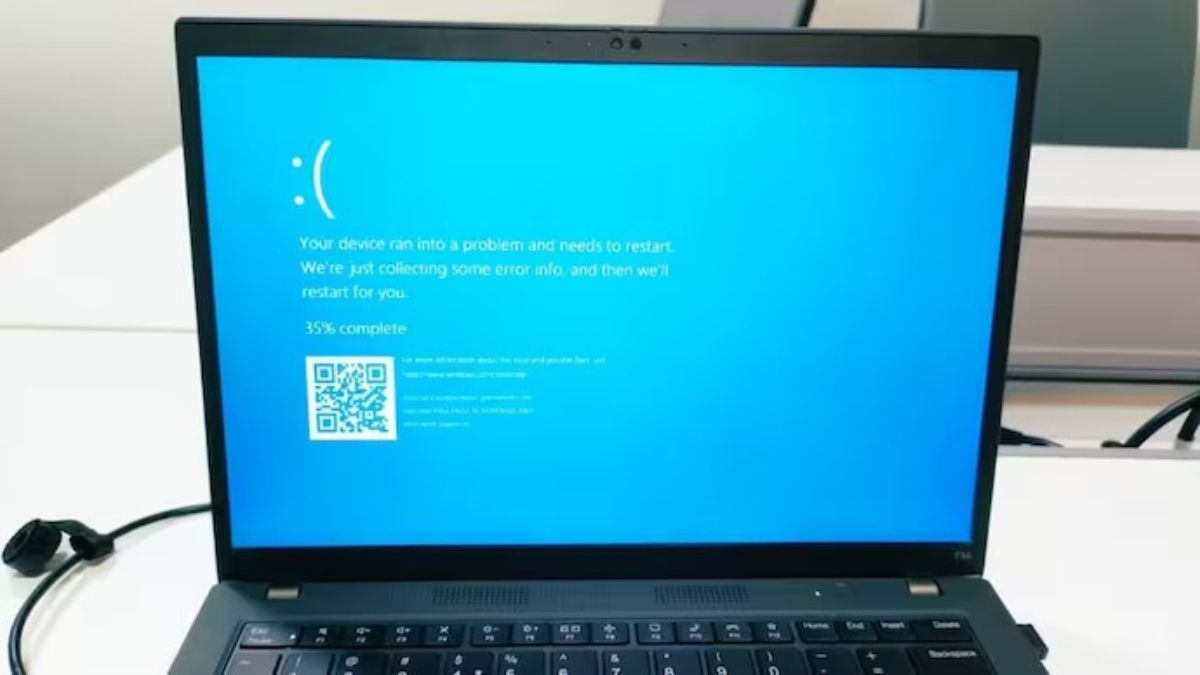

Despite Kurtz’s reassurances, the incident caused widespread disruptions, with various businesses, including airlines and media outlets, reporting significant operational halts. The update led to numerous Windows systems encountering the infamous “blue screen of death,” which further fueled the panic among investors.

Adding to the turmoil, Microsoft also reported issues with its Azure cloud services and Microsoft 365 apps, although it is unclear if these problems were related to CrowdStrike’s update. Microsoft’s shares closed down 0.74% as a result.

The global outage underscores the vulnerability of cyber supply chains, illustrating how a single failure can have extensive repercussions across multiple sectors. As CrowdStrike grapples with the fallout, it is attempting to roll back the problematic update on a global scale.

In the wake of CrowdStrike’s troubles, other cybersecurity companies saw their stocks rise. Palo Alto Networks gained 1.3%, Fortinet increased by 1.6%, and both Zscaler and Cloudflare saw their shares climb around 1% in premarket trading. This shift in the market suggests that investors are exploring alternatives, betting that businesses may consider other cybersecurity providers as a result of CrowdStrike’s misstep.

Prior to the incident, CrowdStrike had enjoyed a successful year, with its stock price rising nearly 118% over the past 12 months. However, analysts had recently expressed concerns about the company’s high valuation and its ability to compete in the expansive enterprise market. On Thursday, Redburn Atlantic downgraded CrowdStrike’s stock to “sell” and reduced its price target from $380 to $275, reflecting a 28% cut.

The situation highlights the fragility inherent in the technology sector and serves as a stark reminder of how quickly market dynamics can shift in response to operational failures. As CrowdStrike works to resolve the issues caused by the update, the broader cybersecurity industry watches closely, aware of the potential impacts on both market performance and client trust.