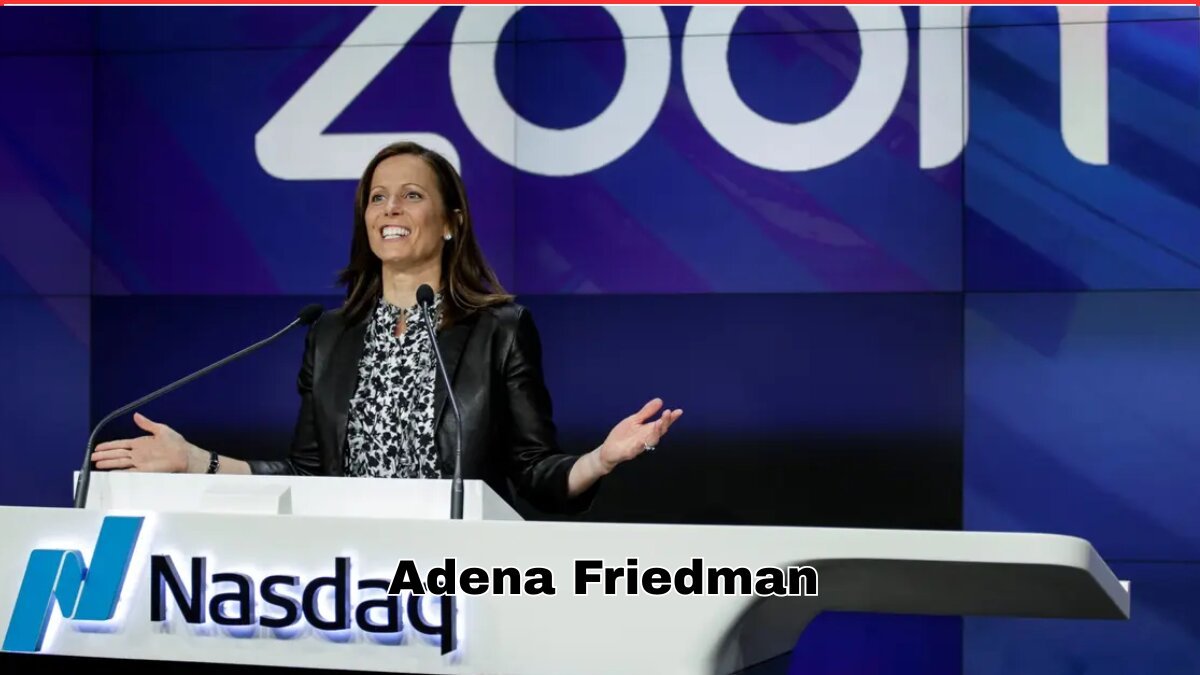

Adena Friedman stands as one of the most influential figures in global finance. As the first woman to lead a major U.S. stock exchange, her journey from an intern to CEO of Nasdaq is not just inspirational—it’s historic. Her leadership has revolutionized how stock markets embrace technology, transparency, and sustainability, setting a new benchmark for financial innovation.

Friedman has built her legacy on resilience, intelligence, and bold decision-making. Through strategic acquisitions, tech-driven innovation, and policies focused on diversity and inclusion, she has shaped Nasdaq into a global leader in financial infrastructure. Her role has garnered attention beyond Wall Street, making her a role model for aspiring professionals worldwide.

By examining her professional trajectory and financial milestones, we also position her net worth alongside other prominent CEOs in the finance sector. Whether you’re an investor, a student of business, or someone inspired by powerful leadership, Adena Friedman’s journey offers valuable insights into how strategic vision translates into substantial financial growth.

Adena Friedman’s Networth in 2025: Latest Figures and Sources of Income

As of 2025, Adena Friedman’s estimated net worth stands at approximately $150 million. This significant figure results from a combination of her executive compensation at Nasdaq, long-term investments, and accumulated assets. Her financial portfolio reflects decades of strategic planning and consistent success.

Adena’s base salary as CEO of Nasdaq has typically hovered around $1.2 million annually, but her total annual compensation—including stock awards, bonuses, and other incentives—can exceed $15 million, depending on company performance. Stock options and equity-based compensation form a major part of her wealth accumulation strategy, and over time, these have matured into valuable assets.

Friedman also benefits from other income streams, such as dividends, speaking engagements, and advisory board roles. Her market insight and thought leadership in the fintech industry make her a sought-after name at global finance conferences and corporate events.

A considerable portion of her net worth is tied to Nasdaq shares and investments in technology-driven ventures. Friedman holds stock in companies aligned with her belief in digital transformation, artificial intelligence, and cybersecurity—sectors she has emphasized throughout her tenure.

In addition to direct income, her net worth includes substantial real estate investments, retirement plans, and private portfolios managed by top-tier wealth advisors. As the financial world becomes more transparent, CEOs like Friedman demonstrate how executive leadership and well-structured compensation packages can build long-term financial empires.

From Analyst to CEO: Adena Friedman’s Career Timeline at Nasdaq

Adena Friedman’s career began with a summer internship at Nasdaq in the early 1990s. Armed with a degree in political science from Williams College and later an MBA from Vanderbilt University, she quickly rose through the ranks, making her mark with bold ideas and strategic thinking.

In her early years, she served as an analyst and later became Nasdaq’s Chief Financial Officer. During this time, she led several transformational initiatives, including the acquisition of the OMX Group, which expanded Nasdaq’s global reach. Her influence helped turn Nasdaq from a U.S. stock exchange into a global technology leader.

In 2011, Friedman took on the role of CFO at The Carlyle Group, a private equity powerhouse. This experience gave her exposure to global finance at a higher level and enhanced her strategic decision-making. However, her heart remained with Nasdaq, and she returned in 2014 as President and COO.

By 2017, she made history by becoming Nasdaq’s CEO—the first woman to lead a global exchange. Under her leadership, Nasdaq has evolved far beyond a stock exchange into a full-scale technology provider for financial services. Her focus on cloud transformation, ESG compliance, and fintech integration has made Nasdaq more agile and future-ready.

Friedman’s journey is defined by adaptability, vision, and an unshakable commitment to growth. Her rise from intern to CEO exemplifies the power of internal career development and long-term organizational loyalty. Her success story serves as a blueprint for young professionals aiming for leadership in finance and tech.

Major Investments and Assets Owned by Adena Friedman

Adena Friedman’s financial empire extends well beyond her Nasdaq salary. Over the years, she has made strategic investments in both traditional and innovative sectors, creating a diversified asset portfolio that supports her long-term financial growth.

Her most notable investment is in Nasdaq stock, where she owns hundreds of thousands of shares. These holdings are valued in the tens of millions and form the core of her net worth. She has repeatedly emphasized the importance of aligning leadership with shareholder interests, which is reflected in her own equity-based compensation.

Beyond Nasdaq, Friedman has invested in technology startups, particularly in the fields of artificial intelligence, blockchain, and cybersecurity. These investments align with her vision of the future of financial markets, and many of these companies have gone on to achieve strong valuations.

She also owns real estate properties in major cities like New York, Washington D.C., and possibly international locations. These properties serve both as personal residences and investment assets, generating rental income and appreciating in value over time.

A portion of her assets are managed through private wealth firms, focusing on diversified holdings—mutual funds, bonds, ETFs, and international equities. This diversified structure ensures stability against market volatility and provides consistent returns.

Additionally, Friedman is known to contribute to philanthropic ventures, particularly those supporting women in STEM, financial literacy, and public education. These charitable contributions, while not direct investments, are part of her broader legacy strategy and add to her influence in the social impact sector.

How Adena Friedman’s Leadership Impacted Nasdaq’s Valuation and Growth

Under Adena Friedman’s leadership, Nasdaq has experienced unprecedented growth, both in market valuation and strategic influence. Her vision to transition Nasdaq into a technology-first exchange laid the foundation for a dramatic transformation in its global relevance.

Nasdaq’s market capitalization has seen consistent growth, crossing $35 billion during her tenure. This growth is driven by strategic acquisitions, digital innovation, and expansion into non-traditional services such as cloud-based trading platforms, market surveillance, and ESG tools.

Friedman championed the idea of Nasdaq being more than a stock market—it’s now a technology partner to over 130 global exchanges and financial institutions. She led the acquisition of companies that provide risk management and anti-financial crime solutions, strengthening Nasdaq’s role as a holistic financial service provider.

Her focus on sustainability and governance also elevated Nasdaq’s brand. She introduced transparency regulations requiring listed companies to disclose board diversity data, which sparked industry-wide conversations and positioned Nasdaq as a values-driven platform.

Under her leadership, Nasdaq’s annual revenue has consistently increased, reaching over $6 billion by 2024. Earnings per share and operating margins have also shown steady improvement, attracting long-term investors and enhancing shareholder value.

Friedman’s balanced approach—combining fiscal discipline with innovation—has turned Nasdaq into a diversified powerhouse. Her tenure showcases how dynamic leadership can create value, not just in financial terms, but in brand reputation, investor confidence, and technological evolution.

Comparing Adena Friedman’s Salary and Networth with Other Financial Sector CEOs

In the realm of financial executives, Adena Friedman stands tall both in influence and compensation. While her net worth may not rival the tech world’s billionaires, it places her among the top-tier CEOs in global finance.

Her annual compensation package, which includes base salary, bonuses, stock options, and benefits, has been comparable to CEOs of major financial institutions like Goldman Sachs, JPMorgan Chase, and Morgan Stanley. While JPMorgan CEO Jamie Dimon reportedly earns $30–35 million annually, Friedman’s package, totaling around $15–20 million, is significant—especially for a tech-powered exchange.

Where Friedman stands out is in her equity holdings, which emphasize long-term wealth creation. Her net worth—estimated at $150 million in 2025—surpasses many CEOs of traditional exchanges and investment banks who have shorter tenures or less stock-based compensation.

Her compensation also reflects her ability to deliver consistent results. Nasdaq’s performance metrics—return on equity, shareholder returns, and earnings growth—have been strong under her leadership, justifying her high-end package.

Moreover, she has achieved this while breaking gender barriers in an industry historically dominated by men. Compared to her female counterparts in the financial sector, she ranks among the top 5 in terms of compensation and influence.

Overall, Adena Friedman represents a new breed of financial leadership—where vision, inclusion, and innovation are as important as earnings and returns. Her standing among peers is a reflection of how impactful and well-rounded leadership can translate into financial and reputational success.

Conclusion

Adena Friedman’s rise from intern to CEO of Nasdaq is a modern-day success story fueled by perseverance, innovation, and purpose. Her net worth in 2025—estimated at $150 million—is a financial reflection of decades of value creation and forward-thinking leadership.

Through her bold strategies, Nasdaq has evolved from a traditional exchange to a full-fledged technology platform. She’s redefined the way we perceive financial markets—not just as centers of commerce, but as engines of social progress, inclusion, and digital transformation.

Her investments, assets, and compensation packages showcase a well-balanced financial portfolio built on trust, credibility, and performance. More importantly, her influence stretches beyond Wall Street. As a trailblazer for women in finance, a tech-forward executive, and a global business strategist, Friedman continues to inspire a generation of professionals.

By comparing her to other industry leaders, we see the unique niche she occupies—someone who didn’t just inherit leadership but earned it through vision and results. Her story proves that leadership isn’t just about capital—it’s about creating a lasting impact.

As we look ahead, Adena Friedman remains a symbol of what the future of finance can look like—diverse, digitally driven, and deeply human at its core.